Will QBTS Stock Rise Or Fall After Its Next Earnings Report?

Table of Contents

Analyzing QBTS's Recent Performance and Trends

To predict the post-earnings movement of QBTS stock, we must first analyze its recent performance and underlying trends.

Revenue Growth and Profitability

QBTS's recent financial performance reveals a mixed bag. While revenue has shown steady growth over the past year, increasing by X% year-over-year (source needed), profitability margins have been compressed due to rising operating costs.

- Key Revenue Drivers: The company's primary revenue streams include [List key revenue sources, e.g., subscription fees, advertising revenue, product sales]. Recent growth has been primarily driven by [Explain specific drivers, e.g., successful new product launches, expansion into new markets].

- Cost-Cutting Measures: To address margin pressures, QBTS has implemented several cost-cutting measures, including [List examples, e.g., streamlining operations, reducing workforce, renegotiating supplier contracts]. The effectiveness of these measures will be crucial in determining profitability in the upcoming quarter.

- Market Competition: Increased competition from [Name key competitors] has put pressure on pricing and market share, impacting overall profitability. QBTS's ability to innovate and differentiate itself will be key to maintaining its competitive edge.

Key Performance Indicators (KPIs)

Beyond revenue and profit, several other KPIs will influence investor sentiment:

- Customer Acquisition Cost (CAC): A rising CAC suggests increased difficulty in acquiring new customers, potentially hindering future growth.

- Customer Churn Rate: A high churn rate indicates that customers are leaving the platform at a rapid pace, which negatively impacts long-term revenue streams.

- User Engagement: For companies with a significant online presence, metrics such as daily/monthly active users, average session duration, and conversion rates are crucial indicators of platform health and future growth potential. [If applicable, include relevant data and analysis for QBTS.]

Market Sentiment and Analyst Predictions

Current market sentiment towards QBTS is cautiously optimistic. [Cite sources such as financial news articles or analyst reports]. Leading financial analysts have issued mixed predictions:

- Price Target Changes: Analyst firm X has recently adjusted its price target from $Y to $Z (source needed).

- Buy/Sell Ratings: The consensus rating from leading analysts currently stands at [Mention the consensus rating, e.g., "Hold," "Buy," or "Sell"] (source needed). This reflects a degree of uncertainty among experts regarding the stock's future trajectory.

Factors That Could Influence QBTS Stock After Earnings

The post-earnings stock price movement will depend heavily on several key factors:

Earnings Beat or Miss

The most immediate impact will stem from whether QBTS beats or misses earnings expectations:

- Significant Beat: Exceeding expectations significantly could trigger a substantial price increase due to increased investor confidence.

- Slight Miss: A minor miss might cause a temporary dip, but if the overall outlook remains positive, the stock could recover quickly.

- Major Miss: A substantial miss in earnings would likely trigger a significant sell-off, reflecting investor disappointment and concerns about the company's future prospects. Past responses to earnings announcements offer clues, indicating [describe previous reactions].

Future Outlook and Guidance

The company's guidance for future quarters will be crucial:

- Optimistic Guidance: Strong revenue projections and positive growth expectations will likely boost investor confidence and drive the stock price upward.

- Pessimistic Guidance: Conversely, a cautious outlook or lowered expectations could lead to a sell-off.

Macroeconomic Factors

Broader economic conditions will also play a role:

- Inflation and Interest Rates: High inflation and rising interest rates could negatively impact consumer spending and negatively affect QBTS's performance.

- Overall Market Sentiment: A broader market downturn could put downward pressure on QBTS stock regardless of the company's performance.

Competitive Landscape

The competitive landscape will significantly impact QBTS's future prospects:

- Key Competitors: Aggressive actions from competitors could erode QBTS’s market share.

- Competitive Advantages: QBTS’s ability to innovate and maintain its competitive advantages will be crucial.

Risk Assessment and Investment Strategies

Investing in QBTS stock entails several risks:

Potential Risks

- Volatility: QBTS stock is known for its volatility, potentially leading to significant price swings.

- Market Uncertainty: Uncertain macroeconomic conditions could negatively impact the stock price.

- Company-Specific Risks: Unexpected operational challenges or strategic setbacks could negatively affect the company’s performance.

Investment Strategies

Your investment strategy should align with your risk tolerance and goals:

- Buy-and-Hold: This strategy is suitable for long-term investors with a high risk tolerance.

- Short-Term Trading: This involves buying and selling frequently based on short-term price fluctuations, requiring a high degree of market knowledge and risk tolerance.

- Diversification: Diversifying your portfolio across multiple assets reduces overall risk.

Conclusion

Whether QBTS stock rises or falls after its next earnings report depends on a complex interplay of factors, including its financial performance, future outlook, macroeconomic conditions, and competitive landscape. While the potential for significant gains exists, investors must carefully assess the inherent risks. Understanding these factors is crucial for making informed decisions about your QBTS stock investments. Stay informed about QBTS's upcoming earnings report and make informed decisions about your QBTS stock investments.

