Why Is Gold Soaring? Trade Wars And The Bullion Market

Table of Contents

Trade Wars: A Safe Haven for Gold

Gold has long held the reputation of a safe-haven asset, a reliable store of value during times of economic uncertainty. Trade wars, with their inherent instability and unpredictability, create precisely this kind of environment, prompting investors to seek refuge in the perceived security of gold. The resulting increased demand drives up gold prices.

- Increased Market Volatility: Trade tariffs and sanctions introduce significant volatility into the global markets. Investors, seeking to protect their capital, often flock to less volatile assets like gold.

- Weakening of Global Currencies: Trade disputes can destabilize currencies, making gold, priced in many currencies, a more attractive investment. A weakening currency often translates to a rise in gold prices.

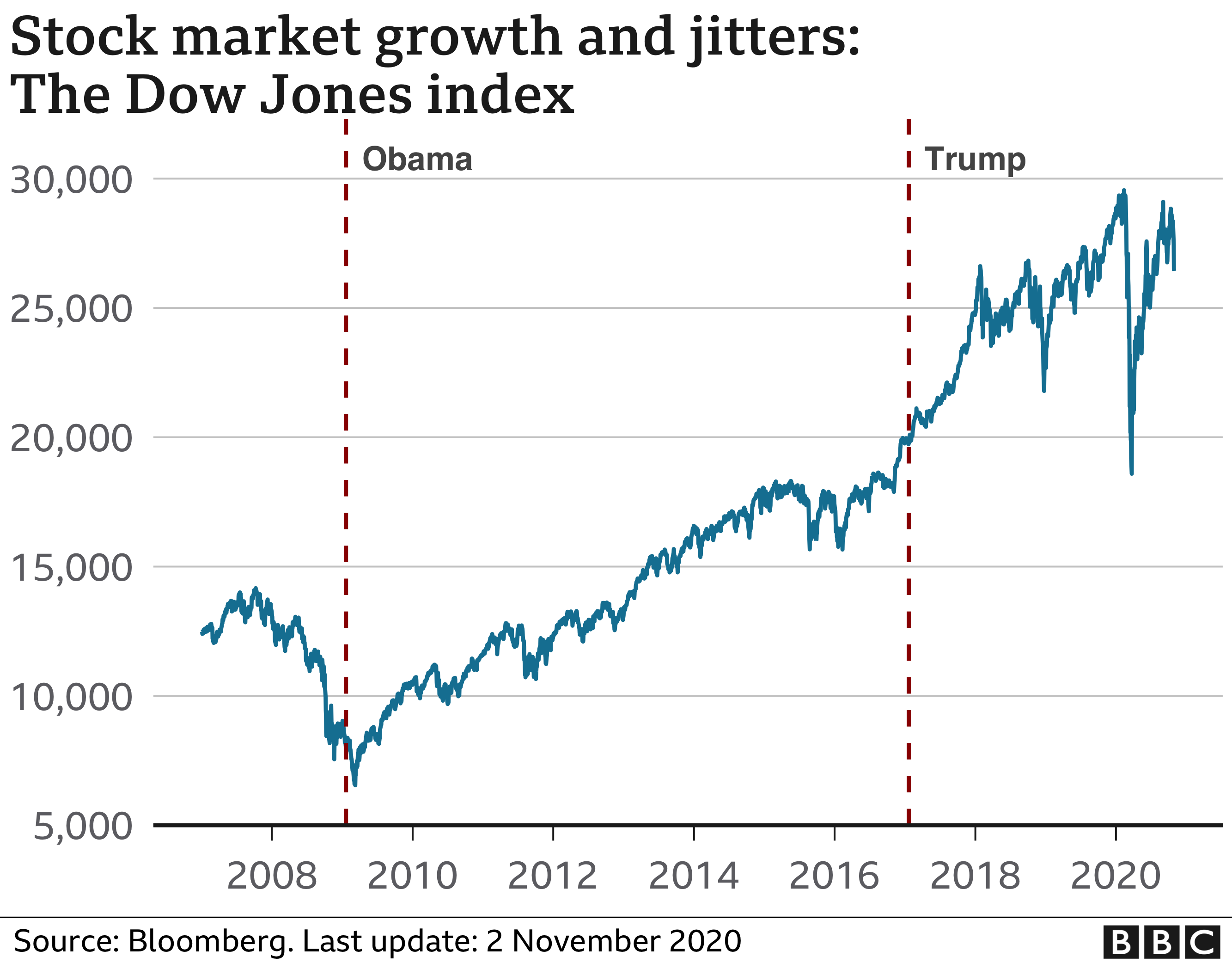

- Uncertainty About Future Economic Growth: Trade wars cast a shadow of doubt over future economic growth, impacting stock market performance. This uncertainty pushes investors towards the relative stability of gold.

