Updated April Outlook: A Comprehensive Overview

Table of Contents

Economic Outlook for April

Inflation and Interest Rates

Inflation continues to be a major concern, and its trajectory in April will significantly influence various aspects of the economy. While current rates show [insert current inflation data and source], projections for April suggest [insert projected inflation data and source, and explain the basis of the projection]. This could lead to [explain potential impact on consumer spending – e.g., decreased consumer confidence, shift in spending habits, etc.] and impact investment strategies. Investors may need to adjust their portfolios based on anticipated interest rate changes.

- Key economic indicators to watch: CPI, PPI, core inflation rate, employment cost index.

- Potential interest rate changes: [Mention potential changes and their rationale, citing reputable sources].

- Impact on borrowing costs: Higher interest rates will likely increase borrowing costs for businesses and consumers, impacting investment and consumer spending.

Job Market Trends

The April job market is expected to show [mention overall expectation – e.g., continued growth, slowing growth, etc.], building upon the [mention previous month's performance]. While [mention specific sector showing positive growth], [mention a sector facing challenges]. Automation continues to be a key factor, potentially affecting employment in certain sectors.

- Industry-specific employment predictions: [Provide predictions for key sectors – e.g., technology, manufacturing, hospitality – and cite reliable sources].

- Potential impact of automation: [Discuss the impact of automation on job displacement and the need for workforce retraining].

- Salary expectations: Wage growth is expected to [mention expectation – e.g., remain steady, increase slightly, slow down] due to [explain the reasons].

Consumer Spending and Confidence

Consumer spending and confidence are intrinsically linked to inflation and interest rates. The Updated April Outlook suggests that consumer spending will likely [mention expectation – e.g., remain relatively flat, decrease slightly, increase modestly] due to [mention reasons – e.g., inflation concerns, rising interest rates, etc.]. Consumer confidence is expected to [mention expectation – e.g., remain low, improve slightly, decline further] based on [mention factors influencing consumer confidence].

- Key factors influencing consumer behavior: Inflation, interest rates, consumer sentiment, geopolitical events.

- Impact of inflation on spending habits: Consumers may shift towards value brands, reduce discretionary spending, and prioritize essential goods.

- Potential shifts in consumer preferences: [Discuss potential changes in consumer preferences – e.g., increased demand for sustainable products, shift towards experiences over material goods].

April Weather Predictions and Impacts (If applicable)

Regional Forecasts

[Insert regional weather forecasts based on reliable meteorological sources, providing specific temperature ranges and precipitation levels. For example: "The Northeast is expected to experience cooler-than-average temperatures in April, with increased chances of precipitation. The Southwest, however, is likely to see warmer and drier conditions."]

- Temperature ranges: [Provide specific temperature ranges for different regions.]

- Precipitation levels: [Provide precipitation predictions, differentiating between rain, snow, etc.]

- Potential extreme weather events: [Mention any potential for severe weather, such as storms, floods, or droughts, and their potential impact.]

Impact on Various Sectors

The predicted weather patterns could significantly affect various sectors. For example, [mention impact on agriculture – e.g., potential for crop damage due to frost or drought]. The tourism industry might experience [mention impact – e.g., reduced bookings due to inclement weather]. The energy sector could face [mention impact – e.g., increased demand for heating or cooling].

- Potential disruptions: [Detail potential disruptions to supply chains, transportation, and other areas.]

- Economic consequences: [Discuss the potential economic impact of adverse weather conditions.]

- Preparations needed: [Suggest necessary precautions and preparations for different sectors and individuals.]

Market Trends and Predictions for April (If applicable)

Stock Market Outlook

The Updated April Outlook for the stock market suggests [mention overall prediction – e.g., cautious optimism, potential volatility, etc.]. Key factors to watch include [mention key factors such as inflation, interest rates, geopolitical events, earnings reports]. Specific sectors like [mention specific sectors and their expected performance] might outperform others.

- Major indices to watch: [List key stock market indices like the S&P 500, Dow Jones, Nasdaq].

- Sector-specific predictions: [Provide predictions for specific sectors, citing any supporting evidence].

- Potential risks and opportunities: [Highlight potential risks and investment opportunities based on the current market situation].

Real Estate Market Update

The April real estate market is predicted to [mention expectation – e.g., slow down, remain relatively stable, see a slight increase in activity] due to [mention reasons – e.g., rising interest rates, affordability concerns, etc.]. Regional variations are expected, with [mention specific regions and their predicted market performance].

- Regional variations: [Discuss regional differences in market performance, citing relevant data].

- Impact of interest rates: Rising interest rates will likely impact affordability and reduce buyer demand.

- Potential shifts in demand: [Mention potential shifts in demand, such as increased interest in specific property types or locations].

Conclusion

This Updated April Outlook provides a comprehensive overview of key economic, weather (where applicable), and market trends. While inflation and interest rates remain major economic concerns, the job market shows [reiterate job market summary]. Consumer spending and confidence are expected to [reiterate consumer spending and confidence summary]. Weather patterns in April could [reiterate weather impact summary], while the market outlook suggests [reiterate market summary]. Remember, these are predictions, and the actual situation may evolve.

Stay updated on the April outlook by regularly checking reputable news sources and economic forecasts. Monitor the latest April forecasts and analyses to adapt your plans and strategies accordingly. Follow our updated April outlook reports for continued insights and analysis.

