Winning Strategies For AIMSCAP's World Trading Tournament (WTT)

Table of Contents

Mastering Fundamental Analysis for AIMSCAP WTT

Successful AIMSCAP WTT trading hinges on a deep understanding of fundamental analysis. This involves assessing the intrinsic value of assets within the simulated AIMSCAP market by analyzing macroeconomic factors and individual company performance. Understanding these underlying forces will allow you to make informed trading decisions and gain a significant edge over your competitors.

Keywords: Fundamental analysis, WTT trading strategies, AIMSCAP market analysis, economic indicators, financial statements

-

Macroeconomic Factors: Keep a close watch on key economic indicators. Changes in inflation rates, interest rate adjustments by central banks, GDP growth forecasts, and unemployment figures all significantly impact market trends within the AIMSCAP WTT simulation. Understanding how these factors interact is critical.

-

Company Financial Health: Dive deep into company financials. Scrutinize balance sheets to assess the financial strength of companies, analyze income statements to evaluate profitability, and examine cash flow statements to understand their liquidity. This meticulous approach will help you identify undervalued or overvalued assets.

-

Industry Analysis: Don't just focus on individual companies. Understanding the overall health and trends within specific industries is crucial. Analyze industry reports and news to identify sectors poised for growth or decline within the AIMSCAP WTT environment.

-

Bullet Points:

- Analyze key economic indicators like inflation, interest rates, and GDP growth daily.

- Understand the impact of monetary and fiscal policies on market trends within the AIMSCAP WTT.

- Perform thorough due diligence on companies' financial statements before investing.

- Utilize reputable financial news sources like Bloomberg, Reuters, and the Wall Street Journal for up-to-date information.

- Practice fundamental analysis on historical AIMSCAP WTT data to refine your skills and test your strategies.

Technical Analysis Techniques for the AIMSCAP WTT

While fundamental analysis provides the long-term perspective, technical analysis helps identify optimal entry and exit points for maximizing profits. Mastering technical analysis techniques is essential for short-term trading success in the AIMSCAP WTT.

Keywords: Technical analysis, chart patterns, indicators, AIMSCAP trading signals, trading psychology

-

Chart Patterns: Learn to recognize and interpret common chart patterns, such as head and shoulders, double tops and bottoms, triangles, and flags. These patterns provide valuable clues about potential price movements.

-

Technical Indicators: Effectively utilize various technical indicators, including Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages (simple and exponential). These indicators offer insights into momentum, trend strength, and potential reversals.

-

Support and Resistance Levels: Identify support and resistance levels on price charts. These levels often represent areas where price is likely to find buyers (support) or sellers (resistance).

-

Candlestick Patterns: Familiarize yourself with candlestick patterns. These patterns, formed by the daily opening, closing, high, and low prices, can provide valuable clues about market sentiment and potential price action.

-

Bullet Points:

- Master chart pattern recognition for different timeframes.

- Utilize a combination of technical indicators to confirm trading signals.

- Understand how support and resistance levels are formed and used for trading decisions.

- Develop a robust trading plan based on technical signals and your risk management strategy.

- Practice backtesting your technical strategies on historical AIMSCAP WTT data to optimize your approach.

Risk Management and Capital Allocation in the AIMSCAP WTT

Even the best trading strategies can fail without effective risk management. Protecting your capital is paramount for long-term success in the AIMSCAP WTT.

Keywords: Risk management, capital allocation, position sizing, stop-loss orders, AIMSCAP risk mitigation

-

Position Sizing: Never risk more than a small percentage of your total capital on any single trade. This principle, known as position sizing, limits potential losses and protects you from catastrophic events.

-

Stop-Loss Orders: Always use stop-loss orders to automatically exit a trade if the price moves against you by a predetermined amount. This helps to limit your potential losses and prevents emotional trading decisions.

-

Diversification: Diversify your portfolio across different assets within the AIMSCAP WTT simulation to reduce your overall risk. Don't put all your eggs in one basket.

-

Risk Tolerance: Before the tournament, define your risk tolerance. This will guide your trading decisions and help you avoid impulsive choices.

-

Bullet Points:

- Define your risk tolerance before the tournament begins.

- Use stop-loss orders consistently on all trades.

- Diversify your portfolio across different asset classes.

- Practice proper position sizing to manage risk effectively. A common rule of thumb is to risk no more than 1-2% of your capital per trade.

- Regularly review and adjust your risk management strategy based on your performance and market conditions.

The Psychology of Winning in the AIMSCAP WTT

The AIMSCAP WTT isn't just about technical and fundamental analysis; it's also a test of mental fortitude. Emotional discipline is a critical component of successful trading.

Keywords: Trading psychology, emotional discipline, AIMSCAP mental fortitude, stress management, confidence building

-

Emotional Discipline: Avoid making emotional trading decisions driven by fear or greed. Stick to your trading plan, and don't let short-term market fluctuations derail your strategy.

-

Stress Management: Develop effective stress management techniques to maintain focus and clarity during periods of market volatility. Take breaks when needed, and avoid making impulsive decisions when stressed.

-

Confidence Building: Build confidence through consistent preparation and practice. The more you practice, the more comfortable and confident you will become in your abilities.

-

Self-Reflection: Regularly analyze your trades to identify areas for improvement. Learning from your mistakes is crucial for long-term success.

-

Bullet Points:

- Maintain emotional discipline during periods of market volatility.

- Avoid impulsive decisions driven by fear or greed.

