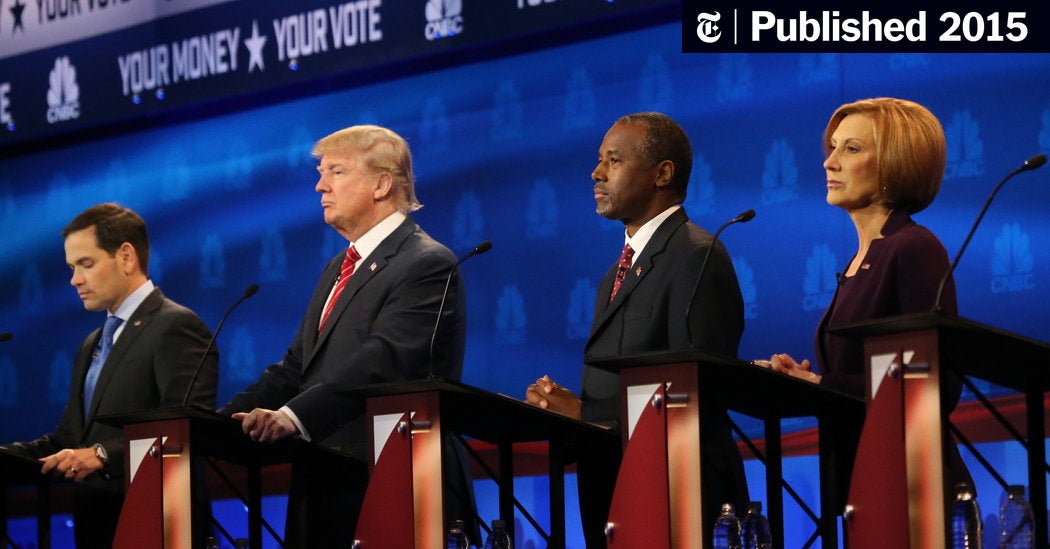

Will Republican Divisions Sink Trump's Tax Plan?

Table of Contents

Intra-Party Conflicts Over Tax Cuts

The Republican party, while united in its general support for tax cuts, is far from monolithic in its vision for tax reform. Significant disagreements on crucial aspects of Trump's tax plan threaten to fracture the party's unity and jeopardize the bill's passage.

Disagreements on Corporate Tax Rates

A major point of contention centers on the proposed corporate tax rate cuts. While the Trump administration initially proposed a significant reduction to 15%, many within the Republican party have voiced concerns, advocating for either a higher or lower rate.

- Senator X: A prominent voice arguing for a higher rate, citing concerns about potential revenue losses and the need for fiscal responsibility. Their proposed rate might be closer to 20%, emphasizing the importance of balancing tax cuts with deficit reduction.

- Representative Y: On the other hand, advocates for a lower rate, even below 15%, arguing that such a dramatic reduction is necessary to stimulate economic growth and enhance global competitiveness. They propose a rate closer to 12%, emphasizing the potential for job creation and increased investment.

- Projected Revenue Losses: Independent analyses project vastly different revenue losses depending on the chosen corporate tax rate. A 15% rate could lead to a projected annual revenue loss of $X trillion, while a 20% rate might reduce this loss to $Y trillion. These discrepancies fuel the internal debate.

Debate on Individual Tax Cuts

The individual income tax cuts proposed in Trump's tax plan have also sparked considerable internal debate. The proposed brackets, standard deductions, and the overall impact on different income groups remain contentious issues within the Republican party.

- Concerns about Tax Cuts for the Wealthy: Several Republicans express concern that the proposed individual tax cuts disproportionately benefit high-income earners, exacerbating income inequality. They advocate for adjustments to ensure a more equitable distribution of tax relief.

- Alternative Proposals: Alternative proposals from within the party suggest modifying the tax brackets to provide more targeted relief to middle-class families while limiting benefits for the wealthy. These alternative proposals often incorporate expanded child tax credits or increased standard deductions as methods for achieving this goal.

- Distributional Effects: Economic models project significantly different distributional effects depending on the specific structure of the individual income tax cuts. Some analyses show a considerable increase in after-tax income for high-income households, fueling concerns amongst fiscally conservative and socially conscious Republicans.

The Role of Fiscal Conservatives

The Trump tax plan also faces significant pushback from fiscal conservatives within the Republican party, deeply concerned about its potential impact on the national debt and deficit.

Concerns About the National Debt

Many fiscally conservative Republicans view the proposed tax cuts as fiscally irresponsible, warning of a substantial increase in the national debt and the long-term consequences for the economy.

