Why Did D-Wave Quantum (QBTS) Stock Price Increase On Friday?

Table of Contents

Friday saw a significant increase in the D-Wave Quantum (QBTS) stock price, leaving many investors scrambling to understand the reasons behind this unexpected upward trend. This article will delve into the potential factors contributing to this surge, examining market sentiment, company-specific announcements, and broader macroeconomic influences impacting the burgeoning quantum computing sector. Understanding these factors is crucial for investors considering future investments in QBTS and the wider quantum computing market.

Positive Market Sentiment Towards Quantum Computing

The recent rise in D-Wave Quantum's stock price can be partly attributed to a growing positive market sentiment surrounding quantum computing as a whole. This increased optimism stems from several key developments.

Increased Investor Confidence

- Recent breakthroughs in quantum computing research: Recent scientific breakthroughs and successful implementations of quantum algorithms have garnered significant media attention, fueling investor confidence in the long-term potential of the technology. This increased visibility translates directly into greater interest in companies at the forefront of the field, such as D-Wave.

- Growing government investment: Governments worldwide are increasingly recognizing the strategic importance of quantum computing and are investing heavily in research and development. This substantial financial backing validates the sector's potential and encourages further private investment. The US, China, and the EU are leading the charge, injecting billions into quantum technology initiatives.

- Increased venture capital funding: The quantum computing sector is attracting substantial venture capital funding, with numerous startups securing significant investments. This influx of capital demonstrates investor confidence in the industry's growth trajectory and further strengthens the overall positive sentiment.

Strategic Partnerships and Collaborations

D-Wave's strategic partnerships and collaborations play a crucial role in shaping investor perception. While specific details may vary depending on the timing of the stock price increase, any new partnerships announced around that time would significantly impact investor confidence.

- New partnerships and agreements: (Insert any specific partnerships or collaborations announced around the Friday stock price surge, e.g., "A newly announced partnership with a major technology company to integrate D-Wave's quantum annealing technology into their cloud computing platform could be a key factor."). This would boost investor confidence by demonstrating the practical applications and market viability of D-Wave's technology.

- Increased revenue and market share: Successful partnerships translate directly into increased revenue streams and market share expansion for D-Wave. Investors respond positively to such demonstrable progress, driving up stock prices.

- Strengthened competitive position: Strategic alliances position D-Wave more strongly within the competitive quantum computing landscape, enhancing its long-term prospects and appealing to investors seeking robust growth opportunities.

Company-Specific News and Announcements

Internal company developments can also significantly impact stock performance. Examining D-Wave's recent announcements is key to understanding the Friday surge.

Financial Results or Earnings Reports

Strong financial performance is a major catalyst for positive stock price movements.

- Recent financial announcements: (Insert any details about D-Wave's recent financial performance. For example: "The release of better-than-expected Q[Quarter] earnings, showing significant growth in revenue and a narrowing of losses, could have triggered the surge.")

- Key Performance Indicators (KPIs): Highlighting improvements in key metrics such as revenue growth, customer acquisition, or reduced operating costs would bolster investor confidence.

- Market reaction: Analyze how the market reacted to these financial announcements. A positive market reaction directly correlates to increased stock prices.

Product Launches or Technological Advancements

The release of new products or significant technological breakthroughs can generate considerable excitement among investors.

- New products or services: (If applicable, discuss any recent product launches or software updates, for instance, "The launch of a new, more powerful quantum annealing system with improved performance metrics could have excited investors.")

- Technological advancements: Emphasize any significant technological improvements that enhance the capabilities and appeal of D-Wave's quantum systems.

- Expanded market opportunities: New products and advancements can unlock new market opportunities, leading to projected future growth and attracting further investment.

Broader Macroeconomic Factors

External macroeconomic factors also influence stock prices. Understanding these broader trends is essential for a comprehensive analysis.

Overall Market Trends

The overall state of the stock market and related sectors plays a vital role.

- Broader market conditions: A generally positive market trend often lifts all boats, including QBTS. A strong overall market sentiment can contribute to increased investor appetite for riskier assets.

- Sector-specific performance: Positive performance within the broader technology sector or specifically the quantum computing sub-sector can have a ripple effect on QBTS's stock price.

- Correlation analysis: Analyzing the correlation between QBTS's price movements and the overall market indices provides valuable insights into the influence of broader market trends.

Investor Speculation and Short Covering

Speculation and short covering can temporarily inflate stock prices.

- Role of speculation: Investor speculation, driven by anticipation of future growth or positive news, can lead to price increases, even in the absence of fundamental improvements.

- Impact of short covering: Investors who had previously bet against D-Wave (short selling) might have been forced to buy back shares to cover their positions, creating upward pressure on the price.

- Risks associated with speculation: It's crucial to understand that speculation-driven price increases are often temporary and volatile and carry inherent risks.

Conclusion

The Friday surge in D-Wave Quantum (QBTS) stock price was likely a multifaceted event, driven by a combination of positive market sentiment towards quantum computing, possibly strong company-specific news (financial results, new products, or strategic partnerships), and broader macroeconomic trends. While speculation and short covering may have contributed to the price increase, understanding the fundamental factors driving the surge is vital for informed investment decisions. Continued monitoring of D-Wave Quantum's activities and the overall quantum computing market landscape is highly recommended. Stay informed about future developments in D-Wave Quantum (QBTS) to capitalize on opportunities within this rapidly evolving sector. Further research into QBTS stock and the broader quantum computing market is crucial for making informed investment decisions.

Featured Posts

-

The New Peppa Pig Baby Everything We Know So Far

May 21, 2025

The New Peppa Pig Baby Everything We Know So Far

May 21, 2025 -

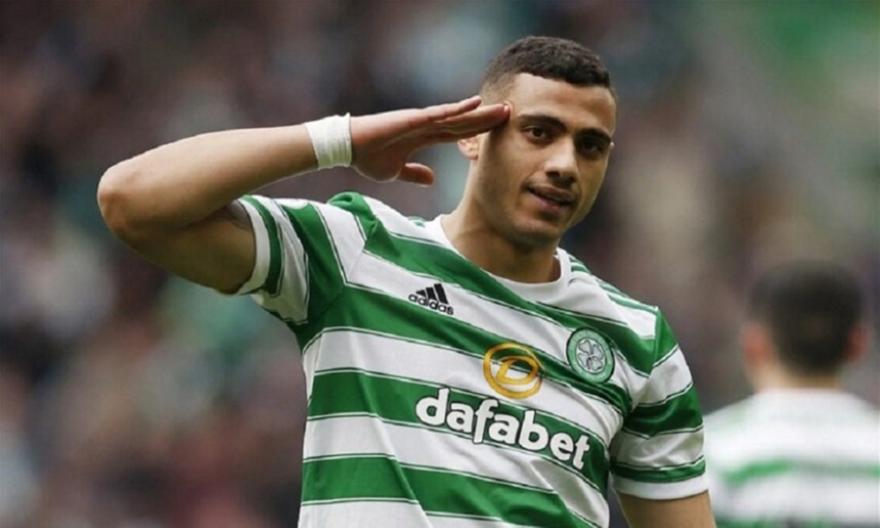

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 21, 2025

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 21, 2025 -

Analyse Abn Amro En Geen Stijl Over Betaalbaarheid Woningen In Nederland

May 21, 2025

Analyse Abn Amro En Geen Stijl Over Betaalbaarheid Woningen In Nederland

May 21, 2025 -

Improving Siri Apples Focus On Llm Technology

May 21, 2025

Improving Siri Apples Focus On Llm Technology

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League Terakhir

May 21, 2025