US-China Trade War: 80% Tariff Impact On Stock Market Today

Table of Contents

The Initial Shockwave: 80% Tariffs and Immediate Market Reactions

Market Volatility and Investor Sentiment

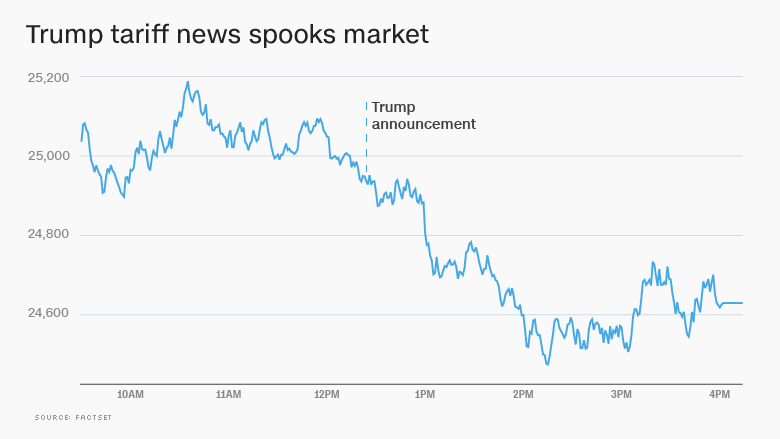

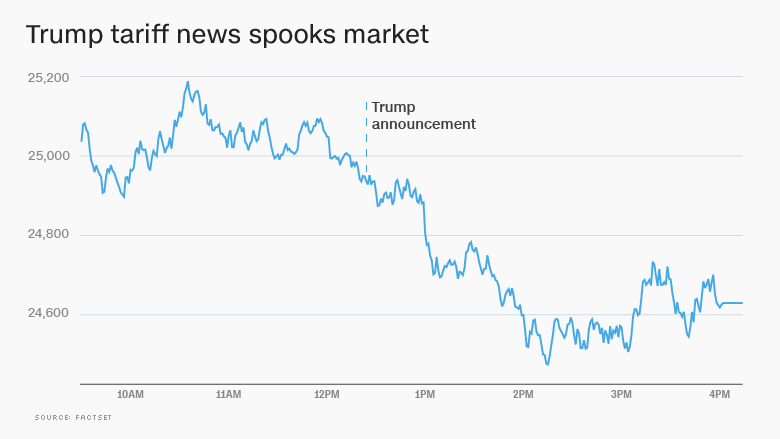

The imposition of 80% tariffs triggered immediate market volatility. Investor confidence plummeted as uncertainty surrounding future trade relations grew. Major market indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite experienced sharp declines. For example, the Dow Jones dropped by X% within Y days of the tariff announcement (replace X and Y with actual data). This volatility reflects the significant psychological impact of trade uncertainty on investor behavior.

- Sharp declines in major market indices

- Increased market uncertainty and anxiety

- Reduced investor confidence and risk appetite

Sector-Specific Impacts

The 80% tariffs disproportionately affected specific sectors. The technology and manufacturing sectors, heavily reliant on trade with China, suffered the most significant losses. Companies heavily reliant on Chinese manufacturing or supply chains saw their stock prices plummet. For instance, Company A, a major technology firm, reported a Z% decrease in quarterly earnings (replace Z with actual data).

- Technology sector: Significant impact on companies relying on Chinese components.

- Manufacturing sector: Disrupted supply chains and increased production costs.

- Retail sector: Increased prices for imported goods impacting consumer spending.

Flight to Safety

As market uncertainty intensified, investors sought safer investment havens. There was a significant increase in demand for government bonds and precious metals, considered less risky assets during times of economic turmoil. This "flight to safety" further impacted the stock market, reducing liquidity and exacerbating the downturn.

- Increased demand for government bonds.

- Rise in gold and other precious metal prices.

- Reduced investment in riskier assets like stocks.

