Up To $5000: Personal Loans For Bad Credit With No Credit Check

Table of Contents

Understanding No Credit Check Loans and Their Implications

A "no credit check" loan doesn't mean a lender completely ignores your credit history. More accurately, it often signifies a soft credit pull, using alternative credit scoring methods, or a reliance on other factors to assess your creditworthiness. This approach allows lenders to offer loans to individuals with limited or damaged credit histories. However, these loans typically come with significantly higher interest rates than traditional personal loans for those with good credit.

Why the higher interest rates? Lenders assume a greater risk when lending to individuals with poor credit or a limited credit history. To compensate for this increased risk, they charge higher interest to make the loan profitable. This can lead to a higher total repayment amount.

Responsible borrowing is key when considering these loans. Failing to repay on time can severely damage your credit further and lead to a cycle of debt.

- Higher APRs (Annual Percentage Rates): Expect interest rates considerably higher than those offered on loans to borrowers with excellent credit.

- Shorter Repayment Terms: No credit check loans often have shorter repayment periods, resulting in higher monthly payments.

- Potential for Debt Traps: If not managed carefully, the high interest rates and short repayment terms can create a debt trap, making it difficult to repay the loan.

- Importance of Comparing Multiple Offers: Always compare interest rates, fees, and repayment terms from multiple lenders before committing to a loan.

Where to Find Personal Loans for Bad Credit with No Credit Check (Up to $5000)

Several options exist for obtaining personal loans for bad credit without a hard credit check. However, each comes with its own set of advantages and disadvantages.

-

Online Lenders Specializing in Bad Credit Loans: Many online lenders focus on providing loans to individuals with poor credit. These lenders often use alternative credit scoring methods to assess your eligibility. Researching and comparing several online lenders is crucial to finding the best deal.

-

Payday Lenders: Payday lenders offer short-term, high-interest loans typically due on your next payday. These loans are extremely risky and should be avoided unless absolutely necessary due to their exceptionally high interest rates and potential for debt cycles.

-

Credit Unions: Credit unions sometimes offer better interest rates and more flexible terms than traditional banks. They may have programs specifically designed for borrowers with less-than-perfect credit. Check if you're eligible for membership at a local credit union.

-

Banks: Banks are less likely to approve loans for individuals with bad credit, but it's worth exploring if you have a long-standing relationship with a particular bank.

-

Examples of Online Lenders: (Note: Including specific lender links here would require extensive due diligence and constant updating to ensure ethical and accurate representation. It’s advisable to conduct independent research using reputable review sites.)

-

Credit Union Programs: (Specific programs vary significantly by credit union; research local credit unions for their offerings.)

-

Researching Lender Reputation: Always thoroughly research the reputation and legitimacy of any lender before submitting an application. Check online reviews and the Better Business Bureau's website.

Factors Affecting Loan Approval and Interest Rates

While your credit score is a significant factor, lenders also consider other aspects of your financial situation when assessing your loan application.

-

Income and Employment Stability: A steady income and stable employment history significantly impact your chances of approval. Lenders want to ensure you can afford the monthly payments.

-

Debt-to-Income Ratio (DTI): Your DTI ratio (total monthly debt payments divided by your gross monthly income) is a critical indicator of your ability to manage debt. A lower DTI ratio improves your chances of approval and can lead to better interest rates.

-

Loan Amount Requested: Requesting a reasonable loan amount you can comfortably repay increases your likelihood of approval.

-

Length of Repayment Term: Choosing a longer repayment term lowers your monthly payments but increases the total interest paid over the life of the loan.

-

Tips to Improve Income Stability: Consider seeking a more stable job, negotiating a raise, or exploring additional income streams to improve your financial stability.

-

Strategies to Lower Debt-to-Income Ratio: Explore options like debt consolidation, budgeting, or paying down existing debts to improve your DTI.

-

Importance of Reasonable Loan Amounts: Only borrow what you absolutely need and can comfortably repay.

Protecting Yourself from Predatory Lending Practices

Be wary of extremely high interest rates, short repayment terms, and hidden fees. Predatory lenders often target individuals with poor credit, taking advantage of their financial vulnerability.

-

Red Flags to Watch Out For: Hidden fees, aggressive sales tactics, pressure to borrow more than you need, difficulty contacting the lender, and unclear loan terms are all major red flags.

