Wildfire Speculation: Is Betting On Natural Disasters The New Normal?

Table of Contents

The Growing Market for Wildfire Prediction and Investment

The wildfire prediction market is booming. Sophisticated algorithms, fueled by vast datasets, are attempting to predict the likelihood and severity of wildfires. This data, including satellite imagery capturing vegetation density and dryness, historical fire patterns, and real-time weather forecasts, forms the basis for complex predictive modeling. These models are then used to inform various investment vehicles.

- Companies and Platforms: Several companies are developing advanced wildfire prediction models and offering investment products based on their forecasts. These range from established financial institutions offering catastrophe bonds to smaller startups using AI to analyze risk.

- Investment Strategies: Investors can utilize various strategies, including derivatives like wildfire-indexed insurance contracts and insurance-linked securities (ILS). These ILS, often structured as catastrophe bonds, allow investors to profit from payouts triggered by severe wildfire events.

- High Returns, High Risks: While the potential for high returns is alluring, the inherent risks are equally significant. The unpredictable nature of wildfires, coupled with the complexities of predictive modeling, makes this a highly speculative market. Inaccurate predictions can lead to substantial financial losses for investors.

Ethical Concerns and the Social Impact of Wildfire Speculation

The ethical implications of profiting from wildfire devastation are profound. Critics argue that wildfire speculation amounts to disaster capitalism, where profit is extracted from suffering. This raises serious concerns about:

- Exploitation and Profiteering: The very act of betting on the destruction caused by wildfires is seen by many as morally reprehensible. It suggests a detachment from the human suffering and environmental devastation caused by these events.

- Hindering Recovery Efforts: Resources that could be used for wildfire prevention, mitigation, and community recovery might be diverted towards speculative investment. This could potentially hinder long-term recovery efforts in affected areas.

- Market Manipulation and Price Inflation: The potential for market manipulation and price inflation further exacerbates ethical concerns. Falsely inflating the perceived risk of wildfires can lead to unnecessary insurance costs and increased financial burden on communities.

- Regulation and Oversight: Increased regulation and robust oversight mechanisms are needed to ensure that wildfire speculation doesn't worsen the impact of these disasters on vulnerable communities. Transparency in pricing and risk assessment is crucial.

The Role of Climate Change in Fueling Wildfire Speculation

Climate change is undeniably exacerbating wildfire risk. Rising temperatures, prolonged droughts, and changes in vegetation patterns are contributing to more frequent and intense wildfires globally. This increased risk fuels the wildfire speculation market in two ways:

- Increased Frequency and Intensity: The scientific consensus points to a clear link between climate change and the increasing severity of wildfires. This makes accurate prediction more challenging but also increases the perceived risk, making wildfire-related investments more attractive to some.

- Climate Models and Projections: Climate models play a significant role in shaping investment decisions. Projections of future wildfire activity, based on various climate scenarios, are incorporated into risk assessments and inform investment strategies. This often leads to increased investment in wildfire risk mitigation strategies.

- Statistics and Examples: The number of large wildfires and the area burned are increasing globally. For example, the Western United States has experienced a dramatic rise in wildfire activity in recent decades. These observable trends reinforce the perceived risk and drive investment in wildfire prediction and mitigation.

Regulation and the Future of Wildfire Speculation

Currently, the regulatory landscape surrounding wildfire speculation is fragmented. While some financial instruments, like catastrophe bonds, are subject to regulatory oversight, the overall regulatory framework needs strengthening.

- Arguments for Stricter Regulation: Many argue for stricter regulations to prevent exploitation and protect vulnerable communities. This includes increased transparency in pricing, risk assessment, and investment strategies.

- Challenges in Regulation: Regulating this complex and rapidly evolving market presents significant challenges. International cooperation is crucial given the global nature of wildfire risk.

- The Role of International Cooperation: Addressing the global wildfire risk requires international cooperation. Shared data, standardized risk assessment methodologies, and harmonized regulations are essential.

The Future of Wildfire Speculation – A Call to Action

The market for wildfire speculation is rapidly growing, driven by advancements in predictive modeling and the undeniable impact of climate change. However, ethical concerns surrounding profiting from natural disasters cannot be ignored. We must strive for a future where financial innovation doesn't come at the cost of human suffering and environmental devastation. We urge readers to research the topic further, advocate for responsible regulation of wildfire speculation and similar disaster-related investments, and support ethical investment practices that prioritize both profit and social responsibility. Let's work towards a future where financial markets contribute to disaster risk reduction, rather than exacerbating it.

