Wall Street Bets: Is The Worst Of Trump's Trade War Over?

Table of Contents

Assessing the Economic Fallout of Trump's Trade Policies

Trump's trade war, characterized by significant increases in trade tariffs, left a considerable mark on the US and global economy.

Impact on Specific Sectors

Many sectors suffered, particularly agriculture and manufacturing. The imposition of tariffs on imported goods led to:

- Increased prices for consumers: Tariffs on steel and aluminum, for example, raised production costs across various industries, leading to higher prices for consumers.

- Reduced exports: Retaliatory tariffs imposed by other countries significantly impacted US exports, particularly agricultural products like soybeans and pork. For instance, Chinese tariffs on US soybeans caused a dramatic decrease in exports, impacting American farmers' livelihoods.

- Job losses and decreased business investment: Uncertainty caused by the trade war discouraged business investment and led to job losses in some trade-sensitive industries. The automotive sector, for instance, faced challenges due to tariffs on imported parts.

Global Trade Tensions and their Persistence

The ripple effects extended far beyond US borders. The trade war triggered:

- Retaliatory tariffs: China, the European Union, and other nations responded with their own tariffs on US goods, creating a cycle of escalating trade tensions.

- Disruptions to global supply chains: The imposition of tariffs forced businesses to rethink their supply chains, leading to increased costs and delays. This disruption highlighted the interconnectedness of the global economy and the fragility of established trade relationships.

The Role of Wall Street Bets in Market Volatility

Wall Street Bets, a subreddit known for its active and often contrarian trading strategies, has become a significant force in shaping market sentiment.

WSB's Influence on Stock Prices and Market Sentiment

WSB's collective actions can significantly impact individual stock prices and the broader market.

- Examples of significant impacts: The "Gamestock" saga saw WSB users coordinating to drive up the price of GameStop, demonstrating the subreddit's power to influence even established companies. Conversely, coordinated sell-offs have also led to significant drops in stock prices.

- Potential for market manipulation: The coordinated actions of WSB users raise concerns about potential market manipulation and the need for stronger regulatory oversight of online trading platforms.

The Relationship Between WSB Activity and Trade War Anxieties

WSB discussions frequently reflect and amplify concerns about trade policy uncertainty.

- Trade-sensitive sectors in WSB discussions: Threads on WSB often discuss the performance of companies heavily impacted by trade tariffs, reflecting a direct link between online sentiment and real-world economic impacts.

- Influence on investor behavior: The sentiment expressed on WSB can influence individual investor decisions regarding investments in trade-sensitive sectors, either fueling further speculation or driving caution.

Current Economic Indicators and Future Outlook

Analyzing current economic data is crucial to understanding the lasting impact of Trump's trade war.

Analysis of Key Economic Data Points

Recent economic indicators provide a mixed picture:

- GDP growth: While GDP growth has shown signs of recovery, it's unclear how much of that is directly attributable to overcoming trade war effects versus other economic factors.

- Inflation and unemployment: Inflationary pressures persist, potentially linked to lingering supply chain disruptions. Unemployment rates, while low, may reflect a shifting job market still adjusting to the trade war's consequences. (Specific data from reputable sources like the Bureau of Economic Analysis and the Bureau of Labor Statistics should be cited here).

Predictions and Potential Scenarios for Future Trade Relations

Future trade relations remain uncertain:

- Shifts in global trade dynamics: The trade war has accelerated a shift towards regional trade agreements and a potential decoupling of global supply chains.

- Potential positive and negative scenarios: A return to more predictable trade policies could lead to increased economic stability. However, further protectionist measures from any major world power could trigger another period of uncertainty and volatility.

Conclusion: Wall Street Bets and the Uncertain Future of Trade

While some economic indicators suggest recovery, the full extent of Trump's trade war's impact is still unfolding. The unpredictable influence of online platforms like Wall Street Bets adds another layer of complexity to the market's reaction to ongoing trade policy developments. The interplay between official policy announcements and the sentiment expressed on platforms like WSB remains a key factor in shaping market behavior and future trade relations. To stay informed about the ongoing consequences of Trump's trade war and the role of Wall Street Bets, continue monitoring reputable economic news sources and analyzing discussions within online finance communities. Further research into the long-term effects of trade tariffs and their impact on specific industries offers valuable insight into this complex economic landscape.

Featured Posts

-

Quatro Jogadores Do Real Madrid Incluindo Mbappe E Vinicius Jr Investigados Pela Uefa

May 29, 2025

Quatro Jogadores Do Real Madrid Incluindo Mbappe E Vinicius Jr Investigados Pela Uefa

May 29, 2025 -

Perennials Vs Annuals Making The Best Choice For Your Flower Beds

May 29, 2025

Perennials Vs Annuals Making The Best Choice For Your Flower Beds

May 29, 2025 -

El Clasico Reacciones Inmediatas Al Triunfo Del Barcelona 4 3

May 29, 2025

El Clasico Reacciones Inmediatas Al Triunfo Del Barcelona 4 3

May 29, 2025 -

The Casting Of Robert Downey Jr In Jamie Foxxs All Star Weekend A Deeper Look

May 29, 2025

The Casting Of Robert Downey Jr In Jamie Foxxs All Star Weekend A Deeper Look

May 29, 2025 -

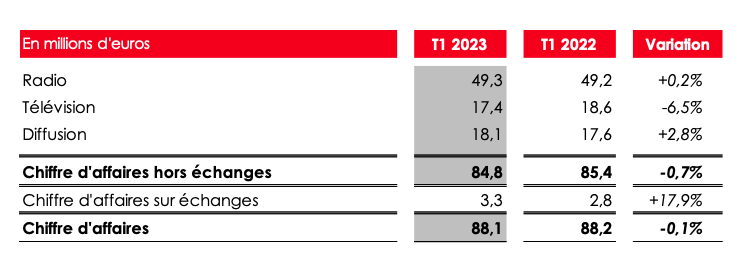

Nrj Group Chiffre D Affaires En Baisse Au 1er Trimestre 2024

May 29, 2025

Nrj Group Chiffre D Affaires En Baisse Au 1er Trimestre 2024

May 29, 2025