- Develop a pre-defined trading plan and stick to it rigorously.

- Practice stress management techniques like deep breathing and mindfulness.

- Build confidence through consistent practice and preparation using historical AIMSCAP WTT data.

Conclusion

The AIMSCAP World Trading Tournament (WTT) presents a unique challenge, demanding a holistic approach that combines sharp analytical skills, robust risk management, and unwavering emotional control. By mastering fundamental and technical analysis, implementing effective risk management strategies, and cultivating a strong trading psychology, you'll significantly enhance your prospects for success. Remember to continuously learn, adapt, and refine your strategies based on your experiences. Start preparing now and develop your winning strategies for the AIMSCAP World Trading Tournament—the ultimate test of trading prowess! Conquer the AIMSCAP WTT and claim your victory!

Featured Posts

-

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025

Abn Amro Sterke Stijging Occasionverkoop Door Toenemend Autobezit

May 21, 2025 -

Abn Amro Hogere Aex Notering Dankzij Goede Resultaten

May 21, 2025

Abn Amro Hogere Aex Notering Dankzij Goede Resultaten

May 21, 2025 -

D Wave Quantum Qbts Explaining The Friday Stock Price Increase

May 21, 2025

D Wave Quantum Qbts Explaining The Friday Stock Price Increase

May 21, 2025 -

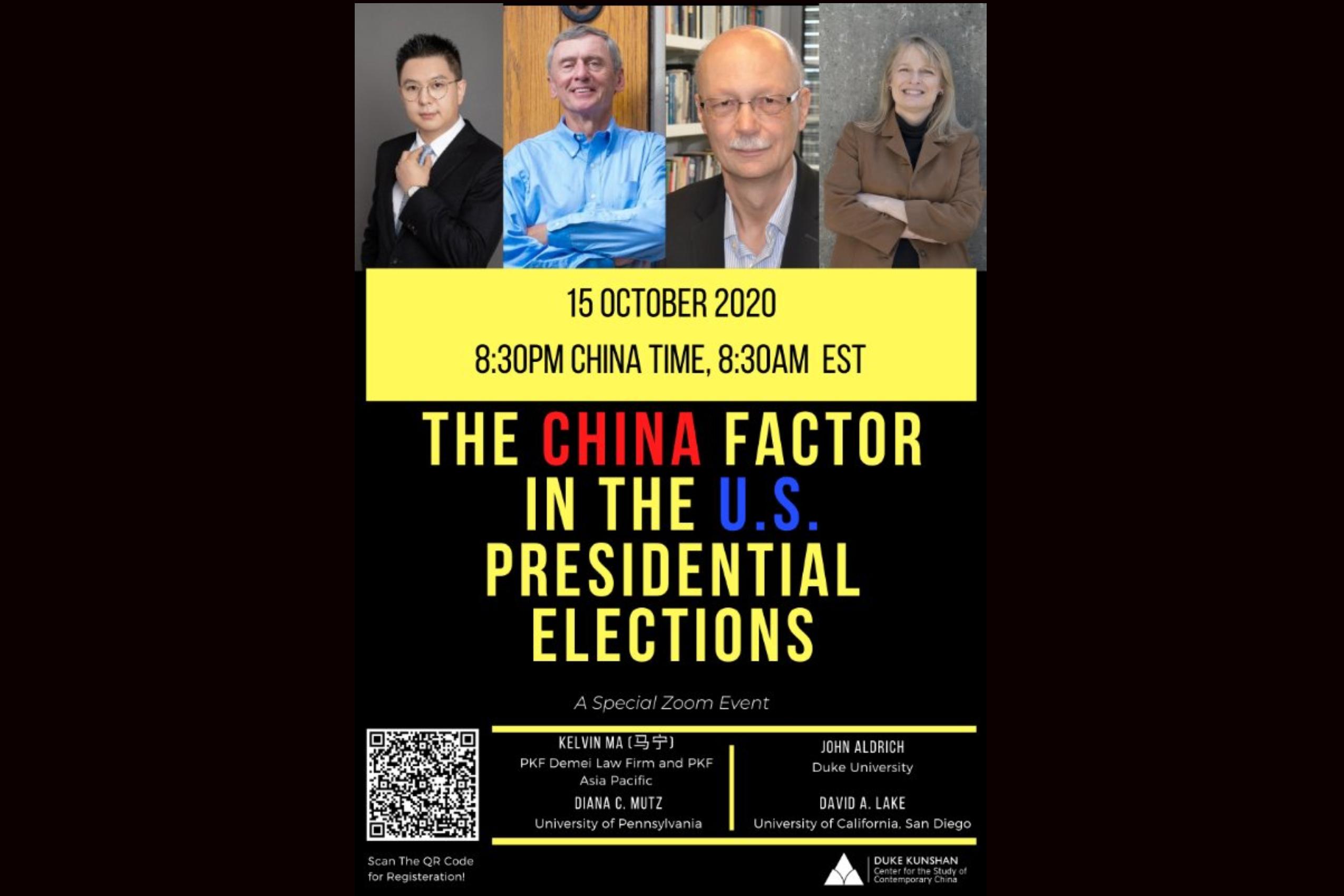

The China Factor Why Bmw Porsche And Others Face Market Difficulties

May 21, 2025

The China Factor Why Bmw Porsche And Others Face Market Difficulties

May 21, 2025 -

Trans Australia Run On The Brink Of A New Record

May 21, 2025

Trans Australia Run On The Brink Of A New Record

May 21, 2025