Why Stretched Stock Market Valuations Aren't A Worry: BofA's View

Table of Contents

BofA's Rationale: Why High Stock Valuations Aren't Necessarily a Red Flag

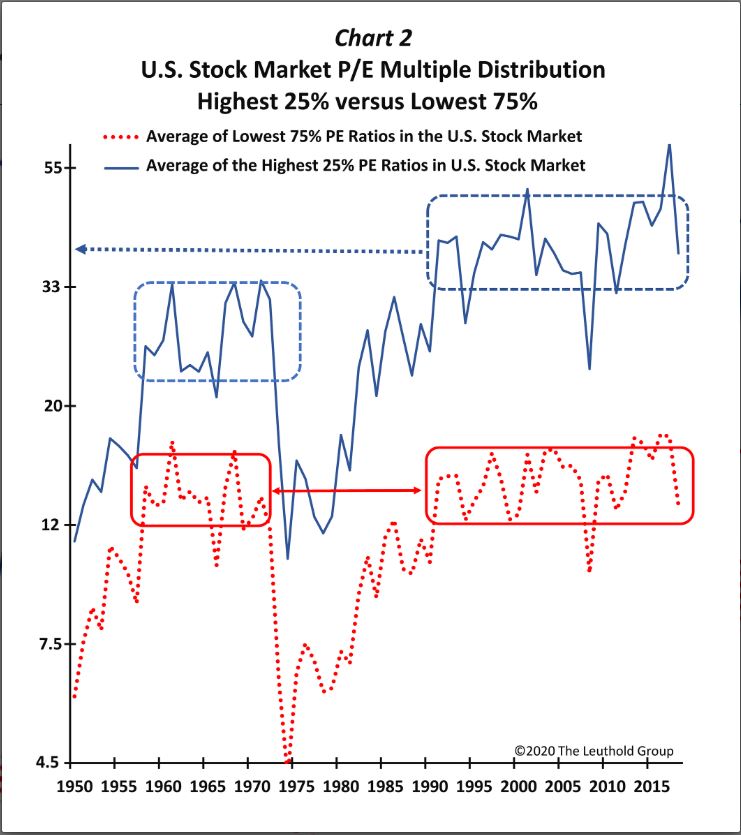

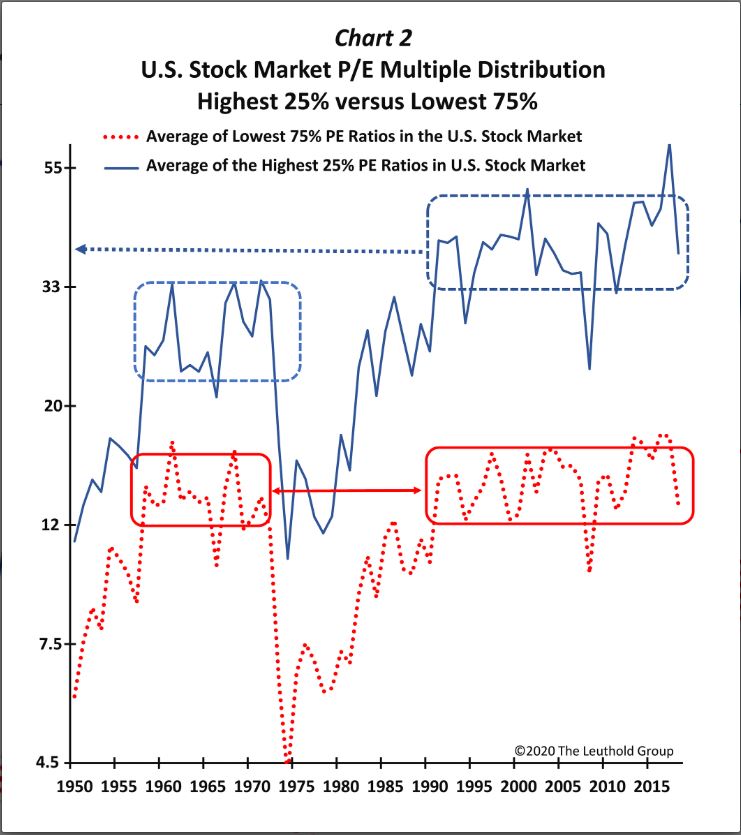

BofA's investment strategy rests on the argument that current high stock valuations are justified by several key factors. Their market analysis points to strong corporate earnings growth and positive economic forecasts as primary justifications for their bullish outlook. This isn't to say they ignore the elevated price-to-earnings (P/E) ratios and other valuation metrics; rather, they believe these are currently supported by underlying fundamentals.

-

Strong Corporate Earnings Growth: BofA points to robust corporate profit growth across various sectors as a key driver supporting current valuations. This strong earnings performance, they argue, offsets the impact of higher prices, leading to a justifiable market valuation. They cite specific examples of companies exceeding expectations, demonstrating resilience even in a potentially challenging economic climate.

-

Positive Economic Forecasts: BofA's economic forecasts suggest continued, albeit perhaps moderated, growth. This expectation of future earnings growth, even with current high valuations, supports their belief that the market isn't overvalued in the long term. They analyze macroeconomic indicators such as GDP growth, employment rates, and consumer spending to support their projections.

