XAUUSD Gold Price Recovery: Impact Of Weakening US Economic Data

Table of Contents

Weakening US Dollar and its Impact on XAUUSD Gold Price

The Inverse Relationship:

The US dollar and gold prices generally exhibit an inverse relationship. A weaker US dollar makes gold more affordable for investors holding other currencies, thus increasing demand and pushing the XAUUSD Gold Price higher. This is because gold is priced in US dollars; when the dollar weakens, the price of gold in other currencies rises.

- Declining US dollar index (DXY): The DXY is a key indicator to watch. A falling DXY often signals a weakening dollar and potentially rising gold prices.

- Reduced interest rate hikes by the Federal Reserve: The Fed's monetary policy significantly impacts the dollar's value. Reduced or paused interest rate hikes often lead to dollar weakness, benefiting the XAUUSD.

- Geopolitical uncertainty: Global instability can weaken the dollar as investors seek safe havens, indirectly boosting gold's appeal and the XAUUSD price.

- Track DXY and Fed announcements: Monitoring these crucial indicators is vital for anticipating potential XAUUSD price movements.

For example, during periods of heightened geopolitical tensions, such as the Russian invasion of Ukraine, the US dollar weakened, while the demand for gold as a safe-haven asset increased, leading to a rise in the XAUUSD Gold Price. Conversely, periods of US economic strength typically see the dollar strengthen and gold prices decline.

Influence of Inflation and Interest Rates on XAUUSD

Inflation as a Gold Price Driver:

High inflation erodes the purchasing power of fiat currencies, making gold, a tangible asset, a more attractive investment. This increased demand directly impacts the XAUUSD Gold Price.

- CPI and PPI reports: The Consumer Price Index (CPI) and Producer Price Index (PPI) are key inflation indicators. Unexpectedly high inflation numbers can trigger a sharp increase in XAUUSD.

- Inflation expectations: Market sentiment and expectations regarding future inflation play a crucial role in influencing gold price movements. Even the anticipation of rising inflation can boost gold demand.

- Historical data analysis: Reviewing historical data clearly illustrates the strong correlation between periods of high inflation and surges in the gold price.

Interest Rate Hikes and Their Effect:

Rising interest rates generally exert downward pressure on gold prices. This is because higher rates increase the opportunity cost of holding non-yielding assets like gold, making other interest-bearing investments more attractive. Conversely, a pause or slowdown in rate hikes can boost the XAUUSD price.

- Federal Reserve policy decisions: The Fed's actions are crucial in determining interest rate trends and their impact on the XAUUSD.

- Market anticipation of rate hikes: Market expectations about future interest rate changes can influence the XAUUSD price even before the actual policy decisions are made.

- Historical impact analysis: Examining historical data shows the clear relationship between interest rate changes and their impact on the price of gold.

- Future rate expectations: Understanding how the market anticipates future interest rates is key to predicting XAUUSD price movements.

Safe-Haven Demand and its Impact on XAUUSD Gold Price

Geopolitical Instability and Economic Uncertainty:

Gold often acts as a safe-haven asset during times of global uncertainty and economic turmoil. This increased demand drives up the price, positively affecting the XAUUSD.

- International conflicts: Geopolitical events, like wars or significant political instability, often increase gold's appeal as investors seek protection from market volatility.

- Economic downturns/recessions: During economic crises, investors tend to flock to gold, pushing up prices.

- Historical events: Analyzing past events that triggered safe-haven buying clearly demonstrates the relationship between uncertainty and gold price increases.

- Investor sentiment: Investor confidence and fear significantly influence the demand for gold as a safe haven, and consequently the XAUUSD price.

The perception of risk is paramount. When global uncertainty increases, investors shift towards safer assets, including gold, boosting the XAUUSD.

Conclusion:

The XAUUSD Gold Price is significantly affected by the health of the US economy. Weakening economic data typically results in a rise in gold prices. Understanding the inverse relationship between the US dollar and gold, the impact of inflation and interest rates, and gold's role as a safe-haven asset is essential for navigating the XAUUSD market. By closely monitoring key economic indicators and geopolitical events, investors can make more informed decisions about their XAUUSD gold investments. Stay informed about upcoming economic releases and Federal Reserve announcements to better anticipate XAUUSD Gold Price fluctuations and capitalize on opportunities. Actively track the XAUUSD Gold Price and adjust your investment strategy accordingly.

Featured Posts

-

Preocupacion Por Los Prestamos Estudiantiles Que Implica Un Segundo Mandato De Trump

May 17, 2025

Preocupacion Por Los Prestamos Estudiantiles Que Implica Un Segundo Mandato De Trump

May 17, 2025 -

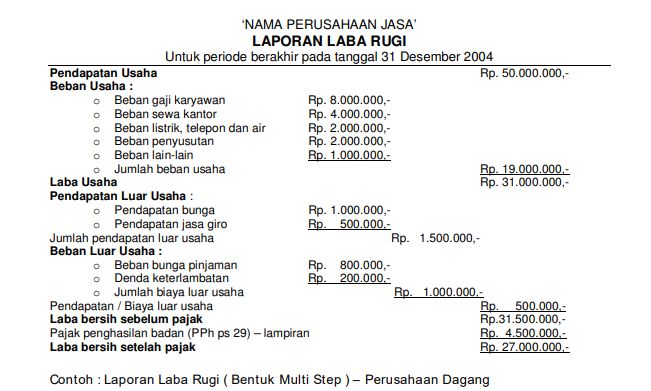

Laporan Keuangan Jenis Pentingnya Dan Implementasi Untuk Bisnis Anda

May 17, 2025

Laporan Keuangan Jenis Pentingnya Dan Implementasi Untuk Bisnis Anda

May 17, 2025 -

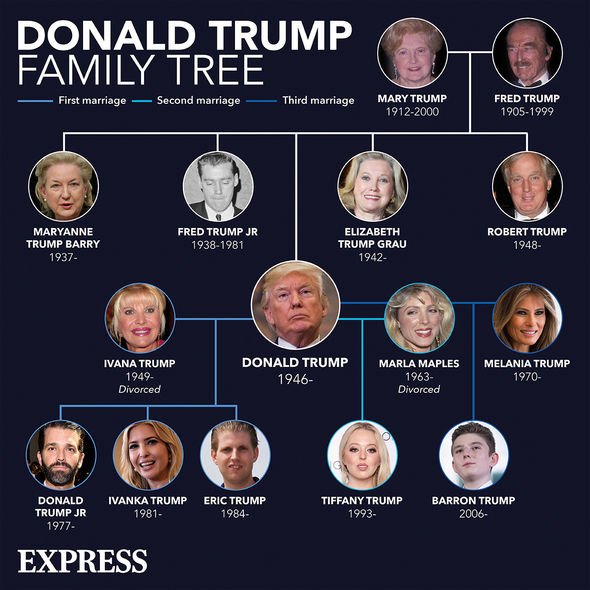

Trump Family Tree Exploring The Extensive Lineage Of The Former Us President

May 17, 2025

Trump Family Tree Exploring The Extensive Lineage Of The Former Us President

May 17, 2025 -

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025

10 Great Tv Shows Cancelled Too Soon A Tragic List

May 17, 2025 -

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025

Wnba Opening Weekend Get Your Angel Reese Jersey Now

May 17, 2025