XRP Price Surge: Grayscale ETF Filing Fuels Record High Hopes

Table of Contents

Grayscale's Spot Bitcoin ETF Filing and its Ripple Effect on XRP

Grayscale's filing for a spot Bitcoin ETF is a monumental event in the cryptocurrency industry. Securing approval would represent a significant step towards mainstream adoption of Bitcoin and, potentially, a domino effect across the entire crypto market. This could lead to increased regulatory clarity, a more positive sentiment towards cryptocurrencies, and a surge in institutional investment.

- Increased regulatory clarity anticipated: Approval of a spot Bitcoin ETF could signal a shift in regulatory attitudes towards cryptocurrencies, potentially paving the way for clearer guidelines and less uncertainty.

- Positive sentiment towards the crypto market as a whole: The success of a Bitcoin ETF would likely boost overall market confidence, benefitting other cryptocurrencies like XRP.

- Potential for increased institutional investment in crypto: Institutional investors, often hesitant due to regulatory uncertainty, might flock to the crypto market with a clear regulatory pathway.

- A renewed focus on crypto assets by mainstream investors: A successful ETF launch could attract significant retail investment, further fueling price increases across the board.

The correlation between Bitcoin's price and XRP's price movement is undeniable. Historically, when Bitcoin experiences a significant price increase, XRP often follows suit, though not always proportionally. Analyzing past price data shows a noticeable positive correlation, suggesting that positive Bitcoin news often translates to positive sentiment for XRP as well.

The Ongoing SEC Lawsuit and its Impact on XRP Price Volatility

The ongoing SEC lawsuit against Ripple Labs, alleging that XRP is an unregistered security, casts a long shadow over the XRP price. The outcome of this lawsuit will significantly impact XRP's future. A favorable ruling could lead to a substantial price increase, while an unfavorable one could severely depress the price.

- Potential positive outcome boosting investor confidence: A win for Ripple could unlock significant gains for XRP, as investor confidence would skyrocket.

- Uncertainty surrounding the lawsuit contributing to price fluctuations: The ongoing legal battle creates volatility, leading to significant price swings based on news and developments in the case.

- Legal developments impacting short-term price volatility: Each court filing, hearing, or statement from the SEC or Ripple directly impacts the short-term price action of XRP.

- Importance of staying updated on court proceedings: Investors need to monitor legal developments closely to gauge the impact on XRP's price.

The prevailing sentiment surrounding the case directly affects trading volume and price. Positive news tends to trigger a surge in trading activity and price increases, while negative news results in the opposite.

Increased Institutional Interest and Trading Volume in XRP

While the SEC lawsuit presents uncertainty, the growing interest from institutional investors is a significant positive factor. Larger entities entering the XRP market bring increased liquidity and stability.

- Large-scale investments potentially pushing up the price: Institutional buying power can significantly impact XRP's price, driving it upward as large volumes are purchased.

- Increased liquidity due to institutional participation: Institutional investors bring greater liquidity to the market, reducing volatility and making it easier to buy and sell XRP.

- Greater market stability as a result of institutional involvement: Their presence tends to stabilize the market, reducing the impact of short-term price swings.

- Potential for long-term price growth due to sustained institutional interest: Continued institutional investment could fuel long-term growth and sustained price appreciation.

While specific examples of institutional investment in XRP are often kept confidential, the overall increase in trading volume and market capitalization strongly suggests a growing institutional presence.

XRP Price Prediction and Future Outlook

Predicting the future price of XRP is inherently speculative. However, considering current market conditions and the factors discussed above, several scenarios are possible.

- Speculative price targets considering current trends: Analysts offer various price targets, but these are highly dependent on the outcome of the SEC lawsuit and broader market trends.

- Risks associated with investing in cryptocurrencies: Cryptocurrency investments are highly volatile and carry significant risk. Investors should only invest what they can afford to lose.

