X's Financial Transformation: Insights From Musk's Recent Debt Sale

Table of Contents

The Details of X's Debt Sale

The specifics of X's debt sale are complex but crucial to understanding its financial transformation. The exact figures haven't been publicly disclosed in their entirety, maintaining a degree of secrecy common in large-scale debt restructurings. However, reports indicate a significant amount of debt financing was secured through a combination of bond issuance and credit facilities. This debt refinancing strategy was likely influenced by prevailing market conditions, including interest rates and investor appetite for risk. The involvement of major investment banks was instrumental in facilitating this complex transaction.

- Amount of debt raised: While the precise amount remains undisclosed, reports suggest billions of dollars were secured.

- Type of debt instruments used: A mix of high-yield bonds and potentially bank loans, reflecting the perceived risk associated with X Corp.

- Interest rates and associated costs: Given the current economic climate and X's credit rating, it's likely the interest rates are relatively high, significantly impacting debt service payments.

- Maturity dates of the debt obligations: The maturity dates are likely staggered to manage repayment over several years, minimizing short-term financial pressure.

- Key players involved in the debt sale: Leading investment banks played key roles in structuring and placing the debt, managing the risk and attracting investors.

- Impact of prevailing market interest rates on the deal: The prevailing high interest rate environment likely influenced the terms and cost of the debt, increasing the overall financial burden on X.

Motivations Behind X's Debt Restructuring

Musk's decision to undertake this significant debt restructuring was driven by several factors. The leveraged buyout of Twitter, now X, was already highly indebted, necessitating a refinancing strategy. The motivations likely included:

- Reduction of existing high-interest debt: Refinancing existing high-interest debt with potentially lower rates, though this aspect remains unclear without full transparency.

- Funding of ongoing operational expenses: Securing funds to cover ongoing operational costs, especially crucial given X's substantial employee base and infrastructure requirements.

- Financing of future acquisitions or investments: The debt sale might provide capital for future acquisitions, aligning with Musk's ambitious expansion plans for X.

- Improving X's credit rating and access to capital: While initially risky, successful debt servicing could improve X's creditworthiness and future access to capital markets.

- Addressing potential liquidity concerns: The restructuring aimed to alleviate any short-term liquidity issues, ensuring X can meet its financial obligations.

Implications and Potential Risks of X's New Financial Structure

The increased debt burden carries significant implications and potential risks for X. The success of this financial strategy hinges on X's ability to manage its debt obligations effectively. Key risks include:

- Increased debt service payments: Higher interest payments will strain X's cash flow, potentially impacting investments in growth and innovation.

- Potential impact on X's credit rating: A credit rating downgrade could further increase borrowing costs and limit access to capital.

- Vulnerability to changes in interest rates: Fluctuations in interest rates could significantly impact debt service payments, making financial planning more challenging.

- Increased financial risk and potential for default: Failure to meet debt obligations could lead to financial distress and even bankruptcy.

- Impact on X’s ability to pursue future acquisitions or investments: The increased debt burden may restrict X's ability to pursue future acquisitions or significant investments.

Long-Term Outlook for X's Financial Health

The long-term financial health of X following this debt restructuring is uncertain and hinges on several crucial factors. X needs to demonstrate sustainable revenue growth and cost-efficient operations. Key aspects include:

- Projected revenue growth and profitability: X needs significant revenue growth, potentially through increased advertising revenue, premium subscriptions, and successful diversification.

- Effectiveness of cost-cutting strategies: Implementing cost-cutting measures without compromising product quality or user experience is crucial for improving profitability.

- Dependence on advertising revenue and subscription models: Diversifying revenue streams beyond advertising will be vital for long-term financial sustainability.

- Long-term debt repayment plan: A clear and achievable debt repayment plan is essential for reducing financial risk and building investor confidence.

- Potential for future rounds of financing: Depending on X's performance, further rounds of financing might be necessary, presenting additional challenges.

Conclusion

X's financial transformation, marked by Musk's recent debt sale, represents a high-stakes gamble. While the debt restructuring offers short-term relief and potential funding for future ventures, it also increases financial risk significantly. The success of this strategy hinges on X's ability to generate substantial revenue growth, implement efficient cost-cutting measures, and effectively manage its increased debt burden. The long-term outlook remains uncertain, but the company's financial health will be closely scrutinized in the coming years. Stay informed about the future of X's financial transformation by following the latest news and analyses on this complex financial restructuring. Understanding these developments is crucial for comprehending the future trajectory of this influential social media platform.

