Why High Stock Market Valuations Shouldn't Deter Investors: A BofA Analysis

Table of Contents

The Limitations of Traditional Valuation Metrics in a Low-Interest-Rate Environment

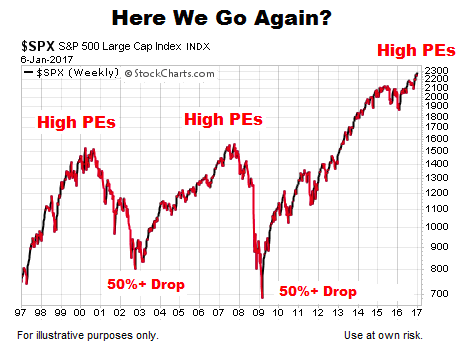

Traditional valuation metrics, such as the Price-to-Earnings (P/E) ratio, are often used to gauge whether a stock or the overall market is overvalued. However, these metrics can be misleading in periods of low interest rates and quantitative easing, such as the environment we've seen in recent years.

Low borrowing costs significantly impact company profitability and valuations.

- Low interest rates reduce the discount rate used in discounted cash flow (DCF) models, leading to higher present values and thus higher valuations. A lower discount rate means future earnings are worth more today.

- Companies can more easily afford debt, impacting their profitability and perceived risk. This increased accessibility to capital can fuel growth and further inflate valuations.

- Historically, comparing valuations across different interest rate environments reveals that high valuations are often associated with periods of low interest rates. The current environment, with historically low interest rates, should therefore be considered within this context.

This isn't to say traditional metrics are useless; rather, they need to be interpreted with a nuanced understanding of the prevailing macroeconomic conditions.

The Role of Technological Innovation and Growth Potential

Many argue that current high valuations are justified by the unprecedented growth potential fueled by technological advancements. We are in the midst of a technological revolution impacting numerous sectors.

High-growth sectors like technology, healthcare, and renewable energy are driving significant innovation and disruption. This disruption translates to:

- Long-term growth prospects: Companies in these sectors often demonstrate exceptional potential for sustained, high growth, which can justify higher valuations. Think of the potential for continued growth in cloud computing, artificial intelligence, or personalized medicine.

- Potential for disruption and innovation: The constant emergence of groundbreaking technologies creates opportunities for new market leaders and disrupts established industries, leading to higher valuations for companies at the forefront of innovation.

- High-valuation, high-growth companies: Many companies with seemingly high valuations are experiencing rapid growth and have the potential to continue expanding their market share. Examples include leading technology firms and innovative biotech companies.

BofA's Specific Arguments and Data Supporting Continued Investment

BofA's analysis supports continued investment despite high valuations. Their research, detailed in recent reports (cite specific reports here if possible, including links), points towards several key findings:

(Include charts and graphs visualizing BofA's key findings here. Examples could include projected market growth, sector-specific outlooks, or comparisons of current valuations to historical data.)

- BofA's future market performance projections: (Summarize BofA's projections, emphasizing positive growth despite high valuations.)

- Recommended sectors for investment: (List specific sectors BofA recommends, providing a brief rationale for each.)

- Acknowledged risk factors: While BofA is bullish, they acknowledge inherent market risks. It is crucial to understand and manage these risks through diversification and a long-term investment strategy.

Strategic Portfolio Diversification to Mitigate Risk

While the long-term outlook appears positive, it's crucial to mitigate risk associated with high valuations. Diversification is paramount:

- International markets: Investing in international markets can help reduce reliance on any single economy and its associated risks.

- Different asset classes: Diversify beyond stocks into asset classes like bonds and real estate to balance risk and potentially enhance returns. A balanced portfolio can cushion against market downturns.

- Long-term investment strategy: A long-term investment horizon allows you to weather short-term market fluctuations and benefit from the potential for long-term growth.

Conclusion

Despite high stock market valuations, a strategic approach informed by thorough analysis, such as BofA's research, can lead to successful long-term investment. Understanding the limitations of traditional valuation metrics in a low-interest-rate environment, recognizing the growth potential driven by technological innovation, and strategically diversifying your portfolio are key to navigating high stock market valuations. Remember the key takeaways: consider the context of low interest rates, focus on long-term growth potential in innovative sectors, and diversify your portfolio. Don't let the fear of high valuations deter you from investing; instead, use this information to make informed decisions. Consult with a qualified financial advisor and conduct thorough research before making any investment decisions. Learn more about BofA's market analysis to inform your strategy for investing despite high valuations and successfully navigating high stock market valuations.

