US-China Trade Talks: Will Words Translate To Action? Market Reaction To Be Crucial

Table of Contents

History of US-China Trade Tensions

The relationship between the US and China has been fraught with trade disputes for years, escalating significantly in recent times. This complex history is marked by periods of cooperation punctuated by intense periods of friction. The core issues revolve around intellectual property rights, technology transfer, market access, and trade imbalances.

- Examples of past trade agreements and their successes/failures: Early agreements focused on China's entry into the World Trade Organization (WTO) promised increased market access but faced criticism regarding enforcement and China's adherence to WTO rules. Subsequent attempts to address specific trade imbalances often resulted in retaliatory tariffs and counter-tariffs.

- Key players and their influence on negotiations: Presidents, trade representatives, and high-ranking officials from both countries play a crucial role, along with lobbying groups representing various sectors. The influence of these players can significantly impact the negotiation process and its outcome.

- Impact on specific sectors (e.g., technology, agriculture): The tech sector has been profoundly affected, with disputes over intellectual property theft and technology dominance. The agricultural sector has also felt the impact, with tariffs affecting exports and imports of agricultural products between both countries. The US-China Trade Talks have had a ripple effect across numerous global industries.

The Current State of Negotiations

Current US-China Trade Talks are characterized by a complex interplay of cooperation and contention. While there have been periods of apparent progress, significant points of disagreement remain. Both sides have made public statements expressing their perspectives and desired outcomes. The tone of these statements, often fluctuating between conciliatory and confrontational, offers valuable insights into the evolving dynamics of the negotiations.

- Key issues under discussion (e.g., intellectual property, technology transfer, agricultural purchases): These remain central to the discussions. Intellectual property protection, forced technology transfer, and imbalances in agricultural trade are persistent sources of conflict.

- Potential compromises or concessions from each side: Both sides may be willing to make concessions to reach a deal, but the extent of these concessions is crucial in determining the success or failure of the talks.

- Role of international organizations (e.g., WTO): The WTO plays a vital role in setting the framework for international trade and resolving disputes. However, its effectiveness in addressing the specific nuances of the US-China trade relationship remains a subject of ongoing debate.

Market Reactions and Indicators

Financial markets closely monitor the progress (or lack thereof) in US-China Trade Talks. Fluctuations in stock markets, currency exchange rates, and commodity prices directly reflect investor sentiment and expectations surrounding the outcome of these negotiations.

- Impact on specific indices (e.g., Dow Jones, Shanghai Composite): Major stock market indices, both in the US and China, exhibit significant volatility in response to news related to trade talks.

- Analysis of investor confidence levels: Investor confidence is a key indicator of market stability. Uncertainty surrounding the US-China Trade Talks can lead to decreased confidence and increased volatility.

- Potential risks and opportunities for investors: Navigating these market fluctuations presents both risks and opportunities for investors, necessitating a keen understanding of market dynamics.

Potential Outcomes and Their Impact

Several potential scenarios could emerge from the US-China Trade Talks. Each scenario carries distinct economic implications for global trade, supply chains, and consumer prices.

- Scenario 1: A comprehensive trade agreement is reached. This scenario would likely lead to increased market stability, reduced trade barriers, and potentially positive economic growth for both countries.

- Scenario 2: Partial agreement with ongoing tensions. This outcome would likely leave some trade disputes unresolved, resulting in continued uncertainty and market volatility.

- Scenario 3: Failure to reach an agreement, leading to further escalation. This worst-case scenario could result in a significant escalation of trade tensions, leading to further tariffs, disruptions in supply chains, and negative economic consequences worldwide.

Conclusion: US-China Trade Talks: Assessing the Future and Taking Action

The outcome of the US-China Trade Talks remains uncertain, highlighting the need for continuous monitoring of market reactions and indicators. The potential impact on global markets is significant, making it crucial for businesses and investors to stay informed.

Stay informed about the latest developments in US-China Trade Talks by regularly checking reliable news sources and consulting with financial advisors. Understanding the potential impact on global markets is crucial for making informed decisions. The future of global trade hinges, in part, on the success of these US-China Trade Talks, making informed engagement crucial.

