WhatsApp And Instagram: The FTC's Antitrust Lawsuit Against Meta Platforms

Table of Contents

The FTC's Allegations of Anti-Competitive Behavior

The FTC's core argument centers on the assertion that Meta engaged in anti-competitive behavior by acquiring WhatsApp and Instagram, thereby eliminating potential competitors and solidifying its monopoly in the social networking space. This claim is built upon a two-pronged approach: monopolization and the leveraging of market power.

Monopolization Claims

The FTC argues that Meta, previously known as Facebook, used its considerable financial resources and market influence to strategically acquire WhatsApp and Instagram, preventing these companies from growing into significant rivals. This action, the FTC claims, was not driven by innovation or consumer benefit, but rather a calculated move to eliminate competition.

- Allegation 1: Meta acquired WhatsApp and Instagram to stifle competition and prevent the emergence of alternative dominant social media platforms.

- Allegation 2: Meta leveraged its market power to use the data gathered from WhatsApp and Instagram to further its dominance in advertising and targeted marketing, hindering the ability of smaller competitors to compete effectively.

- Allegation 3: The acquisitions were not justified by legitimate business reasons related to innovation or efficiency, and instead served solely to protect Meta's existing monopoly.

Evidence Presented by the FTC

The FTC's case rests on a substantial body of evidence, aiming to demonstrate Meta's intent and the anti-competitive effects of the acquisitions. This evidence includes internal communications, market analysis, and expert testimony.

- Internal Communications: Emails and internal documents allegedly reveal Meta's intent to neutralize potential competitive threats posed by WhatsApp and Instagram. These documents, if proven authentic and correctly interpreted, would be crucial in establishing Meta’s intent to suppress competition.

- Market Analysis: Statistical data presented by the FTC aimed to illustrate Meta’s overwhelming market share dominance before and after the acquisitions. This quantitative data is designed to support the claim that Meta’s actions created and reinforced a significant barrier to entry for new competitors.

- Expert Testimony: The FTC relied on expert witnesses – economists and market analysts – to provide testimony explaining the anti-competitive implications of the acquisitions. These expert opinions offered an interpretation of the evidence and provided context for the economic considerations.

Meta's Defense Strategy

Meta vehemently denies the FTC's allegations, arguing that the acquisitions of WhatsApp and Instagram were pro-competitive and ultimately beneficial to consumers. Their defense rests on several key arguments.

Denial of Anti-Competitive Intent

Meta's central defense strategy revolves around refuting the notion of anti-competitive intent. They claim the acquisitions were driven by legitimate business objectives focused on innovation, user experience, and expanding their services.

- Enhanced Innovation and User Experience: Meta argues that integrating WhatsApp and Instagram into its ecosystem has led to innovation, improving the user experience by offering greater interoperability and access to various features.

- Increased Integration and Interoperability: The argument is that these acquisitions allowed for seamless integration between the platforms, benefiting users through improved functionality and connectivity.

- Competitive Market: Meta contends that the social media market remains competitive, pointing to the emergence of new social media platforms as evidence against the claim of a monopoly.

Counterarguments and Legal Strategies

Meta’s legal team has employed various strategies to challenge the FTC’s case, including counterarguments to the evidence presented and the leveraging of legal precedents.

- Challenging Market Definition: Meta is likely to contest the FTC's definition of the relevant market, potentially arguing that the market is broader than just social networking, thereby reducing its perceived market share.

- Increased Consumer Choice and Benefits: Meta will emphasize the increased consumer choice and benefits resulting from the acquisitions, highlighting the expanded services and user experience improvements.

- Legal Precedents and Expert Witnesses: Meta will rely on legal precedents and expert witnesses of their own to counter the FTC’s claims, arguing that the acquisitions were legal and did not violate antitrust law.

Potential Outcomes and Implications

The outcome of this landmark lawsuit will have significant implications for both Meta and the future of mergers and acquisitions within the tech industry.

Possible Remedies and Penalties

If the FTC prevails, several remedies are possible, ranging from financial penalties to structural changes within Meta.

- Divestiture: The most significant potential outcome is divestiture—forcing Meta to sell either WhatsApp or Instagram. This would reshape the social media landscape drastically.

- Financial Penalties: Significant financial penalties are a strong possibility, designed to deter future anti-competitive behavior. The amount of these penalties could influence future corporate actions.

- Operational Changes: The court may mandate changes to Meta’s business practices and operational procedures to ensure future compliance with antitrust regulations.

Impact on Future Acquisitions in the Tech Sector

The ruling in this case will serve as a crucial precedent, profoundly impacting how future mergers and acquisitions are evaluated within the tech sector.

- Increased Regulatory Scrutiny: The lawsuit signals a heightened level of regulatory scrutiny for large tech companies looking to acquire smaller competitors.

- Valuation of Tech Companies: The outcome could influence the valuation of tech companies, potentially impacting investment strategies and the willingness of companies to engage in acquisitions.

- Acquisition Strategies: Tech companies will need to reassess their acquisition strategies to ensure compliance with stricter antitrust regulations.