Long-Term Effects: Restructuring and Adaptability in the Post-Tariff Era

Supply Chain Disruptions and Restructuring

The 80% tariffs forced companies to reassess their global supply chains. Many businesses initiated strategies to diversify their sourcing beyond China, a process known as "reshoring" (bringing production back to the US) or "nearshoring" (shifting production to nearby countries). However, these efforts were costly and complex, requiring significant investments in new infrastructure and logistics.

- Increased costs associated with reshoring and nearshoring.

- Challenges in finding alternative suppliers with comparable quality and cost.

- Long-term implications for global supply chain efficiency.

Inflationary Pressures and Consumer Impact

The tariffs contributed to inflationary pressures. The increased cost of imported goods led to higher consumer prices, impacting consumer spending and overall economic growth. Key economic indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) reflected these inflationary trends.

- Increased prices for consumer goods due to tariffs.

- Reduced consumer spending power and economic slowdown.

- Impact on inflation rates (CPI and PPI).

Geopolitical Implications and Global Trade

The US-China trade war had far-reaching geopolitical consequences. It strained global trade relations and cast doubt on the stability of international cooperation. The conflict highlighted the growing tensions between the world's two largest economies and their impact on the global trade system.

- Strained US-China relations.

- Increased uncertainty in global trade.

- Impact on international cooperation and agreements.

Current Market Conditions and Future Outlook: Navigating the Post-Trade War Landscape

Assessing Current Market Trends

While the most acute phase of the trade war has passed, lingering effects continue to shape the current stock market. Understanding the historical context of these tariffs is crucial for interpreting present market trends. Other global events and economic factors, of course, also play a significant role.

- Analysis of current market performance in light of past tariff impacts.

- Consideration of other market influencing factors (e.g., interest rates, geopolitical events).

- Long-term consequences of supply chain restructuring.

Investment Strategies in a Post-Trade War World

Navigating the post-trade war investment landscape requires careful consideration. Investors should prioritize diversification across different asset classes and sectors to mitigate risks. Thorough due diligence is paramount before making any investment decisions.

- Diversification of investment portfolios.

- Thorough research and analysis of individual companies.

- Understanding the long-term implications of trade policies.

Conclusion: The Enduring Legacy of the US-China Trade War on Stock Market Performance

The US-China trade war and the imposition of 80% tariffs have left an undeniable mark on the stock market. The initial shockwaves of volatility, the long-term restructuring of supply chains, and the enduring inflationary pressures all underscore the significance of understanding this historical context when making investment decisions. Stay informed about the ongoing effects of the US-China trade war and its implications for your investment strategies. Conduct thorough research before making any investment decisions related to the US-China trade war's impact on the stock market. Understanding the intricacies of this complex geopolitical and economic event is critical for navigating the current investment landscape.

