Why The 10-Year Mortgage Isn't Popular In Canada: A Financial Analysis

Table of Contents

H2: Higher Initial Interest Rates and Payment Shock

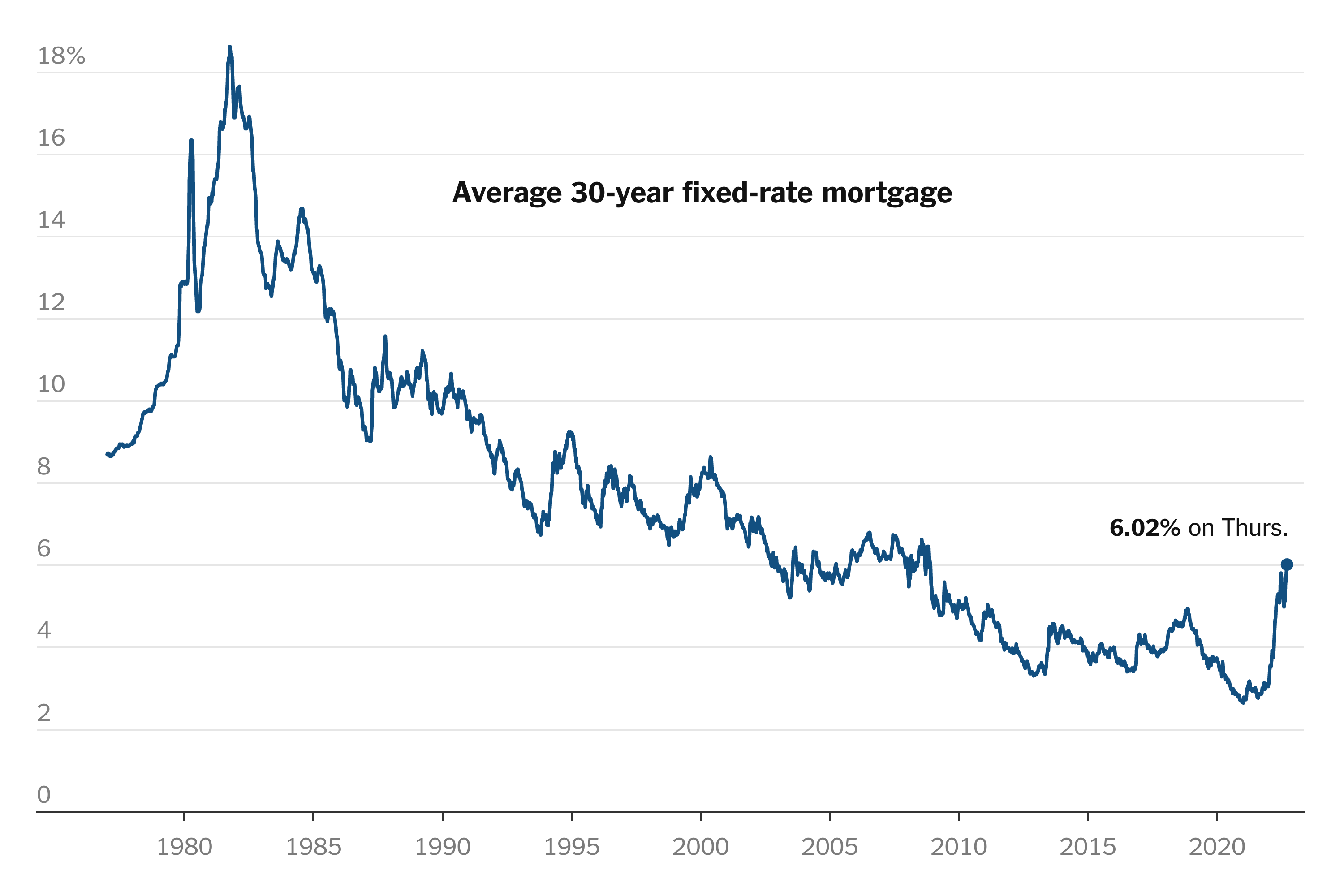

A significant factor deterring many Canadians from a 10-year mortgage is the typically higher initial interest rate compared to shorter-term options like 5-year mortgages. This stems from the increased risk lenders assume when locking in a rate for an extended period. The longer the term, the greater the uncertainty surrounding future interest rate fluctuations.

H3: The Impact of Longer-Term Fixed Rates

Longer-term fixed rates, like those associated with a 10-year mortgage in Canada, inherently carry a higher rate to compensate lenders for the prolonged commitment. This translates directly into higher monthly payments.