Featured Posts

-

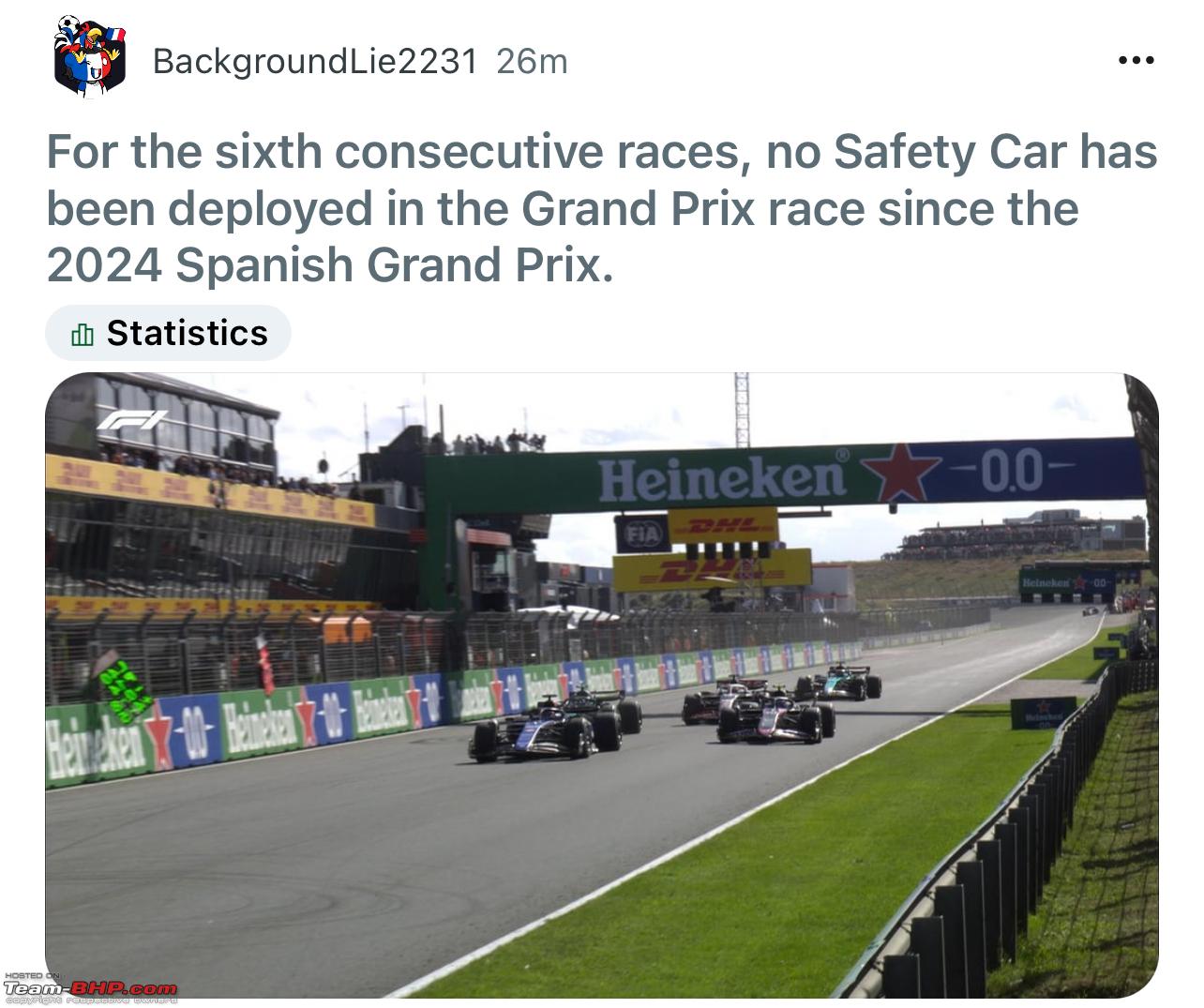

Diskussion Hamilton Och Leclerc I F1 Kaoset Var Det Raettvist

May 20, 2025

Diskussion Hamilton Och Leclerc I F1 Kaoset Var Det Raettvist

May 20, 2025 -

From Rome To History Jasmine Paolinis Triumph

May 20, 2025

From Rome To History Jasmine Paolinis Triumph

May 20, 2025 -

April 2nd Nyt Mini Crossword Solutions

May 20, 2025

April 2nd Nyt Mini Crossword Solutions

May 20, 2025 -

Formula 1 2024 Sezonu Icin Geri Sayim

May 20, 2025

Formula 1 2024 Sezonu Icin Geri Sayim

May 20, 2025 -

Suki Waterhouses Black Tuxedo Dress At The Met Gala 2025 A Head Turning Moment

May 20, 2025

Suki Waterhouses Black Tuxedo Dress At The Met Gala 2025 A Head Turning Moment

May 20, 2025