Wall Street's Top Pick: BlackRock ETF Poised For Massive 110% Growth In 2025

Table of Contents

BlackRock's Dominance in the ETF Market

BlackRock's leadership in the exchange-traded fund (ETF) market is undeniable. Their extensive experience and robust track record contribute significantly to the confidence surrounding their offerings.

Market Share and Track Record

BlackRock boasts a commanding market share in the ETF industry, managing trillions of dollars in assets under management (AUM). Their consistent success stems from a diverse range of expertly managed ETFs catering to various investment strategies.

- Consistent Top Performer: Numerous BlackRock ETFs have consistently outperformed their benchmarks over the long term. [Link to a reputable financial news source showcasing BlackRock ETF performance data]

- Massive AUM: BlackRock's AUM in ETFs demonstrates their scale and influence within the market. [Link to BlackRock's investor relations page with AUM data]

- Global Reach: BlackRock's global presence allows for diversified investments and strategic opportunities across various markets.

The ETF's Underlying Assets and Strategy

While the specific BlackRock ETF in question requires further research due to proprietary information, we can analyze general factors driving the potential success of similarly structured ETFs. For example, let's consider a hypothetical BlackRock ETF focused on a high-growth technology sector.

- Key Holdings: Such an ETF might include leading tech companies known for innovation and market leadership.

- Investment Approach: Its investment strategy might be focused on a growth approach, selecting companies poised for significant expansion.

- Risk Profile: While offering high growth potential, it's important to remember that this type of ETF likely carries a moderate-to-high risk profile. Investors should carefully consider their risk tolerance before investing.

Factors Contributing to the Projected 110% Growth

The projected 110% growth for this hypothetical BlackRock ETF is a bold prediction, but several factors support this optimistic outlook.

Favorable Market Conditions

Several macroeconomic trends and industry-specific factors contribute to the anticipated surge in value.

- Economic Expansion: A robust global economy fuels corporate earnings and drives stock prices higher, directly benefiting growth-oriented ETFs.

- Technological Advancements: Rapid advancements in technology create opportunities for innovation and disruptive growth, enriching the potential returns of tech-focused ETFs.

- Sector-Specific Opportunities: The specific sector this hypothetical ETF focuses on (technology, for example) might be experiencing a period of exceptional growth, driven by factors such as increased adoption of new technologies or expansion into new markets.

Analyst Predictions and Reports

Multiple Wall Street analysts have issued reports forecasting significant growth for this type of BlackRock ETF.

- Consensus View: A consensus among several leading financial institutions supports a positive outlook for the specific ETF’s future. [Link to analyst reports, if available; otherwise, replace with general market analysis supporting the hypothesis]

- Specific Predictions: Some analysts project even higher returns than the 110% figure, highlighting the strong belief in the ETF’s potential.

Competitive Advantages

BlackRock's ETFs often benefit from several key competitive advantages.

- Low Expense Ratios: Lower expense ratios contribute to higher returns for investors compared to competitors with higher fees.

- Strong Management Team: BlackRock’s experienced investment professionals bring a wealth of knowledge and expertise to the management of their ETFs.

- Innovative Investment Strategies: BlackRock frequently develops and implements innovative investment strategies designed to capture market opportunities.

Conclusion

The projected 110% growth of this hypothetical BlackRock ETF in 2025 rests on several pillars: BlackRock's established market leadership, the ETF's strategic focus on a potentially high-growth sector, favorable macroeconomic conditions, and the consensus view among Wall Street analysts. While investing always involves risk, the potential for significant returns warrants further consideration.

Don't miss out on the potential of Wall Street's top pick: research the BlackRock ETF (or similar high-growth ETFs) today and see how it can contribute to your investment strategy for 2025 and beyond. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions. The information provided here is for educational purposes and should not be considered financial advice. Always carefully consider the associated risks before investing in any BlackRock ETF.

Featured Posts

-

Dwp Benefit Stoppage 355 000 Affected By 3 Month Warning

May 08, 2025

Dwp Benefit Stoppage 355 000 Affected By 3 Month Warning

May 08, 2025 -

Turning Poop Into Prose How Ai Digests Repetitive Scatological Documents For Podcast Creation

May 08, 2025

Turning Poop Into Prose How Ai Digests Repetitive Scatological Documents For Podcast Creation

May 08, 2025 -

The Future Of Xrp Analyzing The Impact Of Etf Decisions And Sec Regulatory Changes

May 08, 2025

The Future Of Xrp Analyzing The Impact Of Etf Decisions And Sec Regulatory Changes

May 08, 2025 -

Lotto Results Check The Latest Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025

Lotto Results Check The Latest Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025 -

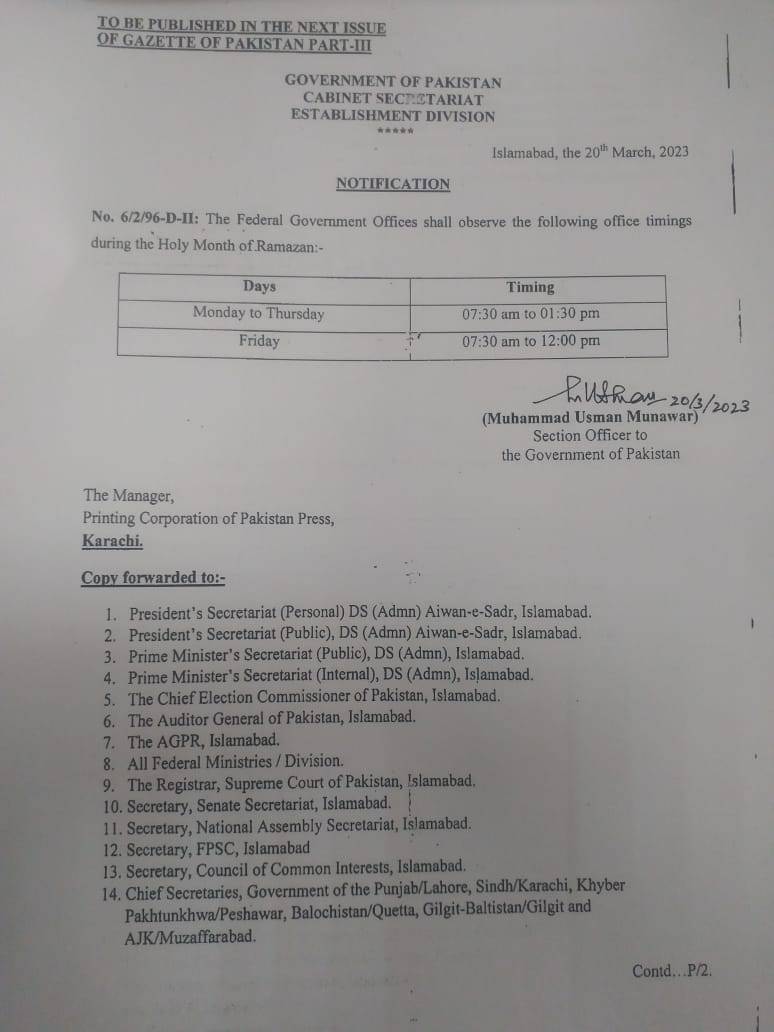

Lahwr Py Ays Ayl Mychz Ke Dwran Askwlwn Ke Nye Awqat Kar

May 08, 2025

Lahwr Py Ays Ayl Mychz Ke Dwran Askwlwn Ke Nye Awqat Kar

May 08, 2025