Urgent HMRC Child Benefit Message: What To Do

Table of Contents

Have you received an urgent message from HMRC regarding your Child Benefit payments? This can be alarming, but understanding the potential reasons and taking the right steps is crucial. This guide will walk you through what to do if you receive an urgent HMRC Child Benefit message, helping you navigate the process efficiently and avoid potential penalties. We'll cover everything from verifying the message's authenticity to knowing how to respond and avoiding scams.

Identifying the Source of the Message

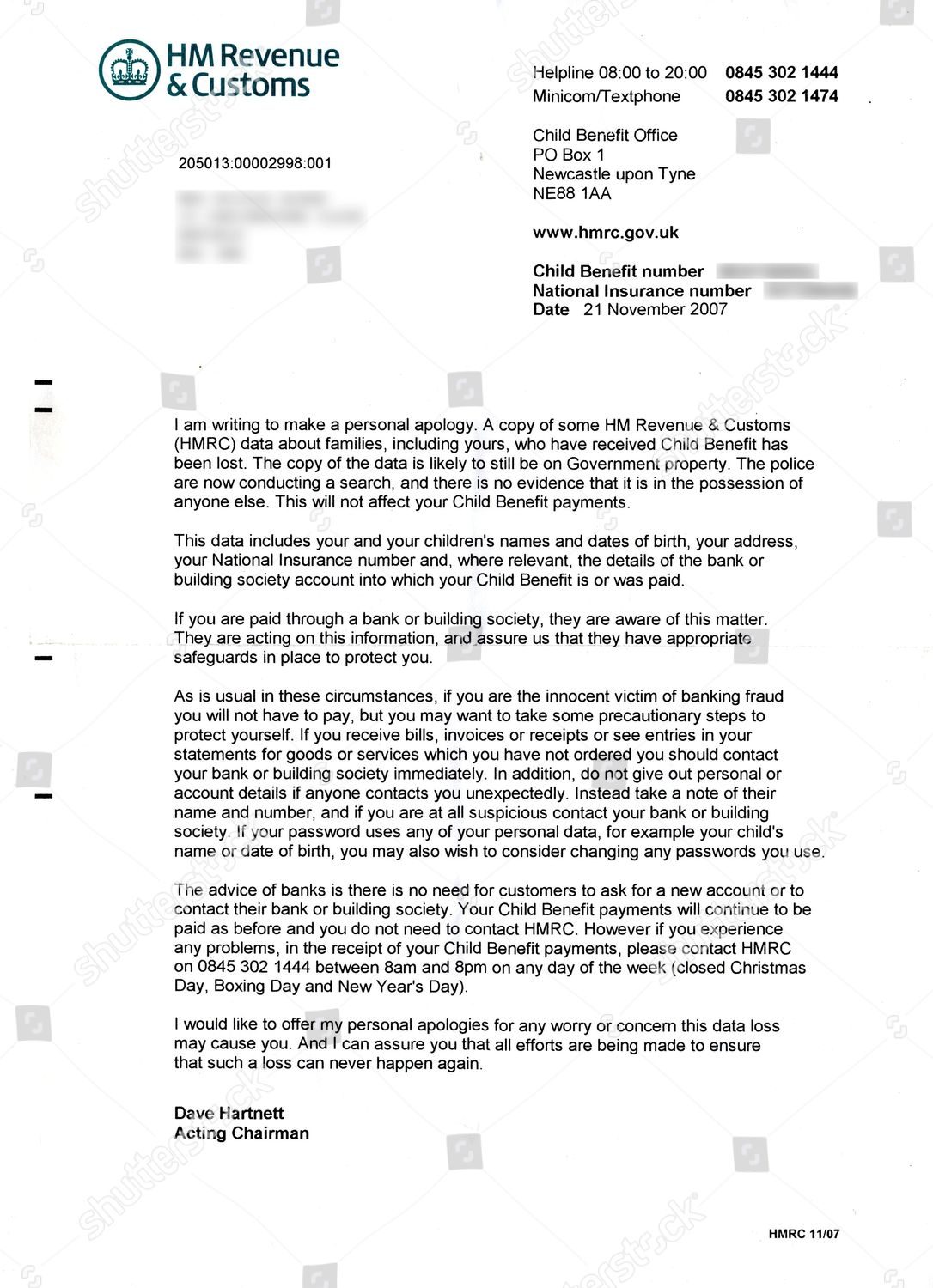

Before you panic, it's essential to verify that the message is genuinely from HMRC. Phishing scams are unfortunately common, and you need to be certain before taking any action.

