XRP (Ripple) Investment Strategy: Building A Secure Financial Future

Table of Contents

Understanding XRP and its Potential

What is XRP?

XRP is a cryptocurrency that acts as a bridge currency on the Ripple network, facilitating fast and low-cost cross-border transactions. Unlike Bitcoin, which relies on a proof-of-work mechanism, XRP uses a unique consensus mechanism, allowing for significantly faster transaction speeds and lower fees. It aims to streamline international payments for banks and financial institutions, offering a more efficient alternative to traditional SWIFT systems.

- Speed: XRP transactions are processed in a matter of seconds, significantly faster than many other cryptocurrencies.

- Low Cost: Transaction fees for XRP are incredibly low, making it a cost-effective solution for large-scale payments.

- Scalability: The Ripple network is designed for high scalability, capable of handling a large volume of transactions simultaneously.

It's crucial to understand the relationship between XRP and Ripple Labs, the company behind the technology. Ongoing legal battles with the Securities and Exchange Commission (SEC) significantly impact XRP's price and overall market sentiment. Staying informed about these legal developments is crucial for any XRP investor.

Market Analysis of XRP

Analyzing XRP's historical price performance reveals periods of significant volatility. However, it has also shown periods of substantial growth driven by factors like increasing adoption by financial institutions and positive regulatory developments (or lack thereof). Future projections vary widely depending on the analyst and their assumptions.

- Influencing Factors: Regulatory clarity, partnerships with financial institutions, broader cryptocurrency market trends, and technological advancements all influence XRP's price. Positive news regarding Ripple's legal battles could act as a major catalyst for growth.

- Potential Catalysts: Widespread adoption by banks and payment processors, successful resolution of the SEC lawsuit, and integration into new DeFi applications could significantly boost XRP's price. (Always consult reputable financial resources for up-to-date market analysis.)

XRP's Role in the Fintech Landscape

Beyond being a cryptocurrency, XRP has the potential to revolutionize the financial technology (Fintech) landscape. Its speed, efficiency, and low cost make it an attractive solution for various applications.

- Disrupting Traditional Banking: XRP can significantly reduce the time and cost associated with international payments, potentially disrupting the dominance of traditional banking systems.

- Improving Cross-Border Payments: Its efficiency makes XRP ideal for facilitating seamless cross-border transactions between businesses and individuals.

- Role in Decentralized Finance (DeFi): XRP is increasingly being integrated into various DeFi protocols, offering new opportunities for investors and users.

Developing a Secure XRP Investment Strategy

Risk Assessment and Mitigation

Investing in XRP, like any cryptocurrency, involves significant risk due to its inherent volatility. Market conditions can change rapidly, leading to substantial price fluctuations.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price, mitigates the risk of investing a lump sum at a market high.

- Diversification: Spreading your investments across different asset classes (cryptocurrencies, stocks, bonds, etc.) reduces overall portfolio risk.

- Stop-Loss Orders: Setting stop-loss orders automatically sells your XRP if the price falls below a predetermined level, limiting potential losses.

Diversification and Portfolio Allocation

Diversification is crucial for managing risk. Allocating a significant portion of your portfolio to a single cryptocurrency like XRP is generally considered risky.

- Balanced Portfolio: A balanced portfolio might include a small percentage of XRP (e.g., 5-10%), alongside other cryptocurrencies, stocks, bonds, and real estate, depending on your risk tolerance and financial goals.

- Risk Tolerance: Your investment strategy should align with your personal risk tolerance. If you're risk-averse, a smaller allocation to XRP is recommended.

Long-Term Investment Planning for XRP

A long-term perspective is crucial for success in the volatile cryptocurrency market. Short-term price fluctuations should not dictate your investment decisions.

- Holding Through Volatility: Holding XRP through market downturns requires patience and a well-defined investment plan.

- Clear Investment Plan: Establishing clear investment goals (e.g., retirement, wealth building) with defined timelines helps maintain a disciplined approach.

Secure Storage and Management of XRP

Choosing the Right Wallet

Securely storing your XRP is paramount. Various wallet types offer different levels of security and convenience.

- Hardware Wallets: Offer the highest level of security by storing your private keys offline. (Ledger and Trezor are popular options.)

- Software Wallets: More convenient but require robust security practices. (Exodus and Atomic Wallet are examples.)

- Exchange Wallets: Convenient for trading but are generally less secure due to the potential for exchange hacks.

Best Practices for Security

Protecting your XRP from theft requires diligence and adherence to best security practices.

- Strong Passwords: Use long, complex, and unique passwords for all your accounts.

- Two-Factor Authentication (2FA): Enable 2FA on all your exchange and wallet accounts to add an extra layer of security.

- Software Updates: Regularly update your wallet software and operating systems to patch security vulnerabilities.

- Phishing Awareness: Be wary of phishing scams and never share your private keys or seed phrases with anyone.

