XRP's Stalled Recovery: Derivatives Market Weighs Down Price

Table of Contents

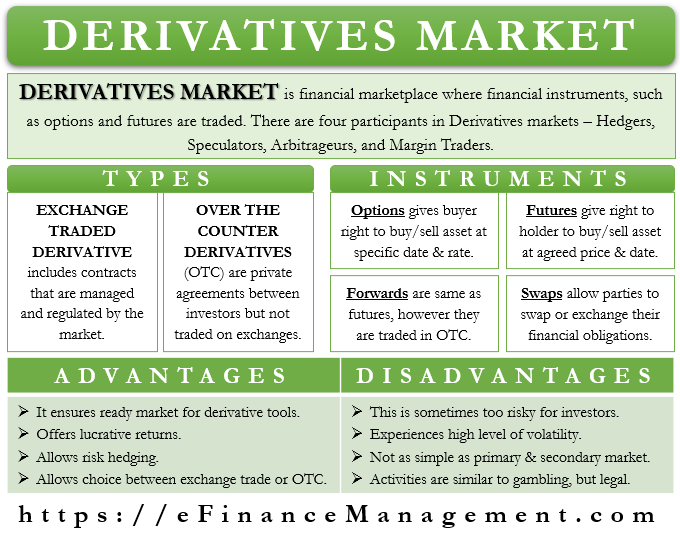

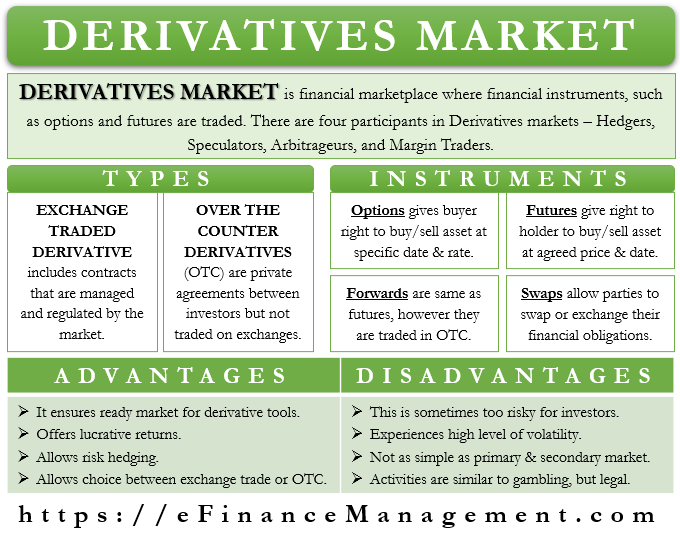

The Impact of XRP Derivatives on Price Discovery

The XRP derivatives market, encompassing futures and options contracts, plays a crucial role in price discovery and volatility. Understanding its mechanics is critical to comprehending XRP's current predicament.

Understanding XRP Futures and Options

- Futures contracts are agreements to buy or sell XRP at a predetermined price on a future date. They allow traders to speculate on future price movements without owning the underlying asset.

- Options contracts grant the buyer the right, but not the obligation, to buy or sell XRP at a specific price (the strike price) on or before a certain date. They offer flexibility for hedging or speculation.

- Leverage in derivatives trading amplifies both profits and losses. High leverage allows traders to control larger positions with smaller capital investments, significantly increasing risk.

- Long positions (buying futures or calls) bet on price increases, while short positions (selling futures or puts) bet on price decreases. The interplay of long and short positions heavily influences price action.

The high leverage available in XRP derivatives trading magnifies price swings. While this can lead to rapid gains, it also exacerbates downward pressure during periods of negative sentiment. Data suggests that XRP derivatives trading volume is substantial, indicating significant market influence.

The Role of Short Selling in Suppressing XRP Price

Short selling in the derivatives market contributes to downward price pressure on XRP.

- Short selling involves borrowing XRP, selling it at the current market price, and hoping to buy it back later at a lower price to return it, profiting from the price difference.

