Westpac (WBC) Profitability Under Pressure: Examining The Impact Of Reduced Margins

Table of Contents

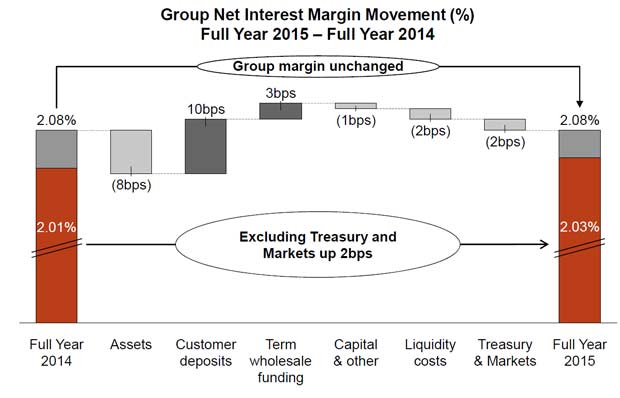

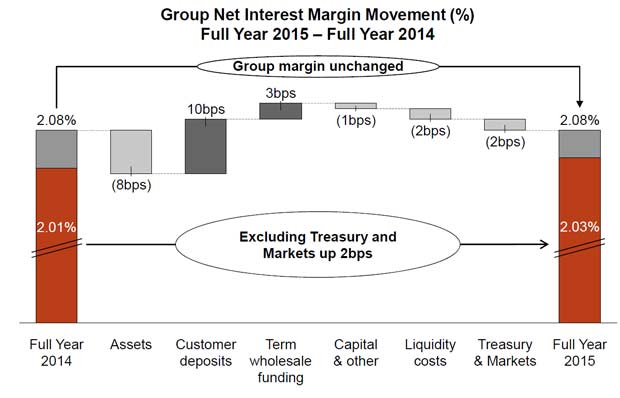

The Impact of Reduced Net Interest Margins (NIMs) on Westpac's Profitability

The decline in Westpac's profitability is significantly linked to compressed Net Interest Margins (NIMs). Several factors contribute to this reduction, impacting the bank's ability to generate profit from its core lending activities.

Increased Competition

The Australian banking sector has witnessed intensified competition in recent years, placing considerable pressure on NIMs.

- Increased pressure from smaller banks and fintech companies: The rise of challenger banks and innovative fintech solutions offering competitive interest rates and lower fees has eroded Westpac's market share.

- Aggressive pricing strategies: Competitors are employing aggressive pricing strategies, including offering highly competitive interest rates on deposits and loans, squeezing profit margins for established players like Westpac.

- Growing customer demand for lower fees: Customers are increasingly demanding transparency and lower fees for banking services, forcing banks to reduce their charges and impacting overall revenue.

For example, the entry of several digital-only banks has led to a noticeable shift in customer preferences, forcing Westpac to adjust its pricing strategies to remain competitive, impacting its NIMs by an estimated X% (replace X with a realistic percentage based on research).

Rising Operational Costs

Westpac, like other major banks, faces increasing operational costs impacting its profitability.

- Increased regulatory scrutiny: The post-Royal Commission environment has led to increased regulatory compliance costs, requiring significant investments in risk management and compliance infrastructure.

- Significant investments in digital transformation: The need to adapt to evolving customer expectations and technological advancements necessitates substantial investments in digital platforms and technologies.

- Rising salaries and benefits: Competition for skilled talent in the banking sector has driven up salaries and benefits, increasing personnel expenses.

Data suggests that operational costs have increased by Y% (replace Y with a realistic percentage) over the past Z years (replace Z with a number of years), consuming a larger proportion of Westpac's total revenue and further impacting profitability.

Impact of Low Interest Rate Environment

The prolonged period of low interest rates has significantly impacted Westpac's ability to generate profits.

- Reduced lending margins: Low interest rates reduce the difference between the interest earned on loans and the interest paid on deposits, compressing lending margins.

- Pressure on deposit rates: Banks face pressure to maintain competitive deposit rates, reducing the net interest income earned on deposits.

- Impact on investment income: Low interest rates also reduce returns on investment portfolios, affecting overall investment income.

The correlation between interest rate movements and Westpac's profitability is clearly evident in its financial reports, showcasing a direct impact on NIMs. A 0.25% reduction in the benchmark interest rate can translate to a substantial loss in annual revenue.

