US Regulatory Developments Boost Bitcoin To All-Time High

Table of Contents

Gradual Regulatory Clarity is Fueling Bitcoin's Rise

The increasing clarity surrounding Bitcoin regulation in the US is a major catalyst for its recent price surge. This improved regulatory landscape is fostering a more welcoming environment for investors, both large and small.

Easing of SEC Scrutiny

The Securities and Exchange Commission (SEC) has historically taken a cautious approach to cryptocurrencies. However, recent statements, while not explicitly classifying Bitcoin as a security, have indicated a less hostile stance. This shift is crucial.

- Decreased regulatory uncertainty attracts institutional investors. The reduced fear of future crackdowns encourages larger players to enter the market.

- Positive SEC pronouncements on certain crypto-related technologies reduce fear of future crackdowns. This fosters a climate of confidence and encourages further investment.

- Increased investor confidence translates directly into higher Bitcoin demand. As confidence grows, more investors are willing to purchase Bitcoin, driving up the price.

CFTC's Focus on Market Integrity

The Commodity Futures Trading Commission (CFTC) has been actively regulating Bitcoin futures markets. This regulatory oversight provides much-needed structure and stability.

- Increased regulatory oversight protects investors from fraud and manipulation. The CFTC's involvement helps to build trust and credibility within the market.

- Well-regulated futures markets attract larger, more institutional-grade investment. Institutional investors are more comfortable operating in regulated environments.

- This enhances Bitcoin’s position as a viable asset class. The added legitimacy increases its appeal to a wider range of investors.

The Impact of Institutional Investment

Institutional investors, such as hedge funds and asset management firms, are increasingly embracing Bitcoin as part of their portfolios. This massive influx of capital is a major driver of the recent price increases.

Growing Institutional Adoption of Bitcoin

The move towards institutional adoption represents a significant milestone for Bitcoin, signaling its growing acceptance as a mainstream asset.

- Large-scale institutional purchases significantly impact Bitcoin's price. The sheer volume of these purchases can quickly move the market.

- This signals Bitcoin's growing acceptance as a mainstream asset. Institutional adoption lends credibility and legitimacy to Bitcoin.

- The shift towards institutional adoption helps stabilize price volatility. Large players tend to be less susceptible to market sentiment swings.

Sophisticated Trading Strategies Enhance Liquidity

Institutional involvement also contributes to improved market liquidity. This makes it easier for investors to buy and sell Bitcoin, reducing price volatility.

- Higher liquidity reduces price volatility and attracts more investment. Easier trading attracts both individual and institutional investors.

- More efficient markets foster greater confidence in Bitcoin’s long-term prospects. A smoother functioning market reduces risks and concerns.

- Improved liquidity makes Bitcoin a more attractive option for various investors. It becomes easier to manage risk and allocate assets.

The Role of Bitcoin ETFs and Other Financial Products

The potential for Bitcoin Exchange-Traded Funds (ETFs) and other innovative financial products is significantly contributing to the bullish sentiment.

Growing Interest in Bitcoin ETFs

The numerous applications for Bitcoin ETFs illustrate the growing demand for regulated and easily accessible Bitcoin investment vehicles.

- ETFs make Bitcoin more accessible to everyday investors. This lowers the barrier to entry and expands the investor base.

- The approval of a Bitcoin ETF could significantly boost Bitcoin adoption. This would legitimize Bitcoin in the eyes of many traditional investors.

- Increased accessibility and regulatory approval contribute to price increases. Greater availability leads to higher demand.

The Emergence of Bitcoin-Related Financial Instruments

The development of sophisticated financial instruments tied to Bitcoin's price allows for more complex trading strategies and risk management.

- Derivatives and other innovative instruments diversify investment strategies. This caters to the needs of a wider range of investors.

- New financial tools cater to evolving investor needs and market conditions. The market continues to innovate to meet demand.

- Greater diversification and complex trading options attract more capital. This further fuels market growth and price appreciation.

Conclusion

The recent surge in Bitcoin's price to an all-time high is strongly linked to the evolving US regulatory landscape. Easing SEC scrutiny, the CFTC's market oversight, increased institutional investment, and the anticipation of Bitcoin ETFs are all crucial factors. This positive regulatory environment is likely to continue attracting significant investment, potentially pushing Bitcoin to even greater heights. Stay informed about further US regulatory developments and continue learning about the evolving landscape of Bitcoin and other cryptocurrencies to make informed investment decisions. Don't miss out on the potential of this exciting asset class. Learn more about Bitcoin investments and the evolving regulatory environment today!