Conclusion

Investing in XRP (Ripple) presents both significant opportunities and considerable risks. By carefully considering the factors discussed above – understanding XRP’s functionality and market trends, developing a secure investment strategy, and employing robust security measures – you can increase your chances of success in building a secure financial future with XRP. Remember to always conduct thorough research, diversify your portfolio, and approach XRP investment with a long-term perspective. Start building your secure financial future with a well-informed XRP investment strategy today!

Featured Posts

-

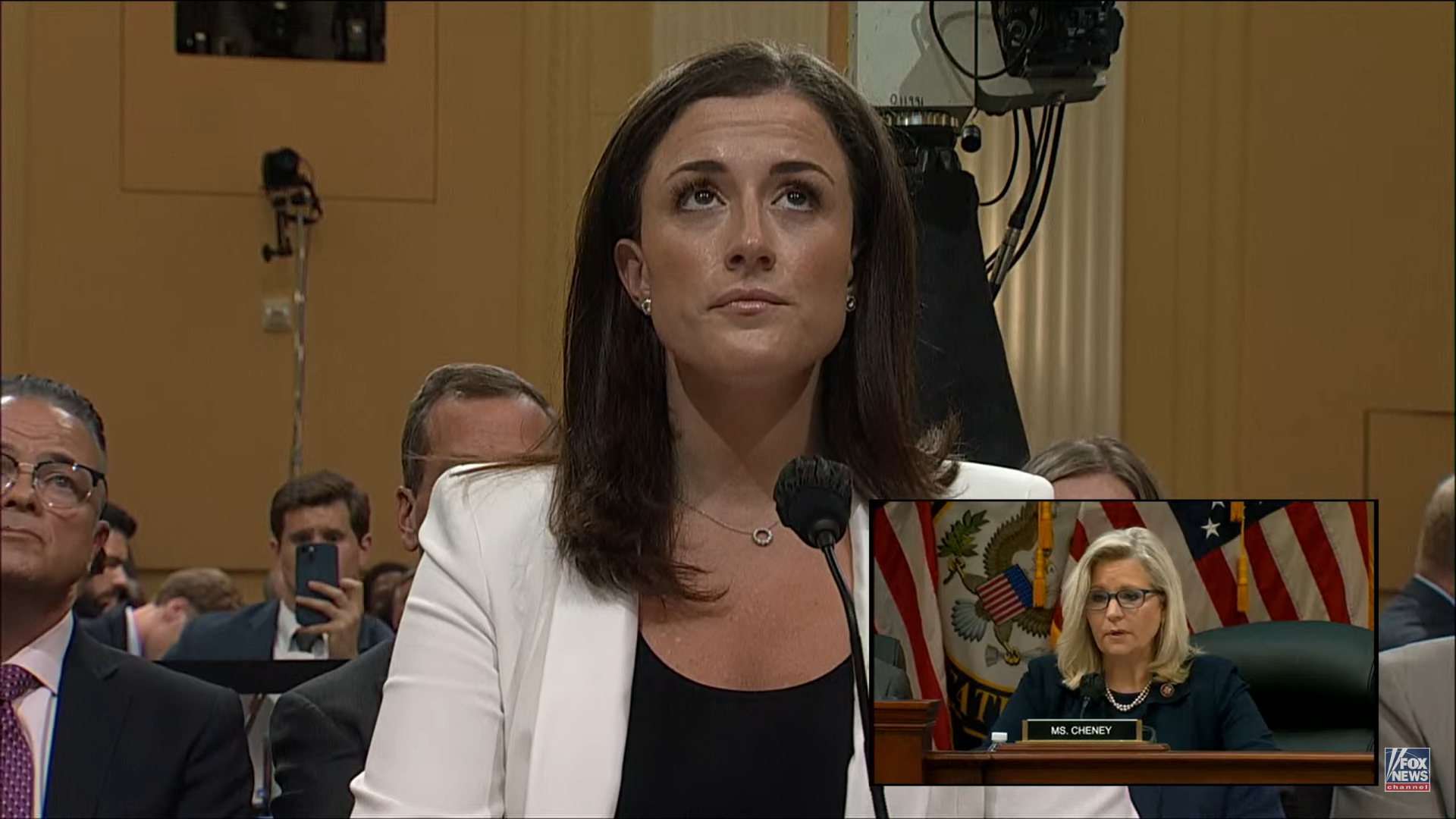

Cassidy Hutchinsons Memoir A Jan 6 Witnesss Account

May 08, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witnesss Account

May 08, 2025 -

Lahwr Myn Py Ays Ayl Trafy Ka Astqbal Shayqyn Ka Jwsh W Jdhbh

May 08, 2025

Lahwr Myn Py Ays Ayl Trafy Ka Astqbal Shayqyn Ka Jwsh W Jdhbh

May 08, 2025 -

The Long Walk First Trailer Reveals Mark Hamill Beyond Luke Skywalker

May 08, 2025

The Long Walk First Trailer Reveals Mark Hamill Beyond Luke Skywalker

May 08, 2025 -

Pro Shares New Xrp Etfs A Deep Dive Into The Non Spot Market

May 08, 2025

Pro Shares New Xrp Etfs A Deep Dive Into The Non Spot Market

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Hub For Innovation

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Hub For Innovation

May 08, 2025