Vodacom (VOD) Financial Report: Earnings And Payouts Above Forecasts

Table of Contents

Exceptional Earnings Growth in the Vodacom (VOD) Financial Report

The Vodacom (VOD) financial report showcased exceptional earnings growth, driven by several key factors. This robust performance underscores the company's strong market position and effective operational strategies.

-

Strong Revenue Growth: Revenue growth was significantly boosted by increased data consumption. The rise in smartphone penetration and the growing demand for mobile data services across all segments contributed to this impressive performance. Subscriber additions also played a crucial role, reflecting successful customer acquisition strategies. This growth was evident across both the South African and international operations.

-

Improved Profitability: Vodacom demonstrated significant improvement in its operating profit margins. This reflects enhanced operational efficiency, effective cost management, and strategic pricing strategies. The company's focus on optimizing its network infrastructure and streamlining its operations contributed significantly to this improved profitability.

-

Higher Net Income: The overall net income exceeded expectations, a direct consequence of the robust revenue growth and effective cost management discussed above. This strong financial health positions Vodacom for further investment and expansion.

-

Segment Performance: A detailed breakdown of earnings per segment (South Africa, International Operations, etc.) would reveal the specific contributions to overall growth. For example, the South African market might have demonstrated strong growth in mobile financial services, while international operations might have benefited from expansion into new markets.

-

Key Performance Indicators (KPIs): Analyzing key performance indicators such as Average Revenue Per User (ARPU), churn rate, and customer acquisition cost provides further insight into the drivers of Vodacom’s financial success. These metrics demonstrate a healthy and growing business.

Dividend Payouts Surpass Forecasts for Vodacom (VOD) Shareholders

The Vodacom (VOD) financial report delivered good news for shareholders, with dividend payouts exceeding analysts' forecasts. This reflects the company's commitment to rewarding its investors and underlines its confidence in future performance.

-

Increased Dividend per Share: The increase in dividend per share surpassed projections, signaling strong financial performance and a healthy outlook. This demonstrates Vodacom’s commitment to returning value to shareholders.

-

Dividend Policy: Vodacom's dividend policy, outlining its approach to distributing profits to shareholders, played a vital role in determining the payout. Understanding this policy provides insights into the company's long-term financial strategy and its commitment to shareholder returns.

-

Stock Price Impact: The higher dividend payout positively impacted the stock price, reflecting investor confidence and positive sentiment towards the company's future prospects. This increased investor confidence can lead to further capital appreciation.

-

Dividend Yield: Comparing Vodacom’s dividend yield to competitors within the South African and broader African telecommunications sector provides valuable context. A higher yield can be attractive to income-seeking investors.

-

Sustainability: The report likely included an analysis of the sustainability of future dividend payouts, based on projected financial performance and cash flow projections. This is crucial for long-term investors.

Key Factors Driving Vodacom (VOD)'s Financial Success

Several key factors contributed to Vodacom’s exceptional financial performance. These include strategic investments, successful marketing, and a favorable regulatory environment.

-

Network Expansion: Investment in expanding 4G and 5G network coverage has been a crucial driver of growth, enabling increased data usage and enhanced customer experience. This improved network infrastructure attracts and retains customers.

-

Marketing and Customer Acquisition: Effective marketing strategies and targeted customer acquisition programs played a vital role in increasing subscriber numbers and driving revenue growth. These strategies likely focus on specific demographics and their needs.

-

Strategic Partnerships: Strategic partnerships and collaborations have undoubtedly contributed to revenue growth and market expansion. These partnerships can provide access to new technologies, markets, or customer bases.

-

Regulatory Environment: A favorable regulatory environment in key markets has supported Vodacom’s growth and operations. Stable regulatory frameworks promote investment and competition.

-

Technological Innovation: Investments in innovative technologies, such as M-Pesa (if applicable), have likely contributed significantly to revenue diversification and growth.

Future Outlook and Investment Implications for Vodacom (VOD)

The Vodacom (VOD) financial report offers valuable insights into the company's future outlook and its implications for investors.

-

Management Guidance: Management's guidance on future revenue and earnings growth provides crucial information for investors in making informed decisions. This guidance reflects the company's expectations and strategic plans.

-

Risk Assessment: The report should include a thorough assessment of the risks and opportunities facing Vodacom in the coming years. This is essential for understanding the potential challenges and uncertainties.

-

Stock Valuation: An analysis of the stock's valuation and potential investment returns is crucial for investors. This analysis should consider various valuation metrics and market conditions.