- A cascading effect can occur where a significant drop in price triggers further short selling, accelerating the decline (a short squeeze, in reverse).

- Large institutional investors can significantly impact the market through coordinated short selling strategies.

Reports indicate considerable short interest in XRP derivatives, suggesting that a substantial portion of the market is betting against its price appreciation.

Regulatory Uncertainty and its Effect on the Derivatives Market

The regulatory environment surrounding XRP and its derivatives significantly impacts market behavior.

The SEC Lawsuit and its Ripple Effect

The ongoing SEC lawsuit against Ripple Labs casts a long shadow over the XRP market.

- Regulatory uncertainty discourages investment and reduces liquidity in XRP derivatives.

- The outcome of the lawsuit will drastically affect XRP's price and the overall derivatives market. A positive ruling could trigger a significant price surge, while a negative one could further depress the price.

This uncertainty makes it challenging for market participants to gauge risk and potentially limits participation in the derivatives market.

Global Regulatory Scrutiny of Crypto Derivatives

Global regulatory landscapes for cryptocurrency derivatives vary considerably.

- Different jurisdictions have different approaches to regulating crypto derivatives, creating inconsistencies and potentially affecting liquidity and trading volume.

- The lack of harmonized global regulatory frameworks adds to the uncertainty surrounding XRP and its derivatives.

This fragmented regulatory environment contributes to the overall market uncertainty and hinders XRP's price recovery.

Market Sentiment and Speculative Trading in XRP Derivatives

Market sentiment and speculative trading within the XRP derivatives market significantly influence price movements.

Fear, Uncertainty, and Doubt (FUD) and its Influence

Negative news and speculation can trigger a sell-off and fuel short selling.

- Reports of regulatory crackdowns, negative market analyses, or social media-driven FUD contribute to downward price pressure.

- News outlets and social media platforms significantly shape market sentiment, leading to amplified volatility.

Examples include the initial SEC lawsuit announcement and subsequent media coverage which created significant downward pressure on XRP price.

The Impact of Whale Activity

Large traders ("whales") can heavily influence XRP's price, especially within the derivatives market.

- Large trades can artificially manipulate prices, leading to short-term volatility.

- The potential for wash trading or other manipulative practices exists, further impacting price discovery.

The actions of these whales can exacerbate the instability and uncertainty in the XRP derivatives market.

Conclusion

XRP's stalled recovery is significantly impacted by the complexities of its derivatives market. Regulatory uncertainty stemming from the SEC lawsuit, coupled with negative market sentiment and the influence of large traders, contribute to downward price pressure and volatility. Understanding the dynamics of short selling, leverage, and the impact of whale activity within the XRP derivatives market is crucial for navigating its volatility. Staying informed about developments in the XRP legal case and the broader regulatory landscape for crypto derivatives is essential. Further research into the intricacies of XRP derivatives trading is recommended before making any investment decisions. Understanding the dynamics of the XRP derivatives market is crucial for navigating the volatility and making informed decisions about XRP investments.

Featured Posts

-

Taiwan Dollars Surge Pressure Mounts For Economic Reform

May 08, 2025

Taiwan Dollars Surge Pressure Mounts For Economic Reform

May 08, 2025 -

Preparing For Partly Cloudy Weather Tips And Advice

May 08, 2025

Preparing For Partly Cloudy Weather Tips And Advice

May 08, 2025 -

Smokey Robinson Accused Of Sexual Assault Four Women Come Forward

May 08, 2025

Smokey Robinson Accused Of Sexual Assault Four Women Come Forward

May 08, 2025 -

Nairobi And Beyond Uber One Offers Discounts And Free Deliveries In Kenya

May 08, 2025

Nairobi And Beyond Uber One Offers Discounts And Free Deliveries In Kenya

May 08, 2025 -

Dwp Communication Important Update On 12 Benefits And Bank Accounts

May 08, 2025

Dwp Communication Important Update On 12 Benefits And Bank Accounts

May 08, 2025