When Professionals Sell, Individuals Buy: Understanding Market Swings

Table of Contents

Professional Investor Strategies and Their Impact

Professional investors, including hedge funds, mutual funds, and institutional traders, operate on a different scale and with different strategies compared to individual investors. Their actions significantly influence market trends, particularly in instances of "When Professionals Sell, Individuals Buy."

Understanding Institutional Selling

Large institutions make investment decisions based on sophisticated quantitative analysis, macroeconomic factors, and rigorous risk management. These decisions often trigger significant market movements.

- Factors triggering institutional selling:

- Portfolio rebalancing: Adjusting asset allocations to maintain a desired risk profile.

- Profit-taking: Selling assets that have appreciated significantly to secure profits.

- Negative economic forecasts: Responding to indicators suggesting an impending economic downturn.

- Regulatory changes: Adapting to new rules and regulations impacting their investments.

The timing of these institutional trades is crucial. Large sell-offs can create downward pressure, influencing market sentiment and potentially triggering further selling by other investors. For example, the rapid sell-off in technology stocks in early 2022 was partly driven by institutional investors rebalancing their portfolios in response to rising interest rates.

The Role of Algorithmic Trading

High-frequency trading (HFT) and algorithmic strategies play a significant role in amplifying market swings. These automated systems react to news, price changes, and other market signals at incredible speeds.

- How algorithms react:

- News sentiment analysis: Algorithms process news articles and social media posts to gauge market sentiment.

- Price-based triggers: Algorithms execute trades based on predefined price thresholds.

- Order book analysis: Algorithms monitor order books to identify potential arbitrage opportunities.

This automated trading can lead to amplified volatility, as algorithms react simultaneously to the same information. "Flash crashes," sudden and dramatic drops in market prices, are often linked to the complex interplay of algorithmic trading strategies.

Individual Investor Behavior and Market Reactions

In contrast to professional investors, individual investors are often influenced by emotions, leading to decisions that may not align with sound financial principles. Understanding this behavioral aspect is crucial in understanding the "When Professionals Sell, Individuals Buy" dynamic.

Emotional Decision-Making

Fear and greed are powerful emotions that significantly impact individual investor behavior. This often results in poor timing, buying high during market peaks driven by greed and selling low during dips fueled by fear.

- Behavioral biases:

- Herd mentality: Following the crowd without independent analysis.

- Overconfidence: Overestimating one's ability to predict market movements.

- Anchoring bias: Over-relying on initial information, even if outdated.

Media and news coverage can exacerbate these emotional responses. Sensational headlines and negative news reports can trigger panic selling, creating self-fulfilling prophecies. Rational decision-making, focusing on long-term financial goals and risk tolerance, is essential to mitigate these emotional biases.

The "Contrarian" Approach

While risky, buying when professionals sell – a contrarian approach – can potentially yield significant returns. However, it requires careful analysis, risk management, and a strong understanding of market dynamics.

- Identifying buying opportunities:

- Analyzing market sentiment: Identifying periods of extreme pessimism.

- Focusing on undervalued assets: Seeking companies with strong fundamentals trading at low prices.

- Utilizing technical analysis (with caution): Identifying potential support levels.

Diversification and a high risk tolerance are crucial for a contrarian strategy. Historically, many successful investors have profited by buying during market downturns, capitalizing on the "When Professionals Sell, Individuals Buy" phenomenon.

Analyzing Market Data to Identify Trends

Effectively navigating market swings requires analyzing relevant economic indicators and market data. Combining this with an understanding of investor behavior can provide valuable insights.

Key Indicators to Watch

Several economic indicators and market data points can signal potential market shifts. Monitoring these can help you anticipate opportunities presented by "When Professionals Sell, Individuals Buy" situations.

- Key indicators:

- GDP growth: Reflects the overall health of the economy.

- Inflation rates: Impact interest rates and investor sentiment.

- Unemployment figures: Indicate consumer spending and economic strength.

- Market indices (S&P 500, Dow Jones): Provide a broad overview of market performance.

- VIX volatility index: Measures market uncertainty and fear.

Utilizing Technical Analysis

Technical analysis involves studying historical market data (price and volume) to identify patterns and predict future price movements. While it can be helpful, it shouldn't be the sole basis for investment decisions.

- Common technical indicators:

- Moving averages: Smooth out price fluctuations to identify trends.

- Relative strength index (RSI): Measures the magnitude of recent price changes to identify overbought or oversold conditions.

