XRP Price: Recovery Hopes Dashed By Stagnant Derivatives Market

Table of Contents

The Ripple Case and its Impact on XRP Price

The Ripple vs. SEC lawsuit has cast a long shadow over the XRP price, creating significant volatility and uncertainty. While recent court rulings have offered some positive signs for Ripple, the lingering uncertainty continues to impact investor sentiment and market behavior.

Lingering Uncertainty

Despite partial victories for Ripple, the legal battle is far from over. The ongoing uncertainty regarding the final outcome and the ultimate regulatory status of XRP continues to deter large-scale institutional investment. This hesitancy is a major factor preventing a significant price surge.

- Ongoing legal battles create uncertainty for investors. The prolonged legal process makes it difficult for investors to assess the long-term risk and reward associated with XRP.

- Regulatory clarity is crucial for price appreciation. A definitive ruling from the SEC is necessary to unlock institutional investment and attract wider adoption.

- Potential for future SEC actions remains a concern. Even with a favorable outcome in the current case, the possibility of future regulatory challenges remains a significant risk.

Market Sentiment and FUD

Negative news coverage and the spread of Fear, Uncertainty, and Doubt (FUD) surrounding the Ripple case have consistently suppressed XRP's price. While positive news occasionally emerges, it's often overshadowed by lingering concerns. Social media sentiment analysis reveals a mixed bag, with ongoing debate and considerable uncertainty surrounding XRP's future.

- Negative news coverage impacts investor confidence. Negative headlines and speculative articles often lead to sell-offs and price drops.

- Social media sentiment analysis reveals mixed feelings about XRP's future. The online conversation about XRP often reflects the uncertainty surrounding the legal battle.

- FUD often overshadows positive developments. Even positive legal developments are often overshadowed by negative narratives, hindering price appreciation.

Stagnant XRP Derivatives Market – A Key Indicator

A key factor contributing to XRP's subdued price action is the surprisingly stagnant performance of its derivatives market. Low trading volumes and open interest suggest a lack of institutional participation and confidence in future price movements. This stands in stark contrast to more established cryptocurrencies.

Low Trading Volume

The volume of XRP traded in the derivatives market remains considerably lower than that of other major cryptocurrencies. This low trading volume indicates a lack of institutional interest in hedging strategies or speculative trading, hindering substantial price growth.

- Low trading volume indicates limited investor participation. A lack of significant trading activity limits price discovery and momentum.

- Lack of institutional interest hampers price growth. Without significant institutional participation, price movements are less pronounced.

- Reduced hedging opportunities for investors. The limited liquidity in the derivatives market makes it difficult for investors to effectively manage their risk.

Limited Open Interest

Open interest in XRP futures and options contracts is also relatively low. This low open interest reflects a lack of confidence in significant future price movements, either upward or downward. This contrasts sharply with the higher open interest observed in the derivatives markets of more established cryptocurrencies.

- Low open interest suggests a lack of bullish sentiment. A lack of substantial open interest suggests limited belief in future price appreciation.

- Limited opportunities for speculative trading. The limited liquidity in the derivatives market restricts speculative trading opportunities.

- Contrasts sharply with the open interest of other cryptocurrencies. The low open interest underscores XRP's relatively weaker position within the broader cryptocurrency market.