Featured Posts

-

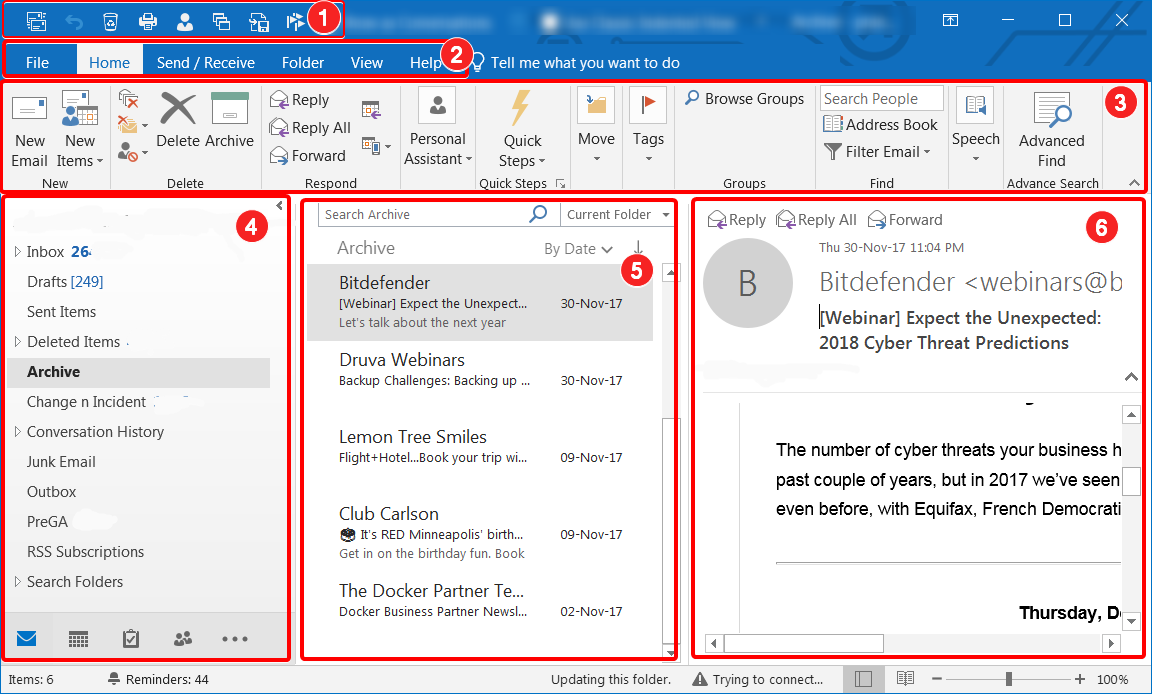

Is A Luis Diaz Transfer To Arsenal Possible

May 28, 2025

Is A Luis Diaz Transfer To Arsenal Possible

May 28, 2025 -

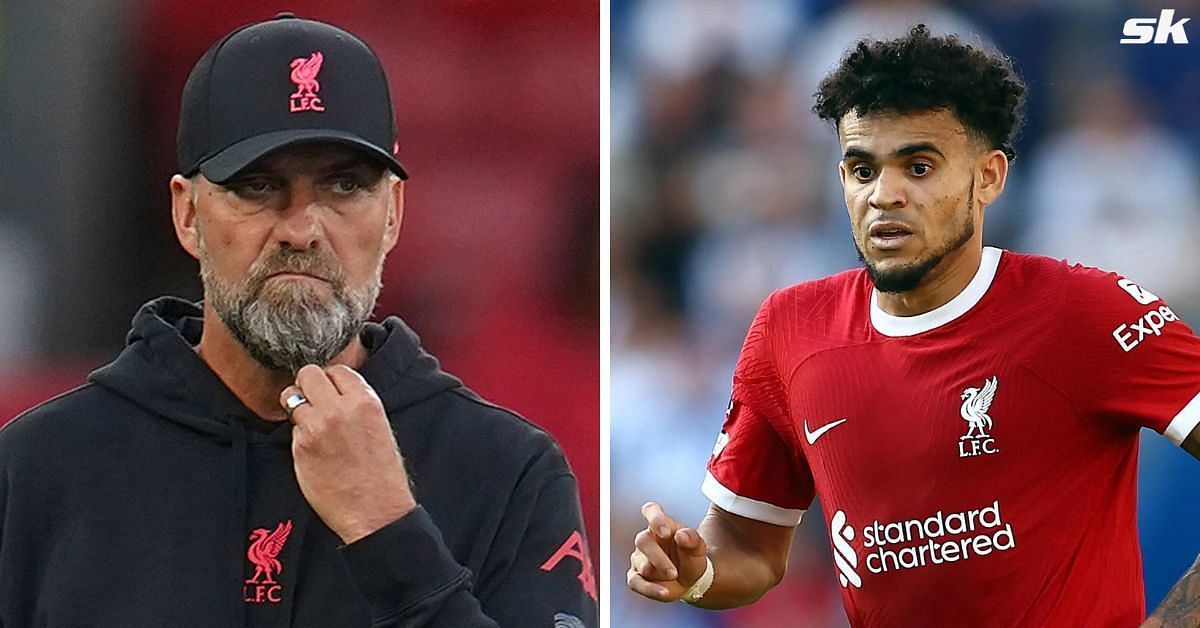

Trumps Threat To Redirect Harvard Funding A Blow To Higher Education

May 28, 2025

Trumps Threat To Redirect Harvard Funding A Blow To Higher Education

May 28, 2025 -

Euro Millions Results Ireland Lucky Players Win A Fortune Ticket Sale Locations

May 28, 2025

Euro Millions Results Ireland Lucky Players Win A Fortune Ticket Sale Locations

May 28, 2025 -

Ipswich Town News Tuanzebe Phillips Chaplin And Murics Uncertainties

May 28, 2025

Ipswich Town News Tuanzebe Phillips Chaplin And Murics Uncertainties

May 28, 2025 -

Canada Post Overhaul A Larger Issue Of Federal Institution Reform

May 28, 2025

Canada Post Overhaul A Larger Issue Of Federal Institution Reform

May 28, 2025