Why Did D-Wave Quantum Inc. (QBTS) Stock Fall On Thursday?

Table of Contents

Lack of Significant News or Earnings Announcements

Sudden stock price drops are often preceded by an absence of positive news, leaving investors feeling uncertain about a company's future prospects. In the case of D-Wave Quantum's Thursday stock fall, a lack of positive catalysts likely played a significant role.

Absence of Positive Catalysts

The absence of positive news can significantly impact investor confidence. For QBTS, this could include:

- No major contract wins announced: Securing large-scale contracts is vital for demonstrating market traction and revenue growth in the quantum computing sector. The lack of such announcements could contribute to negative sentiment.

- No groundbreaking technological advancements reported: Investors are keenly interested in significant breakthroughs in quantum computing technology. Without updates on innovative developments, uncertainty increases.

- Silence on partnerships or funding rounds: Strategic partnerships and successful funding rounds can signal strong investor confidence and future growth potential. The absence of such news might fuel negative speculation.

Market Sentiment and Investor Expectations

Investor sentiment and expectations are powerful forces driving stock prices. High anticipation of positive news can inflate stock prices, while a failure to meet these expectations often leads to sell-offs. For QBTS:

- Analysts' predictions possibly not met: If analysts' expectations regarding performance or future growth weren't met, this could trigger a sell-off.

- General market downturn impacting high-growth tech stocks: The broader tech sector's performance can significantly influence individual stocks. A general market downturn may have disproportionately impacted high-growth tech companies like QBTS.

- Comparison with competitor performance: Investors often compare companies within the same sector. If competitors reported stronger results or achieved significant milestones, it could negatively impact QBTS's relative valuation.

Broader Market Trends Affecting Tech Stocks

The quantum computing industry, while promising, is still relatively young and susceptible to broader market trends.

Overall Market Volatility

General market volatility, particularly in the tech sector, can trigger sell-offs even for fundamentally sound companies. Several factors can contribute to this:

- Prevailing economic concerns: Macroeconomic factors like inflation, interest rate hikes, or recessionary fears can impact investor risk appetite, leading to sell-offs in riskier assets, including tech stocks.

- Geopolitical events: Global geopolitical instability can also increase market volatility and lead to investor uncertainty.

- Recent market indices trends: Negative trends in major market indices (e.g., the Nasdaq) often pull down even strong performing individual stocks.

Sector-Specific Downturn

A sector-specific downturn in the quantum computing industry could also influence investor confidence in QBTS. This might stem from:

- Negative news about competitor companies: Challenges faced by other players in the quantum computing space could create a negative ripple effect, impacting investor sentiment towards the entire sector.

- Challenges facing the quantum computing industry as a whole: Technological hurdles, regulatory uncertainty, or slower-than-expected market adoption could affect the entire sector, leading to a general downturn.

Technical Analysis and Trading Activity

Technical analysis can offer insights into trading patterns and potential explanations for price movements.

Short Selling and Profit-Taking

Increased short selling (betting on a stock price decline) or profit-taking by investors could have contributed to the QBTS stock price decline. Analyzing trading volume and patterns reveals:

- Unusual trading patterns: A sudden surge in trading volume coupled with a price drop might suggest increased short selling or profit-taking.

- Significant changes in the short interest of QBTS: An increase in short interest indicates a growing number of investors betting against the stock.

Chart Patterns and Technical Indicators

Certain technical indicators, while not definitive, can provide context:

- Moving averages: Crossovers of key moving averages can signal potential shifts in price trends.

- RSI (Relative Strength Index): An overbought RSI might suggest a potential correction was overdue.

- Relevant chart patterns: Identifying patterns like head and shoulders or double tops could offer clues, but shouldn't be the sole basis for interpreting price movements. It is crucial to avoid over-reliance on technical analysis without considering fundamental factors.

Speculation and Social Media Influence

Social media sentiment and speculation can also significantly impact stock prices. For QBTS:

- Social media sentiment surrounding QBTS: Negative sentiment on platforms like Twitter or StockTwits could contribute to sell-offs.

- Rumors or unsubstantiated news: Spread of unsubstantiated news or rumors can create negative sentiment and trigger selling pressure.

Conclusion

The D-Wave Quantum Inc. (QBTS) stock fall on Thursday likely resulted from a confluence of factors. The absence of positive news, broader market trends impacting the tech sector, technical indicators suggesting a potential correction, and possibly speculation fueled by social media, all contributed to the negative market reaction. It's crucial to remember that investing in quantum computing, while promising, involves significant risk.

Call to Action: To make informed investment decisions, continue researching D-Wave Quantum Inc. (QBTS) and the broader quantum computing industry. Thoroughly review the company’s financial reports and news releases, understand the competitive landscape, and stay abreast of market trends. Stay informed on D-Wave Quantum (QBTS) stock movements and the evolving landscape of quantum computing.

Featured Posts

-

Premijera Filma Jutarnji List Donosi Popis Slavnih Gostiju

May 20, 2025

Premijera Filma Jutarnji List Donosi Popis Slavnih Gostiju

May 20, 2025 -

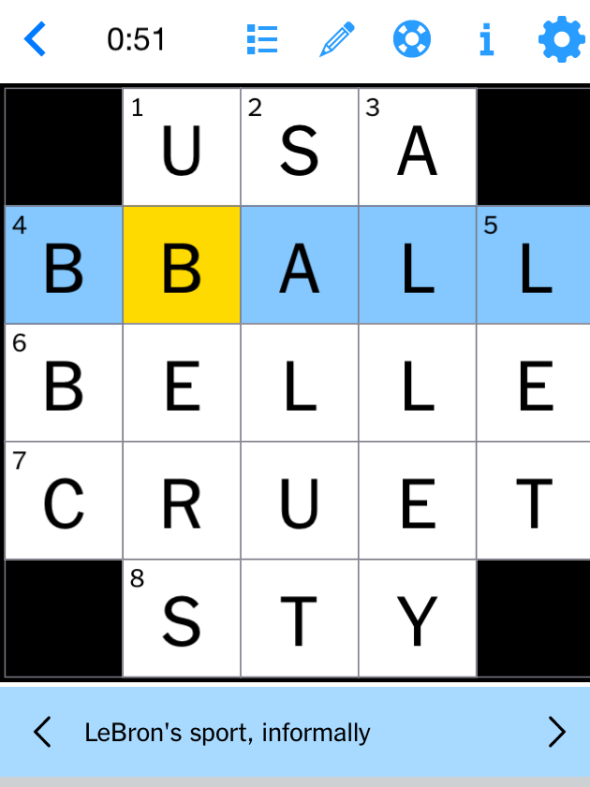

Nyt Mini Crossword April 20 2025 Solutions And Clues

May 20, 2025

Nyt Mini Crossword April 20 2025 Solutions And Clues

May 20, 2025 -

Leclercs Future At Ferrari Imola Gp Update

May 20, 2025

Leclercs Future At Ferrari Imola Gp Update

May 20, 2025 -

The Bbc And Agatha Christie A Deepfake Controversy

May 20, 2025

The Bbc And Agatha Christie A Deepfake Controversy

May 20, 2025 -

Solve The Nyt Mini Crossword March 13 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers

May 20, 2025