-

Resources for Finding Legitimate Lenders: Use reputable resources like the Better Business Bureau (BBB) to check a lender's reputation and legitimacy.

-

Importance of Independent Financial Advice: Seek advice from a qualified financial advisor or credit counselor before making any major financial decisions.

Alternatives to No Credit Check Loans

If you're struggling with bad credit, consider these alternatives before resorting to high-interest, no credit check loans.

-

Credit Counseling Services: Credit counseling agencies can help you create a budget, manage debt, and improve your credit score.

-

Debt Consolidation Programs: Consolidating your debts into a single, lower-interest loan can simplify payments and potentially reduce your overall interest payments.

-

Secured Loans: Secured loans require collateral (like a car or savings account) to secure the loan, often resulting in lower interest rates.

-

Building Credit Through Secured Credit Cards: A secured credit card requires a security deposit and helps build your credit history responsibly.

-

Benefits and Drawbacks of Alternatives: Carefully weigh the pros and cons of each alternative to choose the best option for your financial situation. Research and compare different services to find the best fit.

-

Resources for Credit Counseling: Numerous non-profit organizations offer free or low-cost credit counseling services.

Conclusion: Securing Your Personal Loan for Bad Credit – No Credit Check Needed (Up to $5000)

Finding personal loans for bad credit with no credit check is possible, but it requires careful research, an understanding of the associated risks, and responsible borrowing practices. Remember that while these loans offer quick access to funds, the higher interest rates can lead to long-term financial difficulties if not handled prudently.

Comparing offers from multiple reputable lenders, researching their legitimacy, and being acutely aware of predatory lending practices are crucial steps. By taking these precautions, you can significantly increase your chances of securing a personal loan within the $5000 range, even with bad credit and potentially without a hard credit check. Start researching reputable lenders today and explore your options responsibly to find a personal loan that best suits your needs and financial situation. Remember, responsible borrowing is key to achieving long-term financial well-being.

