Will The Bank Of Canada Cut Rates Again? Economists Weigh In On Tariff Impacts

Table of Contents

The Current Economic Climate and Interest Rate Expectations

The Canadian economy currently presents a mixed picture. While GDP growth remains positive, albeit at a slower pace than previously anticipated, inflation remains a persistent concern, hovering above the Bank of Canada's target range. Unemployment figures, while relatively low, are showing signs of softening, indicating potential labor market headwinds. The Bank of Canada's mandate is to maintain price stability and full employment, a delicate balancing act in the current environment. Recent Bank of Canada statements have emphasized a data-dependent approach to monetary policy, suggesting that future rate decisions will hinge on the incoming economic data.

- Inflation Rate and its Trajectory: Inflation remains stubbornly high, exceeding the Bank of Canada's 2% target. The trajectory of inflation will be crucial in determining future interest rate decisions.

- Unemployment Figures and Labor Market Dynamics: While unemployment remains low, recent data suggests a potential slowing in job creation, raising concerns about the strength of the labor market.

- Consumer Confidence Index: Consumer confidence has softened, reflecting concerns about inflation and economic uncertainty. This impacts consumer spending, a major driver of economic growth.

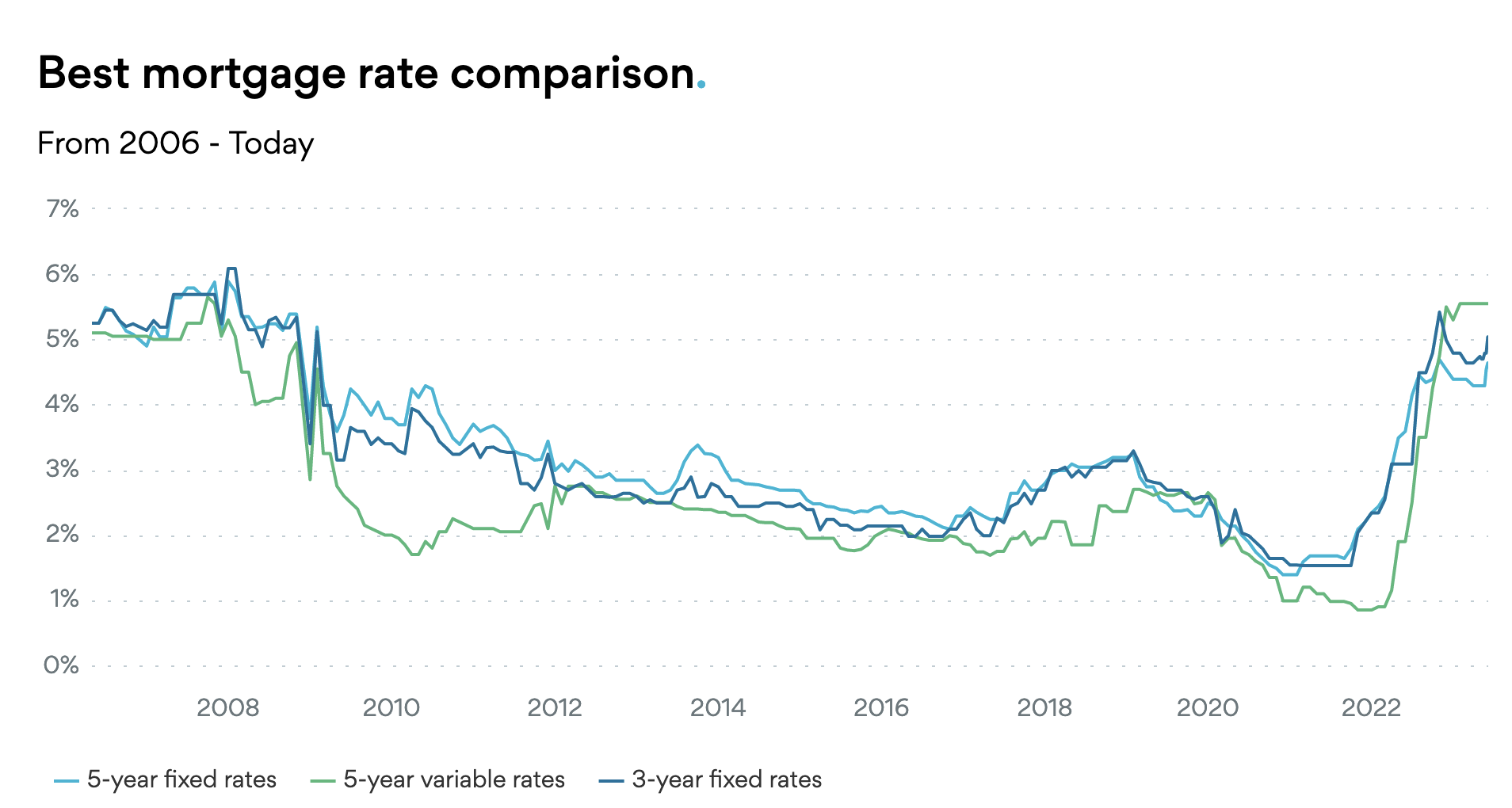

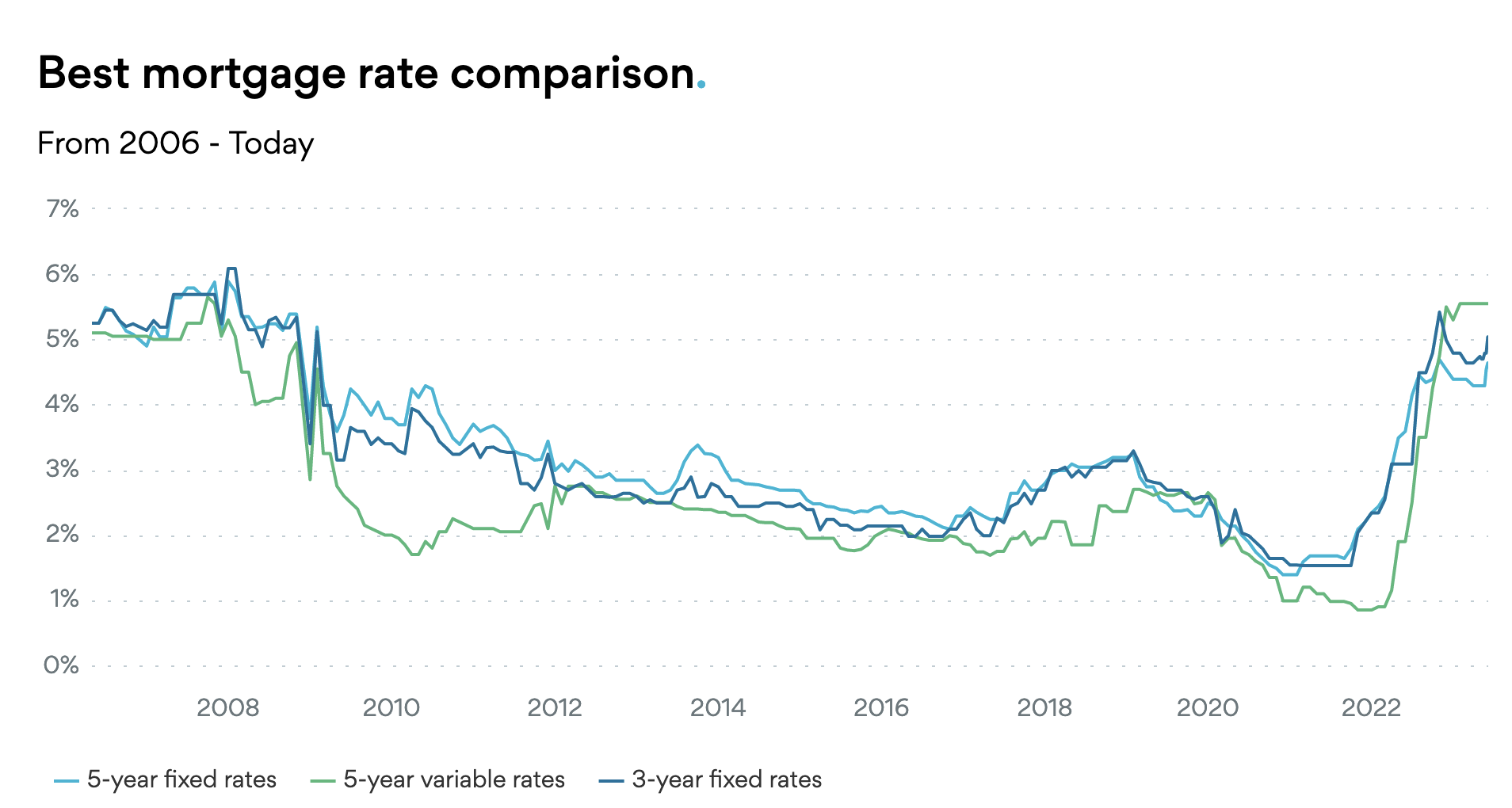

- Housing Market Trends: The Canadian housing market is experiencing a slowdown, with prices declining in some areas. This cooling effect could impact overall economic activity.

