Warren Buffett's Legacy: A Canadian Billionaire Takes The Reins (Without Many Berkshire Shares)

Table of Contents

The End of an Era: Warren Buffett's Retirement and its Impact

Warren Buffett's decades-long stewardship of Berkshire Hathaway is legendary. His influence extends far beyond the realm of finance, shaping business strategies and investment philosophies for generations. His retirement marks the end of an era, presenting immense challenges in finding a successor capable of upholding his incredible track record and maintaining the unique corporate culture he cultivated. The task is monumental: preserving Berkshire Hathaway's distinctive investment strategy and ensuring continued growth in a constantly evolving market is no easy feat.

- Buffett's key investment principles: Value investing, long-term perspective, and understanding underlying business fundamentals were cornerstones of Buffett's success.

- Berkshire Hathaway's diverse portfolio: From insurance giants to iconic consumer brands, the portfolio's diversification reflects Buffett's shrewd investment strategies and risk management.

- The company's long-term growth strategy: A hallmark of Berkshire Hathaway's success has been its patient, long-term approach to investment and growth.

The Canadian Billionaire's Unexpected Role: Who is He and What is His Influence?

While the specific identity of this Canadian billionaire remains undisclosed for now (to maintain confidentiality until official announcements), his emergence as a key figure in shaping Berkshire Hathaway's future is a significant development. His relationship with Berkshire Hathaway, whether as a board member, advisor, or in another capacity, is currently shrouded in some mystery, adding to the intrigue. What makes this situation truly unique is his relatively small ownership stake in Berkshire Hathaway. This raises important questions about the nature of his influence and potential conflicts of interest. Does his investment philosophy align with Buffett's value-oriented approach? Only time will tell.

- The billionaire's investment experience and expertise: Understanding the depth of his experience and expertise is crucial to assessing the potential impact on Berkshire Hathaway's investment decisions.

- His business achievements and track record: A successful track record is essential, but it remains to be seen if this aligns seamlessly with Berkshire Hathaway's existing strategies.

- Potential conflicts of interest: Given the lack of substantial Berkshire Hathaway ownership, careful scrutiny of potential conflicts of interest will be necessary.

- Public perception of his role: The public’s perception of this unexpected successor will heavily influence market sentiment and investor confidence.

Analyzing the Impact on Berkshire Hathaway's Investment Strategy

The question on many investors' minds is: Will the Canadian billionaire significantly alter Berkshire Hathaway's established investment approach? Will we see shifts in portfolio composition, a change in risk tolerance, or a departure from Buffett's proven strategies? The implications for long-term investors and shareholders are substantial. Any deviation from the well-established path could significantly impact stock valuation and future returns.

- Comparison of the billionaire's investment style with Buffett's: A detailed comparison of both investment philosophies is crucial for predicting potential future strategies.

- Potential shifts in investment sectors: Will the billionaire favor specific sectors, leading to a reallocation of Berkshire Hathaway's assets?

- Impact on stock valuation: The market's reaction to any perceived changes in investment strategy will inevitably affect Berkshire Hathaway's stock valuation.

The Future of Berkshire Hathaway: Challenges and Opportunities

Navigating the post-Buffett era presents significant challenges for Berkshire Hathaway. Maintaining the company's unique culture, adapting to changing market conditions, and ensuring seamless succession planning are paramount. However, this transition also presents opportunities for growth and innovation. Diversification into new sectors and the adoption of modern technologies could revitalize the company's investment strategies. But inherent risks and uncertainties remain, including potential market downturns and unforeseen economic challenges.

- Succession planning challenges: The smooth transition of leadership and the continuation of successful strategies are key challenges.

- Maintaining corporate culture: Preserving the values and principles that have defined Berkshire Hathaway's success is crucial for its long-term viability.

- Adapting to changing market conditions: The business landscape is dynamic; Berkshire Hathaway must adapt to thrive.

- Potential for diversification: Exploring new investment avenues is crucial for future growth and resilience.

Conclusion: Warren Buffett's Legacy and the Path Forward

The succession at Berkshire Hathaway is a pivotal moment, shaping the future of a financial giant. The Canadian billionaire's unexpected influence, despite limited share ownership, presents both opportunities and challenges. Maintaining Warren Buffett's legacy requires careful stewardship, a deep understanding of his investment philosophy, and a proactive approach to adapting to the evolving market. The coming years will be critical in determining whether Berkshire Hathaway can successfully navigate this transition and continue its remarkable growth trajectory. Stay informed about developments in Warren Buffett's legacy and the evolution of Berkshire Hathaway by subscribing to our newsletter [link to newsletter] or following us on [link to social media]. Further reading on succession planning in large corporations and the investment strategies of successful Canadian billionaires can offer valuable insights.