Featured Posts

-

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

Apr 24, 2025

Chainalysis Acquisition Of Alterya A Strategic Move In Ai Powered Blockchain Security

Apr 24, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings For Months

Apr 24, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings For Months

Apr 24, 2025 -

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025 -

La Fires Renters Face Price Gouging Claims Reality Star

Apr 24, 2025

La Fires Renters Face Price Gouging Claims Reality Star

Apr 24, 2025 -

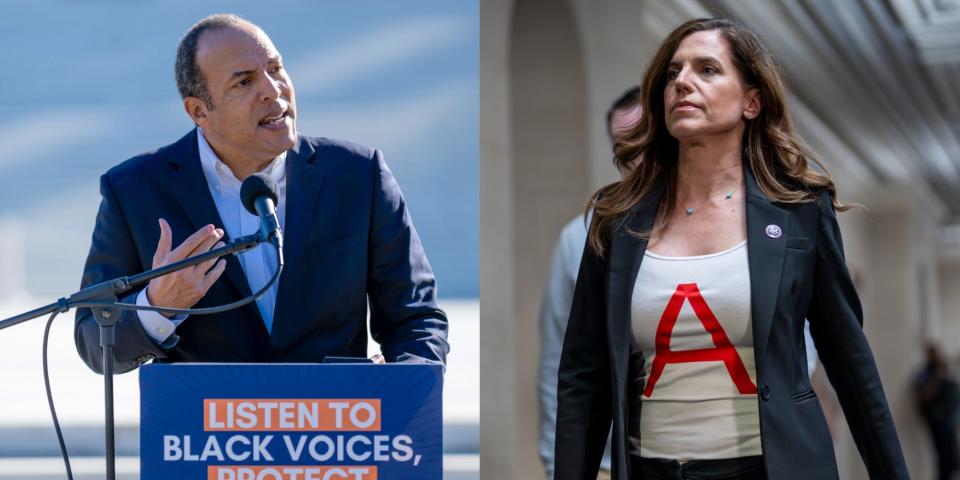

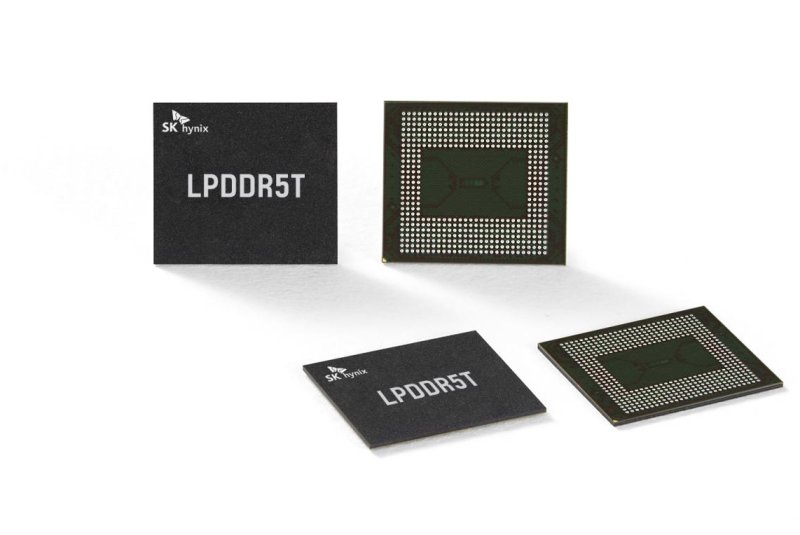

Ai Fuels Sk Hynixs Rise To Top Dram Manufacturer

Apr 24, 2025

Ai Fuels Sk Hynixs Rise To Top Dram Manufacturer

Apr 24, 2025

Latest Posts

-

Find Out When The Next High Potential Episode Airs On Abc

May 10, 2025

Find Out When The Next High Potential Episode Airs On Abc

May 10, 2025 -

Madhyamik Examination 2025 Expected Merit List And Result Updates

May 10, 2025

Madhyamik Examination 2025 Expected Merit List And Result Updates

May 10, 2025 -

Davids High Potential Exploring A Theory To Expose Morgans Weakness

May 10, 2025

Davids High Potential Exploring A Theory To Expose Morgans Weakness

May 10, 2025 -

Abcs High Potential Next Episode Release Date

May 10, 2025

Abcs High Potential Next Episode Release Date

May 10, 2025 -

When To Watch The Next High Potential Episode On Abc

May 10, 2025

When To Watch The Next High Potential Episode On Abc

May 10, 2025