Weak Q1 Figures Trigger 6% Drop In Kering Share Price

Table of Contents

Disappointing Q1 Performance: A Detailed Look at the Numbers

Kering's Q1 2024 figures revealed a concerning picture for the luxury conglomerate. Revenue growth significantly lagged behind projections, with a reported increase of only 3%, compared to the anticipated 7-8%. This underwhelming performance directly impacted profit margins, which fell by 2 percentage points to 28%. Comparing this to Q1 2023 reveals a stark contrast, with revenue growth in the previous year exceeding 15%.

Several brands within the Kering portfolio underperformed expectations. Gucci, traditionally a strong performer, experienced a mere 1% sales growth, far below its projected figures. Yves Saint Laurent showed slightly better results, but still fell short of expectations. Balenciaga, though, was a significant contributor to the decline, suffering a 5% drop in sales due to ongoing reputational challenges.

Geographical performance highlighted regional discrepancies. While the European market showed relatively stable growth, the crucial APAC (Asia-Pacific) region, a major driver of luxury goods sales, experienced a significant slowdown, with sales growth dipping below 2%. North America also showed weaker-than-expected results.

Key Weaknesses in Q1 Performance:

- Lower-than-anticipated sales growth in the APAC region (down 3% compared to Q1 2023 projections).

- Decreased demand for specific product categories, notably leather goods and ready-to-wear within the Gucci brand.

- Increased operating costs impacting profit margins, driven partly by rising raw material prices and supply chain complexities.

Underlying Factors Contributing to the Kering Share Price Drop

Beyond the specific Q1 figures, several broader factors contributed to the Kering share price drop. The current macroeconomic environment presents significant headwinds for luxury goods companies. Global inflation continues to erode consumer purchasing power, leading to decreased discretionary spending, especially on high-value items like luxury goods. Recessionary fears in key markets also dampen consumer confidence, impacting demand for luxury products. Geopolitical instability further adds uncertainty to the market.

Increased competition within the luxury sector also plays a role. Emerging luxury brands and established competitors are aggressively vying for market share, creating a more competitive landscape that is squeezing profit margins. Supply chain disruptions, while easing somewhat, continue to impact production schedules and delivery times, adding further pressure on sales and profitability. Finally, evolving consumer behavior, particularly a growing preference for sustainable and ethical luxury, requires Kering to adapt its strategies and offerings.

Contributing Factors Summary:

- Impact of global inflation on consumer spending, reducing demand for luxury goods.

- Increased competition from emerging and established luxury brands, leading to price wars and reduced margins.

- Lingering supply chain bottlenecks impacting production efficiency and on-time delivery.

- Shifting consumer preferences towards sustainable and ethical luxury brands, requiring brand repositioning and new strategies.

Analyst Reactions and Market Outlook for Kering Stock

Following the release of the disappointing Q1 report, analyst reactions were largely negative. Several investment banks downgraded their rating on Kering stock, citing concerns over the company's ability to meet its full-year targets. One prominent analyst stated, "Kering's Q1 figures represent a significant setback, highlighting the challenges facing the luxury sector in the current macroeconomic environment."

The projected outlook for Kering's share price in the coming quarters remains uncertain. Most analysts forecast a modest recovery in the following quarters, but full recovery to pre-Q1 levels is not expected in the short term. Kering will likely need to implement aggressive strategies to regain investor confidence and bolster sales. This may include strategic price adjustments, renewed marketing campaigns focusing on key product categories, and an accelerated push towards sustainable and ethical practices. However, the success of these strategies remains to be seen.

Analyst Predictions and Market Outlook Summary:

- Consensus forecast for Kering share price recovery is gradual and dependent on successfully addressing underlying issues.

- Potential catalysts for future growth include successful product launches, improved performance in key markets like APAC, and a successful shift towards sustainable practices.

- Risks and challenges include ongoing macroeconomic uncertainty, increased competition, and the need for effective brand repositioning.

