Weakening U.S. Economy: 0.2% Contraction Driven By Spending And Tariffs

Table of Contents

The Impact of Reduced Consumer Spending on the U.S. Economy

Consumer spending is the bedrock of the U.S. economy, accounting for roughly 70% of GDP. A decline in consumer spending, therefore, directly translates to a significant slowdown in economic growth. Several factors have contributed to this reduction in recent months. High inflation, driven by rising energy prices and supply chain disruptions, has eroded purchasing power, leaving consumers with less disposable income. Simultaneously, rising interest rates, implemented by the Federal Reserve to combat inflation, have made borrowing more expensive, impacting major purchases like homes and automobiles. Finally, high levels of consumer debt further limit disposable income, forcing many households to prioritize debt repayment over discretionary spending.

- Increased inflation erodes purchasing power: The rising cost of living significantly impacts consumer confidence and spending habits.

- Higher interest rates make borrowing more expensive: This discourages large purchases financed through loans, impacting sectors like housing and automobiles.

- High levels of consumer debt limit disposable income: Households burdened with debt have less money available for spending on goods and services.

Recent data shows a noticeable decrease in retail sales, reflecting this decline in consumer confidence and spending. Understanding the interplay between inflation, interest rates, and consumer debt is crucial for comprehending the current economic slowdown. Keywords: Consumer Confidence, Inflation, Interest Rates, Disposable Income, Retail Sales.

The Negative Effects of Tariffs on Economic Growth

The imposition of tariffs, a form of protectionism, significantly impacts both businesses and consumers. Tariffs increase the cost of imported goods, leading to higher prices for consumers and increased input costs for businesses. This ripple effect cascades throughout the economy, affecting various sectors. For instance, tariffs on steel and aluminum have impacted the automotive and construction industries, while tariffs on agricultural products have affected farmers and food processors.

- Increased prices for imported goods lead to higher inflation: This further erodes consumer purchasing power and fuels the economic slowdown.

- Businesses face increased input costs, reducing profitability and potentially leading to job losses: Companies struggle to maintain profit margins, leading to potential layoffs and reduced investment.

- Trade wars and retaliatory tariffs further exacerbate the negative impacts: Escalating trade disputes create uncertainty and disrupt global supply chains.

Statistical analysis reveals a clear correlation between the imposition of tariffs and a decline in specific industries' output, ultimately contributing to a lower overall GDP. Keywords: Trade War, Import Costs, Global Trade, Protectionism, Supply Chain Disruptions.

Other Contributing Factors to the Economic Slowdown

Beyond reduced consumer spending and tariffs, several other factors contribute to the weakening U.S. economy. Geopolitical uncertainties, such as the ongoing war in Ukraine and rising tensions in other regions, create instability and impact investor confidence. Supply chain disruptions, though easing somewhat, continue to affect production and increase costs. A slowdown in the housing market, driven by higher mortgage rates, further dampens economic activity. Finally, the Federal Reserve's tightening monetary policy, while aimed at curbing inflation, also slows economic growth by increasing borrowing costs. Keywords: Geopolitical Risk, Supply Chain, Housing Market, Monetary Policy, Federal Reserve.

Conclusion: Understanding and Addressing the Weakening U.S. Economy

The 0.2% economic contraction underscores the seriousness of the weakening U.S. economy. Reduced consumer spending, fueled by inflation and higher interest rates, and the negative impact of tariffs are key drivers of this slowdown. Other factors, including geopolitical risks, supply chain issues, and a cooling housing market, further complicate the economic outlook. Addressing the weakening U.S. economy requires a multi-pronged approach, potentially including fiscal stimulus measures, targeted tax cuts to boost consumer spending, and policies to address supply chain vulnerabilities. Understanding the Weakening U.S. Economy is crucial for informed decision-making. Stay informed about economic developments by following reputable news sources and engaging in discussions about effective economic policies. By addressing the root causes of this slowdown, we can work towards a more robust and stable economy.

Featured Posts

-

Gestion Du Recul Du Trait De Cote A Saint Jean De Luz Enjeux Et Solutions

May 31, 2025

Gestion Du Recul Du Trait De Cote A Saint Jean De Luz Enjeux Et Solutions

May 31, 2025 -

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025

Ex Nypd Commissioner Bernard Kerik Hospitalized Full Recovery Expected

May 31, 2025 -

Katastrophenuebung Am Bodensee Hard Im Ernstfall

May 31, 2025

Katastrophenuebung Am Bodensee Hard Im Ernstfall

May 31, 2025 -

Klimawandel Und Bodensee Droht Der Verlust Des Sees In 20 000 Jahren

May 31, 2025

Klimawandel Und Bodensee Droht Der Verlust Des Sees In 20 000 Jahren

May 31, 2025 -

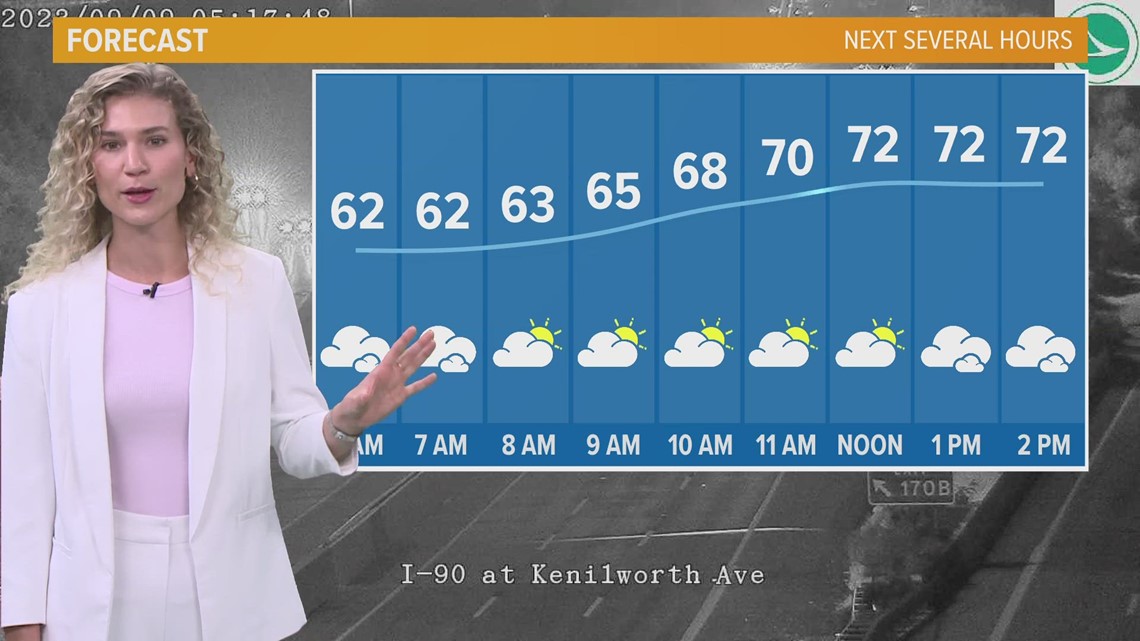

Updated Northeast Ohio Weather Forecast Rain Returns Thursday

May 31, 2025

Updated Northeast Ohio Weather Forecast Rain Returns Thursday

May 31, 2025