Will BigBear.ai (BBAI) Be The Next Penny Stock To Explode? A Realistic Look At Its Potential

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) is a technology company specializing in artificial intelligence (AI) and data analytics solutions. Its primary focus lies in providing mission-critical capabilities to government and commercial sectors. This means BBAI develops and deploys AI-powered tools for a wide range of applications, from national security and defense to supply chain optimization and financial modeling.

-

Key Services and Offerings: BBAI offers a comprehensive suite of AI-driven services, including:

- Advanced analytics and data visualization

- AI-powered predictive modeling and forecasting

- Cybersecurity solutions leveraging AI

- Custom AI solutions tailored to specific client needs

-

Target Market and Competitive Landscape: BBAI primarily targets government agencies and large commercial enterprises seeking to leverage AI for improved decision-making and operational efficiency. The competitive landscape is crowded, with established players and emerging startups vying for market share in the rapidly expanding AI sector. BBAI's success will depend on its ability to differentiate itself through innovative technology, strong client relationships, and effective execution. This makes thorough research of its competitive positioning, using resources like SEC filings and financial news sites crucial before investment.

Analyzing BBAI's Financial Performance and Growth Prospects

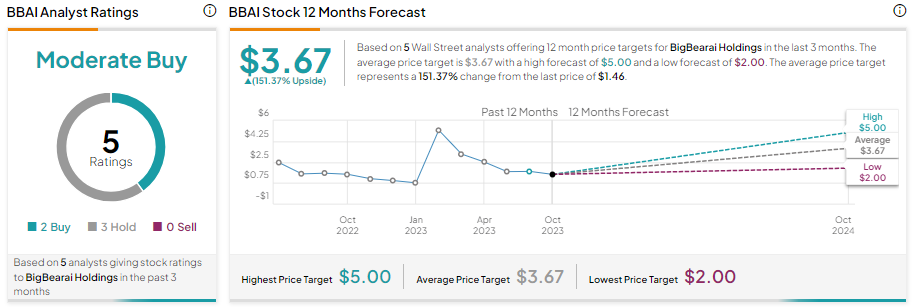

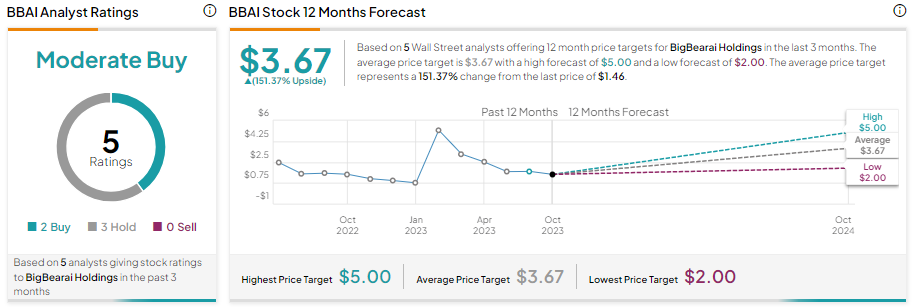

Assessing BBAI's potential for explosive growth necessitates a close examination of its financial performance and growth trajectory. Recent financial reports will reveal crucial information regarding revenue generation, profitability, and overall financial health. Key metrics to analyze include:

- Revenue Growth: Consistent and substantial revenue growth is a positive indicator of a company's potential for future success. Investors should look for trends in revenue growth over time to gauge BBAI's performance and stability.

- Earnings: Profitability, while not always guaranteed in high-growth technology companies, is vital for long-term sustainability. Analyzing earnings per share (EPS) and net income can provide insights into the company's financial health.

- Financial Ratios: Analyzing relevant financial ratios, such as the price-to-earnings (P/E) ratio and debt-to-equity ratio, can provide valuable context for assessing BBAI's valuation and financial risk. These are particularly important when evaluating a penny stock, which tends to carry higher risk than established companies.

- Potential Growth Catalysts: Identifying potential catalysts for future growth is crucial. For BBAI, this could involve securing major new government contracts, developing innovative new AI technologies, or successfully expanding into new commercial markets. Following industry news and company announcements is paramount.

Assessing the Risks Associated with Investing in BBAI

Investing in penny stocks like BBAI inherently carries significant risk. The high volatility of these stocks can lead to rapid price fluctuations, resulting in both substantial gains and significant losses.

- Volatility: BBAI's stock price is likely to experience significant ups and downs, making it a high-risk investment. Sudden market shifts and negative news can quickly impact the stock price.

- Dependence on Government Contracts: A significant portion of BBAI's revenue may come from government contracts. Any disruptions or changes in government spending could negatively affect the company's financial performance.

- Competition: The AI industry is highly competitive, with numerous established players and new entrants. BBAI faces intense competition for both government and commercial contracts.

- Financial Uncertainty: As with any penny stock, BBAI faces financial uncertainty. Its financial health is less stable than larger, established companies, making losses more likely.

Comparing BBAI to Other Successful Penny Stocks

Examining past successful penny stock stories can offer valuable insights into the factors that contribute to explosive growth. While past performance is not indicative of future results, identifying similarities and differences between BBAI and other successful penny stocks can help in assessing its potential. Factors to consider include the company's innovation, market timing, and ability to execute its business plan. Analyzing previous success stories will allow investors to better grasp the intricacies of the penny stock market. Resources like financial news websites and investor forums offer case studies for this research.

Conclusion: Is BigBear.ai (BBAI) Your Next Penny Stock Winner?

BigBear.ai (BBAI) presents a compelling investment opportunity with the potential for explosive growth in the AI sector. However, it's crucial to acknowledge the significant risks associated with investing in penny stocks. Its dependence on government contracts and the highly competitive AI landscape pose challenges. A thorough due diligence process is essential before investing in BBAI or any penny stock. Is BigBear.ai (BBAI) the right penny stock for your portfolio? Only you can decide, after conducting thorough research and carefully assessing your risk tolerance. Learn more about BBAI and other penny stock opportunities, but remember to thoroughly research BigBear.ai (BBAI) before investing. A balanced approach, considering both the potential rewards and the substantial risks, is crucial for informed decision-making in the penny stock market.

Featured Posts

-

D Wave Quantum Inc Qbts Stock Drop On Thursday Reasons And Analysis

May 20, 2025

D Wave Quantum Inc Qbts Stock Drop On Thursday Reasons And Analysis

May 20, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

May 20, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

May 20, 2025 -

From Group Trips To Solo Adventures A Travelers Transformation

May 20, 2025

From Group Trips To Solo Adventures A Travelers Transformation

May 20, 2025 -

Are Quantum Stocks Like Rigetti Rgti And Ion Q A Smart Investment In 2025

May 20, 2025

Are Quantum Stocks Like Rigetti Rgti And Ion Q A Smart Investment In 2025

May 20, 2025 -

The China Factor Why Bmw Porsche And Others Face Headwinds In The Chinese Market

May 20, 2025

The China Factor Why Bmw Porsche And Others Face Headwinds In The Chinese Market

May 20, 2025