Verify the Communication

The first step is to carefully examine the communication you've received. Don't rush into responding.

- Check the sender's email address: Does it end with @gov.uk? Be wary of similar-looking addresses.

- Look for official HMRC branding: Genuine HMRC communications will include official logos and letterheads.

- Verify links: Hover over any links before clicking. They should direct to the official gov.uk website. Never click on links from untrusted sources.

Detail: It's crucial to verify the sender to avoid falling victim to scams. If you have any doubts whatsoever, do not respond directly to the message.

Understanding the Message Type

HMRC sends urgent messages for various reasons. Understanding the type of message helps you prepare your response.

- Requests for information: HMRC might need additional details to verify your eligibility for Child Benefit or to update your records. This could include changes to your circumstances, such as a change of address or income.

- Notices of changes to your payments: You might receive a message about an overpayment or underpayment, requiring you to take action.

- Demands for repayments: In cases of overpayment, HMRC will outline the amount you need to repay and the repayment schedule.

Responding to an Urgent HMRC Child Benefit Message

Once you've verified the message's authenticity, you need to respond promptly and appropriately.

Gathering Necessary Documents

To efficiently respond, gather the following documents:

- Proof of income: Payslips, tax returns, self-assessment records.

- Child details: Birth certificates, passport details.

- Bank statements: To confirm your bank details and any relevant transactions.

Detail: Organizing these documents beforehand will streamline your response and ensure a quicker resolution.

Contacting HMRC

You can contact HMRC through several channels:

- Online portal: Access your HMRC online account for the quickest and most convenient way to interact.

- Phone: Use the HMRC helpline number for urgent queries. Be prepared to wait on hold.

- Letter: While slower, sending a letter provides written confirmation of your response.

Detail: Choose the best method based on your situation. For urgent matters, the phone or online portal is recommended.

Understanding Your Rights

If you disagree with HMRC's assessment, you have the right to appeal.

- Check the HMRC website: Find information on appeals and dispute resolution procedures.

- Seek independent advice: If needed, seek advice from a tax advisor or Citizens Advice.

Avoiding HMRC Child Benefit Scams

Scammers often impersonate HMRC to obtain personal and financial information.

Recognizing Scam Attempts

Be wary of:

- Suspicious emails: Look for poor grammar, generic greetings, and threatening language.

- Unexpected phone calls or texts: HMRC rarely contacts people out of the blue by phone or text.

- Requests for immediate payment: HMRC rarely demands immediate payment by unusual methods.

Detail: Never share personal or financial information unless you are absolutely certain you are communicating with genuine HMRC officials.

Reporting Suspicious Activity

Report suspicious activity immediately to:

- HMRC: Through their official website or helpline.

- Action Fraud: The UK's national reporting centre for fraud and cybercrime.

Conclusion

Receiving an urgent HMRC Child Benefit message can be stressful, but by following these steps – verifying the communication, gathering necessary documents, and contacting HMRC appropriately – you can efficiently address the issue and avoid any potential problems. Remember to always be vigilant about scams and report any suspicious activity immediately. Prompt action regarding your Child Benefit is vital to avoid complications.

Call to Action: If you've received an urgent HMRC Child Benefit message, don't delay! Take action now by following the steps outlined above. Learn more about managing your Child Benefit payments on the official HMRC website. Remember, prompt action will help you avoid further complications with your Child Benefit.

Featured Posts

-

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano

May 20, 2025

Glen Kamara Ja Teemu Pukki Vaihdossa Jacob Friisin Avauskokoonpano

May 20, 2025 -

Canada Post On The Brink Is Phasing Out Door To Door Mail Delivery The Only Solution

May 20, 2025

Canada Post On The Brink Is Phasing Out Door To Door Mail Delivery The Only Solution

May 20, 2025 -

El Helicoptero De Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025

El Helicoptero De Schumacher De Mallorca A Suiza Para Reunion Familiar

May 20, 2025 -

To Epomeno Epeisodio Toy Tampoy I Marilena Thyma Epithesis Me Maxairi

May 20, 2025

To Epomeno Epeisodio Toy Tampoy I Marilena Thyma Epithesis Me Maxairi

May 20, 2025 -

Is The Sell America Trade Back Moodys 30 Year Yield Hits 5

May 20, 2025

Is The Sell America Trade Back Moodys 30 Year Yield Hits 5

May 20, 2025