- Specific Examples: The US-China trade war, for example, significantly impacted global markets and was a major contributing factor to a considerable rise in gold prices. Similar tensions between other nations have had comparable effects.

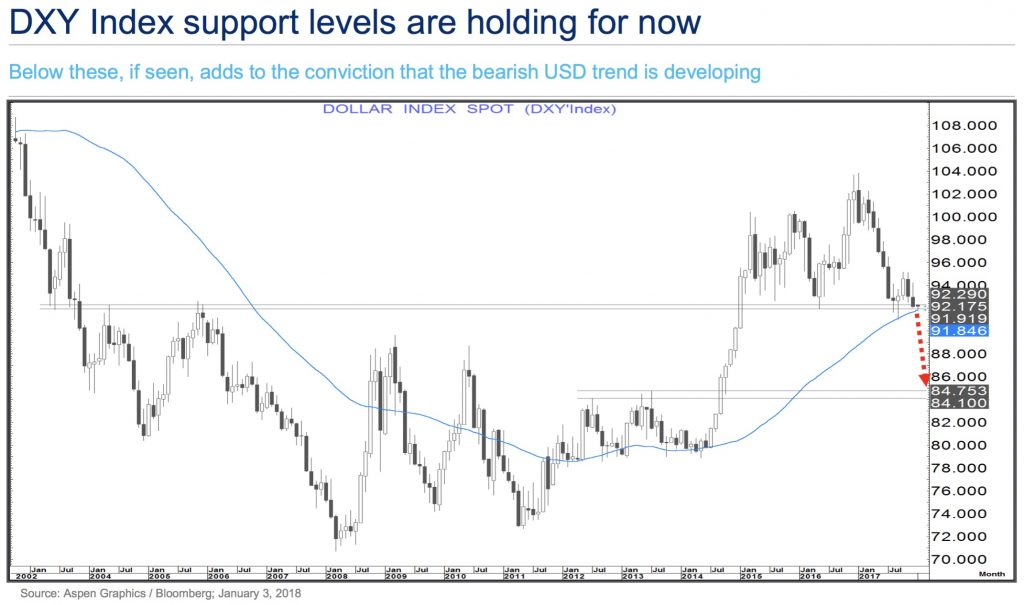

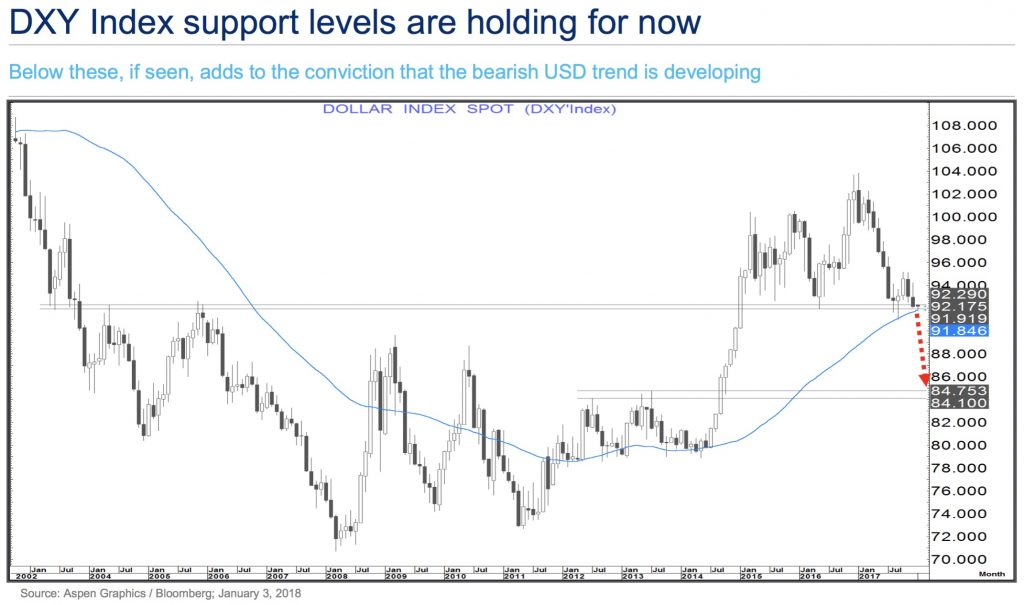

Weakening Dollar and Gold's Inverse Relationship

Gold and the US dollar share an inverse relationship; as the dollar weakens, gold prices tend to rise. Trade wars frequently contribute to this weakening.