Conclusion: Navigating the Future of Kering's Share Price

The 6% drop in Kering's share price following its weak Q1 figures reflects a confluence of factors, including disappointing brand performance, a challenging macroeconomic environment, heightened competition, and evolving consumer preferences. The underwhelming Q1 figures significantly impacted investor sentiment, leading to a reassessment of Kering's short-term prospects. While analysts forecast a gradual recovery, the road ahead remains challenging. Kering's ability to adapt its strategies, address operational inefficiencies, and successfully navigate the evolving luxury goods landscape will determine the future trajectory of its share price. Stay informed about the evolving situation by regularly checking financial news and analysis on Kering's Q2 performance. Understanding the factors affecting the Kering share price is crucial for informed investment decisions.

Featured Posts

-

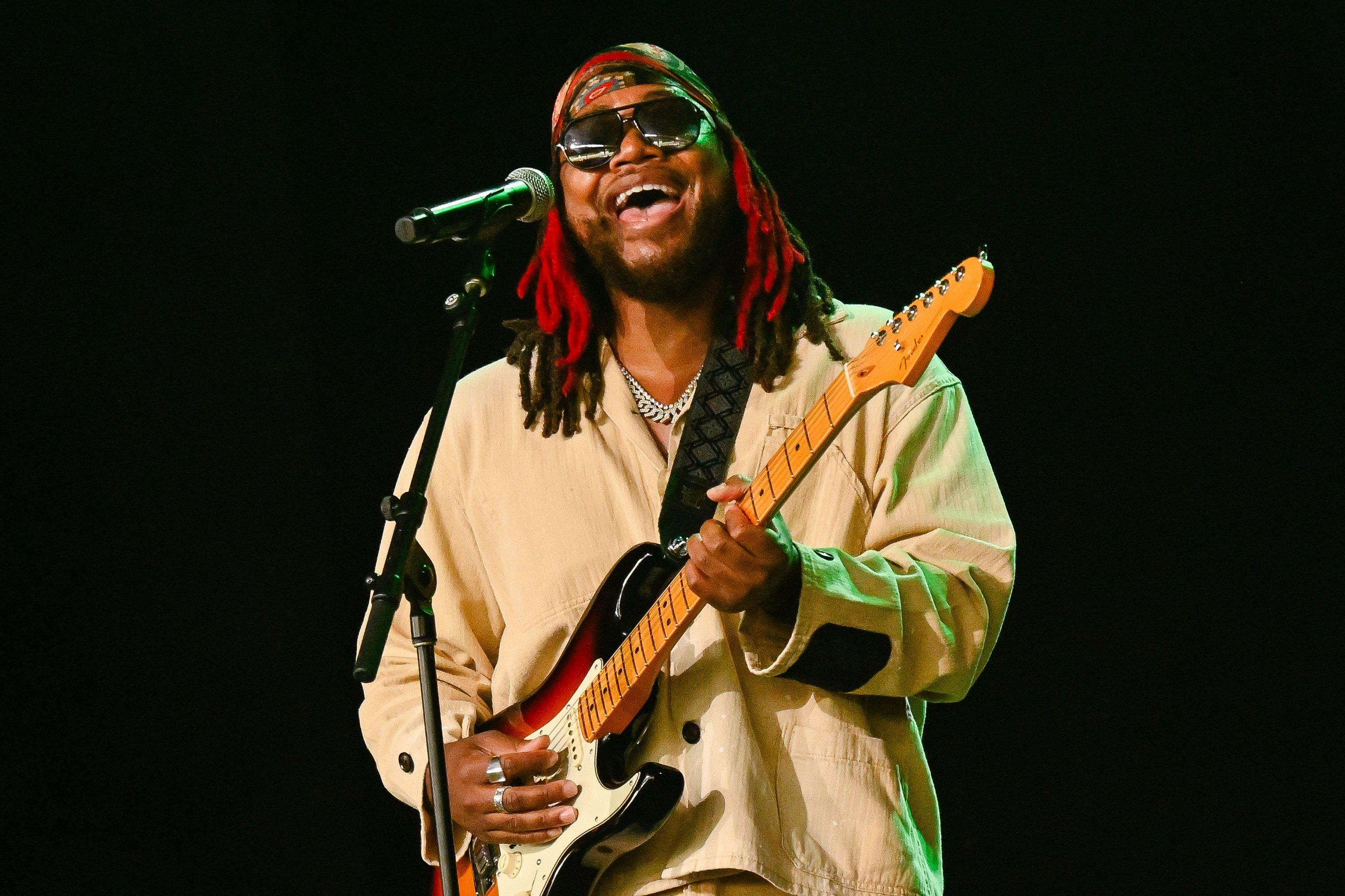

New R And B Music Releases Leon Thomas Flo And More

May 24, 2025

New R And B Music Releases Leon Thomas Flo And More

May 24, 2025 -

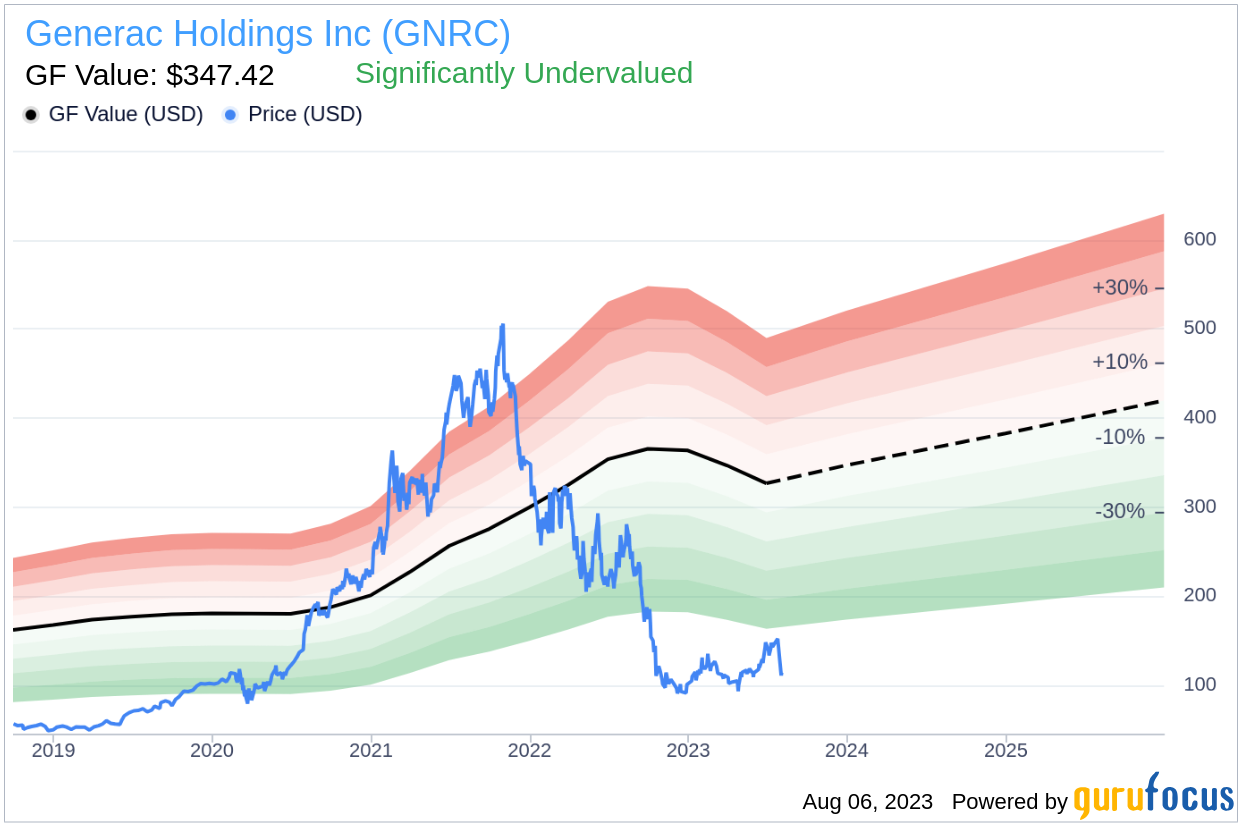

News Corps Undervalued Potential A Comprehensive Analysis

May 24, 2025

News Corps Undervalued Potential A Comprehensive Analysis

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Dates And Booking Information

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Dates And Booking Information

May 24, 2025 -

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yewd Bqwt

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Awl Mwshr Awrwby Yewd Bqwt

May 24, 2025 -

Following Husbands Night Out Annie Kilner Steps Out Alone

May 24, 2025

Following Husbands Night Out Annie Kilner Steps Out Alone

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025