US IPO Filing: Klarna Reports Significant Revenue Growth (24%)

Table of Contents

Klarna's Impressive Revenue Figures and Growth Drivers

Klarna's US IPO filing detailed robust financial performance, underpinning the 24% revenue surge. While precise figures may vary pending finalization, the reported growth underscores a trajectory of significant success. This impressive growth can be attributed to several key factors:

-

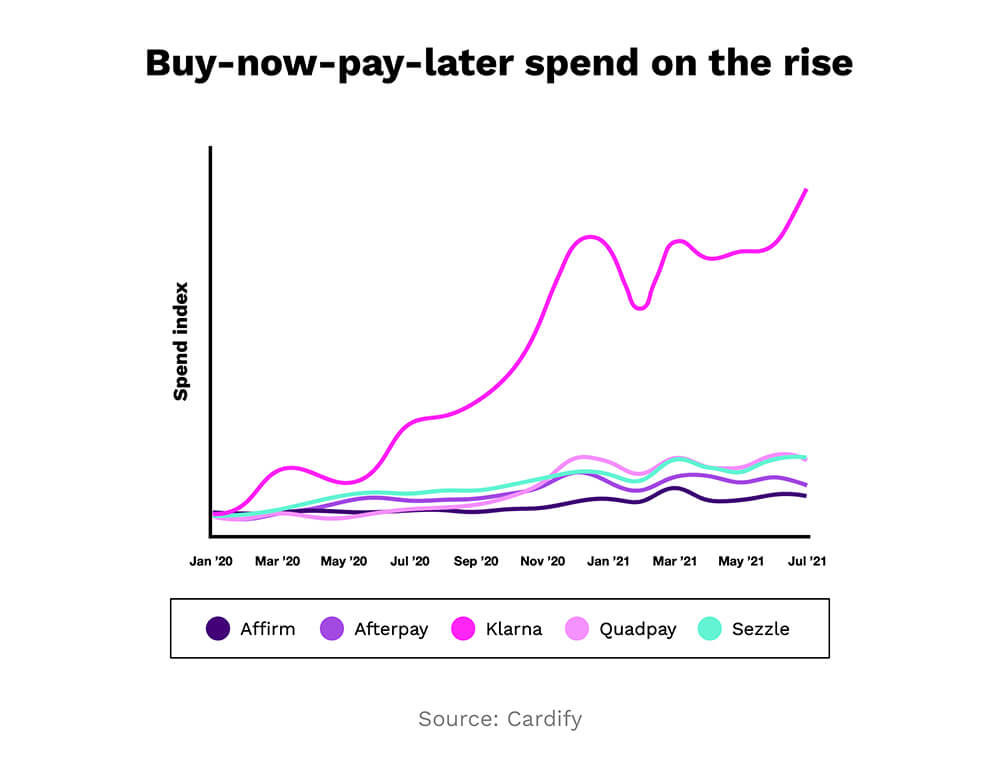

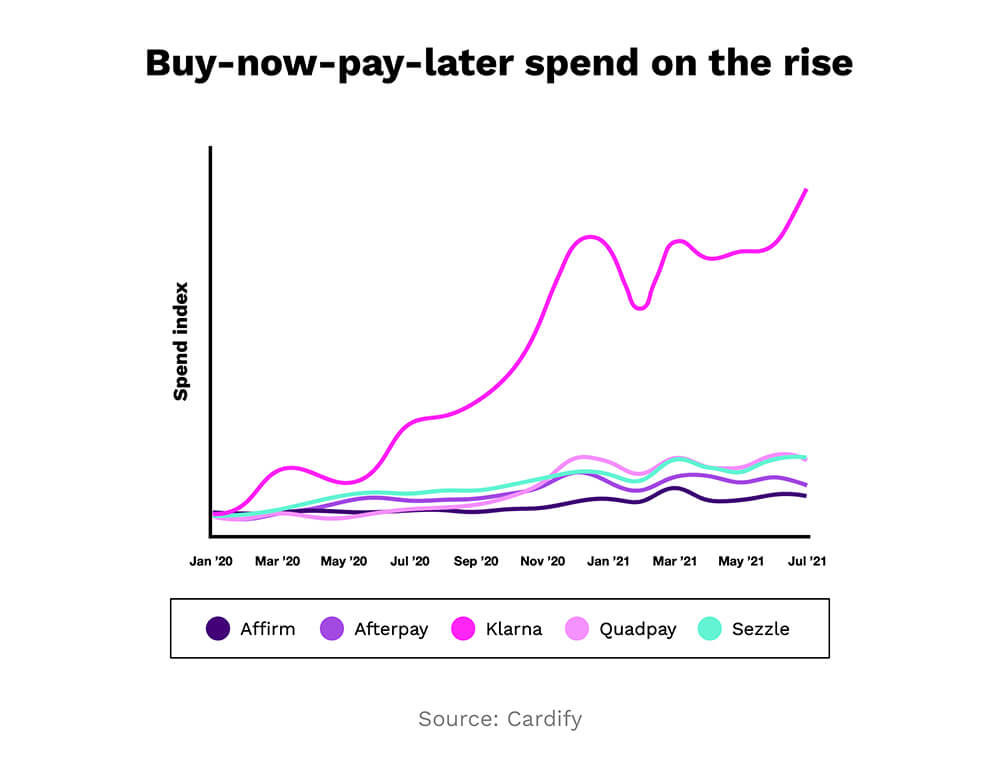

Increased User Base and Transaction Volume: Klarna has witnessed a substantial increase in both active users and the overall transaction volume processed through its platform. While specific numbers remain confidential until the IPO is fully processed, industry analysts suggest a substantial rise in both metrics, fueled by increased consumer adoption of BNPL services.

-

Expansion into New Markets and Product Offerings: Klarna’s strategic expansion into new geographic markets within the US, coupled with the introduction of innovative product offerings, has contributed significantly to its revenue growth. This includes expanding its services beyond core online retail to encompass in-store purchases and partnerships with a wider range of merchants.

-

Successful Partnerships and Collaborations: Strategic alliances with major retailers and financial institutions have played a vital role. Partnerships with leading e-commerce platforms have broadened Klarna's reach and enhanced its brand visibility. These collaborations offer a seamless integration of BNPL services into existing consumer shopping flows.

-

Effective Marketing and Branding Strategies: Klarna's effective marketing campaigns and strong brand recognition have driven user acquisition and increased brand loyalty. Their focus on clear communication, consumer-friendly interfaces, and a modern brand image has resonated strongly with their target demographic. These strategies have been instrumental in establishing Klarna as a trusted and recognizable name in the BNPL market growth.

Analysis of Klarna's US Market Strategy and Potential

Klarna's US market strategy is characterized by a focus on strategic partnerships, targeted marketing, and a commitment to a seamless user experience. The company is aggressively pursuing market share in a highly competitive landscape. Key Klarna competitors include Affirm, Afterpay (now a part of Square), and PayPal's BNPL offerings. However, Klarna's established global presence and brand recognition provide a competitive advantage.