Fundamental Analysis and its Significance

Fundamental analysis involves evaluating a company's financial health, management team, and competitive landscape to determine its intrinsic value. This is crucial for identifying undervalued assets during market corrections.

- Using fundamental analysis:

- Analyzing financial statements: Assessing profitability, debt levels, and cash flow.

- Evaluating competitive advantages: Identifying factors contributing to a company's long-term success.

- Comparing valuation metrics: Assessing whether a company's stock price is justified by its fundamentals.

Conclusion

Understanding the differences between professional and individual investor behavior is crucial for navigating market swings. Professionals often act based on quantitative analysis and risk management, while individuals are prone to emotional decision-making. The "When Professionals Sell, Individuals Buy" dynamic presents both opportunities and risks. By carefully analyzing market data, utilizing fundamental and technical analysis (with caution), and maintaining a rational approach, you can potentially capitalize on market corrections. Mastering the art of understanding when professionals sell and individuals buy can significantly enhance your investment success. Continue your learning journey and build a robust investment strategy today! Explore further resources on investing strategies and risk management to navigate market volatility effectively.

Featured Posts

-

Understanding The Luigi Mangione Movement What His Supporters Want You To Know

Apr 28, 2025

Understanding The Luigi Mangione Movement What His Supporters Want You To Know

Apr 28, 2025 -

Trump Zelensky Meeting A First Since Their Tense Oval Office Confrontation

Apr 28, 2025

Trump Zelensky Meeting A First Since Their Tense Oval Office Confrontation

Apr 28, 2025 -

Yankees 2000 A Look At Joe Torres Leadership And Andy Pettittes Victory

Apr 28, 2025

Yankees 2000 A Look At Joe Torres Leadership And Andy Pettittes Victory

Apr 28, 2025 -

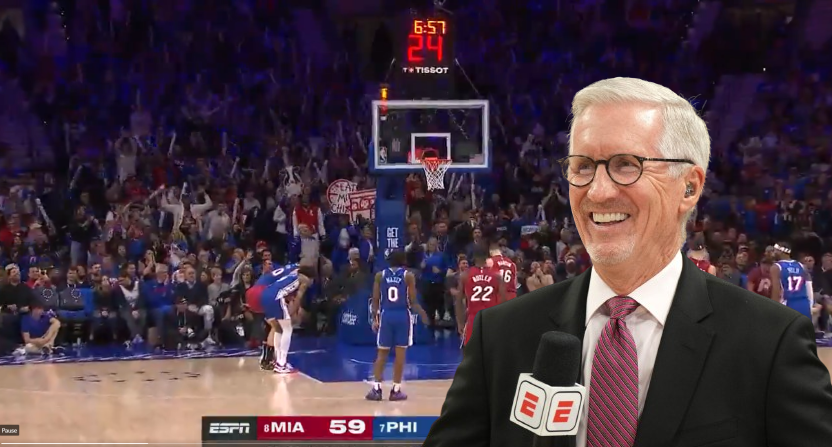

Marv Albert Mike Breens Pick For Greatest Basketball Announcer Of All Time

Apr 28, 2025

Marv Albert Mike Breens Pick For Greatest Basketball Announcer Of All Time

Apr 28, 2025 -

Tylor Megill Returns To Mets Rotation Deniel Nez Optioned

Apr 28, 2025

Tylor Megill Returns To Mets Rotation Deniel Nez Optioned

Apr 28, 2025

Latest Posts

-

Prince Andrews Temperament Unfiltered Accounts From Royal Insiders

May 12, 2025

Prince Andrews Temperament Unfiltered Accounts From Royal Insiders

May 12, 2025 -

Prince Andrews Temper Explosive Accounts From Palace Staff

May 12, 2025

Prince Andrews Temper Explosive Accounts From Palace Staff

May 12, 2025 -

New Undercover Footage Fuels Allegations Of Prince Andrews Sexual Misconduct With A Minor

May 12, 2025

New Undercover Footage Fuels Allegations Of Prince Andrews Sexual Misconduct With A Minor

May 12, 2025 -

Prince Andrew Accusers Dire Claim 4 Days Left

May 12, 2025

Prince Andrew Accusers Dire Claim 4 Days Left

May 12, 2025 -

Skandal Wokol Ksiecia Andrzeja Szokujace Zeznania Masazystki

May 12, 2025

Skandal Wokol Ksiecia Andrzeja Szokujace Zeznania Masazystki

May 12, 2025