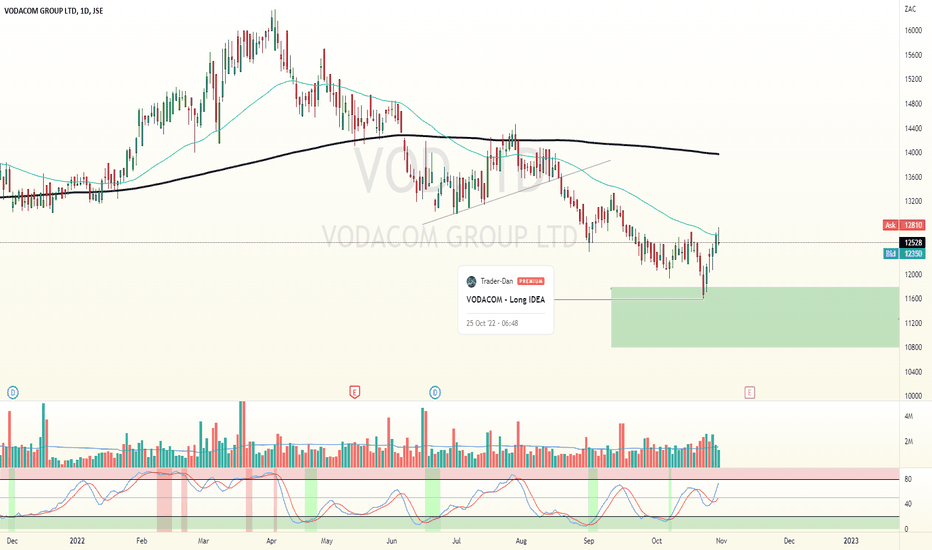

Vodacom (VOD) Reports Higher-Than-Expected Payouts And Improved Earnings

Table of Contents

Surpassing Earnings Expectations: A Detailed Analysis of Vodacom's (VOD) Financial Performance

Vodacom (VOD) dramatically exceeded profit expectations for the [Specify Quarter/Year], showcasing a robust financial performance. The company reported [Specific Figure] in total revenue, a [Percentage]% increase compared to the same period last year. This impressive growth surpasses analyst predictions, which averaged around [Analyst Prediction Percentage]%. This remarkable achievement is a testament to Vodacom's strategic initiatives and its ability to navigate the competitive telecommunications landscape.

Key revenue streams contributing to this success include:

- Mobile Data: Vodacom experienced a surge in mobile data consumption, driven by increased smartphone penetration and the growing demand for high-speed internet access. This segment contributed [Percentage]% to the overall revenue increase.

- Voice Services: Despite the ongoing shift towards data, voice services remain a significant contributor to Vodacom's revenue, showcasing resilience in this area. This segment generated [Specific Figure] in revenue.

- Financial Services (M-Pesa): Vodacom's financial technology arm, M-Pesa, continues to be a major driver of growth, providing a wide range of mobile financial services to its customer base. This area contributed [Percentage]% to the total revenue growth.

Key Financial Highlights:

- Earnings Per Share (EPS): [Specific Figure], representing a [Percentage]% increase year-on-year.

- Total Revenue: [Specific Figure], exceeding analyst expectations by [Percentage]%.

Increased Dividend Payouts: Good News for Vodacom (VOD) Shareholders

The improved financial performance has directly translated into a significant increase in dividend payouts for Vodacom (VOD) shareholders. The company announced a dividend of [Specific Amount] per share, representing a [Percentage]% increase compared to the previous period. This generous payout reflects Vodacom's confidence in its future prospects and its commitment to rewarding its investors.

The implications of this increased dividend are significant:

- Increased Investor Confidence: The higher dividend payout is likely to bolster investor confidence in Vodacom, attracting further investment and potentially driving up the share price.

- Stronger Share Price: The market's reaction to the increased dividend is expected to result in a positive impact on the Vodacom (VOD) share price.

Dividend Details:

- Dividend Payout: [Specific Amount] per share.

- Percentage Increase: [Percentage]% compared to the previous dividend.

- Potential Impact on Share Price: Analysts predict a [Percentage]% – [Percentage]% increase in share price in the short term.

Growth Drivers: Analyzing the Factors Behind Vodacom's (VOD) Success

Vodacom's outstanding performance is the result of a multifaceted strategy focusing on several key growth drivers:

- Increased Market Share: Vodacom has successfully expanded its market share through aggressive marketing campaigns, competitive pricing, and the introduction of innovative services. This growth is reflected in [Specific Market Share Data].

- Successful Product Launches: The introduction of new data plans tailored to different customer segments and the expansion of M-Pesa’s financial services offerings have significantly boosted revenue. The recent launch of [Specific Product Name] has been particularly successful.

- Effective Cost-Cutting Measures: Vodacom has implemented efficient operational strategies, resulting in [Specific Figure] in cost savings, which positively impacted profitability.

- Expansion into New Markets/Services: Vodacom's strategic expansion into new markets and service offerings has broadened its revenue streams and contributed to its overall growth.

Quantifiable Results:

- Market Share Growth: [Specific Figure]% increase in market share.

- New Product Sales: [Specific Figure] units sold of [Specific Product Name].

- Cost Savings: [Specific Figure] in reduced operational expenses.

Future Outlook: Vodacom (VOD)'s Prospects for Continued Growth

Based on the current financial performance and market trends, Vodacom (VOD) is well-positioned for continued growth. However, the company faces both opportunities and challenges:

Future Prospects:

- Revenue Growth Prediction: Analysts predict [Percentage]% - [Percentage]% revenue growth in the next fiscal year.

- Potential Risks: Increased competition from other telecommunications providers and potential regulatory changes pose risks to Vodacom's future success.

- Opportunities for Expansion and Innovation: Vodacom has significant opportunities to expand its 5G network, further develop its fintech offerings, and explore new technologies such as IoT (Internet of Things).

Conclusion: Investing in the Future of Vodacom (VOD)

Vodacom (VOD)'s outstanding financial results, highlighted by higher-than-expected payouts and improved earnings, demonstrate the company's robust financial health and strategic prowess. The increased dividend payout is a strong signal of confidence for investors, while the company's growth drivers suggest a promising future. The positive outlook, driven by factors such as market share gains, innovative product launches, and effective cost management, makes Vodacom (VOD) an attractive investment opportunity. Learn more about investing in Vodacom (VOD) and its potential for future growth by visiting [Link to relevant resource]. Stay updated on Vodacom (VOD)'s financial performance and future dividend announcements.

Featured Posts

-

Nyt Mini Crossword Answers March 8th Solutions

May 20, 2025

Nyt Mini Crossword Answers March 8th Solutions

May 20, 2025 -

Investing In Big Bear Ai Bbai Is This Ai Penny Stock A Smart Buy

May 20, 2025

Investing In Big Bear Ai Bbai Is This Ai Penny Stock A Smart Buy

May 20, 2025 -

Euro Cup Quarterfinals Germanys Path To Victory Against Italy

May 20, 2025

Euro Cup Quarterfinals Germanys Path To Victory Against Italy

May 20, 2025 -

Rozhodovanie Medzi Home Officom A Kancelariou Sprievodca Pre Manazerov

May 20, 2025

Rozhodovanie Medzi Home Officom A Kancelariou Sprievodca Pre Manazerov

May 20, 2025 -

Solving The Marvels Avengers Crossword Clue A Complete Guide Nyt Mini May 1st

May 20, 2025

Solving The Marvels Avengers Crossword Clue A Complete Guide Nyt Mini May 1st

May 20, 2025