Featured Posts

-

Restaurant Review Salon Yevani In Herzliya The Jerusalem Post

May 26, 2025

Restaurant Review Salon Yevani In Herzliya The Jerusalem Post

May 26, 2025 -

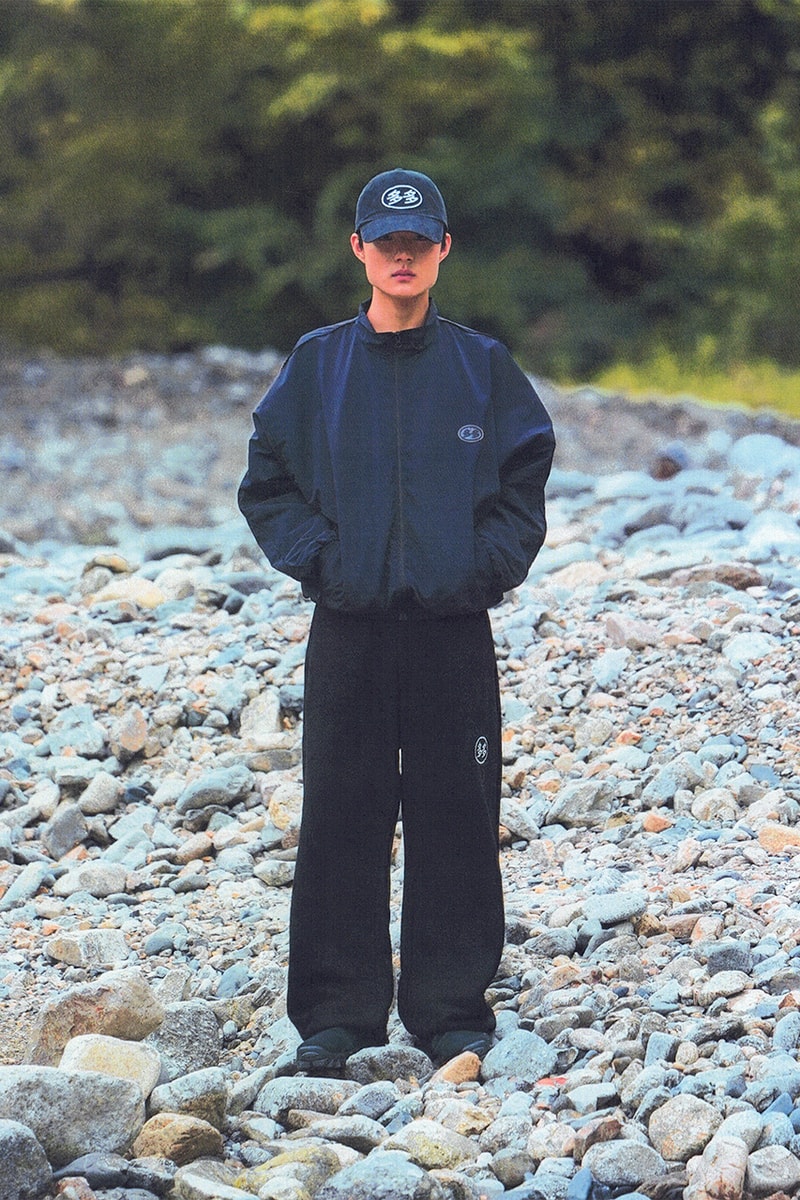

Jenson And The Fw 22 Extended Collection Details And Release Date

May 26, 2025

Jenson And The Fw 22 Extended Collection Details And Release Date

May 26, 2025 -

Florentino Perez Y El Futuro Del Real Madrid

May 26, 2025

Florentino Perez Y El Futuro Del Real Madrid

May 26, 2025 -

Get Ready For Sinners A Louisiana Filmed Horror Movie

May 26, 2025

Get Ready For Sinners A Louisiana Filmed Horror Movie

May 26, 2025 -

Semua Yang Perlu Anda Ketahui Tentang Moto Gp Inggris Jadwal Pembalap Dan Lainnya

May 26, 2025

Semua Yang Perlu Anda Ketahui Tentang Moto Gp Inggris Jadwal Pembalap Dan Lainnya

May 26, 2025