US-UK Trade Deal: Trump's Planned Announcement

Table of Contents

Potential Benefits of a US-UK Trade Deal

A successful US-UK trade deal could unlock significant economic growth for both nations. The primary driver would be the reduction of tariffs, creating increased market access for a wide range of goods and services. This transatlantic trade boost promises considerable job creation across various sectors. The potential benefits extend far beyond simple tariff reductions; a comprehensive agreement could foster deeper economic integration and stronger bilateral ties.

- Reduced tariffs on agricultural products and manufactured goods: Lowering or eliminating tariffs would make goods cheaper for consumers in both countries, boosting demand and stimulating production.

- Increased investment opportunities in key sectors: Businesses in both the US and the UK would be incentivized to invest in each other's markets, leading to innovation and expansion.

- Enhanced access to the US and UK markets for businesses: Removing trade barriers would create a level playing field, allowing companies to compete more effectively and reach a wider customer base.

- Potential boost to GDP for both nations: Economists predict a significant increase in GDP for both countries as a result of increased trade and investment.

- Positive impact on employment in various sectors: Increased economic activity translates to more jobs, benefiting workers across a spectrum of industries.

Challenges and Obstacles to a US-UK Trade Deal

Despite the potential upside, several challenges could hinder the progress of a US-UK trade deal. Significant differences in regulations, particularly in areas like agriculture and food safety, present a major hurdle. The complexities of Brexit and its ongoing impact on the UK economy add another layer of uncertainty. Furthermore, disagreements on issues such as intellectual property rights and state aid could prove difficult to resolve.

- Differences in food safety and environmental regulations: Harmonizing these regulations to create a unified market would be a time-consuming and potentially contentious process.

- Potential disputes over agricultural subsidies: Both countries have substantial agricultural sectors with differing subsidy schemes, potentially leading to trade friction.

- Negotiating intellectual property rights protection: Ensuring robust protection for intellectual property is crucial for innovation but can be a complex negotiation.

- Concerns regarding state aid and competition policy: Preventing unfair competition requires careful consideration of state aid policies in both countries.

- Uncertainty surrounding the post-Brexit UK economic landscape: The ongoing economic adjustments following Brexit add another layer of complexity to trade negotiations.

Key Sectors to Watch in the US-UK Trade Deal

Several key economic sectors stand to be significantly impacted by the US-UK trade deal. The outcome of negotiations in these areas will have far-reaching consequences for businesses and consumers alike. Closely monitoring progress in these sectors will provide valuable insights into the overall success of the agreement.

- Financial services: The deal could determine the level of access UK-based financial firms have to the vast US market, and vice-versa.

- Pharmaceuticals: Negotiations on patent protection and drug pricing will be crucial for both the pharmaceutical industry and healthcare consumers.

- Technology: Data privacy regulations and digital trade rules are major points of contention in modern trade agreements.

- Automotive: Tariffs on car parts and finished vehicles could significantly impact the automotive industry in both countries.

- Agriculture: Access to the large US market is vital for UK farmers, while US producers seek similar access to UK markets.

The Political Landscape and Trump's Influence

The Trump administration's trade policy significantly shaped the initial approach to the US-UK trade deal. The emphasis on bilateral agreements and a focus on specific economic interests influenced the negotiation strategy. However, the political landscape in both countries continues to evolve, potentially impacting the final agreement’s shape and success.

- Trump's stance on bilateral trade agreements: His preference for bilateral deals over multilateral agreements has influenced the structure of the negotiations.

- Potential influence of domestic political considerations: Political pressures in both countries may influence the concessions made during the negotiations.

- Impact of broader geopolitical factors: International relations and global economic conditions can affect the negotiation timeline and outcomes.

Conclusion

The potential US-UK trade deal presents a complex mix of opportunities and challenges. While the reduction of tariffs and increased market access promise substantial economic benefits, significant hurdles remain, including regulatory differences, agricultural disputes, and the lingering effects of Brexit. Key sectors like finance, pharmaceuticals, technology, automotive, and agriculture will be closely watched for their individual impact. The Trump administration's influence is undeniable, shaping the initial strategy but not fully dictating the final outcome. Stay tuned for further updates on the US-UK trade deal and its implications for global commerce. Understanding the nuances of this agreement is crucial for businesses and policymakers alike.