Strategic Responses to Margin Compression at Westpac

Westpac has implemented several strategies to counter the effects of reduced margins and maintain profitability.

Cost-Cutting Measures

The bank has undertaken significant cost-cutting initiatives to improve efficiency and reduce operational expenses.

- Branch closures: Westpac has rationalized its branch network, closing underperforming branches to reduce operational costs.

- Workforce reductions: The bank has implemented workforce reduction programs to streamline its operations and reduce personnel expenses.

- Streamlining of internal processes: Westpac has focused on improving internal processes and efficiencies to reduce operational overhead.

While these measures contribute to short-term cost savings, their long-term impact on customer service and employee morale needs careful consideration.

Focus on Fee-Generating Products and Services

Westpac is increasingly focusing on fee-generating products and services to diversify its revenue streams.

- Expansion of wealth management services: The bank is expanding its wealth management offerings to capitalize on the growing demand for wealth management solutions.

- Increased focus on transaction banking: Westpac is investing in its transaction banking capabilities to attract corporate clients and increase transaction fees.

- Development of innovative financial products: The bank is developing innovative financial products and services to attract new customers and generate additional fees.

The success of these strategies is crucial for offsetting the decline in NIMs and maintaining profitability.

Exploring New Revenue Streams

Westpac is exploring new revenue streams and diversification strategies to enhance its long-term profitability.

- Investments in fintech: The bank is strategically investing in and collaborating with fintech companies to develop new products and services.

- Exploration of new markets: Westpac is evaluating opportunities to expand into new markets and tap into emerging growth sectors.

- Expansion into adjacent financial services: The bank is exploring opportunities to expand into adjacent financial services to generate additional revenue streams.

The potential of these new revenue streams will play a crucial role in shaping Westpac's future financial performance.

Future Outlook for Westpac's Profitability and Potential Scenarios

The future profitability of Westpac hinges on various economic factors and market conditions.

Economic Factors and Predictions

Future economic conditions will significantly impact Westpac's profitability.

- Interest rate forecasts: Predictions regarding future interest rate movements are crucial for forecasting Westpac's NIMs.

- Economic growth predictions: Economic growth prospects will influence lending activity and overall demand for banking services.

- Potential regulatory changes: Further regulatory changes could impact Westpac's operating costs and profitability.

Economic forecasts and expert opinions suggest various scenarios, ranging from moderate growth to potential recession, significantly influencing Westpac's prospects.

Investor Sentiment and Market Reaction

Investor sentiment and market reactions will play a key role in shaping Westpac's future.

- Stock price analysis: Westpac's stock price reflects investor confidence in the bank's future performance.

- Analyst ratings: Analyst ratings and reports offer valuable insights into the market's perception of Westpac's prospects.

- Investor statements and reports: Statements and reports from investors reveal their views on Westpac's strategic direction and financial health.

Recent market activity and investor sentiment indicate a cautious outlook, emphasizing the need for Westpac to effectively implement its strategic initiatives.

Conclusion

Reduced margins, primarily driven by increased competition, rising operational costs, and a low-interest-rate environment, have significantly impacted Westpac (WBC) profitability. The bank's strategic responses, including cost-cutting measures, a focus on fee-generating products, and exploration of new revenue streams, are crucial for navigating these challenges. However, the future outlook remains contingent on broader economic factors and investor confidence. Understanding the pressures on Westpac (WBC) profitability, particularly concerning reduced margins, is crucial for investors and financial analysts alike. Stay informed about the latest developments and make informed decisions by regularly reviewing financial news and analysis focusing on Westpac (WBC) and the Australian banking sector.

