US Credit Downgrade: Live Updates On Dow Futures And Dollar

Table of Contents

Understanding the US Credit Downgrade

Credit rating agencies, such as Moody's, Standard & Poor's, and Fitch, play a crucial role in assessing the creditworthiness of governments and corporations. Their ratings influence borrowing costs and investor confidence. The recent downgrade of the US credit rating reflects concerns about the nation's fiscal health.

Several factors contributed to this downgrade. The protracted debt ceiling crisis, characterized by intense political gridlock, heightened concerns about the US government's ability to manage its debt. The escalating national debt, driven by factors including increased government spending and tax cuts, further fueled these concerns. This downgrade signifies a diminished perception of the US government's ability to repay its debts, impacting its borrowing capacity and overall financial standing.

The significance of this downgrade is far-reaching. It affects not only the US economy but also has global implications.

- Impact on borrowing costs for the US government: A downgraded credit rating typically leads to higher borrowing costs for the US government, increasing the cost of servicing its debt.

- Effect on investor sentiment and risk appetite: The downgrade erodes investor confidence, leading to a decrease in risk appetite and potential capital flight.

- Potential implications for international trade and relations: The downgrade can negatively impact the US's standing in the global economy and its relationships with other nations.

Impact on Dow Futures

The Dow Jones Industrial Average (Dow), a key indicator of US stock market performance, experienced immediate and significant volatility following the credit downgrade. The downgrade triggered a sell-off in the stock market as investors reacted to increased uncertainty and perceived higher risk.

The volatility in Dow futures trading reflects the uncertainty surrounding the economic consequences of the downgrade. Investors are employing various strategies to navigate this turbulent market. Some are hedging their portfolios against further losses, while others are taking advantage of potential buying opportunities in a depressed market. Still others are opting to sell assets to reduce exposure to risk.

- Short-term and long-term predictions for Dow futures: Short-term predictions vary widely, with some analysts forecasting further declines while others anticipate a rebound. Long-term forecasts are even more uncertain, depending heavily on the government's response and the overall global economic climate.

- Analysis of specific sectors most affected by the downgrade: Sectors heavily reliant on government borrowing or sensitive to interest rate changes, such as real estate and financials, are likely to experience more pronounced negative effects.

- Comparison to previous market downturns caused by credit rating changes: Historical precedent suggests that while initial reactions are negative, markets eventually adjust, although the recovery period can be extended depending on various factors.

The US Dollar's Response to the Downgrade

The US dollar's response to the credit downgrade is complex. While initially, the dollar might be perceived as a safe haven asset, leading to increased demand, the long-term impact is less certain. The downgrade raises questions about the US economy's stability, potentially undermining the dollar's status as the world's reserve currency.

The interplay between the dollar's value and other global currencies is significant. A weakening dollar could make US exports more competitive but also increase the cost of imports.

- Examination of currency exchange rates against major currencies (Euro, Yen, Pound): The downgrade will cause fluctuations in exchange rates, with the dollar's strength or weakness relative to other major currencies varying depending on market sentiment and economic data.

- Discussion of potential for "flight to safety" and its impact on the dollar: A flight to safety might temporarily strengthen the dollar, as investors seek stability during times of uncertainty. However, this effect may be temporary.

- Long-term forecast for the US dollar's value: The long-term outlook for the US dollar remains uncertain and depends on several factors, including the government's fiscal policy, the overall global economic climate, and the actions of other central banks.

Live Updates and Data Visualization (Optional)

(This section would ideally contain dynamically updating charts and graphs showing real-time Dow futures prices and USD exchange rates against major currencies. A continuously updated news feed would also be included here.)

Conclusion

The US credit downgrade has had a significant and multifaceted impact on Dow futures and the US dollar. The downgrade has increased market uncertainty, affected investor confidence, and prompted substantial market fluctuations. While the short-term consequences are evident, the long-term effects remain to be seen and will depend heavily on how the US government addresses the underlying issues that led to the downgrade.

Stay informed about the ongoing developments surrounding the US credit downgrade and its effect on the Dow futures and the dollar by regularly checking back for live updates and in-depth analysis. Understanding the implications of this major economic event is crucial for making informed financial decisions. Follow our continuing coverage of the US credit downgrade for the latest market insights.

Featured Posts

-

Premier League Transfer Battle Cunhas Next Club

May 20, 2025

Premier League Transfer Battle Cunhas Next Club

May 20, 2025 -

Significant Hmrc Changes To Side Hustle Tax What You Need To Know

May 20, 2025

Significant Hmrc Changes To Side Hustle Tax What You Need To Know

May 20, 2025 -

Charles Leclerc Partners With Chivas Regal In New Global Campaign

May 20, 2025

Charles Leclerc Partners With Chivas Regal In New Global Campaign

May 20, 2025 -

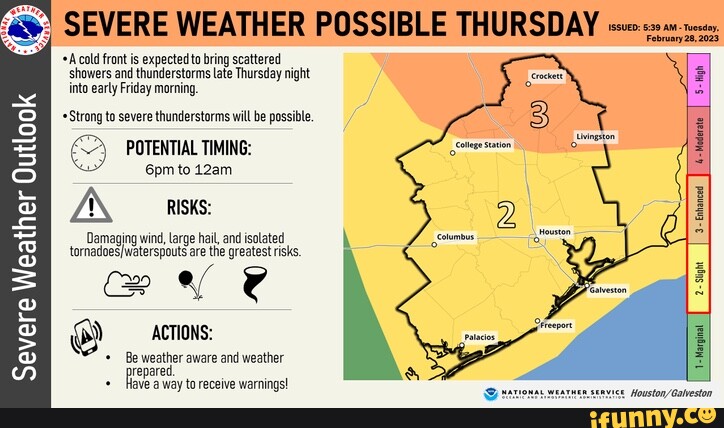

Overnight Storm Chance And Mondays Severe Weather Outlook

May 20, 2025

Overnight Storm Chance And Mondays Severe Weather Outlook

May 20, 2025 -

Agatha Christie Family Drama Private Letters Reveal Dispute Over Important Book

May 20, 2025

Agatha Christie Family Drama Private Letters Reveal Dispute Over Important Book

May 20, 2025