-

Competitor Performance: Comparing Vodacom's performance with its competitors provides valuable context and insights into the company's market position and competitive advantage.

-

Long-Term Investment Potential: The report should offer insights into the long-term investment potential of Vodacom (VOD) stock, considering its growth prospects and market dynamics.

Conclusion

The Vodacom (VOD) financial report showcases exceptional performance, exceeding expectations in both earnings and dividend payouts. The strong financial results are attributable to a combination of factors including increased data usage, strategic investments, and effective cost management. The higher-than-anticipated dividend payout reflects Vodacom's commitment to delivering significant returns to shareholders. For investors, this report presents a positive outlook for the company's future performance. To stay updated on Vodacom's financial performance and other important news, regularly review the Vodacom (VOD) financial reports and related analysis. Stay informed about the latest developments impacting Vodacom (VOD) and its stock price. Understanding the nuances of the Vodacom (VOD) financial reports is key to making sound investment decisions.

Featured Posts

-

Gina Schumacher A Nascut O Fetita Michael Schumacher Este Bunic

May 20, 2025

Gina Schumacher A Nascut O Fetita Michael Schumacher Este Bunic

May 20, 2025 -

Analyzing The Discrepancy Why Leclerc Outperforms Hamilton In 2023

May 20, 2025

Analyzing The Discrepancy Why Leclerc Outperforms Hamilton In 2023

May 20, 2025 -

Finding The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Finding The Answers Nyt Mini Crossword March 16 2025

May 20, 2025 -

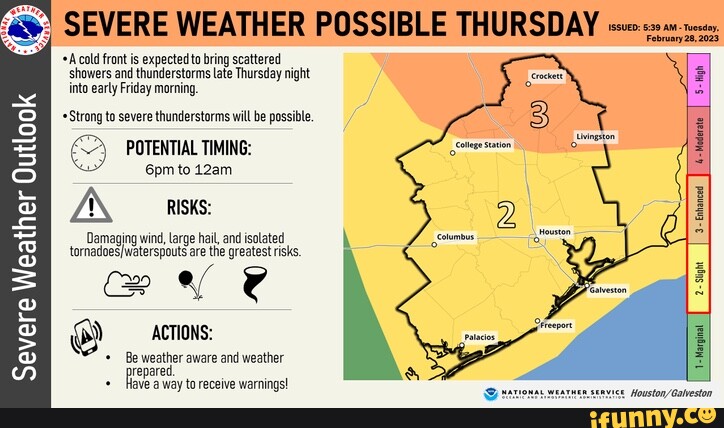

Overnight Storm Chance And Mondays Severe Weather Outlook

May 20, 2025

Overnight Storm Chance And Mondays Severe Weather Outlook

May 20, 2025 -

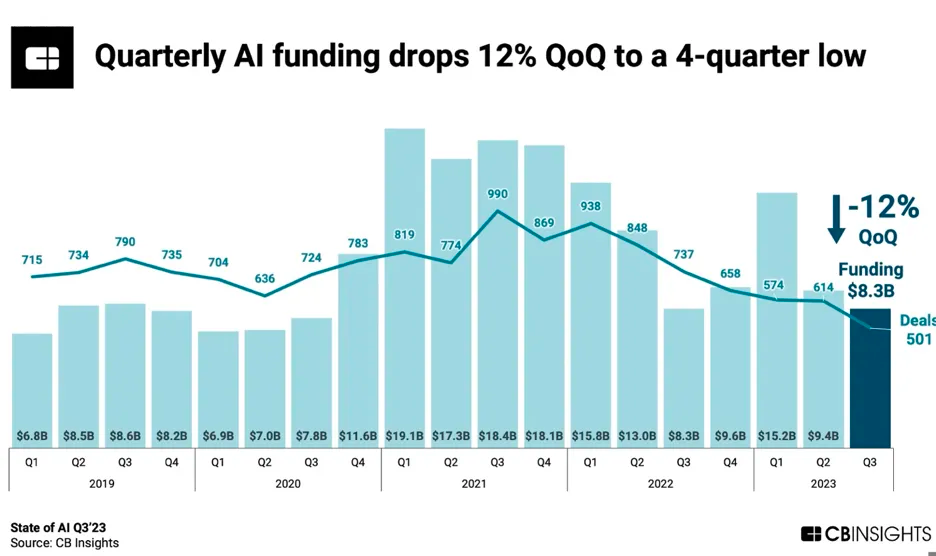

Reddits 12 Ai Stock Predictions For 2024 And Beyond

May 20, 2025

Reddits 12 Ai Stock Predictions For 2024 And Beyond

May 20, 2025