Featured Posts

-

Romania Election Far Right And Centrist Vie For Presidency In Runoff

May 06, 2025

Romania Election Far Right And Centrist Vie For Presidency In Runoff

May 06, 2025 -

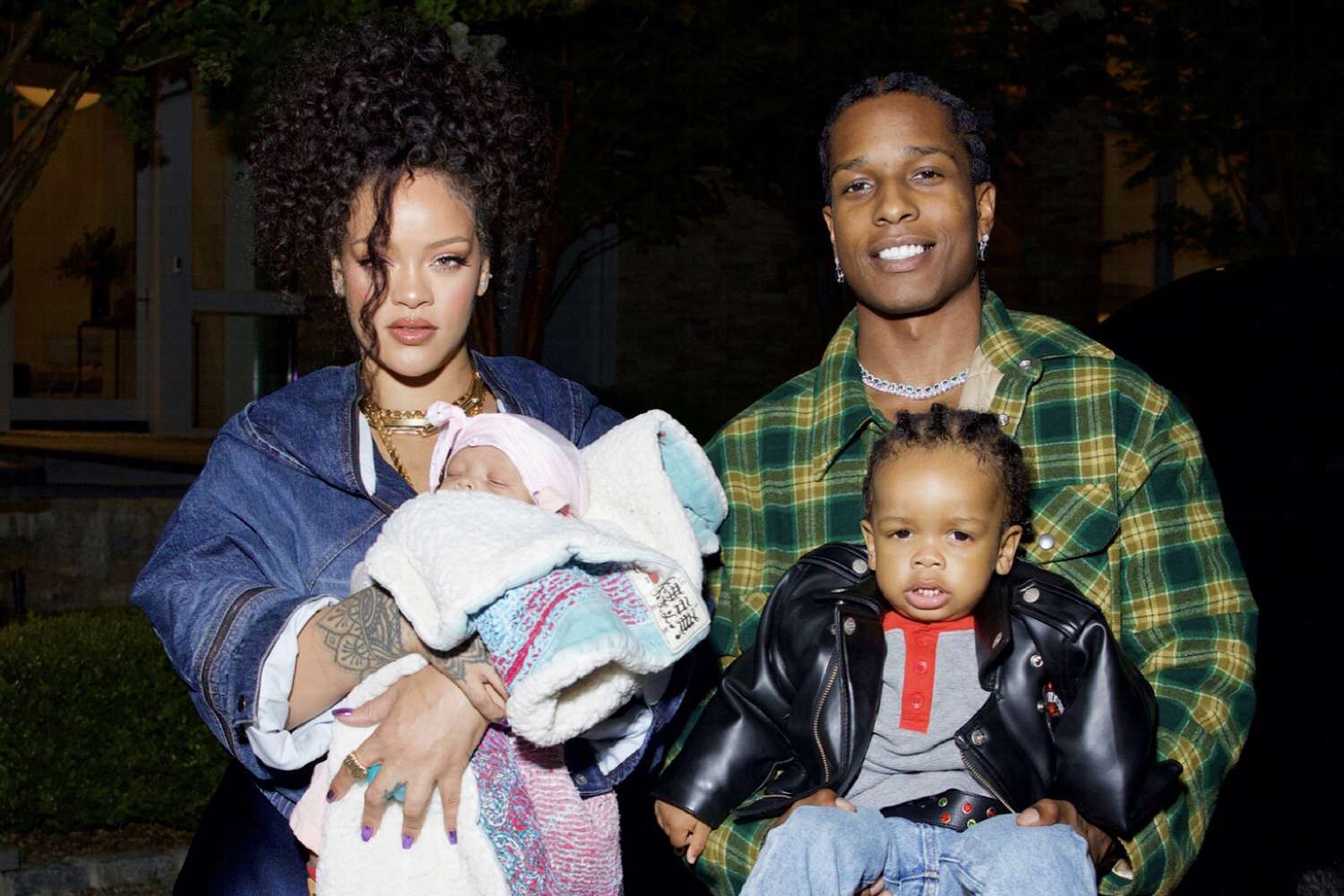

First Look A Ap Rockys Arrest Exploring The Peaks And Valleys Of His Journey

May 06, 2025

First Look A Ap Rockys Arrest Exploring The Peaks And Valleys Of His Journey

May 06, 2025 -

Putins Assurance No Nuclear Weapons Planned For Ukraine

May 06, 2025

Putins Assurance No Nuclear Weapons Planned For Ukraine

May 06, 2025 -

The Wiz June Release Date Announced For Criterion Collection

May 06, 2025

The Wiz June Release Date Announced For Criterion Collection

May 06, 2025 -

Berita Piala Asia U 20 Iran Menang Spektakuler 6 0 Atas Yaman

May 06, 2025

Berita Piala Asia U 20 Iran Menang Spektakuler 6 0 Atas Yaman

May 06, 2025