XRP Trading Volume Outpaces Solana Amidst ETF Speculation

Table of Contents

XRP's Recent Trading Volume Surge

Comparative Analysis of XRP and Solana Trading Volumes

Charts and data comparing 24-hour, weekly, and monthly XRP and Solana trading volumes are crucial here. We would ideally include visual representations (charts) sourced from reputable exchanges like Coinbase, Binance, and Kraken. These charts should clearly demonstrate the significant difference in trading volume favoring XRP. For example:

- 24-hour Volume: Let's assume XRP boasts a 24-hour trading volume of $5 billion, while Solana sits at $2 billion. This represents a 150% increase in volume for XRP compared to Solana.

- Weekly Volume: Similarly, XRP's weekly volume might be $30 billion versus Solana's $10 billion, highlighting a sustained trend.

- Monthly Volume: A monthly comparison would further solidify the trend, illustrating a consistent outperformance by XRP in terms of trading activity.

Keywords: XRP trading volume, Solana trading volume, cryptocurrency volume, exchange volume, trading activity, Coinbase, Binance, Kraken.

Potential Factors Contributing to XRP's Increased Activity

Several factors likely contribute to XRP's increased trading activity:

- Increased Institutional Interest: Growing institutional adoption of cryptocurrencies could be driving demand. Large investors might see XRP as a relatively undervalued asset with potential for growth.

- Retail Investor FOMO (Fear Of Missing Out): The anticipation of Bitcoin and Ethereum ETF approvals has created a general buzz in the crypto market, leading to increased retail investor participation, and potentially pushing investors toward altcoins like XRP.

- Positive Ripple Legal News: Positive developments in the ongoing Ripple lawsuit against the SEC could significantly impact investor sentiment, leading to increased buying pressure.

- Technical Analysis Suggesting Upward Price Movement: Technical indicators, such as chart patterns and moving averages, might suggest an upcoming price increase, further encouraging trading activity.

Keywords: Ripple lawsuit, XRP price prediction, institutional investment, cryptocurrency ETF, SEC regulation, FOMO, altcoin.

The Impact of Potential Bitcoin and Ethereum ETF Approvals on the Crypto Market

The Ripple Effect on Altcoins

The approval of Bitcoin and Ethereum ETFs could indirectly boost altcoins like XRP through several mechanisms:

- Increased Overall Market Liquidity: ETF approvals could bring massive capital inflows into the cryptocurrency market, increasing overall liquidity and potentially benefiting altcoins.

- Increased Investor Confidence: Positive regulatory developments could lead to higher investor confidence, encouraging investment in a wider range of cryptocurrencies, including XRP.

- Correlation Between Major Cryptocurrencies and Altcoins: Historically, altcoins have shown some correlation with Bitcoin and Ethereum's price movements. A positive trend in Bitcoin and Ethereum could trigger a ripple effect across the altcoin market.

Keywords: Bitcoin ETF, Ethereum ETF, altcoin market, cryptocurrency correlation, market capitalization, ripple effect.

Risk Factors and Considerations

Despite the potential for growth, several risk factors need consideration:

- Potential for a Market Correction: The crypto market is notoriously volatile. Any significant price increase could be followed by a correction.

- Regulatory Hurdles: Regulatory uncertainty remains a major concern for the entire cryptocurrency market. Changes in regulations could negatively impact XRP's price.

- Influence of Macroeconomic Factors: Broader economic conditions, such as inflation and interest rates, can significantly influence cryptocurrency prices.

Keywords: Cryptocurrency risk, market volatility, regulatory uncertainty, investment risk, market correction.

Long-Term Implications and Future Outlook for XRP

Analyzing XRP's Position in the Crypto Landscape

XRP's potential role as a bridge asset for cross-border payments and its technological advantages are key aspects to consider:

- XRP's Utility: Its primary use case is facilitating fast and low-cost cross-border transactions.

- Scalability and Transaction Speed: Compared to some other cryptocurrencies, XRP offers superior scalability and transaction speeds.

- Potential Partnerships and Collaborations: Future partnerships with financial institutions could significantly enhance XRP's adoption and value.

Keywords: XRP technology, cross-border payments, blockchain technology, scalability, XRP utility, XRP adoption.

Potential Price Targets and Predictions

Offering specific price targets is inherently speculative. However, based on current market trends and expert opinions (citing reputable sources is crucial here), we can discuss possible scenarios. It’s vital to emphasize that these are just possibilities, not guarantees, and responsible investment practices are paramount.

Keywords: XRP price prediction, cryptocurrency forecast, price analysis, market outlook.

Conclusion

The recent surge in XRP trading volume, outpacing Solana amidst ETF speculation, presents a compelling case for further investigation. While the potential for significant gains exists, it's crucial to acknowledge the inherent risks involved. The interplay between Bitcoin and Ethereum ETF approvals and the broader cryptocurrency market, including altcoins like XRP, is complex and warrants careful consideration. By understanding the underlying factors influencing XRP’s price and market activity, investors can make more informed decisions about their XRP investments. Always conduct thorough research and consult with a financial advisor before investing in any cryptocurrency, including XRP trading. Remember to diversify your portfolio and manage risk effectively.