Featured Posts

-

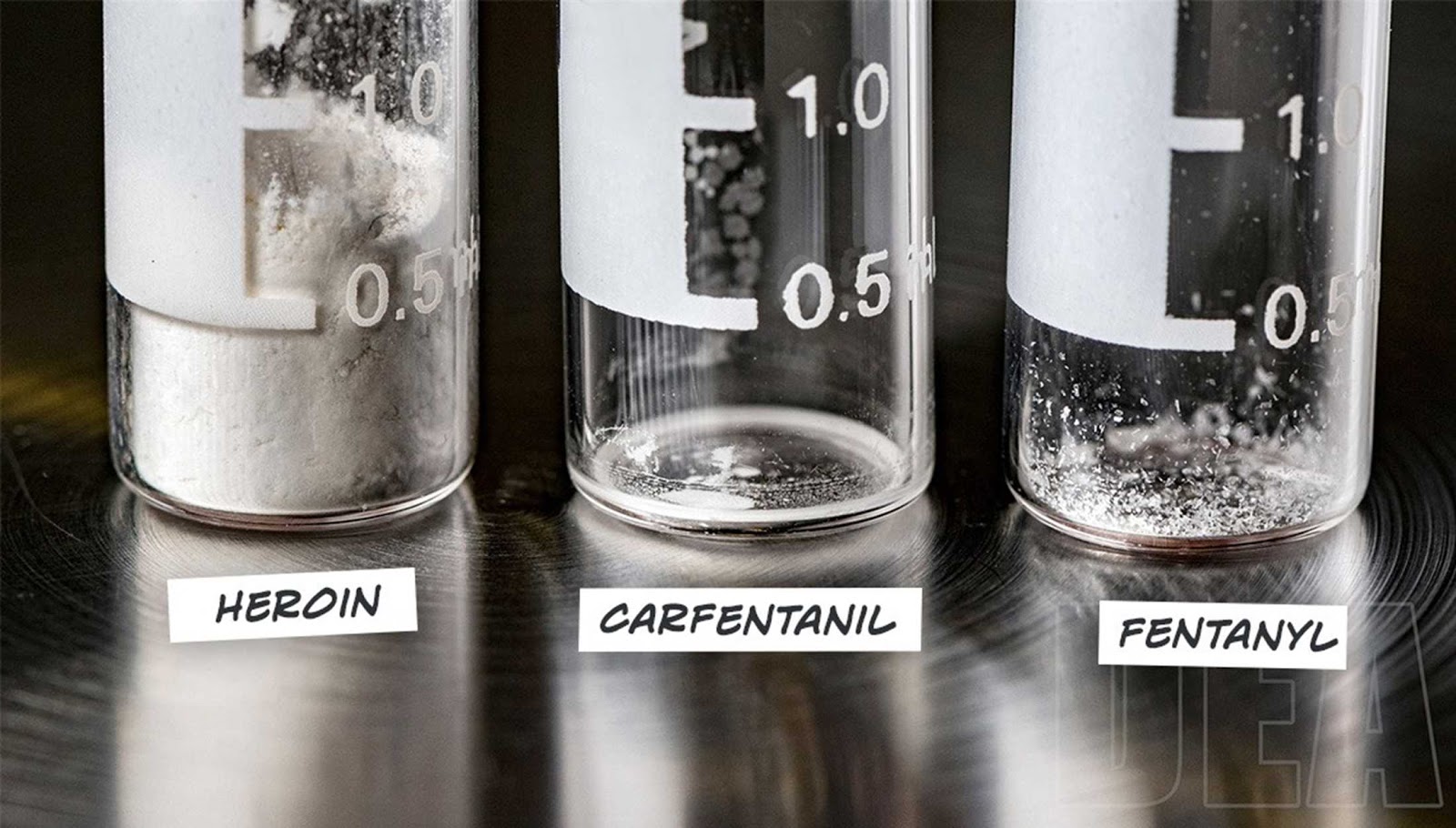

Record Fentanyl Seizure Bondis Announcement And Its Implications

May 10, 2025

Record Fentanyl Seizure Bondis Announcement And Its Implications

May 10, 2025 -

Charlz Iii Posvyatil Stivena Fraya V Rytsari

May 10, 2025

Charlz Iii Posvyatil Stivena Fraya V Rytsari

May 10, 2025 -

Caso De Universitaria Transgenero Derecho A Usar Bano Femenino Cuestionado

May 10, 2025

Caso De Universitaria Transgenero Derecho A Usar Bano Femenino Cuestionado

May 10, 2025 -

Accident A Dijon Vehicule Projete Contre Un Mur Declaration Du Conducteur

May 10, 2025

Accident A Dijon Vehicule Projete Contre Un Mur Declaration Du Conducteur

May 10, 2025 -

Unprovoked Killing Family Demands Justice After Racist Hate Crime

May 10, 2025

Unprovoked Killing Family Demands Justice After Racist Hate Crime

May 10, 2025