The Impact of Tariffs on the Canadian Economy

Tariffs, particularly those stemming from global trade disputes, significantly impact the Canadian economy. Sectors heavily reliant on exports, such as agriculture and manufacturing, are particularly vulnerable to reduced demand and increased competition. Increased import costs due to tariffs contribute to inflationary pressures, further complicating the Bank of Canada's task of managing inflation.

- Specific Examples of Industries Affected by Tariffs: The Canadian agricultural sector, for instance, has felt the impact of tariffs imposed by other countries, leading to reduced export volumes and lower revenues for farmers.

- Quantifiable Impact on GDP Growth: While precise figures are difficult to isolate, economists estimate that tariffs have contributed to a measurable reduction in Canada's GDP growth.

- Effects on Supply Chains and Consumer Prices: Tariffs disrupt global supply chains, leading to shortages and higher prices for consumers. This contributes to inflationary pressures and reduces purchasing power.

Economists' Predictions and Diverging Opinions

Forecasting the Bank of Canada's next move is challenging, with economists offering diverging opinions. Some leading analysts believe a rate cut is necessary to stimulate economic growth and counteract the negative impacts of tariffs and inflation. However, others argue that maintaining the current interest rate or even implementing a slight rate hike is necessary to control inflation and prevent further economic imbalances.

- Quotes from Prominent Economists Supporting Different Positions: For example, [Economist A] suggests a rate cut is warranted due to weakening economic indicators, while [Economist B] argues that a rate hike is necessary to prevent runaway inflation.

- Summary of their Economic Models and Rationale: The differing predictions stem from varied economic models and underlying assumptions about the resilience of the Canadian economy and the future trajectory of inflation.

- Predictions for the Future Trajectory of Interest Rates: Predictions range from further rate cuts to a period of stable interest rates or even a gradual increase.

Potential Consequences of a Rate Cut (or No Cut)

A rate cut by the Bank of Canada would likely lower borrowing costs for businesses and consumers, potentially stimulating investment and consumer spending. However, it could also exacerbate inflationary pressures and weaken the Canadian dollar. Maintaining the current interest rate would help control inflation but might hinder economic growth.

- Impact on Consumer Spending and Business Investment: A rate cut could boost consumer spending and encourage businesses to invest, leading to higher economic activity.

- Effects on the Canadian Dollar Exchange Rate: A rate cut might weaken the Canadian dollar, making imports more expensive and exports cheaper.

- Potential Implications for Government Debt: Lower interest rates can reduce the cost of servicing government debt, but they can also increase the overall debt burden over time.

Conclusion: Will the Bank of Canada Cut Rates Again? The Verdict

The decision of whether the Bank of Canada will cut rates again remains uncertain. The interplay of inflation, economic growth, and the impact of tariffs creates a complex scenario. While a rate cut could stimulate economic activity, it carries the risk of fueling inflation. Conversely, maintaining current rates or raising them could stifle growth but help control inflation.

Monitoring key economic indicators, such as inflation rates, unemployment figures, and consumer confidence, is crucial. Closely following statements and analysis from the Bank of Canada and leading economists will provide valuable insights into the future trajectory of interest rates. Stay informed about the Bank of Canada's decisions and the evolving economic landscape. Regularly check for updates on interest rate predictions and analysis to understand the potential impact of future Bank of Canada rate changes. Continue to monitor the situation as new economic data emerges to stay informed on whether the Bank of Canada will cut rates again.

Featured Posts

-

Oqtf Algerie France Les Explications D Abdelaziz Rahabi

May 14, 2025

Oqtf Algerie France Les Explications D Abdelaziz Rahabi

May 14, 2025 -

The Power Of Branding Comparing Jannik Sinner And Roger Federers Logos

May 14, 2025

The Power Of Branding Comparing Jannik Sinner And Roger Federers Logos

May 14, 2025 -

King George Straits Unexpected Dairy Queen Stop Creates Buzz

May 14, 2025

King George Straits Unexpected Dairy Queen Stop Creates Buzz

May 14, 2025 -

Alessia Marcuzzi E Mara Venier Scontro Imbarazzante Il Web Si Infuria

May 14, 2025

Alessia Marcuzzi E Mara Venier Scontro Imbarazzante Il Web Si Infuria

May 14, 2025 -

Does Jannik Sinners Fox Logo Have The Same Branding Power As Roger Federers Rf

May 14, 2025

Does Jannik Sinners Fox Logo Have The Same Branding Power As Roger Federers Rf

May 14, 2025