XRP's Rise: Outpacing Bitcoin And Other Cryptocurrencies After Grayscale ETF News

Table of Contents

The Grayscale Effect: Ripple's Indirect Benefit

The Grayscale Bitcoin ETF approval has had a ripple effect across the cryptocurrency landscape, indirectly benefiting XRP. This positive impact stems from two key factors: reduced regulatory uncertainty and increased institutional interest in altcoins.

Reduced Regulatory Uncertainty

The Grayscale ETF approval signals a potential shift towards greater regulatory clarity in the US crypto market. This positive sentiment benefits not only Bitcoin but also other cryptocurrencies, including XRP, reducing investor hesitation.

- Decreased regulatory uncertainty attracts institutional investment. Large financial institutions, previously hesitant due to regulatory ambiguity, are now more likely to allocate funds to the crypto market.

- Positive media coverage amplifies the overall market sentiment. Favorable news surrounding ETF approvals creates a positive narrative, further boosting investor confidence.

- Increased confidence boosts trading volume and price appreciation for XRP. Higher trading volumes often lead to increased price volatility, but in a positive market sentiment, this can result in significant price gains.

Increased Institutional Interest in Altcoins

The success of the Bitcoin ETF could pave the way for future ETF approvals for other cryptocurrencies, sparking renewed interest in altcoins like XRP.

- Investors are looking for diversification beyond Bitcoin. While Bitcoin remains the dominant cryptocurrency, investors are increasingly seeking diversification across different crypto assets.

- XRP's utility in cross-border payments is becoming increasingly attractive to institutional players. XRP's speed and low transaction costs make it a compelling option for large-scale international transactions.

- Potential future XRP ETFs could significantly increase demand. The possibility of future XRP ETF approvals could trigger a substantial influx of institutional investment, driving up prices.

XRP's Intrinsic Value Proposition: More Than Just a "Bitcoin Killer"

XRP's recent performance isn't solely due to market sentiment; its inherent technological advantages and real-world applications play a crucial role.

Technological Advantages

XRP boasts several technological advantages over Bitcoin and other cryptocurrencies.

- Faster transaction speeds compared to Bitcoin. XRP transactions are significantly faster, offering near real-time settlement.

- Lower transaction fees make XRP more cost-effective for large-scale transactions. This is a critical advantage for institutional investors processing high-volume payments.

- Scalability solutions enable XRP to handle a higher volume of transactions. XRP's underlying technology is designed to handle a large number of transactions concurrently, unlike Bitcoin which faces scalability challenges.

Real-World Applications and Partnerships

XRP's adoption in real-world applications, particularly cross-border payments, is a key driver of its value.

- Successful implementation of XRP in cross-border payment systems. Several financial institutions are already utilizing XRP for faster and cheaper international transfers.

- Strategic partnerships with banks and financial institutions bolster credibility. These partnerships demonstrate the growing acceptance of XRP within the traditional financial sector.

- Expanding use cases beyond payments demonstrate versatility. XRP's potential extends beyond payments, with applications in other areas like supply chain management and asset tokenization.

Market Sentiment and Technical Analysis of XRP's Performance

Analyzing XRP's recent performance requires considering both market sentiment and technical indicators.

Price Chart Analysis

(Insert a relevant chart here showing XRP's price movement post-Grayscale ETF approval. Clearly mark key support and resistance levels.)

- Chart patterns indicating upward momentum. Identify and describe any bullish chart patterns, such as rising wedges or breakouts, supporting the upward price trend.

- Volume analysis confirming price increases. High trading volume during price increases confirms the strength of the upward trend.

- Comparison to Bitcoin and other altcoins' price performance. Highlight XRP's outperformance compared to Bitcoin and other leading altcoins.

Social Media Sentiment

Social media sentiment plays a significant role in shaping market perception.

- Positive social media trends driving investor interest. Increased positive mentions and discussions on platforms like Twitter and Reddit can significantly influence price.

- Increased mentions and discussions on relevant crypto forums and communities. Analyze the overall sentiment expressed on specialized crypto forums and communities.

- Influencer opinions and their effect on the XRP price. The opinions of prominent crypto influencers can have a noticeable impact on investor sentiment and XRP's price.

Conclusion

XRP's recent surge, fueled by the positive implications of the Grayscale Bitcoin ETF approval and its inherent strengths as a cryptocurrency, highlights its potential as a significant player in the evolving crypto market. Its technological advantages, coupled with its growing real-world applications and positive market sentiment, make it a compelling asset to watch. While the future remains uncertain, the current trajectory indicates a promising outlook for XRP. Continue to follow the latest news and developments surrounding XRP and consider its potential inclusion in your diversified crypto portfolio. Understand the risks associated with investing in cryptocurrencies like XRP before making any investment decisions. Learn more about XRP's potential and stay informed on future developments. Remember to always conduct thorough research before investing in any cryptocurrency.

Featured Posts

-

Dodgers Star Mookie Betts Sidelined By Illness

May 08, 2025

Dodgers Star Mookie Betts Sidelined By Illness

May 08, 2025 -

12 Inch Surface Pro Everything You Need To Know

May 08, 2025

12 Inch Surface Pro Everything You Need To Know

May 08, 2025 -

Psl 10 Ticket Sales Commence Today

May 08, 2025

Psl 10 Ticket Sales Commence Today

May 08, 2025 -

Mookie Betts Illness Keeps Him Out Of Freeway Series Game

May 08, 2025

Mookie Betts Illness Keeps Him Out Of Freeway Series Game

May 08, 2025 -

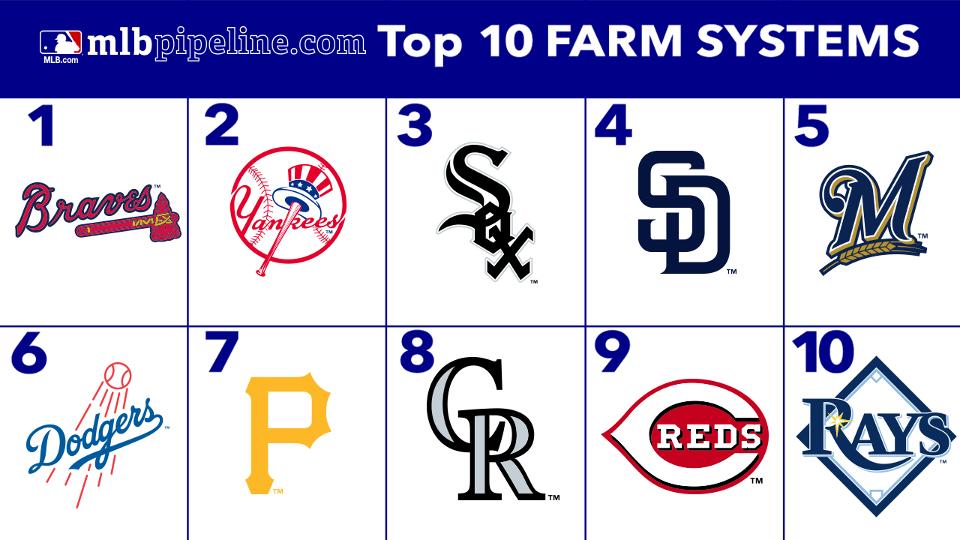

Mlb Experts Rank Angels Farm System Among The Worst

May 08, 2025

Mlb Experts Rank Angels Farm System Among The Worst

May 08, 2025