Why Is BigBear.ai (BBAI) Stock Falling In 2025? A Comprehensive Analysis

Table of Contents

Main Points: Dissecting the Factors Behind BBAI Stock's Fall

H2: Macroeconomic Factors Impacting BBAI Stock Performance in 2025

The overall health of the economy significantly impacts individual stocks, and BBAI is no exception. Understanding the broader market trends is crucial for comprehending the BBAI stock price decline.

H3: Broader Market Trends:

2025's economic landscape has presented significant headwinds for technology stocks like BBAI. A potential recession, coupled with persistent inflation and aggressive interest rate hikes by central banks, has created a risk-averse environment. Investors have shifted away from growth stocks, impacting companies like BBAI that rely on future growth projections.

- High Inflation: Eroding consumer spending and impacting BBAI's operational costs.

- Rising Interest Rates: Increasing borrowing costs, potentially hindering BBAI's expansion plans and reducing investor appetite for growth stocks.

- Recessionary Fears: Reduced overall market confidence, leading to decreased investment in technology sectors.

H3: Geopolitical Uncertainty and its Effect on BBAI's Growth:

Geopolitical instability often creates uncertainty in the market, impacting investor confidence. Several global events in 2025 might have contributed to the negative sentiment surrounding BBAI.

- Increased Global Tensions: Leading to supply chain disruptions, impacting BBAI's operations and potentially its revenue streams.

- Trade Wars and Sanctions: Creating uncertainty about international markets and BBAI's ability to operate effectively globally.

- Energy Price Volatility: Affecting BBAI's operational costs and profitability.

H2: Company-Specific Challenges Affecting BigBear.ai (BBAI) Stock Price

Beyond macroeconomic factors, several company-specific challenges might have played a role in the BigBear.ai stock performance slump.

H3: Financial Performance and Earnings Reports:

Analyzing BBAI's financial reports from 2025 reveals potential clues to the stock's decline. Missed earnings expectations or disappointing revenue growth can significantly impact investor sentiment.

- Lower-Than-Expected Revenue: Perhaps due to decreased demand or challenges in securing new contracts.

- Reduced Profit Margins: Potentially caused by increased operational costs or pricing pressures.

- Increased Debt Levels: Raising concerns about BBAI's financial stability and ability to invest in future growth. (Note: This section would benefit from specific data from hypothetical 2025 BBAI financial reports, if available.)

H3: Competition and Market Saturation:

The competitive landscape in BBAI's industry is intense. Increased competition or market saturation can erode BBAI's market share and profitability, affecting its stock price.

- Emergence of Strong Competitors: Offering similar services or technologies at potentially lower prices.

- Market Saturation: Limiting the potential for growth and expansion for BBAI.

- Technological Disruption: The potential for new innovations to render BBAI's technology obsolete.

H3: Management Changes and Strategic Decisions:

Changes in leadership or significant strategic shifts can influence investor confidence. Any controversies or perceived missteps might have contributed to the negative sentiment surrounding BBAI.

- Leadership Changes: The departure of key personnel could create uncertainty and negatively impact investor confidence.

- Strategic Missteps: Poorly executed strategic initiatives might have led to disappointing financial results.

- Lack of Clear Vision: Uncertainty about BBAI's future direction could deter investors.

H2: Investor Sentiment and Market Speculation Driving BBAI Stock's Decline

Investor sentiment plays a crucial role in stock price fluctuations. Negative sentiment, fueled by various factors, could have amplified the downward pressure on BBAI stock.

H3: Analyst Ratings and Recommendations:

Financial analysts' opinions heavily influence investor decisions. A significant number of downgrades from analysts could trigger a sell-off.

- Negative Analyst Ratings: Reflecting concerns about BBAI's future prospects, prompting investors to sell their shares.

- Lowered Price Targets: Further reinforcing negative sentiment and potentially accelerating the decline.

- Withdrawal of Investment Recommendations: Leading to a reduction in overall investor interest.

H3: Short Selling and Market Manipulation:

While difficult to prove, the possibility of short selling or market manipulation should be considered. A high level of short interest could exacerbate downward pressure on the stock price.

- High Short Interest: Suggesting a significant number of investors are betting against BBAI's success.

- Market Rumors and Speculation: Negative news, even if unsubstantiated, can influence investor behavior and drive down the stock price. (Note: This section would require data on short interest, if available, to strengthen its claims.)

Conclusion: BigBear.ai (BBAI) Stock Outlook and Future Investment Considerations

The decline of BigBear.ai (BBAI) stock in 2025 appears to be a multifaceted issue, stemming from a confluence of macroeconomic headwinds, company-specific challenges, and negative investor sentiment. Understanding the interplay of these factors – encompassing broader market trends, geopolitical uncertainty, financial performance, competition, management decisions, and analyst opinions – is crucial for assessing BBAI's future trajectory. While this analysis provides insights into the potential reasons behind the "BigBear.ai (BBAI) stock falling" trend, it's essential to conduct further research and stay informed about BBAI's developments to make sound investment choices. Keep an eye on the BigBear.ai (BBAI) stock price and stay updated on future developments to make informed investment decisions.

Featured Posts

-

Understanding The Billionaire Boy Phenomenon Impact And Implications

May 20, 2025

Understanding The Billionaire Boy Phenomenon Impact And Implications

May 20, 2025 -

Avauskokoonpano Paljastettu Kamaran Ja Pukkin Tilanne

May 20, 2025

Avauskokoonpano Paljastettu Kamaran Ja Pukkin Tilanne

May 20, 2025 -

South China Sea Tension China Pressures Philippines On Missile Deployment

May 20, 2025

South China Sea Tension China Pressures Philippines On Missile Deployment

May 20, 2025 -

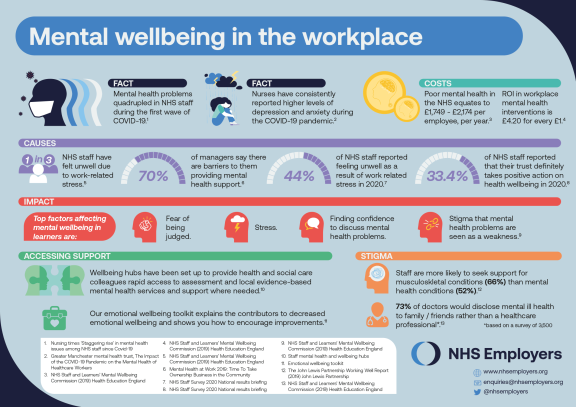

Resilience And Mental Health A Path To Positive Mental Wellbeing

May 20, 2025

Resilience And Mental Health A Path To Positive Mental Wellbeing

May 20, 2025 -

Unraveling The Mysteries A Deep Dive Into Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Deep Dive Into Agatha Christies Poirot Stories

May 20, 2025