Featured Posts

-

Nba Buzz Analyzing Tyrese Haliburtons Impact In The Pacers Knicks Matchup

May 28, 2025

Nba Buzz Analyzing Tyrese Haliburtons Impact In The Pacers Knicks Matchup

May 28, 2025 -

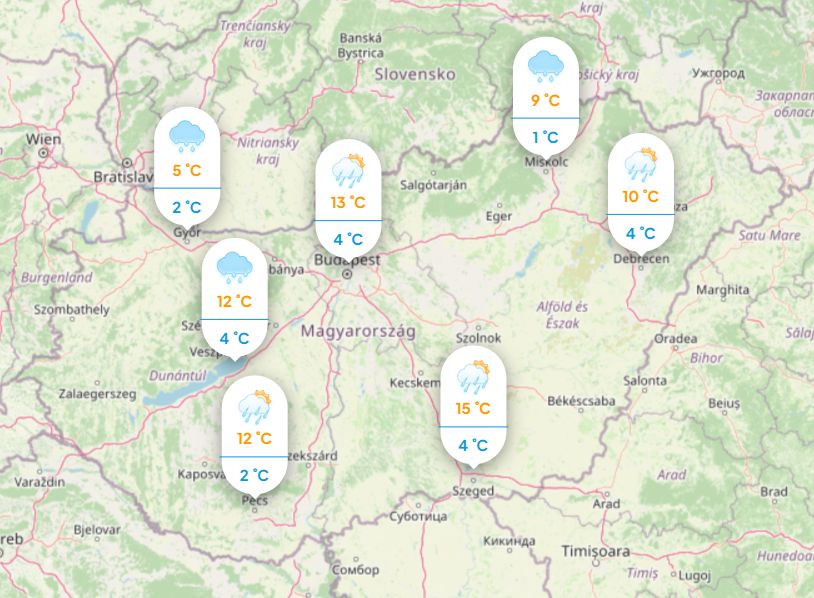

Idojarasjelentes Belfoeld Csapadek Toebb Hullamban Tavaszias Homerseklet

May 28, 2025

Idojarasjelentes Belfoeld Csapadek Toebb Hullamban Tavaszias Homerseklet

May 28, 2025 -

Red Carpet Glamour Michael B Jordan And Hailee Steinfeld At Sinner

May 28, 2025

Red Carpet Glamour Michael B Jordan And Hailee Steinfeld At Sinner

May 28, 2025 -

Best Tribal Loans For Bad Credit Direct Lenders Guaranteed Approval

May 28, 2025

Best Tribal Loans For Bad Credit Direct Lenders Guaranteed Approval

May 28, 2025 -

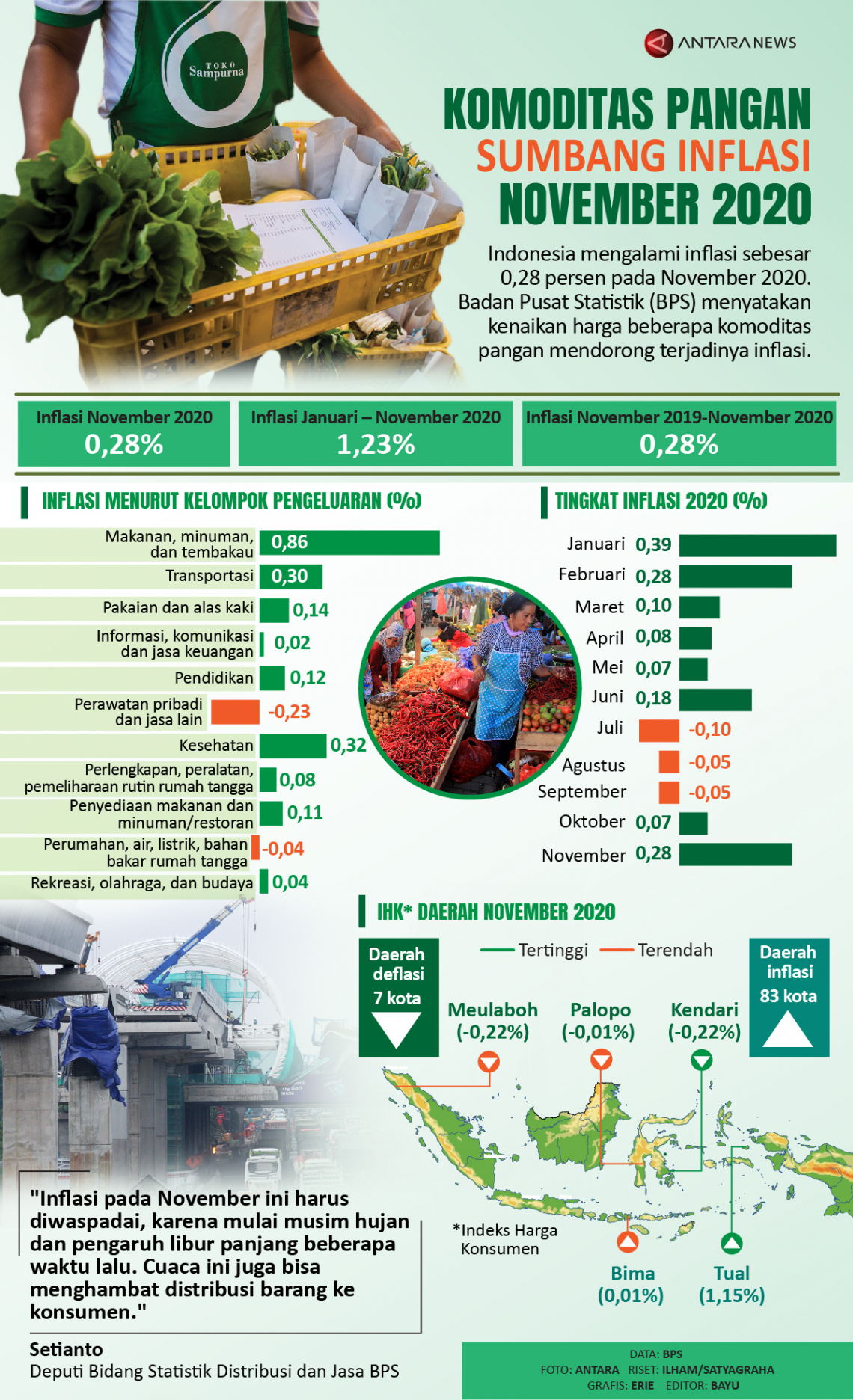

Koster Minta Bps Tak Masukkan Canang Sebagai Komoditas Inflasi

May 28, 2025

Koster Minta Bps Tak Masukkan Canang Sebagai Komoditas Inflasi

May 28, 2025