-

Inflation's Impact: While inflation is a concern, BofA believes that current inflation levels are manageable and factored into their valuation models. Their analysis suggests that corporate pricing power can effectively offset inflationary pressures, thus protecting profit margins and supporting earnings growth. They acknowledge the volatility of inflation but believe that the current trajectory aligns with their forecast for sustained economic expansion.

-

Specific Sector Strength: BofA highlights specific sectors, such as technology and healthcare, as particularly well-positioned to benefit from long-term growth trends, even with current valuations. They analyze the growth potential of these sectors, considering factors such as innovation, technological advancements, and demographic shifts. They also employ metrics like price-to-sales ratios to assess valuation within specific sectors.

The Role of Interest Rates and Monetary Policy in BofA's Assessment

BofA's assessment of stock market valuations is inextricably linked to their view of interest rates and the Federal Reserve's monetary policy. Understanding their perspective on interest rate hikes and cuts is crucial to grasping their bullish outlook.

-

Federal Reserve's Monetary Policy: BofA carefully analyzes the Federal Reserve's actions and statements, considering their implications for both bond yields and stock market performance. They assess the pace and magnitude of future interest rate adjustments, anticipating their potential impact on corporate borrowing costs and investor sentiment.

-

Interest Rate Predictions and Market Impact: BofA predicts a measured approach to future interest rate changes. While acknowledging potential rate hikes to combat inflation, they believe that the Fed will act cautiously to avoid triggering a significant economic slowdown. They analyze historical data and current economic indicators to support these predictions.

-

Bond Yields and Stock Valuations: BofA examines the relationship between bond yields and stock valuations, noting that rising bond yields can sometimes put downward pressure on stock prices. However, their analysis suggests that current bond yields are not yet at a level that warrants significant concern regarding stock market valuations.

-

Interest Rate Expectations in Valuation Assessment: BofA explicitly incorporates their interest rate expectations into their overall market valuation models. This integrated approach ensures that their assessment considers the interplay between monetary policy, interest rates, and stock market dynamics.

Counterarguments and Addressing Potential Risks

While BofA maintains a bullish outlook, they acknowledge potential counterarguments and risks. A crucial part of their analysis involves addressing potential downsides and mitigating those risks within their investment strategy.

-

Market Correction and Recession Risks: BofA acknowledges the possibility of a market correction or even a recession. However, their analysis suggests that the likelihood of a severe downturn is relatively low, given the strength of the underlying economy and corporate earnings.

-

BofA's Risk Mitigation Strategy: To mitigate risks, BofA emphasizes the importance of diversification and prudent risk management. They advise investors to maintain a balanced portfolio, avoiding excessive concentration in any single sector or asset class.

-

Specific Risks and Likelihood Assessment: BofA identifies specific risks, including geopolitical instability and unexpected inflationary pressures. They assess the likelihood of these risks materializing and incorporate these assessments into their overall market outlook.

-

Factoring Risks into the Market Outlook: The potential risks are not ignored; instead, they are carefully considered and factored into their projections, leading to a more nuanced and realistic assessment of the market.

BofA's recommended investment strategy considering stretched valuations.

Considering the "stretched" valuations, BofA recommends a balanced and diversified investment approach.

-

Diversification and Risk Management: They stress the importance of diversifying investments across asset classes and sectors to mitigate risk. This approach helps to reduce the impact of any single investment performing poorly.

-

Strategic Asset Allocation: They advocate for a strategic asset allocation approach, tailoring the portfolio to the investor's risk tolerance and long-term financial goals. This involves carefully considering the proportion of investments allocated to stocks, bonds, and other assets.

-

Focus on Long-Term Growth: BofA encourages investors to focus on long-term growth opportunities rather than short-term market fluctuations. This approach allows investors to ride out temporary market corrections and benefit from sustained growth over time.

Conclusion

BofA's analysis suggests that while stock market valuations are high, they are not necessarily a cause for alarm. Strong corporate earnings growth, positive economic forecasts, and a measured approach by the Federal Reserve all contribute to their optimistic outlook. While acknowledging potential risks such as market corrections and recessionary pressures, BofA emphasizes the importance of diversification, risk management, and a long-term investment strategy. While BofA's analysis offers a reassuring perspective on current market conditions, thorough due diligence and a carefully considered investment strategy remain crucial. Learn more about navigating “stretched stock market valuations” and building a robust portfolio by exploring BofA's research and resources. Consult a financial advisor for personalized guidance.

Featured Posts

-

Microsoft Activision Merger Ftcs Appeal And Future Implications

May 15, 2025

Microsoft Activision Merger Ftcs Appeal And Future Implications

May 15, 2025 -

Atlanta Braves Vs San Diego Padres Who Will Win

May 15, 2025

Atlanta Braves Vs San Diego Padres Who Will Win

May 15, 2025 -

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Options

May 15, 2025

Watch Andor Season 1 Episodes 1 3 Hulu And You Tube Options

May 15, 2025 -

Ge Force Now Adds Halo Balatro And Other Games This Week

May 15, 2025

Ge Force Now Adds Halo Balatro And Other Games This Week

May 15, 2025 -

The 2024 Australian Election A Deep Dive Into Albanese And Duttons Campaigns

May 15, 2025

The 2024 Australian Election A Deep Dive Into Albanese And Duttons Campaigns

May 15, 2025