Featured Posts

-

Arctic Comic Con 2025 Photo Highlights Characters Ectomobile And Fan Connections

May 09, 2025

Arctic Comic Con 2025 Photo Highlights Characters Ectomobile And Fan Connections

May 09, 2025 -

Nhl Highlights Kucherov And Lightning Dominate Oilers In 4 1 Win

May 09, 2025

Nhl Highlights Kucherov And Lightning Dominate Oilers In 4 1 Win

May 09, 2025 -

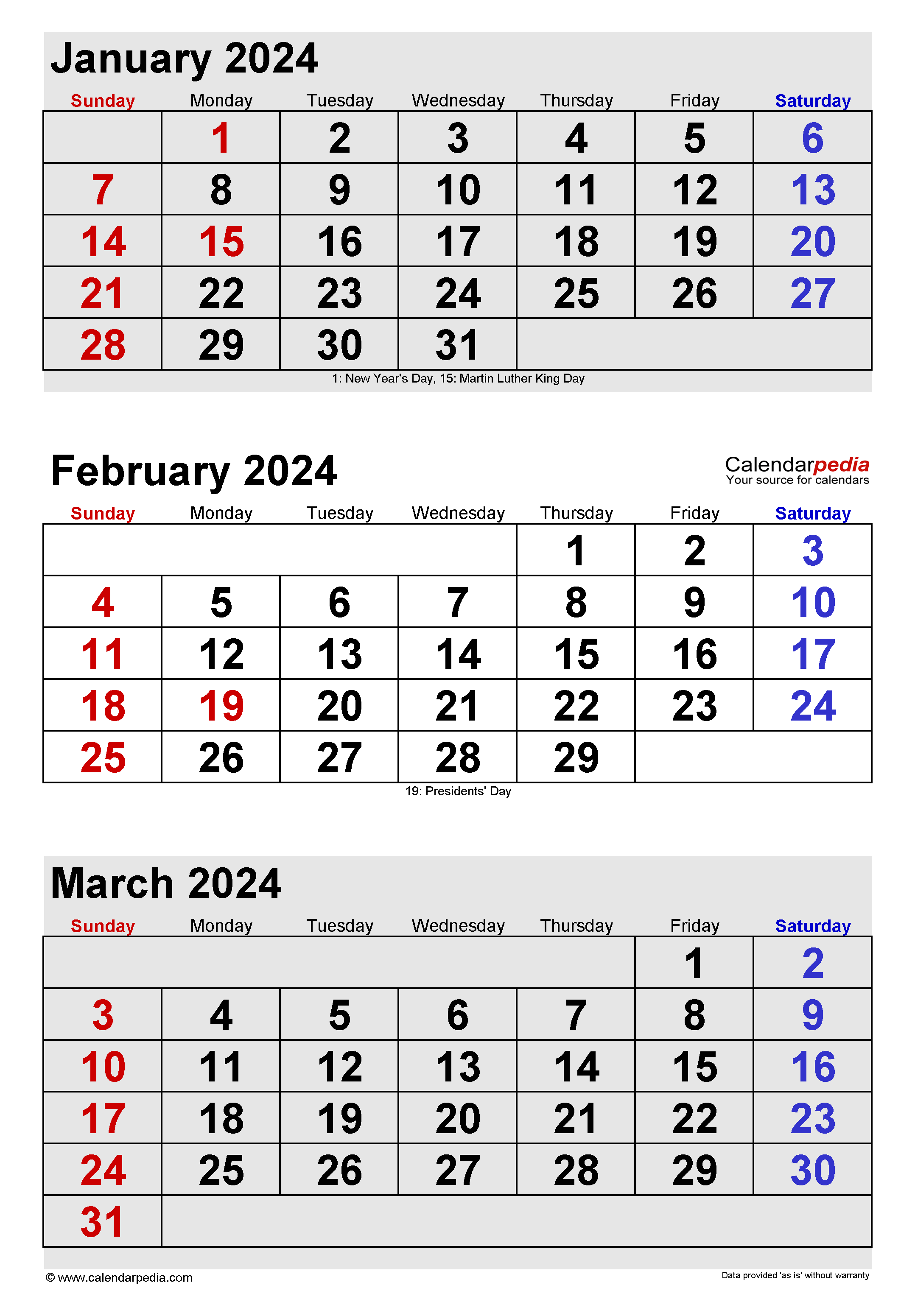

February And March 2024 Elizabeth Line Strike Impact On Routes And Schedules

May 09, 2025

February And March 2024 Elizabeth Line Strike Impact On Routes And Schedules

May 09, 2025 -

El Bolso Hereu De Dakota Johnson Minimalismo Y Estilo

May 09, 2025

El Bolso Hereu De Dakota Johnson Minimalismo Y Estilo

May 09, 2025 -

Next Month France And Poland Sign Historic Friendship Treaty

May 09, 2025

Next Month France And Poland Sign Historic Friendship Treaty

May 09, 2025