Vodacom (VOD) Exceeds Earnings Expectations With Strong Payout

Table of Contents

Strong Financial Performance: Key Revenue Drivers for Vodacom (VOD)

Vodacom's impressive financial performance is a testament to its strategic focus and operational excellence. Several key factors contributed to the company's remarkable revenue growth and increased market share.

Revenue Growth and Market Share

Vodacom experienced significant growth across multiple revenue streams, driven by strong performance in several key areas.

- Mobile Data Revenue: A substantial increase of X% in mobile data revenue was observed, reflecting the rising demand for data services across Vodacom's operating regions. This growth was fueled by increasing smartphone penetration and the expansion of Vodacom's 4G and 5G networks. Successful product launches like [mention a specific data plan or service] further boosted this segment.

- Fintech Revenue: Vodacom's fintech services, including M-Pesa, experienced Y% growth, demonstrating the increasing adoption of mobile financial services in Africa. The expansion of M-Pesa's services into new markets and the introduction of innovative financial products contributed significantly to this growth.

- Market Share Growth: Vodacom solidified its position as a market leader, increasing its market share by Z% in [mention specific region/market]. This reflects the company's ability to attract and retain customers through superior network quality and compelling service offerings.

These achievements highlight the success of Vodacom's strategy in capitalizing on the growing demand for mobile data and financial services across its markets. Vodacom revenue growth significantly outpaced industry averages, demonstrating a clear market leadership position.

Profitability and Efficiency Improvements

Beyond revenue growth, Vodacom demonstrated significant improvements in profitability and operational efficiency.

- EBITDA Growth: Vodacom's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) increased by A%, indicating improved operational profitability. This growth reflects successful cost optimization initiatives and efficient management of operational expenses.

- Net Income Increase: Net income also saw a substantial increase of B%, showcasing the overall improvement in the company's financial health. This is a direct reflection of the strong revenue growth and improved operational efficiency.

- Cost Optimization Initiatives: Vodacom implemented several cost reduction strategies, including streamlining operations and optimizing its supply chain, contributing significantly to the enhanced profitability margins.

Vodacom profitability demonstrates a clear focus on operational efficiency and cost management, leading to substantial improvements in the company's bottom line. The strong EBITDA growth showcases a sustainable business model capable of delivering exceptional returns.

Impressive Dividend Payout: Vodacom (VOD) Rewards Shareholders

Vodacom's strong financial performance translated into an impressive dividend payout for its shareholders, reflecting the company's commitment to returning value to its investors.

Dividend Announcement and Implications

Vodacom announced a dividend of [amount] per share, representing a dividend yield of [percentage]. This represents a [increase/decrease] compared to the previous period, highlighting the company's confidence in its future prospects and its commitment to rewarding shareholder loyalty. The increased dividend payout reflects the company's robust financial position and its ability to generate substantial free cash flow.

Attractiveness to Investors

The generous dividend payout significantly enhances Vodacom's attractiveness to investors.

- Stock Price Impact: The announcement is expected to positively impact Vodacom's stock price, reflecting investor confidence in the company's financial health and future growth prospects.

- Investor Confidence: The strong dividend signals Vodacom's commitment to its shareholders and strengthens investor confidence in the long-term stability and profitability of the company.

- Stock Valuation: The increased dividend payout contributes to a higher stock valuation, making Vodacom a compelling investment opportunity for both income-seeking and growth-oriented investors. Several analysts have upgraded their ratings on Vodacom's stock following this announcement.

The strong dividend payout further cements Vodacom's position as an attractive investment, appealing to both short-term and long-term investors seeking high returns. The strong dividend yield coupled with positive growth prospects makes Vodacom stock a compelling proposition in the current market environment.

Future Outlook and Growth Strategies: Vodacom (VOD)'s Path Forward

Vodacom's future outlook remains positive, underpinned by its robust growth strategies and the continued expansion of its operations.

Growth Prospects and Market Opportunities

Vodacom is actively pursuing several strategic initiatives to drive future growth.

- 5G Expansion: Vodacom's investment in 5G network infrastructure presents significant growth opportunities, enabling the delivery of enhanced mobile broadband services and supporting the development of new applications and services.

- Expansion into New Markets: Vodacom continues to explore opportunities for expansion into new markets across Africa, leveraging its expertise and experience to penetrate underserved areas and capitalize on rising demand for telecommunications services.

- Technology Investment: Investments in innovative technologies, such as IoT (Internet of Things) and cloud computing, will support the development of new revenue streams and strengthen Vodacom's competitive position.

These strategic initiatives will play a key role in driving future revenue growth and enhancing Vodacom's market leadership position in the telecommunications sector. The focus on technology and expansion into new markets positions Vodacom for long-term, sustainable growth.

Challenges and Risks

While the outlook is positive, Vodacom faces certain challenges and risks.

- Competition: Intense competition from other telecommunications providers poses a potential threat to Vodacom's market share and revenue growth.