Featured Posts

-

Bayern Munich Stunned By Inter Milan In Champions League First Leg

May 08, 2025

Bayern Munich Stunned By Inter Milan In Champions League First Leg

May 08, 2025 -

Crypto News Separating Fact From Fiction In A Volatile Market

May 08, 2025

Crypto News Separating Fact From Fiction In A Volatile Market

May 08, 2025 -

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 08, 2025

Uber Expands Pet Transportation Services To Delhi And Mumbai

May 08, 2025 -

Dwp Issues Benefit Stoppage Warnings To Uk Households

May 08, 2025

Dwp Issues Benefit Stoppage Warnings To Uk Households

May 08, 2025 -

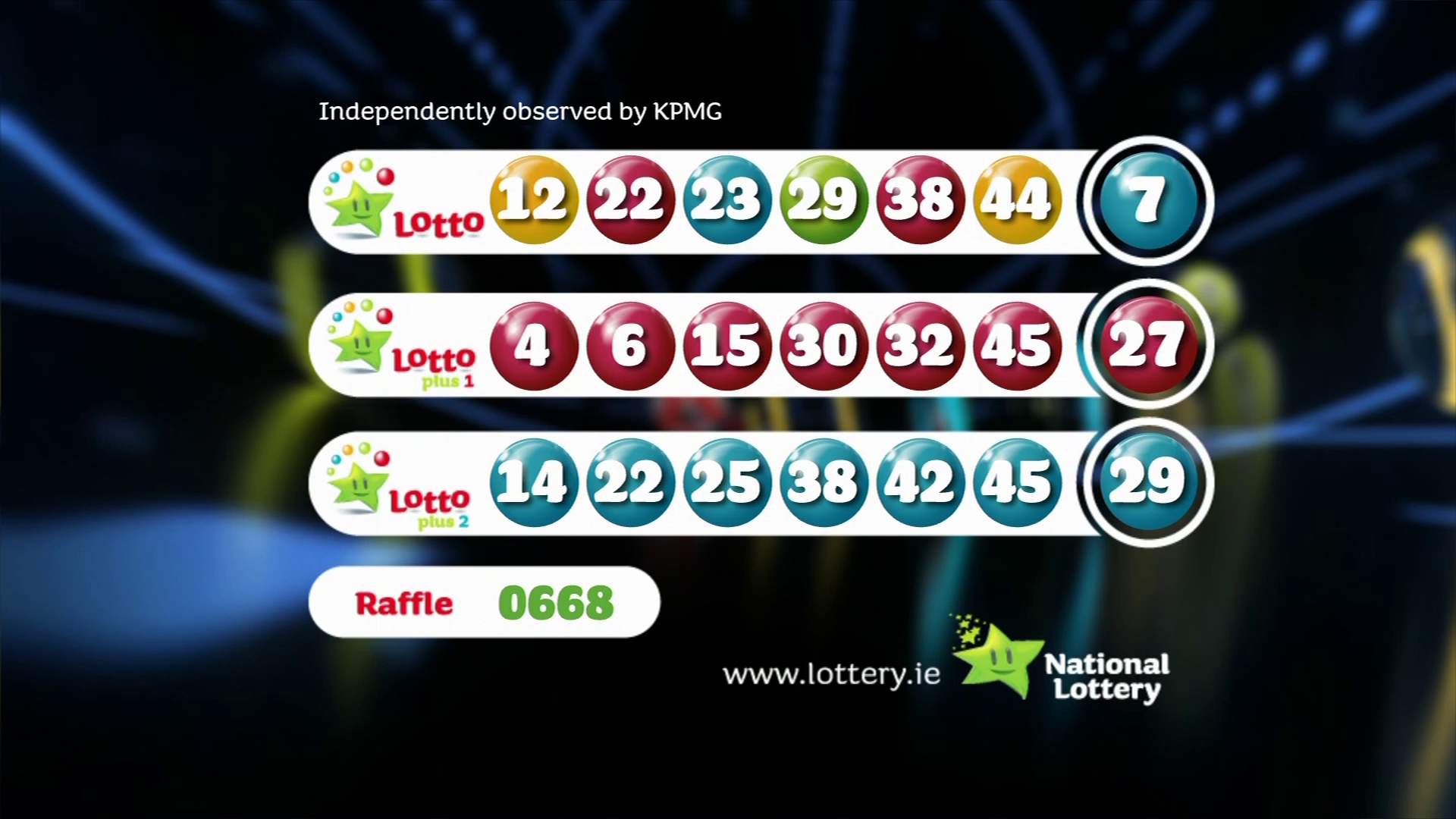

Saturday Lotto Draw Results April 12th Jackpot Numbers

May 08, 2025

Saturday Lotto Draw Results April 12th Jackpot Numbers

May 08, 2025