The US BNPL market is rapidly expanding, presenting significant opportunities for further growth. Klarna's potential for continued success hinges on its ability to maintain its innovative edge, navigate regulatory changes, and adapt to evolving consumer preferences within the broader US fintech market.

Implications of the IPO Filing for Investors and the Fintech Industry

The Klarna IPO carries significant implications for both investors and the wider fintech landscape. The valuation of Klarna, while still subject to market fluctuations, is expected to be substantial, reflecting investor confidence in the company's future prospects and the growth potential of the BNPL sector. This Klarna valuation will undoubtedly influence future Fintech investment trends and could stimulate further investment in the BNPL space.

The successful IPO impact will likely encourage other fintech companies, particularly those operating in the BNPL sector, to consider their own IPO strategies. This could lead to increased competition and innovation within the BNPL investment landscape.

Conclusion: Klarna's US IPO Filing: A Sign of Strong Growth and Future Potential

Klarna's US IPO filing, showcasing a remarkable 24% revenue growth, underscores the company's strong position and the vibrant growth of the BNPL market. The company's strategic market approach, coupled with its impressive financials, positions it for continued success in the competitive US market. The Klarna IPO is a significant event for the fintech industry, signaling a maturing and increasingly lucrative sector.

Stay updated on the latest news and developments surrounding Klarna's US IPO and its impact on the BNPL market. Follow the latest Klarna news and Fintech IPO news for further insights into the dynamic world of Buy Now Pay Later and its future impact on the financial services landscape.

Featured Posts

-

Zheng Qinwens Madrid Open Upset Loss To Potapova

May 14, 2025

Zheng Qinwens Madrid Open Upset Loss To Potapova

May 14, 2025 -

Mission Impossible Streaming Guide Watch Every Film Before Mission 7

May 14, 2025

Mission Impossible Streaming Guide Watch Every Film Before Mission 7

May 14, 2025 -

Jose Pepe Mujica El Expresidente De Uruguay Fallece A Los 89 Anos

May 14, 2025

Jose Pepe Mujica El Expresidente De Uruguay Fallece A Los 89 Anos

May 14, 2025 -

On Transgender Day Of Visibility How A Gender Euphoria Scale Can Improve Mental Health

May 14, 2025

On Transgender Day Of Visibility How A Gender Euphoria Scale Can Improve Mental Health

May 14, 2025 -

Le Mans 2024 Roger Federer To Wave The Green Flag

May 14, 2025

Le Mans 2024 Roger Federer To Wave The Green Flag

May 14, 2025