Why High Stock Market Valuations Shouldn't Deter Investors: BofA

Table of Contents

Understanding Current High Valuations: Beyond the Headlines

High stock market valuations are a complex issue, often oversimplified in headlines. Several interconnected factors contribute to the current situation. Understanding these nuances is crucial for making informed investment decisions.

- Low Interest Rates: Historically low interest rates make equities a more attractive investment compared to bonds. The lower returns from bonds push investors towards higher-yielding assets, including stocks, thereby increasing demand and valuations.

- Strong Corporate Earnings: Many companies have reported robust earnings, supporting higher price-to-earnings (P/E) ratios. Strong fundamentals, driven by innovation and efficient operations, justify higher valuations for some businesses.

- Technological Advancements: Rapid technological innovation fuels growth expectations and future potential, often driving up stock prices. Companies at the forefront of technological advancements tend to command higher valuations reflecting their perceived growth trajectory.

- Quantitative Easing (QE) Policies: Past quantitative easing policies have significantly increased market liquidity, influencing stock prices and contributing to higher valuations. This increased money supply can inflate asset prices across the board.

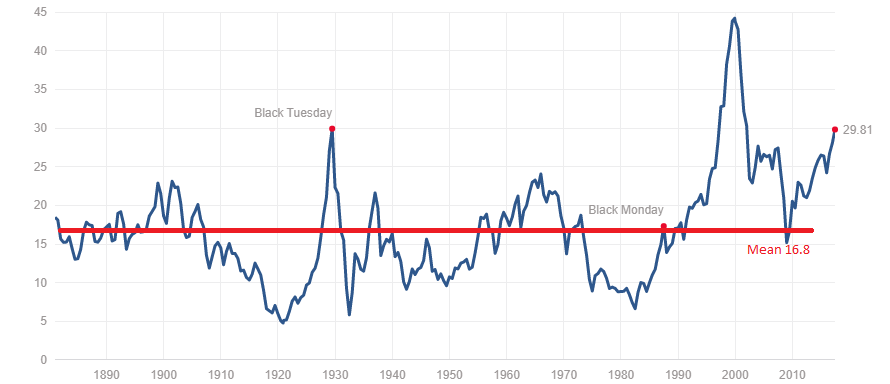

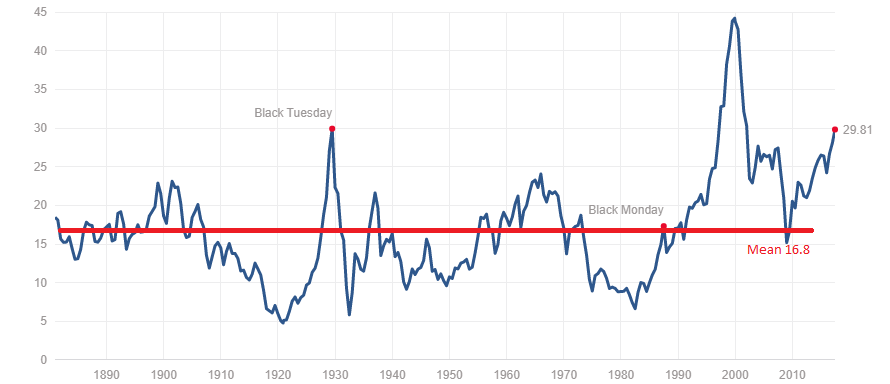

Commonly, high P/E ratios are viewed as a red flag, suggesting overvaluation and impending market corrections. However, this isn't always the case. Historical data shows that high P/E ratios don't always directly correlate with immediate market crashes. Context is critical; strong earnings growth can justify higher P/E ratios, reflecting future prospects rather than immediate risk.

BofA's Argument: Why High Valuations Aren't Necessarily a Red Flag

BofA's research consistently emphasizes a long-term perspective on market valuations. Their analysts argue that focusing solely on short-term volatility overlooks the significant growth potential inherent in many sectors. (Note: Specific BofA reports and analyses should be cited here if available, for example, referencing specific report titles and dates).

