Will GOP Infighting Block Trump's "Big Beautiful" Tax Bill?

Table of Contents

Factional Divisions Within the GOP

The Republican party is far from a monolith. Deep ideological rifts fracture the party, potentially crippling any unified approach to tax legislation. These divisions significantly threaten the passage of the "big beautiful" tax bill, creating an uncertain future for the proposed reforms.

The Conservative vs. Moderate Divide

A major fault line runs between fiscally conservative Republicans and their more moderate counterparts. Fiscally conservative Republicans, often members of the Freedom Caucus, prioritize deep tax cuts for corporations and high-income earners, believing this will stimulate economic growth through "trickle-down" economics. Moderates, however, express concerns about the impact on the national debt and the potential for exacerbating income inequality. They advocate for more targeted tax relief and greater protections for social programs.

- Specific Policy Disagreements: Disagreements center on the proposed corporate tax rate, the extent of individual tax cuts, and the elimination or preservation of certain deductions.

- Prominent Figures: Senators like Ted Cruz represent the conservative wing pushing for significant tax cuts, while others, such as Susan Collins, voice concerns about the budgetary implications.

- Impact on Income Brackets: Proposed cuts disproportionately benefit high-income earners, fueling the moderate's concerns about fairness and widening the wealth gap. This creates significant tension and complicates the passage of any unified bill.

Trump's Influence and its Limits

President Trump's role in navigating these divisions is crucial. While he championed the "big beautiful" tax bill as a key campaign promise, his ability to unify his party remains questionable. His leadership style, characterized by both deal-making and unpredictable pronouncements, has simultaneously encouraged and undermined party unity.

- Attempts at Brokering Deals: Trump has engaged in behind-the-scenes negotiations, attempting to garner support from reluctant Republicans.

- Public Disagreements: However, public clashes with prominent figures like Senator Rand Paul have highlighted the limits of his influence and the deep-seated ideological conflicts within the party.

- Negotiating Style: Trump's often confrontational approach, while effective in some situations, has also alienated some moderate Republicans, making consensus building more challenging.

The Role of Lobbying and Special Interests

Powerful lobbying groups and special interests exert considerable influence on the legislative process, potentially exacerbating the existing infighting. These groups actively lobby individual GOP members, pushing for provisions that benefit their specific agendas, further fragmenting the party's approach.

- Key Lobbying Groups: Business organizations like the U.S. Chamber of Commerce and various industry-specific groups exert significant pressure on lawmakers.

- Influence on Individual Members: Lobbyists target swing votes and vulnerable senators, increasing the likelihood of amendments and compromises that deviate from the initial "big beautiful" tax bill framework.

- Consequences for the Bill: This influence could lead to a diluted final version, compromising the intended impact of the tax cuts or potentially leading to the bill's failure altogether.

Policy Challenges and Compromises

Even with unified GOP support, significant policy hurdles stand in the way. These hurdles create further opportunities for delays, compromises that significantly alter the bill, or even complete legislative failure of the "big beautiful" tax plan.

Senate Filibuster and the 60-Vote Threshold

The Senate's filibuster rule requires 60 votes to overcome procedural obstacles. With a narrow Republican majority, securing enough votes for the original "big beautiful" tax bill remains a daunting task.

- Overcoming the Filibuster: Republicans may attempt to use budget reconciliation to bypass the filibuster, but this process is complex and has its limitations.

- Bipartisan Support: The prospect of bipartisan support is minimal, given the partisan nature of tax policy and the deep divisions between the Republican and Democratic parties.

- Compromises: To secure the necessary votes, significant compromises might be necessary, potentially softening or eliminating key elements of Trump's original vision.

Budget Reconciliation and its Limitations

Budget reconciliation allows certain budgetary measures to pass with a simple majority, potentially circumventing the filibuster. However, this process has strict rules and limitations.

- Reconciliation Process: Using this route necessitates adherence to specific procedural rules, restricting the scope and content of the tax bill.

- Procedural Challenges: Any procedural missteps could derail the entire process and create further delays.

- Impact on Bill's Scope: The reconciliation process might force Republicans to scale back the proposed tax cuts, further diminishing the impact of the legislation.

Economic Projections and Public Opinion

Economic projections associated with the tax bill vary widely, fueling further debate. The potential impact on the national debt and public opinion adds another layer of complexity to the legislative process.

- Projected Economic Growth: Supporters claim the tax cuts will stimulate economic growth, while critics warn of increased deficits and rising inequality.

- National Debt: Concerns about the potential impact on the national debt significantly influence moderate Republicans.

- Public Opinion: Public opinion polls reveal mixed public sentiment towards the tax bill. Negative public perception could impact legislators' willingness to support the proposed tax cuts.

Conclusion

The fate of Trump's "big beautiful" tax bill remains uncertain. Deep divisions within the GOP, compounded by significant policy challenges, create a high probability of delays, compromises, or even complete failure. The upcoming legislative battles will reveal whether the President can effectively navigate these internal conflicts and deliver on a core campaign promise. Will the GOP ultimately coalesce around a significantly altered version of the tax plan, or will infighting lead to its demise? Stay informed and closely follow the ongoing developments regarding this crucial legislation and the future of the "big beautiful" tax bill.