Featured Posts

-

Academic Responsibility In Reporting On Mental Illness And Crime

May 09, 2025

Academic Responsibility In Reporting On Mental Illness And Crime

May 09, 2025 -

The Real Safe Bet Investing Strategies For Secure Returns

May 09, 2025

The Real Safe Bet Investing Strategies For Secure Returns

May 09, 2025 -

Colapintos Rise Challenging Liam Lawson For A Red Bull Seat

May 09, 2025

Colapintos Rise Challenging Liam Lawson For A Red Bull Seat

May 09, 2025 -

Zolotaya Malina 2024 Dakota Dzhonson I Nominatsiya Na Khudshiy Film

May 09, 2025

Zolotaya Malina 2024 Dakota Dzhonson I Nominatsiya Na Khudshiy Film

May 09, 2025 -

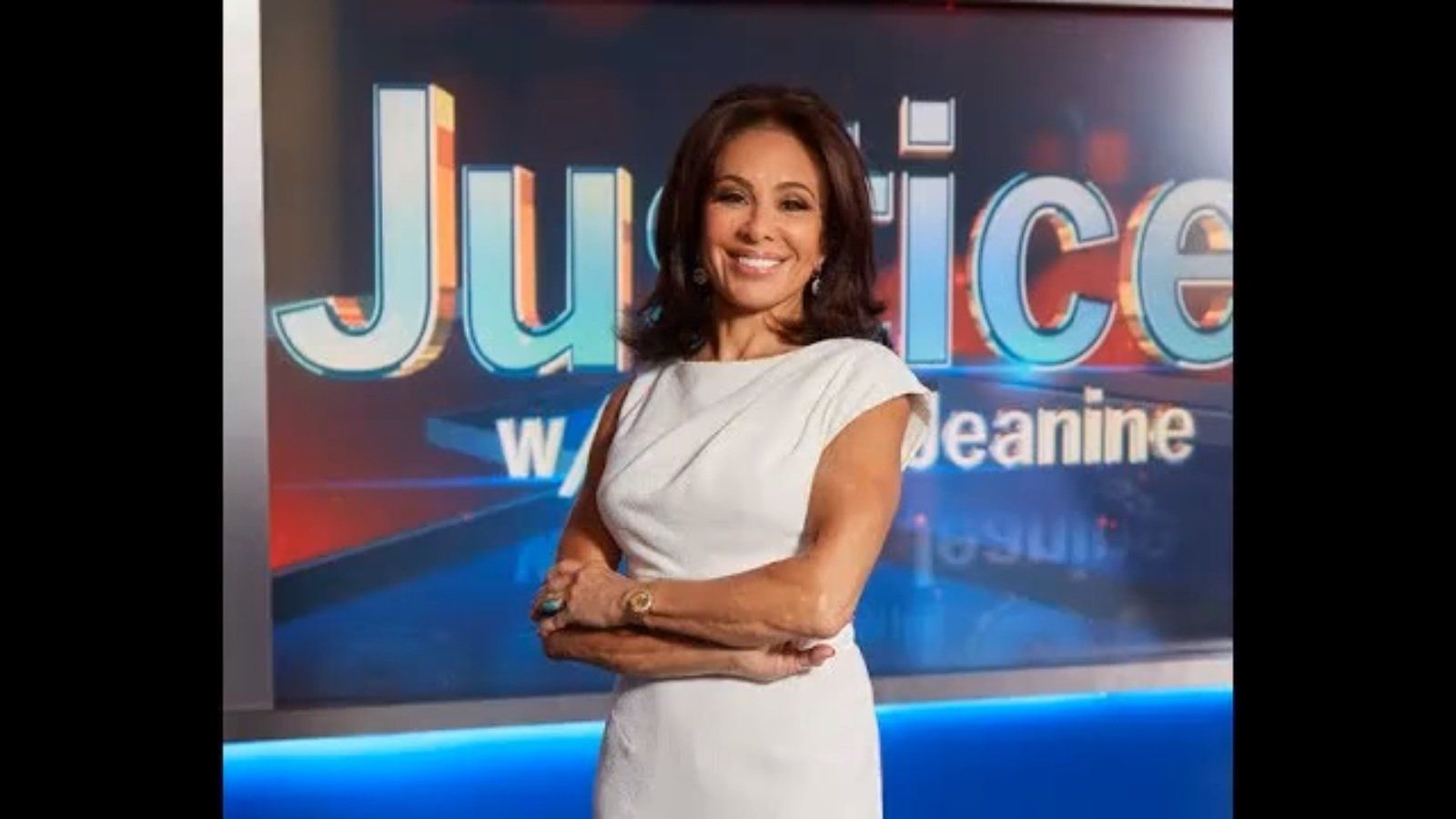

Jeanine Pirros Fox News Career An Inside Perspective

May 09, 2025

Jeanine Pirros Fox News Career An Inside Perspective

May 09, 2025