XRP's Potential Record High: Analyzing The Grayscale ETF's Influence

Table of Contents

Grayscale's Bitcoin ETF Approval and Market Sentiment

The approval of a Grayscale Bitcoin ETF would undoubtedly be a watershed moment for the entire cryptocurrency market. This landmark event holds immense implications for the future of digital assets and could trigger a ripple effect across various cryptocurrencies, including XRP.

Positive Market Sentiment: A successful Grayscale Bitcoin ETF launch would likely ignite a wave of positive market sentiment. This translates to:

- Increased Institutional Investment: The ETF would open the doors for institutional investors – hedge funds, pension funds, and others – to easily and legally invest in Bitcoin, significantly increasing capital inflow into the cryptocurrency market.

- Positive Media Coverage: Increased institutional participation invariably translates to broader media attention, generating positive narratives and attracting retail investors.

- Increased Trading Volume Across the Crypto Market: The influx of new capital and enhanced investor confidence would boost trading volumes across the entire crypto market, driving up prices for both Bitcoin and other cryptocurrencies, including XRP.

This positive sentiment is crucial for XRP. Historically, XRP's price has correlated with the overall market sentiment. A bull market generally benefits altcoins like XRP.

Ripple Effect on Altcoins: The positive sentiment stemming from the Bitcoin ETF approval is unlikely to be confined to Bitcoin alone. A significant portion of institutional investors often diversify their portfolios across different cryptocurrencies. This could lead to:

- Increased Demand for Altcoins: Investors seeking diversification beyond Bitcoin might turn to altcoins like XRP, increasing demand and driving its price upward.

- Diversification Strategies: Institutional investors often employ diversification strategies, allocating a portion of their funds to altcoins with promising fundamentals and potential for growth, like XRP.

- Potential for Increased Partnerships and Collaborations for XRP: A bullish market often encourages collaborations and partnerships, potentially benefiting XRP's development and adoption.

Bitcoin's price performance has frequently influenced XRP's historical performance, suggesting a strong correlation between the two.

XRP's Fundamental Strength and Recent Developments

While external factors like the Grayscale ETF play a significant role, XRP's inherent strengths and recent developments are also vital to consider when assessing its potential for a record high.

Ongoing Legal Battle with the SEC: The ongoing legal battle between Ripple and the SEC remains a key factor influencing XRP's price. However, recent developments suggest a possible positive outcome:

- Positive Legal Developments: Favorable court rulings or settlements could significantly boost investor confidence and lead to a surge in XRP's price.

- Potential Positive Outcome Scenarios: Various scenarios for a positive resolution of the case could positively impact XRP's future.

- Market Reaction to Court Decisions: The market's reaction to any significant legal development will be swift and pronounced, potentially causing significant price fluctuations.

A positive resolution could remove a significant hurdle, paving the way for increased adoption and potentially pushing XRP towards a record high.

Technological Advancements and Adoption: XRP continues to advance technologically and find increased adoption in various sectors:

- New Partnerships: New partnerships and collaborations broaden XRP's reach and utility, further solidifying its position in the market.

- Increased Usage in Payment Systems: Increased usage in cross-border payments and other financial applications demonstrates XRP's practical applications and value proposition.

- Improvements in Transaction Speed and Efficiency: Continuous improvements in transaction speed and efficiency enhance XRP's appeal to businesses and users.

These advancements contribute significantly to XRP's long-term potential for growth.

Technical Analysis and Price Prediction

While fundamental analysis is crucial, technical analysis provides further insights into XRP's potential price movements.

Chart patterns and indicators: Technical indicators, such as:

- Support and resistance levels: Identifying key support and resistance levels can offer insights into potential price reversals or breakouts.

- Moving averages: Analyzing moving averages can help predict short-term and long-term price trends.

- RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence): These indicators can provide insights into overbought or oversold conditions and potential momentum shifts.

can suggest potential price targets. However, it's crucial to remember that technical analysis is not foolproof.

Risk Factors: It's important to acknowledge potential downsides:

- Regulatory Uncertainty: Regulatory uncertainty remains a significant risk factor for the entire cryptocurrency market, including XRP.

- Market Volatility: The cryptocurrency market is inherently volatile, and XRP's price can experience significant fluctuations.

- Competition from other cryptocurrencies: Competition from other cryptocurrencies with similar functionalities presents a challenge to XRP's growth.

Responsible investment and thorough risk management are crucial before investing in any cryptocurrency.

Conclusion

In summary, the approval of a Grayscale Bitcoin ETF could act as a significant catalyst for XRP, potentially boosting market sentiment, increasing institutional investment, and driving up demand. Coupled with XRP's inherent strengths, technological advancements, and potential positive resolution in the SEC lawsuit, the conditions for a new record high seem promising. However, it is vital to acknowledge inherent market risks and uncertainties. We reiterate our central argument: a positive outcome regarding the Grayscale ETF could contribute significantly to XRP reaching a new record high.

Learn more about XRP's potential record high and its relationship with the Grayscale ETF. Consider adding XRP to your diversified portfolio, but always conduct thorough research before investing. Remember, responsible investment is paramount.

Featured Posts

-

Microsoft Surface Pro 12 A Detailed Look At The Smaller Model

May 08, 2025

Microsoft Surface Pro 12 A Detailed Look At The Smaller Model

May 08, 2025 -

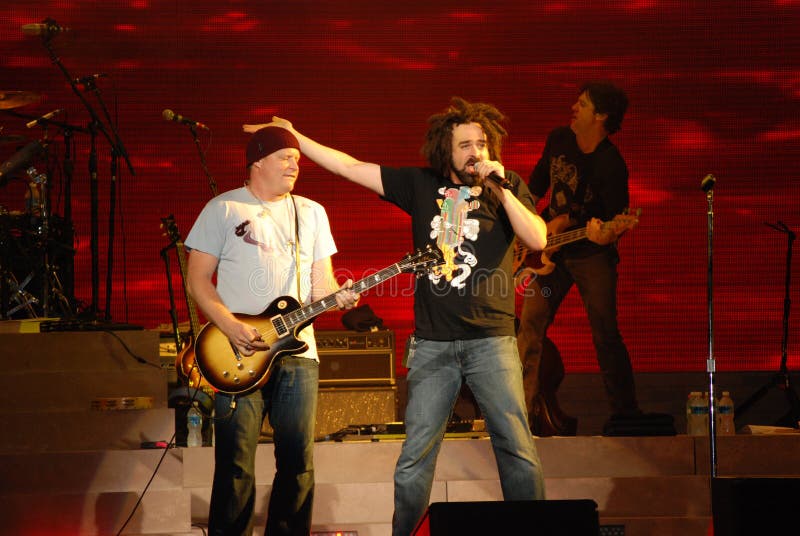

Counting Crows Snl Performance A Turning Point

May 08, 2025

Counting Crows Snl Performance A Turning Point

May 08, 2025 -

Investing In 2025 Micro Strategy Stock Vs Bitcoin

May 08, 2025

Investing In 2025 Micro Strategy Stock Vs Bitcoin

May 08, 2025 -

Andor Season 1 Where To Stream Episodes Before Season 2 Premieres

May 08, 2025

Andor Season 1 Where To Stream Episodes Before Season 2 Premieres

May 08, 2025 -

Nantes Psg Yi Evinde Puanlamayi Basardi Mac Raporu

May 08, 2025

Nantes Psg Yi Evinde Puanlamayi Basardi Mac Raporu

May 08, 2025