Featured Posts

-

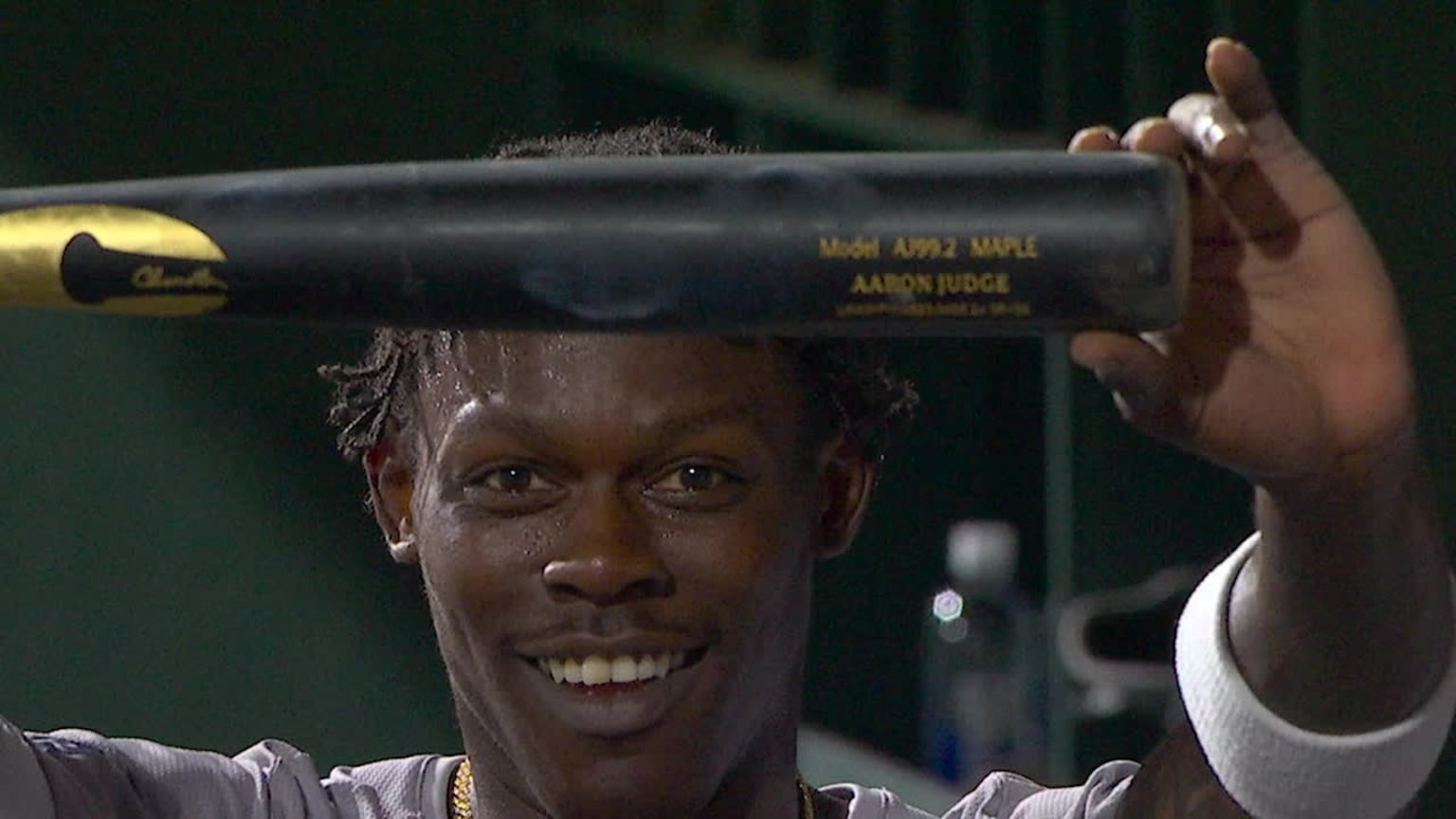

Is Jazz Chisholm Outpacing Aaron Judge Statistically Early Season Data Analysis

May 12, 2025

Is Jazz Chisholm Outpacing Aaron Judge Statistically Early Season Data Analysis

May 12, 2025 -

80 Game Ban The Full Story Of Jurickson Profars Ped Violation

May 12, 2025

80 Game Ban The Full Story Of Jurickson Profars Ped Violation

May 12, 2025 -

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 12, 2025

Efficient Podcast Production Ais Role In Processing Repetitive Scatological Documents

May 12, 2025 -

John Wick 5 Confirmed Release Date And Keanu Reeves Return

May 12, 2025

John Wick 5 Confirmed Release Date And Keanu Reeves Return

May 12, 2025 -

Who Could Be The Next Pope Leading Candidates And Their Platforms

May 12, 2025

Who Could Be The Next Pope Leading Candidates And Their Platforms

May 12, 2025