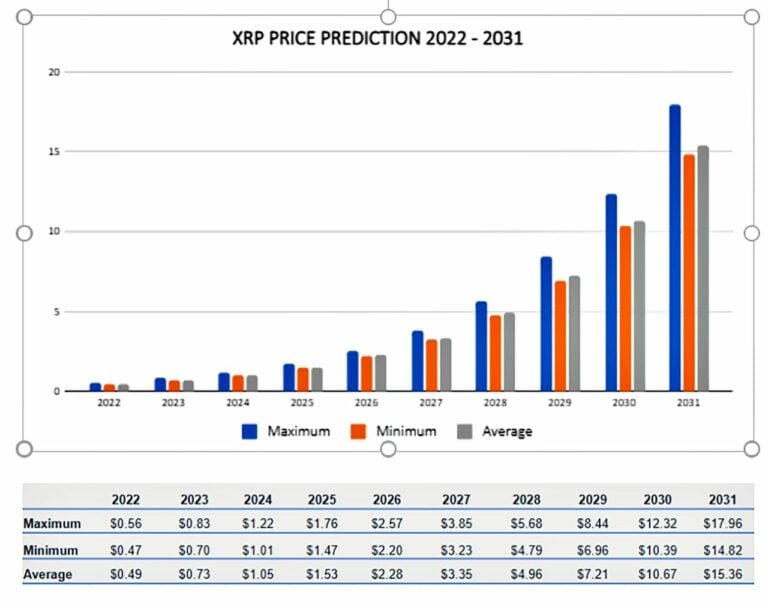

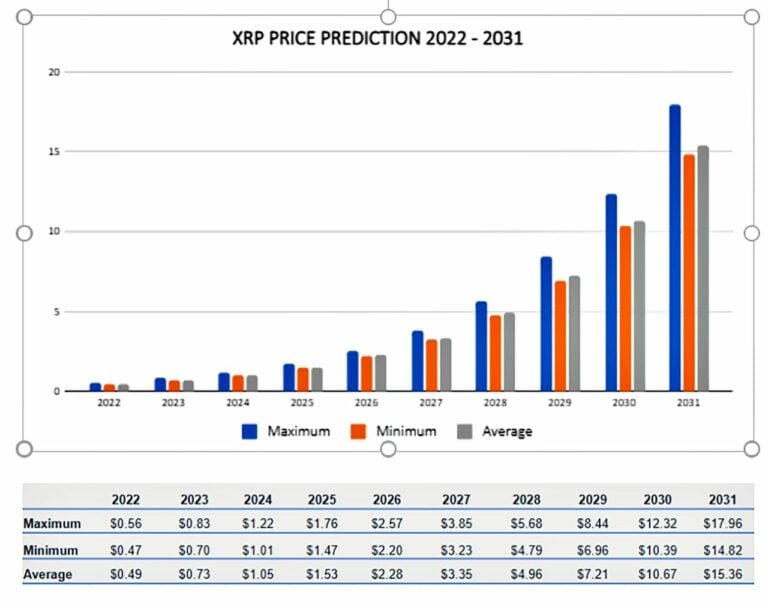

Technical Analysis and Price Predictions

Technical analysis of XRP's price chart reveals a range-bound pattern, suggesting limited upside potential in the near term. Key resistance levels continue to hinder significant price breakthroughs. While some analysts remain optimistic about XRP's long-term prospects, many express caution in their short-term price predictions, citing the stagnant derivatives market as a significant headwind.

Chart Patterns

Technical indicators reveal a lack of strong upward momentum. XRP's price chart shows a tendency to trade within a defined range, with repeated attempts to break through key resistance levels consistently failing.

- Chart patterns show limited upward momentum. Technical indicators suggest a lack of sustained buying pressure.

- Key resistance levels hinder price appreciation. The price repeatedly struggles to break above key resistance points.

- Technical indicators suggest a sideways trend. The overall technical picture points towards a period of consolidation, rather than a clear upward or downward trend.

Analyst Opinions

While some analysts maintain a long-term bullish outlook for XRP, many express caution regarding short-term price predictions. The stagnant derivatives market and lingering regulatory uncertainty are key factors contributing to this cautious sentiment.

- Analyst opinions are mixed, with some expressing caution. The overall outlook is far from uniformly optimistic.

- Long-term prospects remain uncertain. The ultimate success of XRP hinges on several unpredictable factors.

- The derivatives market is a key factor influencing price predictions. The lack of activity in the derivatives market is a significant concern for many analysts.

Conclusion

Despite some positive legal developments in the Ripple case, the XRP price remains subdued due to lingering uncertainty and a surprisingly stagnant derivatives market. Low trading volume and open interest point to a lack of institutional confidence and limited speculative activity. While long-term prospects for XRP remain uncertain, the current situation underscores the importance of regulatory clarity and market sentiment in shaping its future price. To stay informed about the latest developments and potential shifts in the XRP price, continue monitoring news related to the Ripple case and the performance of the XRP derivatives market. Keep a close watch on XRP price updates for a clearer picture of its future trajectory.

Featured Posts

-

Andor Season 2 A Rogue One Star Reveals A Star Wars Rewriting

May 08, 2025

Andor Season 2 A Rogue One Star Reveals A Star Wars Rewriting

May 08, 2025 -

Save With Uber One Now Available In Kenya With Exclusive Benefits

May 08, 2025

Save With Uber One Now Available In Kenya With Exclusive Benefits

May 08, 2025 -

Lotto Results Check The Latest Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025

Lotto Results Check The Latest Lotto Plus 1 And Lotto Plus 2 Numbers

May 08, 2025 -

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Ke Khatme Ka Nwtyfkyshn

May 08, 2025

Wfaqy Hkwmt Ka Lahwr Ky Ahtsab Edaltwn Ke Khatme Ka Nwtyfkyshn

May 08, 2025 -

Saturday Lotto Draw Results April 12 2025

May 08, 2025

Saturday Lotto Draw Results April 12 2025

May 08, 2025