- Regulatory Hurdles: Changes in regulatory frameworks and policies could impact Vodacom's operations and profitability.

- Economic Outlook: Economic downturns or instability in its operating markets could affect consumer spending and demand for telecommunications services.

Vodacom recognizes these challenges and proactively manages these risks through a combination of strategic investments, operational efficiency improvements, and strong regulatory engagement. Addressing these potential challenges will be crucial for maintaining Vodacom's strong financial performance and market leadership.

Conclusion: Vodacom (VOD)'s Strong Performance Signals a Positive Future

Vodacom's exceptional financial performance, exceeding earnings expectations and delivering a strong payout to shareholders, underscores the company's robust business model and strategic vision. The impressive revenue growth, improved profitability, and substantial dividend payout signal a positive future for Vodacom. The company's strategic focus on technological innovation, market expansion, and operational efficiency positions it for continued growth and success. Stay informed about Vodacom (VOD)'s continued success by following our updates and exploring further investment opportunities.

Featured Posts

-

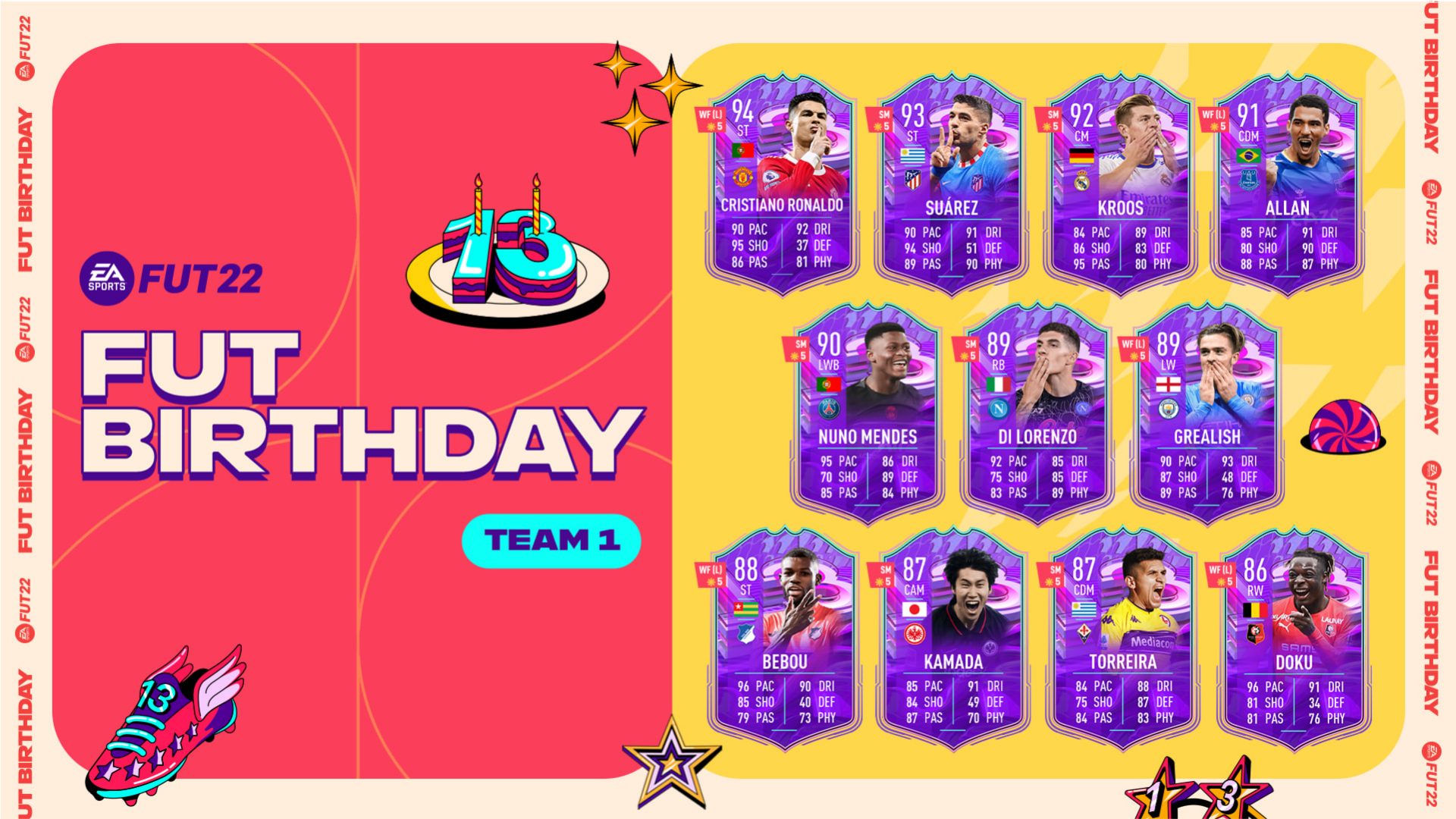

Top Ea Fc 25 Fut Birthday Players Tier List For Optimal Squad Building

May 21, 2025

Top Ea Fc 25 Fut Birthday Players Tier List For Optimal Squad Building

May 21, 2025 -

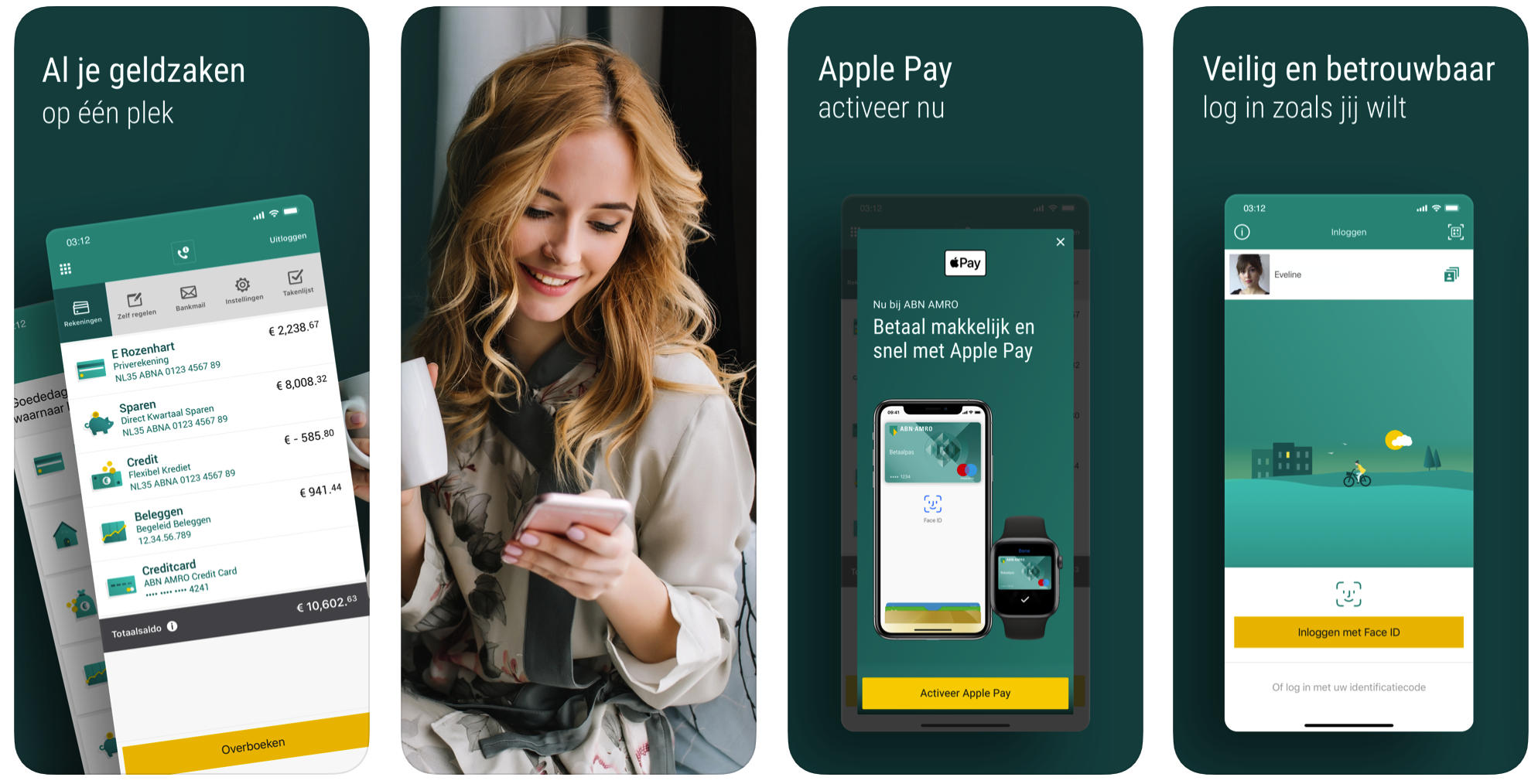

Innovatief Betalingsplatform Transferz Ontvangt Financiering Van Abn Amro

May 21, 2025

Innovatief Betalingsplatform Transferz Ontvangt Financiering Van Abn Amro

May 21, 2025 -

Retired Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025

Retired Four Star Admirals Corruption Conviction A Detailed Look

May 21, 2025 -

Southport Stabbing Mothers Tweet Leads To Jail Sentence Home Visit Blocked

May 21, 2025

Southport Stabbing Mothers Tweet Leads To Jail Sentence Home Visit Blocked

May 21, 2025 -

Problemen Met Online Betalen Naar Abn Amro Opslag

May 21, 2025

Problemen Met Online Betalen Naar Abn Amro Opslag

May 21, 2025