- Projected Debt Increases: Independent analyses project substantial increases in the national debt under the Trump tax plan. These projections vary depending on economic growth assumptions and the specific details of the plan, ranging from hundreds of billions to trillions of dollars over the next decade.

- Statements from Fiscal Hawks: Prominent Republican fiscal hawks have publicly expressed their reservations, arguing that the tax cuts are unsustainable and will jeopardize the nation's long-term fiscal health. They advocate for greater fiscal restraint and emphasize the importance of controlling government spending.

- Political Consequences of Increased Debt: The potential political fallout from a significantly increased national debt is also a major concern. This could lead to reduced credit ratings, higher interest rates, and ultimately, diminished economic growth.

Opposition from the Freedom Caucus

The House Freedom Caucus, a group of conservative Republicans known for their staunch opposition to government spending, poses a significant threat to the passage of Trump's tax plan.

- Freedom Caucus Concerns: The Freedom Caucus has expressed strong reservations about the plan, citing concerns about its cost, its potential impact on the national debt, and its lack of sufficient tax simplification.

- Past Legislative Blocks: The Freedom Caucus has a proven track record of successfully blocking legislation it deems unacceptable. Its potential opposition could be decisive in the fate of the tax plan.

- Leverage and Bargaining Power: The Freedom Caucus holds considerable leverage within the House of Representatives, and its demands are likely to significantly influence the final shape of any tax legislation.

The Influence of Lobbying and Special Interests

The final version of Trump's tax plan is also likely to be heavily influenced by lobbying efforts from various corporate interests and the perspectives of tax policy experts.

Impact of Corporate Lobbying

Powerful corporate lobbying groups have exerted significant influence on the drafting and debate surrounding the tax plan.

- Industries Benefiting from Tax Cuts: Specific industries such as pharmaceuticals, technology, and finance stand to gain substantially from the proposed corporate tax cuts. Their lobbying efforts are aimed at ensuring the final legislation benefits them to the greatest extent possible.

- Lobbying Strategies: These corporations and their lobbyists have employed various strategies to influence Republican lawmakers, including campaign contributions, targeted advertising, and direct engagement with congressional representatives.

- Potential Conflicts of Interest: Concerns about potential conflicts of interest between lawmakers and corporate lobbyists have been raised, particularly concerning the potential for quid pro quo arrangements.

Influence of Tax Policy Experts

The debate within the Republican party is also significantly influenced by various tax policy experts and think tanks.

- Supporting and Opposing Arguments: Prominent economists and policy analysts from across the ideological spectrum provide analysis and arguments both supporting and opposing various aspects of the tax plan.

- Policy Recommendations: These experts offer detailed policy recommendations, influencing the discussion and shaping the positions taken by different factions within the Republican party.

Conclusion

The future of Trump's tax plan is uncertain. While the President enjoys the support of a Republican-controlled Congress, deep-seated internal divisions within the GOP present a formidable obstacle. Disagreements over corporate and individual tax rates, concerns about the national debt, and the influence of the Freedom Caucus and corporate lobbying groups all contribute to a highly volatile political climate. The coming weeks will be crucial in determining whether Republican leadership can broker a compromise satisfying the various factions. The success or failure of Trump's tax reform will hinge on the ability to navigate these internal divisions and forge a united front. Will Republican unity prevail, or will internal divisions sink Trump's Tax Plan? The answer remains to be seen. Stay informed on the developments of this pivotal legislation and the evolving dynamics of Trump's tax reform, Republican tax plan, and the GOP tax plan.

Featured Posts

-

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

May 22, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

May 22, 2025 -

Kanali Mi Ukrayina 5 Kanal 1 1 Pryamiy Inter Ictv Noviy Kanal Stb Up Ta Nv Otrimali Status Kritichno Vazhlivikh Vid Minkulturi

May 22, 2025

Kanali Mi Ukrayina 5 Kanal 1 1 Pryamiy Inter Ictv Noviy Kanal Stb Up Ta Nv Otrimali Status Kritichno Vazhlivikh Vid Minkulturi

May 22, 2025 -

Ea Fc 24 Fut Birthday Tier List And Best Card Choices For Your Squad

May 22, 2025

Ea Fc 24 Fut Birthday Tier List And Best Card Choices For Your Squad

May 22, 2025 -

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025 -

The Goldbergs A Comprehensive Guide To Each Season

May 22, 2025

The Goldbergs A Comprehensive Guide To Each Season

May 22, 2025