Featured Posts

-

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 24, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 24, 2025 -

Chainalysis Boosts Ai With Alterya Acquisition

May 24, 2025

Chainalysis Boosts Ai With Alterya Acquisition

May 24, 2025 -

Ces Unveiled Europe Innovation Et Technologie A Amsterdam

May 24, 2025

Ces Unveiled Europe Innovation Et Technologie A Amsterdam

May 24, 2025 -

Sterke Aex Prestaties Na Trumps Uitstel

May 24, 2025

Sterke Aex Prestaties Na Trumps Uitstel

May 24, 2025 -

Exploring Growth Opportunities Bangladeshs Expanding European Network

May 24, 2025

Exploring Growth Opportunities Bangladeshs Expanding European Network

May 24, 2025

Latest Posts

-

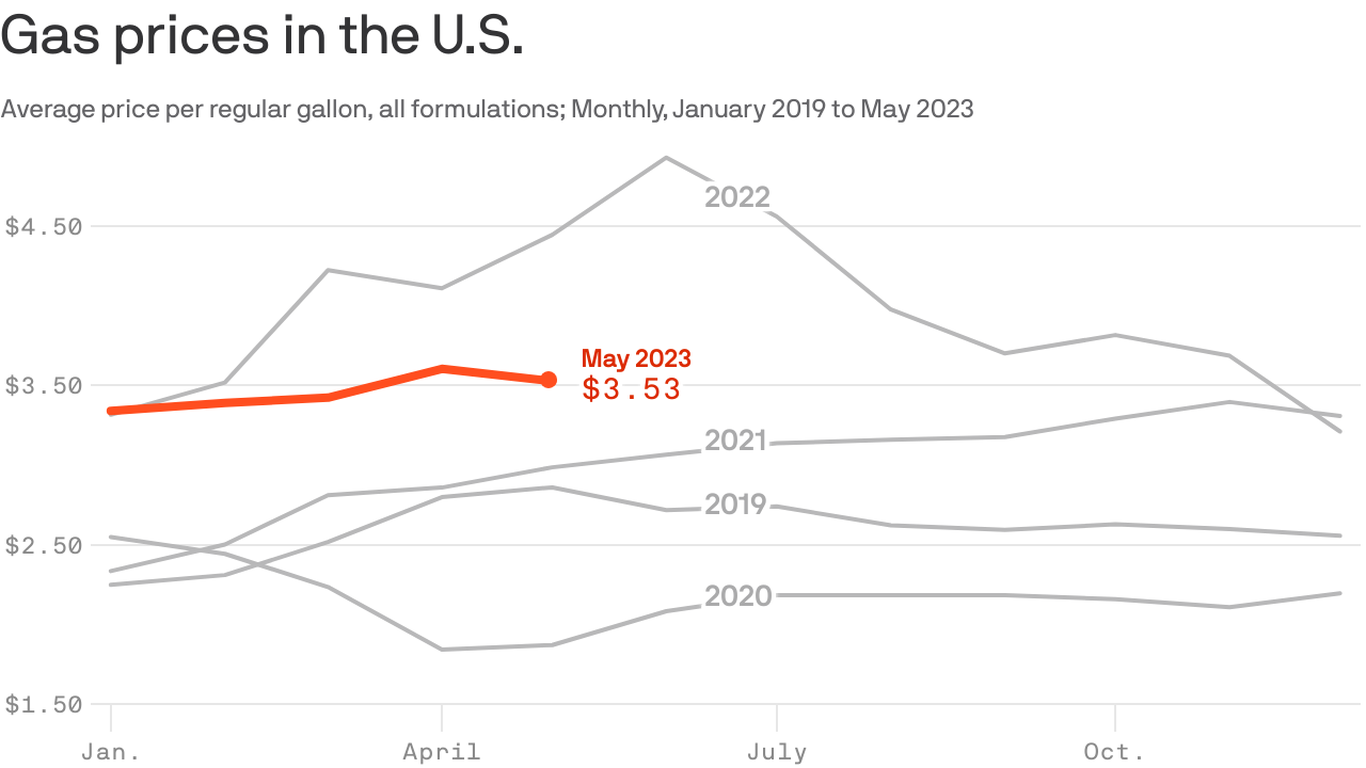

Memorial Day Gas Prices A Decade Low Forecast

May 24, 2025

Memorial Day Gas Prices A Decade Low Forecast

May 24, 2025 -

Record Low Gas Prices Predicted For Memorial Day Weekend

May 24, 2025

Record Low Gas Prices Predicted For Memorial Day Weekend

May 24, 2025 -

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025