US Regulatory Hopes Drive Bitcoin To Record High

Table of Contents

Positive Regulatory Signals from the US

Several positive regulatory signals emanating from the US have significantly boosted investor confidence and fueled the recent Bitcoin price rally. These signals suggest a potential shift towards a more supportive and less ambiguous regulatory framework for cryptocurrencies.

- Potential for a clearer regulatory framework: Discussions surrounding comprehensive crypto legislation in the US have increased, promising a more defined legal landscape for digital assets. This reduced uncertainty is a major catalyst for investment.

- Supportive statements from US regulatory bodies: Statements from key regulatory bodies like the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) indicating a more nuanced and potentially less restrictive approach to cryptocurrencies have calmed investor fears.

- Progress on specific legislation: While still in progress, tangible advancements in specific legislation related to digital assets – including stablecoins and other cryptocurrencies – signal a proactive approach from US lawmakers. This positive momentum is clearly impacting market sentiment.

- Reduced regulatory uncertainty: The overall reduction in regulatory uncertainty is perhaps the most significant factor. Clearer rules and regulations make the crypto market more attractive to both institutional and individual investors.

These positive regulatory signals have significantly improved investor sentiment, leading to increased investment and driving Bitcoin's price higher. Keywords: SEC, CFTC, regulatory framework, crypto legislation, investor confidence, market sentiment.

Institutional Investment Fueled by Regulatory Hopes

The increased participation of institutional investors is another key driver of Bitcoin's recent price surge. Regulatory clarity is paramount for large-scale institutional investment, mitigating the risks associated with operating in an uncertain regulatory environment.

- Reduced risk for large-scale investments: Clearer regulations reduce the perception of risk for institutional investors, making Bitcoin a more attractive asset class for their portfolios.

- Examples of institutional adoption: Numerous examples of major financial institutions, hedge funds, and investment firms allocating significant portions of their portfolios to Bitcoin demonstrate the growing institutional adoption of this cryptocurrency.

- Sophisticated investment strategies: Institutional investors are employing increasingly sophisticated investment strategies, including derivatives and other instruments, to gain exposure to the Bitcoin market. This increased sophistication contributes to market stability and growth.

The entry of institutional investors brings significant capital into the Bitcoin market, pushing prices upwards and adding to market stability. Keywords: Institutional investors, institutional adoption, Bitcoin investment, hedge funds, large-scale investment, risk mitigation.

Impact on Bitcoin Price and Market Volatility

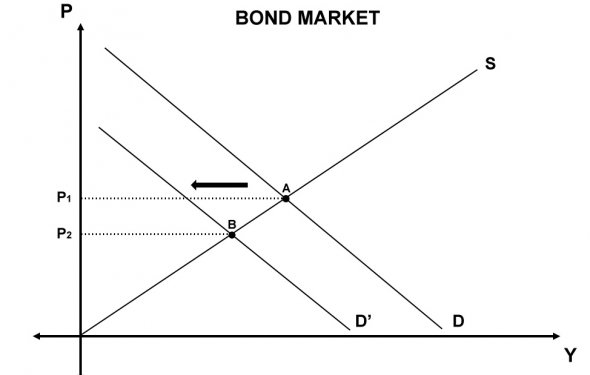

The correlation between positive regulatory news and Bitcoin's price increase is undeniable. While market volatility remains a characteristic of the cryptocurrency market, the recent surge demonstrates a clear upward trend directly linked to improving regulatory sentiment.

- Bitcoin price chart analysis: Charts clearly show a strong correlation between periods of positive regulatory developments and significant increases in Bitcoin's price.

- Market volatility: Although volatility persists, the overall trend indicates a reduction in volatility related to regulatory uncertainty.

- Crypto market cap increase: The growth in Bitcoin's price has also contributed to an overall increase in the crypto market cap, reflecting a positive sentiment across the entire sector.

Analyzing the Bitcoin price chart alongside relevant regulatory news provides compelling evidence of this correlation. Keywords: Bitcoin price chart, market volatility, price surge, crypto market cap, correlation analysis.

Future Outlook and Potential Challenges

While the current outlook for Bitcoin is positive, fueled by the ongoing hopes for US regulatory clarity, potential challenges and uncertainties remain.

- Future regulatory developments: The ongoing evolution of US cryptocurrency regulations will continue to shape Bitcoin's price trajectory. Further positive developments will likely support price growth, while negative developments could trigger corrections.

- Market risks: Market risks inherent in any cryptocurrency remain, including potential hacks, technological vulnerabilities, and unexpected market shifts.

- Expert predictions: Many experts predict continued growth for Bitcoin, especially if regulatory clarity materializes as hoped. However, they also caution against excessive speculation.

Navigating the future requires a careful assessment of both the positive regulatory momentum and the inherent risks within the crypto market. Keywords: future of Bitcoin, regulatory uncertainty, market risks, crypto predictions, long-term outlook.

Conclusion: US Regulatory Hopes Continue to Drive Bitcoin's Trajectory

In conclusion, the strong correlation between positive US regulatory expectations and Bitcoin's record high is undeniable. Clearer regulations are crucial for the growth and stability of the cryptocurrency market, attracting institutional investment and reducing overall market volatility. While challenges and uncertainties remain, the current positive regulatory sentiment significantly impacts Bitcoin's price and future trajectory. To stay informed about the evolving landscape, monitor Bitcoin price movements and keep abreast of US regulatory developments impacting Bitcoin and the broader cryptocurrency market. Consider exploring further resources on Bitcoin price analysis and US crypto regulation to make informed decisions regarding crypto investment. Keywords: Bitcoin price, cryptocurrency regulation, crypto investment, US crypto laws, Bitcoin future, monitor Bitcoin price.

Featured Posts

-

Posthaste Trouble Brewing In The Global Bond Market

May 23, 2025

Posthaste Trouble Brewing In The Global Bond Market

May 23, 2025 -

Deep Dive Into Big Rig Rock Report 3 12 97 1 Double Q Data

May 23, 2025

Deep Dive Into Big Rig Rock Report 3 12 97 1 Double Q Data

May 23, 2025 -

5 Zodiac Signs With The Best Horoscopes For April 14 2025

May 23, 2025

5 Zodiac Signs With The Best Horoscopes For April 14 2025

May 23, 2025 -

Month Year Hulu Movie Removals Everything Leaving Soon

May 23, 2025

Month Year Hulu Movie Removals Everything Leaving Soon

May 23, 2025 -

F1 Pace Setter Mc Laren

May 23, 2025

F1 Pace Setter Mc Laren

May 23, 2025

Latest Posts

-

Couple Fights Over Joe Jonas His Response Is Golden

May 23, 2025

Couple Fights Over Joe Jonas His Response Is Golden

May 23, 2025 -

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025

Joe Jonass Perfect Response To A Couples Fight Over Him

May 23, 2025 -

The Last Rodeo Featuring Neal Mc Donough

May 23, 2025

The Last Rodeo Featuring Neal Mc Donough

May 23, 2025 -

Neal Mc Donoughs The Last Rodeo A Western Drama

May 23, 2025

Neal Mc Donoughs The Last Rodeo A Western Drama

May 23, 2025 -

Review Neal Mc Donough In The Last Rodeo

May 23, 2025

Review Neal Mc Donough In The Last Rodeo

May 23, 2025