Featured Posts

-

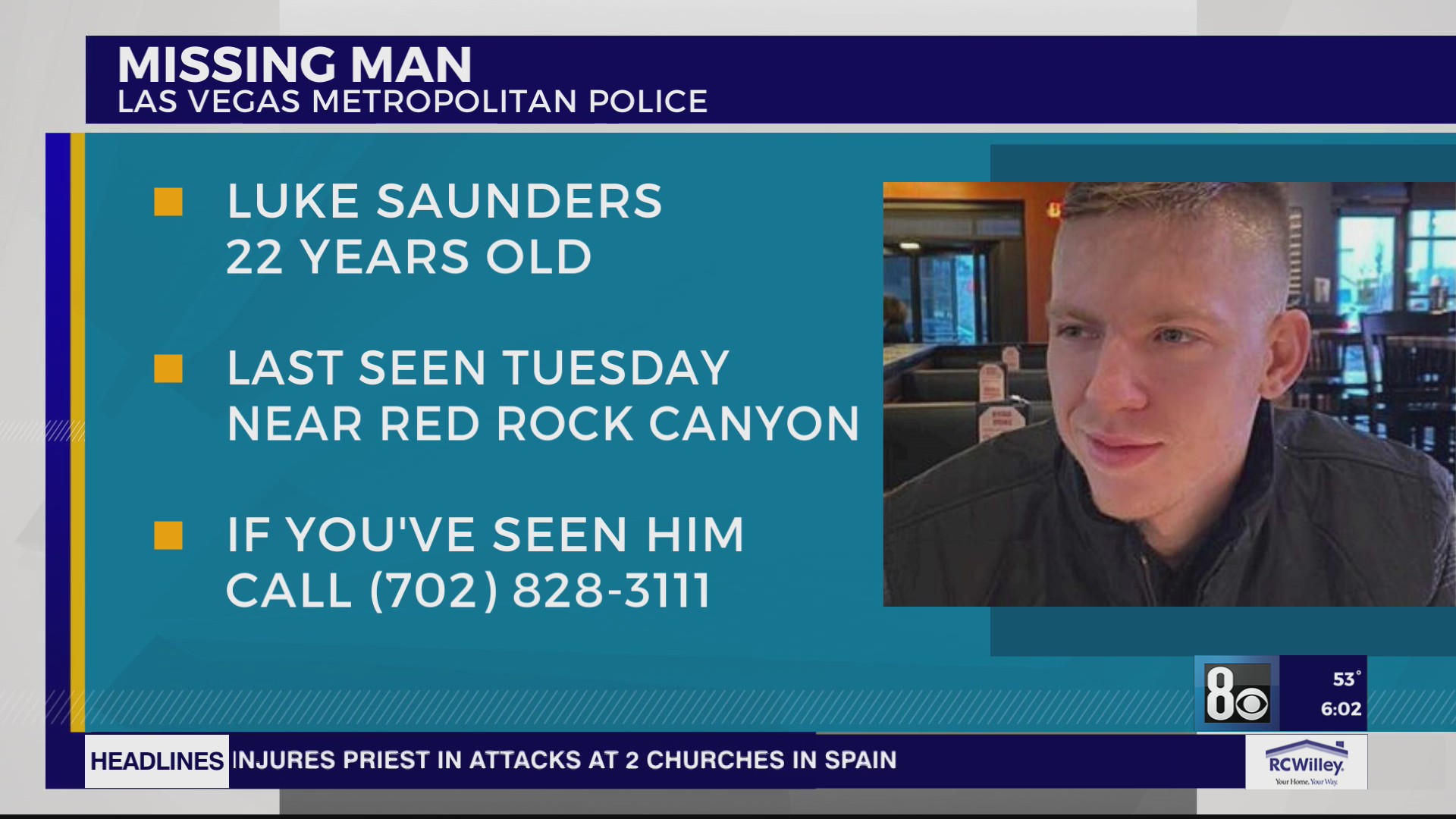

Las Vegas Police Search For Missing Paralympian Sam Ruddock

Apr 29, 2025

Las Vegas Police Search For Missing Paralympian Sam Ruddock

Apr 29, 2025 -

Deutsche Rivalitaeten Die Wichtigsten Spiele Der Champions League

Apr 29, 2025

Deutsche Rivalitaeten Die Wichtigsten Spiele Der Champions League

Apr 29, 2025 -

Getting Tickets To The Capital Summertime Ball 2025 The Ultimate Guide

Apr 29, 2025

Getting Tickets To The Capital Summertime Ball 2025 The Ultimate Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Your Guide To Purchase

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Your Guide To Purchase

Apr 29, 2025 -

Georgian Husband Arrested Wife Seriously Injured In German Fire

Apr 29, 2025

Georgian Husband Arrested Wife Seriously Injured In German Fire

Apr 29, 2025