-

Example: Let's say a 5-year fixed mortgage offers a rate of 4.5%, while a 10-year fixed mortgage carries a rate of 5.5%. On a $500,000 mortgage, this difference results in a substantially higher monthly payment over the entire term.

-

Payment Shock Potential: The risk of significant payment shock increases with a 10-year mortgage. If interest rates rise during the term (and you can't refinance), your monthly payment remains fixed at the initially higher rate, potentially stretching your budget.

-

Predicting Long-Term Rates: Accurately predicting long-term interest rate trends is virtually impossible. Committing to a 10-year mortgage involves accepting a higher degree of risk related to rate fluctuations over an extended period.

H2: Financial Uncertainty and Life Changes

Life is unpredictable. A decade is a long time, and circumstances can change dramatically, making a long-term commitment to a 10-year mortgage risky.

H3: The Unpredictable Nature of the Next Decade

The stability assumed when taking out a mortgage can be easily disrupted.

-

Job Loss or Career Changes: A job loss or career change could significantly impact your ability to maintain high monthly payments.

-

Unexpected Expenses: Unexpected medical expenses, family emergencies, or significant home repairs can create financial strain, making mortgage payments challenging.

-

Relocation: Life often necessitates relocation. A 10-year mortgage reduces flexibility to move for job opportunities or family reasons without incurring hefty penalties.

-

Changing Housing Needs: Family size changes (children arriving or leaving home) or shifting lifestyle needs may necessitate a larger or smaller home, making a 10-year mortgage less adaptable.

H2: Limited Availability and Higher Costs

The relative unpopularity of 10-year mortgages in Canada translates to limited availability and potentially higher costs.

H3: Fewer Lenders Offering 10-Year Mortgages

Compared to the readily available 5-year and 25-year mortgages, 10-year options are offered by fewer lenders. This reduced competition can impact securing the most favorable interest rates.

H3: Potentially Higher Fees and Costs

Longer-term mortgages might come with higher administrative costs or fees.

-

Availability Comparison: Finding lenders offering competitive 10-year mortgages requires more extensive research.

-

Interest Rate Impact: Limited competition can mean less negotiating power and potentially higher interest rates.

-

Additional Costs: There might be higher closing costs or prepayment penalties associated with a 10-year mortgage compared to shorter-term alternatives.

H2: The Psychological Factor: Comfort with Shorter Terms

Many homeowners prefer the perceived predictability and control of shorter-term mortgages. The ability to reassess their financial situation and refinance after a shorter period provides a sense of comfort and security.

H3: Preference for Predictability and Control

A shorter-term mortgage allows for greater flexibility and control.

-

Psychological Comfort: The shorter the term, the more manageable the commitment feels to many borrowers.

-

Rate Drop Opportunities: Shorter terms offer the chance to capitalize on potential interest rate drops when refinancing.

-

Payment Flexibility: Shorter terms provide opportunities to adjust payments or refinance based on changing financial circumstances and market conditions.

3. Conclusion

The low popularity of the 10-year mortgage in Canada stems from a combination of factors: higher initial interest rates and the risk of payment shock, the inherent financial uncertainty associated with a decade-long commitment, limited availability, and a psychological preference for shorter-term predictability. While a 10-year mortgage in Canada might suit some, understanding these factors is crucial before making a decision. Research your options carefully and speak to a mortgage broker to find the right mortgage term for your financial situation. Consider exploring alternative mortgage options like 5-year or 25-year mortgages to best align with your individual financial goals and risk tolerance.

Featured Posts

-

Navigating The Chinese Market Case Studies Of Bmw And Porsche

May 04, 2025

Navigating The Chinese Market Case Studies Of Bmw And Porsche

May 04, 2025 -

Bradley Cooper And Will Arnett Behind The Scenes Of Is This Thing On Nyc Shoot

May 04, 2025

Bradley Cooper And Will Arnett Behind The Scenes Of Is This Thing On Nyc Shoot

May 04, 2025 -

Kham Pha Dac San Loai Qua Quen Lang Nay Duoc Ban 60 000d Kg

May 04, 2025

Kham Pha Dac San Loai Qua Quen Lang Nay Duoc Ban 60 000d Kg

May 04, 2025 -

The Most Iconic Final Destination Moment A Nostalgic Look Back

May 04, 2025

The Most Iconic Final Destination Moment A Nostalgic Look Back

May 04, 2025 -

Gibonni Intimno Predstavljanje Knjige Drvo I Najava Koncerta U Subotici

May 04, 2025

Gibonni Intimno Predstavljanje Knjige Drvo I Najava Koncerta U Subotici

May 04, 2025