Conclusion

The FTC’s antitrust lawsuit against Meta Platforms regarding WhatsApp and Instagram is a watershed moment in the tech industry's regulatory landscape. This case underscores the complex challenge of balancing the need for innovation with the prevention of anti-competitive practices. The final outcome will not only significantly impact Meta but will also shape the future of competition, innovation, and antitrust enforcement in the ever-evolving digital world. Understanding this intricate legal battle – the Meta Platforms antitrust lawsuit – and its implications is crucial for anyone interested in the future of social media competition and the tech sector as a whole. Stay informed on the latest developments in this ongoing case.

Featured Posts

-

Upcoming Leonardo Di Caprio Movies Release Dates And Details

May 13, 2025

Upcoming Leonardo Di Caprio Movies Release Dates And Details

May 13, 2025 -

Unlocking The Mysteries Of The Da Vinci Code

May 13, 2025

Unlocking The Mysteries Of The Da Vinci Code

May 13, 2025 -

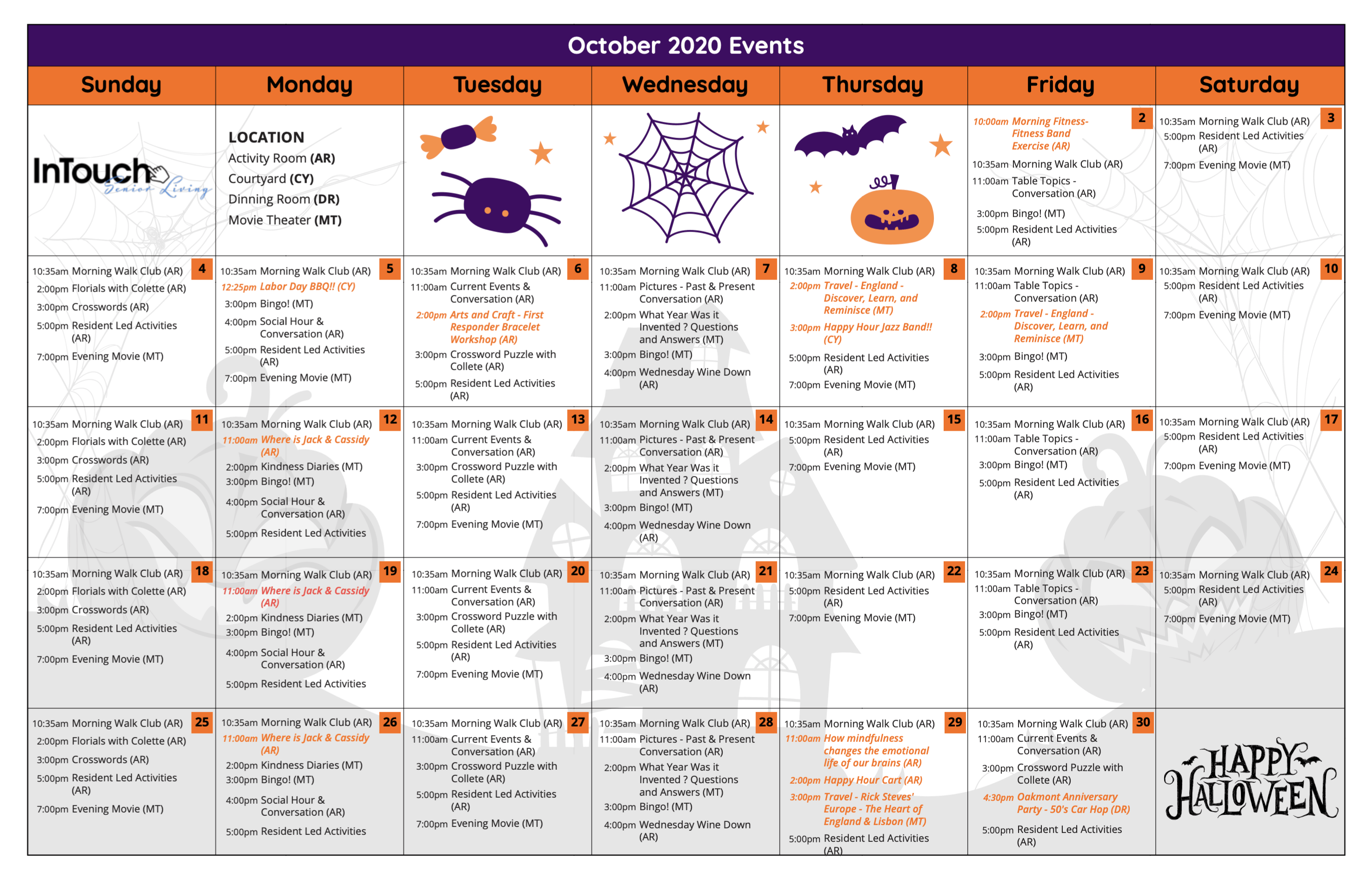

Senior Travel And Activity Calendar Events And Excursions

May 13, 2025

Senior Travel And Activity Calendar Events And Excursions

May 13, 2025 -

Doom The Dark Ages Release Date Trailers And News

May 13, 2025

Doom The Dark Ages Release Date Trailers And News

May 13, 2025 -

Cubs Vs Dodgers Game Preview Lineups And Where To Watch 2 05 Ct

May 13, 2025

Cubs Vs Dodgers Game Preview Lineups And Where To Watch 2 05 Ct

May 13, 2025