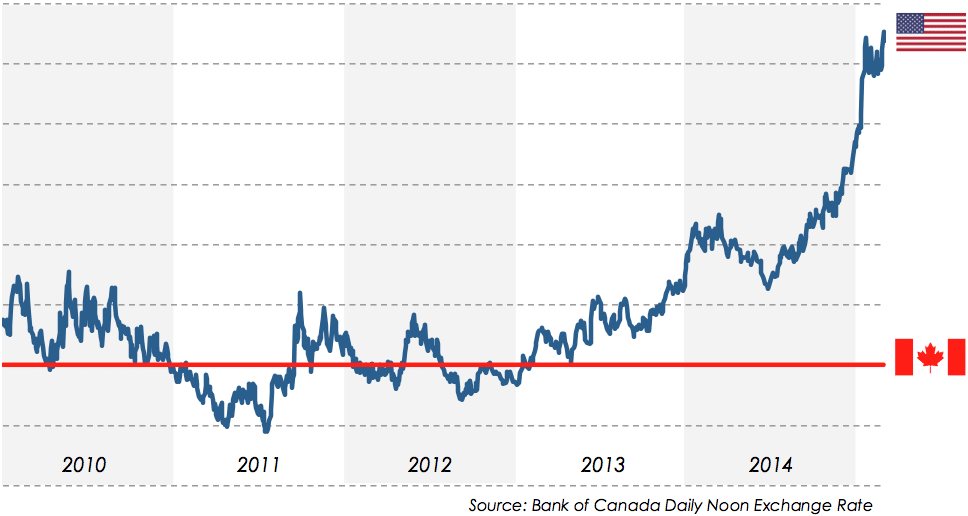

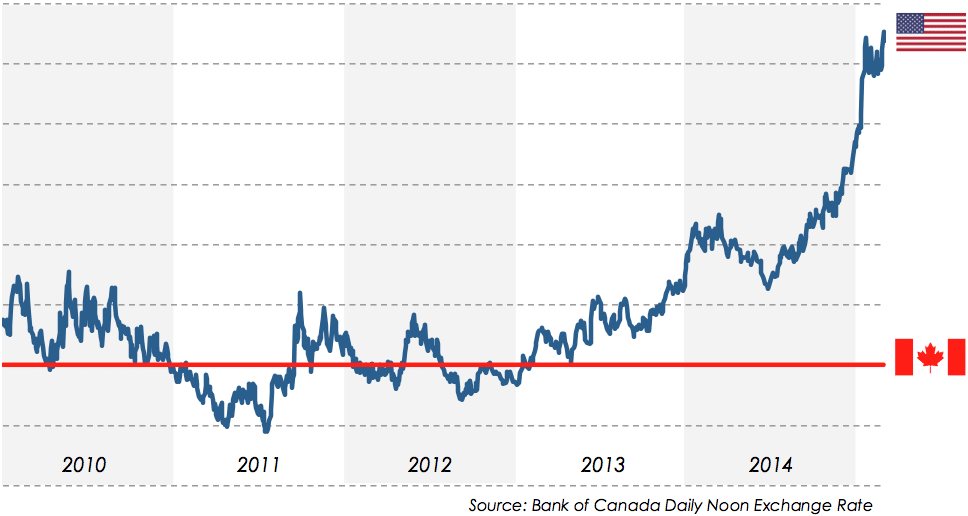

Why Is The Canadian Dollar Falling Against Other Currencies?

Table of Contents

The Canadian dollar, affectionately known as the "loonie," has seen significant fluctuations against major global currencies like the US dollar, the euro, and the British pound in recent times. This volatility impacts businesses involved in international trade, investors managing portfolios with foreign currency exposure, and even everyday Canadians traveling abroad. Understanding the factors driving these changes is crucial for navigating the complexities of the foreign exchange market. This article delves into the key reasons behind the Canadian dollar's decline.

<h2>Impact of Commodity Prices on the Canadian Dollar</h2>

Canada's economy is heavily reliant on the export of natural resources, particularly oil and gas. The price of these commodities significantly influences the value of the Canadian dollar (CAD). A strong correlation exists between commodity prices and the CAD's exchange rate.

-

Lower Oil Prices: A drop in global oil prices directly translates to reduced export revenues for Canada. This decrease in earnings weakens the demand for the CAD, leading to depreciation against other currencies. This is because less foreign currency flows into Canada to purchase Canadian oil.

-

Global Demand for Commodities: The health of the global economy plays a pivotal role. Slower economic growth or recessions in major trading partners, like the US or China, reduce the demand for Canadian commodities, thus weakening the CAD. Reduced demand leads to lower prices and consequently, a weaker Canadian dollar.