Featured Posts

-

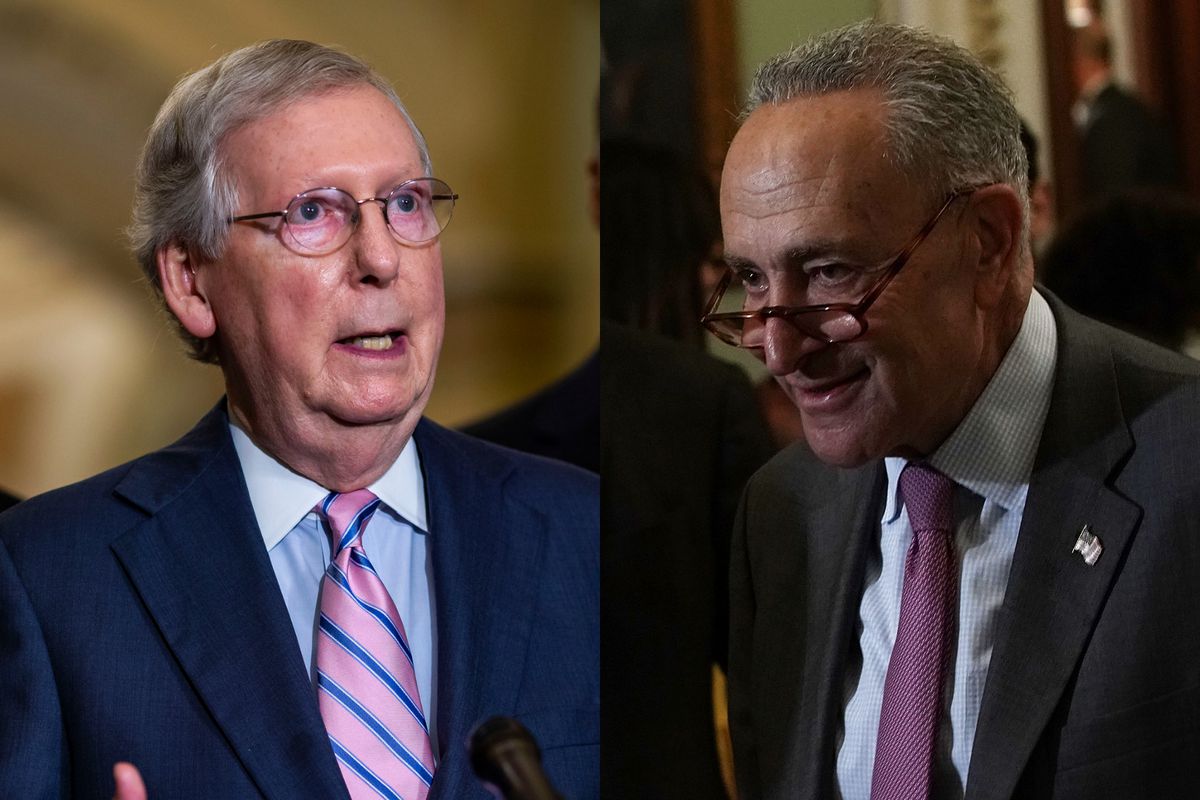

I M Staying Put Schumer Affirms Continued Senate Leadership

Apr 29, 2025

I M Staying Put Schumer Affirms Continued Senate Leadership

Apr 29, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods And The Case Details

Apr 29, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods And The Case Details