- Increased Demand for Gold: A weaker dollar increases the demand for gold, as it becomes cheaper for investors holding other currencies to purchase. This increased demand further propels gold prices upward.

- Monetary Policy Impact: Quantitative easing and other monetary policies implemented in response to trade war anxieties can weaken the dollar, influencing the price of gold.

- Dollar Index Fluctuations: Recent significant drops in the US Dollar Index have often correlated directly with increases in gold prices, visually demonstrating this inverse relationship.

Inflationary Pressures and Gold as a Hedge

Trade wars frequently fuel inflationary pressures, making gold an attractive hedge against rising prices.

- Increased Cost of Goods: Tariffs imposed during trade wars directly increase the cost of imported goods, contributing to inflation.

- Supply Chain Disruptions: Trade wars can disrupt global supply chains, further exacerbating price increases.

- Historical Performance: Throughout history, gold has proven to be a relatively reliable store of value during inflationary periods, protecting purchasing power.

- Purchasing Power Preservation: During periods of high inflation, the purchasing power of fiat currencies erodes, while gold often maintains or even increases its value.

Increased Demand from Central Banks and Institutional Investors

Central banks worldwide are increasingly diversifying their foreign exchange reserves by accumulating gold, reflecting a growing confidence in gold as a stable asset. Institutional investors are also showing a renewed interest in gold as a portfolio diversifier.

- Central Bank Gold Purchases: Data reveals a significant increase in central bank gold purchases in recent years, demonstrating a global shift towards gold as a strategic reserve asset.

- Reasons for Accumulation: Central banks are motivated by various factors, including geopolitical risks and a desire for currency diversification, leading to increased gold holdings.

- Institutional Investor Interest: Major institutional investors are also increasing their gold holdings, recognizing its role in mitigating portfolio risk during periods of economic uncertainty.

Conclusion: Is the Gold Rush Over? Navigating the Bullion Market in Uncertain Times

The recent surge in gold prices is a complex phenomenon driven by several factors. However, the escalating impact of trade wars on global economic stability plays a crucial role. The resulting uncertainty has propelled gold's status as a safe-haven asset and a hedge against inflation, driving increased demand from investors and central banks alike. Understanding why gold is soaring is crucial for navigating the current economic climate. Learn more about incorporating gold into your investment strategy and stay informed on the impact of trade wars on the bullion market.

Featured Posts

-

Solve Todays Nyt Spelling Bee February 26th Puzzle 360 Tips And Tricks

Apr 26, 2025

Solve Todays Nyt Spelling Bee February 26th Puzzle 360 Tips And Tricks

Apr 26, 2025 -

7 Hot New Orlando Restaurants To Try In 2025 Beyond Disney

Apr 26, 2025

7 Hot New Orlando Restaurants To Try In 2025 Beyond Disney

Apr 26, 2025 -

Stockholm Stadshotell Fullstaendig Recension Av Krogkommissionen

Apr 26, 2025

Stockholm Stadshotell Fullstaendig Recension Av Krogkommissionen

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two Trailer Highlights And Speculation

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Trailer Highlights And Speculation

Apr 26, 2025 -

Historic First Vivienne Westwoods Inaugural Bridal Fashion Show

Apr 26, 2025

Historic First Vivienne Westwoods Inaugural Bridal Fashion Show

Apr 26, 2025

Latest Posts

-

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025

100 Days Of Trump How Did It Affect Elon Musks Net Worth

May 10, 2025 -

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025

The Impact Of Trumps First 100 Days On Elon Musks Financial Status

May 10, 2025 -

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025

The Tesla Dogecoin Connection Examining The Influence Of Elon Musk And Market Volatility

May 10, 2025 -

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025

Analyzing The Change In Elon Musks Net Worth The Trump Presidencys First 100 Days

May 10, 2025 -

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025

Analyzing The Impact Of Teslas Stock Performance On Dogecoins Value The Elon Musk Factor

May 10, 2025