-

Supply Chain Disruptions: Unexpected events like natural disasters, geopolitical instability, or production outages can disrupt the supply of Canadian commodities. These disruptions can lead to price volatility and negatively impact the CAD's exchange rate, causing further depreciation. Think of the impact of a major pipeline disruption or an unexpected freeze impacting oil sands production.

<h2>Influence of Interest Rate Differentials</h2>

Interest rate differentials between Canada and other major economies are a key driver of currency exchange rates. Investors seek higher returns on their investments, and interest rates play a crucial role in attracting capital.

-

Bank of Canada Interest Rate Decisions: The Bank of Canada's monetary policy decisions directly affect interest rates. If the Bank of Canada lowers interest rates relative to other central banks, the Canadian dollar becomes less attractive to investors. This reduced demand leads to a weaker CAD.

-

International Interest Rate Environments: The global economic landscape impacts interest rates worldwide. If major economies like the US raise interest rates, investors may move their funds to these higher-yielding markets, strengthening the US dollar and weakening the CAD. This is known as capital flight.

-

Investor Sentiment and Capital Flows: Investor confidence in the Canadian economy is intertwined with interest rates. Negative investor sentiment, often fueled by economic uncertainty, can lead to capital outflows and a subsequent depreciation of the CAD. A decline in foreign direct investment further exacerbates this effect.

<h2>Geopolitical Factors and Their Impact</h2>

Geopolitical events and global uncertainties introduce significant volatility into currency markets, including the CAD. Risk aversion often leads to capital flight to safer havens.

-

Global Political Instability: Major geopolitical events, such as wars, political upheavals, or escalating trade tensions, inject uncertainty into the global market. Investors often seek refuge in more stable currencies, leading to a weakening of the CAD.

-

US-Canada Relations: Given the close economic ties between Canada and the US, shifts in the bilateral relationship can considerably impact the CAD. Any significant deterioration in relations can negatively affect investor confidence and the CAD's value.

-

North American Free Trade Agreement (NAFTA/USMCA): Trade agreements like the USMCA have a substantial impact on the Canadian economy. Negotiations and potential changes to these agreements can inject uncertainty into the market, causing fluctuations in the CAD's exchange rate.

<h2>Government Debt and Fiscal Policy</h2>

High levels of government debt and unsustainable fiscal deficits can erode investor confidence in the Canadian economy, ultimately affecting the CAD's value.

-

Budget Deficits: Large and persistent budget deficits indicate increased government borrowing, potentially leading to higher inflation. Higher inflation makes the CAD less attractive, leading to depreciation.

-

Government Spending: Uncontrolled government spending can contribute to inflationary pressures, further weakening the Canadian dollar. This is especially true if the spending is not matched by corresponding economic growth.

-

Credit Ratings: Credit rating agencies assess a country's creditworthiness. Downgrades in Canada's credit rating can negatively impact investor confidence, leading to a weaker CAD as investors perceive increased risk.

<h2>Conclusion</h2>

The decline of the Canadian dollar against other currencies is a multifaceted issue stemming from the interplay of commodity prices, interest rate differentials, geopolitical factors, and government fiscal policies. Understanding these interconnected factors is crucial for businesses, investors, and individuals seeking to navigate the foreign exchange market effectively. To stay informed about the future fluctuations of the Canadian dollar, continue monitoring economic news and global events closely. Regularly reviewing economic indicators and geopolitical developments will assist you in better anticipating and responding to changes in the CAD's exchange rate.

Featured Posts

-

Condena De Q6 Millones A Kevin Malouf La Perspectiva De La Familia De La Victima

Apr 25, 2025

Condena De Q6 Millones A Kevin Malouf La Perspectiva De La Familia De La Victima

Apr 25, 2025 -

The Denver Broncos Path To The Super Bowl The Ashton Jeanty Factor

Apr 25, 2025

The Denver Broncos Path To The Super Bowl The Ashton Jeanty Factor

Apr 25, 2025 -

La Carrera Por La Bota De Oro 2024 25 Sin Messi Y Ronaldo

Apr 25, 2025

La Carrera Por La Bota De Oro 2024 25 Sin Messi Y Ronaldo

Apr 25, 2025 -

Suicide Prevention Jay Barbershops Innovative Haircut Marathon

Apr 25, 2025

Suicide Prevention Jay Barbershops Innovative Haircut Marathon

Apr 25, 2025 -

Leroy Sanes Brilliance Leads Bayern Munich To Victory Over St Pauli

Apr 25, 2025

Leroy Sanes Brilliance Leads Bayern Munich To Victory Over St Pauli

Apr 25, 2025