- Long-Term Growth Focus: BofA's strategy encourages investors to prioritize long-term growth potential over short-term market fluctuations. This approach minimizes the impact of temporary valuation swings.

- Strong Fundamentals Despite High Valuations: BofA identifies specific sectors and companies demonstrating strong fundamentals, even with high valuations. These companies show resilience and potential for sustained growth.

- Diversification as a Risk Mitigation Tool: BofA highlights the importance of diversification across asset classes and sectors to mitigate the risk associated with high valuations in any single area. This reduces exposure to potential market downturns.

- Suggested Investment Strategies: BofA likely provides specific investment strategies, such as sector allocation or specific stock recommendations, tailored to navigate the high-valuation market. (Again, specific examples from BofA's recommendations should be included here if available).

BofA counters the bearish sentiment by emphasizing the importance of fundamental analysis, long-term vision, and strategic diversification. Their analyses aim to identify opportunities within the market, rather than simply reacting to headline-grabbing valuation figures.

Long-Term Investing Strategies in a High-Valuation Market

Based on BofA's insights, investors can adopt several strategies to navigate the current market:

- Value Investing: Focus on undervalued companies with strong fundamentals, seeking opportunities where market pricing lags behind intrinsic value.

- Growth Investing: Target companies with high growth potential, even if their valuations seem high, focusing on long-term prospects rather than short-term price fluctuations.

- Risk Management and Diversification: Diversify across different asset classes (stocks, bonds, real estate), sectors, and geographies to mitigate risk.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of market fluctuations, reducing the risk of investing a lump sum at a market peak.

- Alternative Asset Classes: Consider allocating a portion of your portfolio to alternative asset classes like real estate or commodities to diversify further.

A long-term investment horizon is paramount. Short-term market volatility should not derail a well-defined long-term strategy.

Addressing Investor Concerns and Market Volatility

While BofA's perspective offers reassurance, acknowledging the risks associated with high valuations is crucial.

- Market Corrections: Market corrections are a normal part of the cycle, and high valuations increase the probability of a correction. Understanding this possibility is crucial.

- Risk Mitigation Strategies: Diversification, stop-loss orders, and careful position sizing are essential tools to limit potential losses during market corrections.

- Economic Indicator Monitoring: Staying informed about economic indicators, news events, and geopolitical factors is critical for adapting investment strategies.

- Emotional Discipline: Maintaining emotional discipline is vital; avoid impulsive decisions based on short-term market fluctuations.

BofA's perspective emphasizes caution but not panic. A well-informed, strategically diversified approach can allow investors to navigate the challenges of a high-valuation market.

Conclusion: Navigating High Stock Market Valuations with Confidence

High stock market valuations don't automatically signal an impending crash. BofA's analysis supports a long-term perspective, emphasizing fundamental analysis, diversification, and strategic risk management. Investors can mitigate risks through careful planning and a well-defined investment strategy. While caution is warranted, a long-term horizon, coupled with a robust approach, can help navigate the complexities of high stock market valuations. Don't let high stock market valuations sideline your investment goals. Learn more about BofA's insights and develop a robust strategy today! (Insert links to relevant BofA resources here).

Featured Posts

-

Offshore Wind Balancing Cost And Sustainability

May 04, 2025

Offshore Wind Balancing Cost And Sustainability

May 04, 2025 -

Blake Lively And Anna Kendrick A Timeline Of Their Reported Feud

May 04, 2025

Blake Lively And Anna Kendrick A Timeline Of Their Reported Feud

May 04, 2025 -

Are The Thunderbolts Marvels Next Big Thing A Critical Analysis

May 04, 2025

Are The Thunderbolts Marvels Next Big Thing A Critical Analysis

May 04, 2025 -

Bradley Coopers Daughter Lea In Green Super Bowl 2025 Appearance

May 04, 2025

Bradley Coopers Daughter Lea In Green Super Bowl 2025 Appearance

May 04, 2025 -

Rolly Romeros Bold Prediction Crawford Outboxes Then Kos Canelo

May 04, 2025

Rolly Romeros Bold Prediction Crawford Outboxes Then Kos Canelo

May 04, 2025