Apr 29, 2025 -

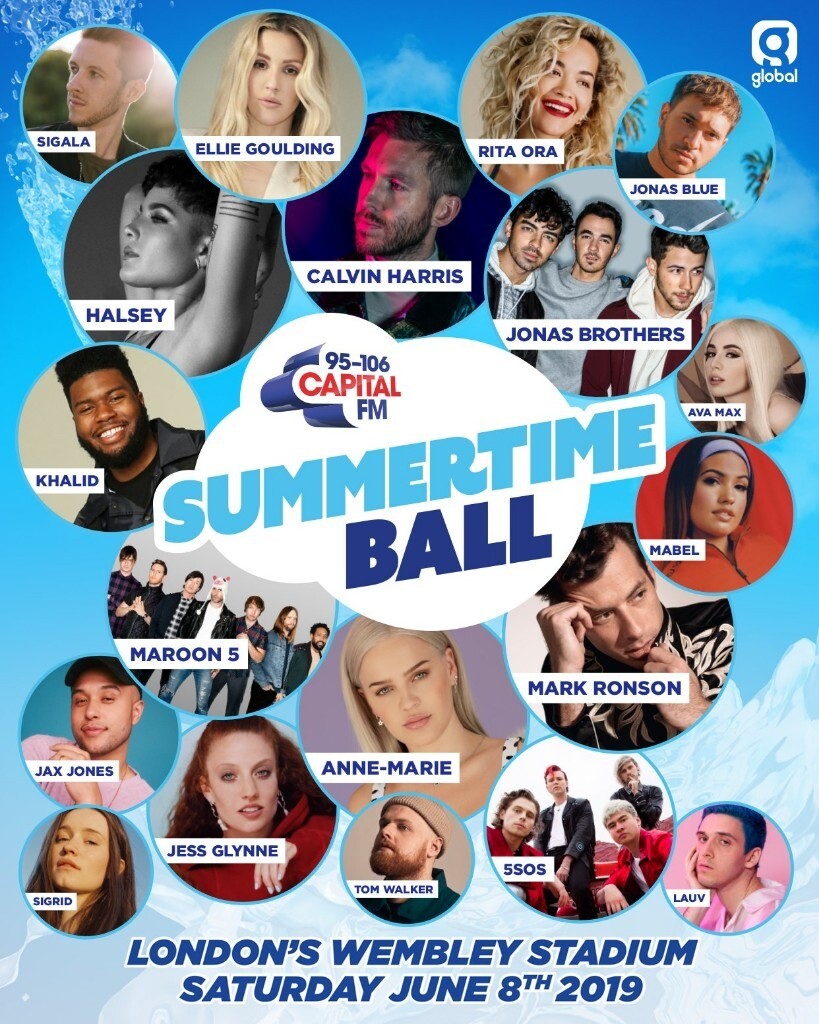

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025 -

Snow Fox Closures And Delays Tuesday February 11

Apr 29, 2025

Snow Fox Closures And Delays Tuesday February 11

Apr 29, 2025 -

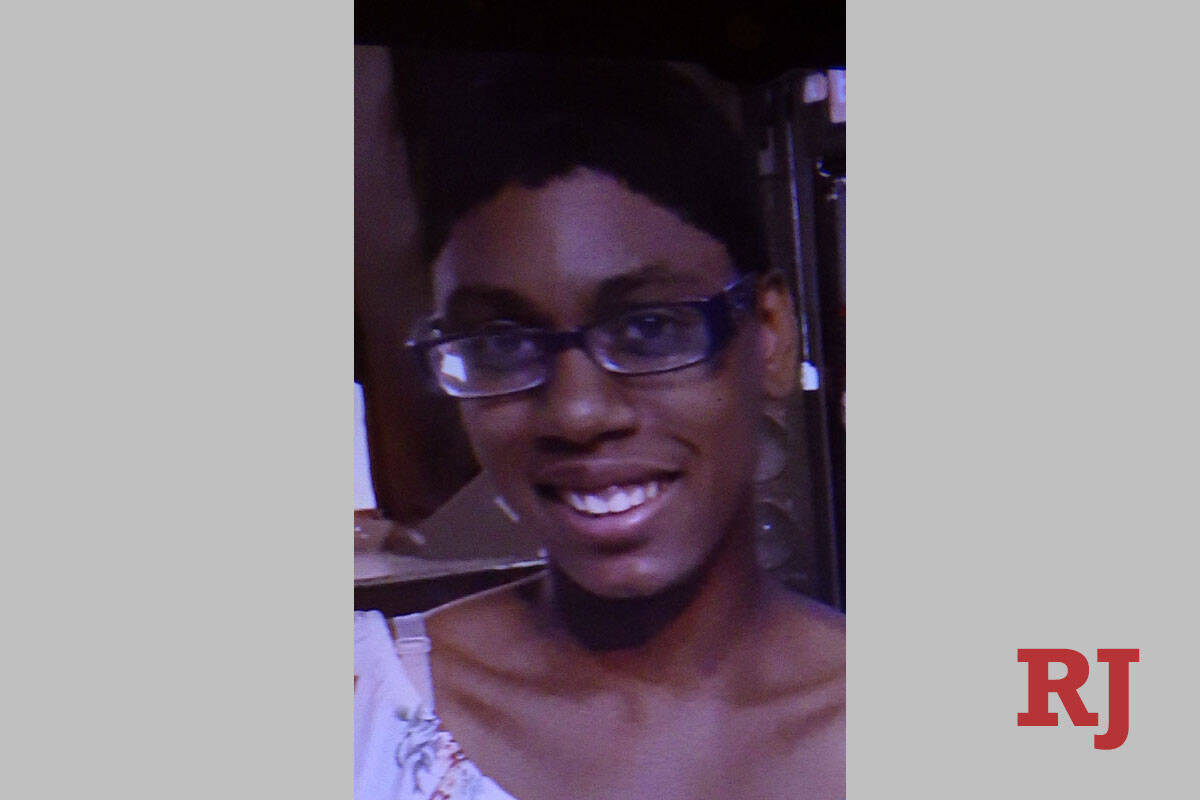

Las Vegas Police Seek Publics Help In Finding Missing Paralympian

Apr 29, 2025

Las Vegas Police Seek Publics Help In Finding Missing Paralympian

Apr 29, 2025