- Importance of conducting thorough research before investing: Thorough due diligence is crucial before investing in any cryptocurrency, including XRP.

- The role of market sentiment and news events: News events and overall market sentiment play a huge role in shaping XRP's price.

A balanced perspective is necessary. While the potential for significant gains is present, the uncertainties surrounding the SEC lawsuit and the inherent volatility of the cryptocurrency market must be acknowledged.

Conclusion

The recent XRP price surge is a complex phenomenon, fueled by Grayscale's Bitcoin ETF filing, the ongoing SEC lawsuit against Ripple, and growing institutional interest in XRP. While uncertainty remains, the positive sentiment and potential for increased regulatory clarity contribute to a cautiously optimistic outlook. The outcome of the SEC lawsuit will be a pivotal moment for XRP, potentially catapulting it to new heights or significantly impacting its value.

Call to Action: Stay informed about the latest developments in the XRP market, understand the risks involved, and make informed decisions regarding your cryptocurrency investments. Monitor the XRP price surge and explore the potential of XRP for your portfolio. Learn more about the implications of the Grayscale ETF filing on the future of XRP and make strategic decisions based on your risk tolerance and investment goals.

Featured Posts

-

Analiza E Performances Se Psg Se Fitore Minimaliste Pas Pjeses Se Pare

May 08, 2025

Analiza E Performances Se Psg Se Fitore Minimaliste Pas Pjeses Se Pare

May 08, 2025 -

Debate Ignites Has Saving Private Ryan Lost Its Top Spot As Best War Movie

May 08, 2025

Debate Ignites Has Saving Private Ryan Lost Its Top Spot As Best War Movie

May 08, 2025 -

Revisiting Rare Double Performances In Okc Thunder History

May 08, 2025

Revisiting Rare Double Performances In Okc Thunder History

May 08, 2025 -

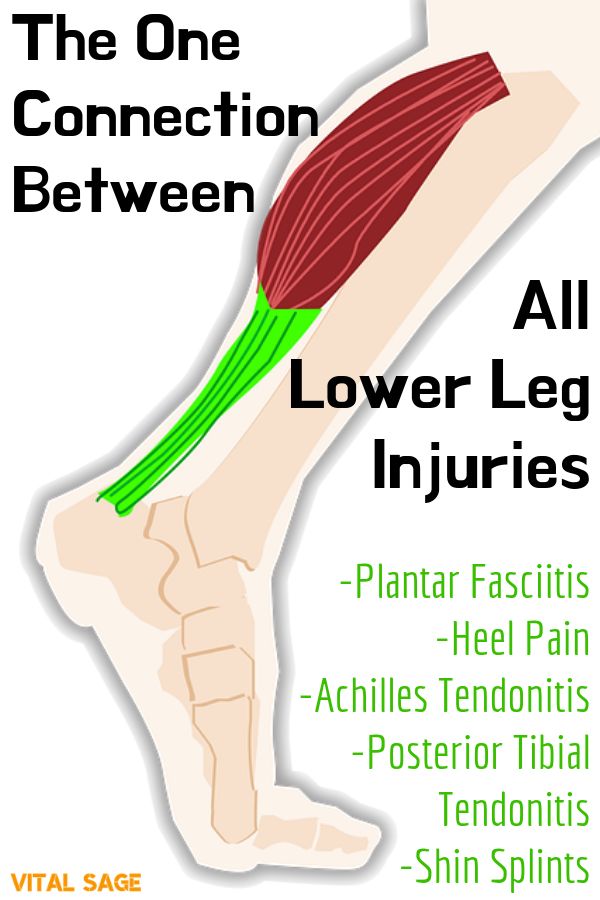

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025

Calf Injury Could Keep Inters Zielinski Out For Several Weeks

May 08, 2025 -

Sommers Thumb Injury Setback For Inter In Serie A And Champions League

May 08, 2025

Sommers Thumb Injury Setback For Inter In Serie A And Champions League

May 08, 2025