Your Guide To Low Inflation: A Podcast Series

Table of Contents

Understanding Low Inflation: What it Means and Why it Matters

Defining Low Inflation:

What constitutes low inflation? Generally, economists consider inflation rates below 2% annually as low inflation. This is in contrast to high inflation (above 5% annually, often causing significant economic disruption) and deflation (a sustained decrease in the general price level, which can be equally harmful). Understanding these different states is crucial for interpreting economic data and making sound financial decisions.

- Inflation: A general increase in the prices of goods and services in an economy over a period of time. This reduces the purchasing power of money.

- Deflation: A sustained decrease in the general price level of goods and services. While seemingly positive, deflation can lead to decreased consumer spending and economic stagnation.

- Disinflation: A slowdown in the rate of inflation. This means prices are still rising, but at a slower pace than before.

- Impact of Inflation on Purchasing Power: High inflation erodes the purchasing power of your money, meaning your savings buy less over time. Low inflation, on the other hand, allows your money to retain more of its value.

- Historical Examples of Low Inflation Periods: Many countries have experienced periods of low inflation, often following periods of economic stabilization or significant technological advancements. Analyzing these periods offers valuable insights into the long-term effects of a low-inflation environment.

The Causes of Low Inflation:

Several factors contribute to low inflation. These include:

- Technological Innovation and its Effect on Prices: Advances in technology often lead to increased productivity and lower production costs, thus contributing to lower prices. Automation, for example, can significantly reduce labor costs.

- Globalization and its Impact on Cost of Goods: Global competition increases the availability of goods and services, putting downward pressure on prices. Companies compete for market share, often leading to price reductions.

- Government Policies Influencing Inflation: Central banks, like the Federal Reserve in the US, utilize monetary policy tools (interest rate adjustments, quantitative easing) to influence inflation rates. Fiscal policies (government spending and taxation) can also have a significant impact.

- Supply and Demand Dynamics: A surplus of goods and services relative to demand can contribute to low inflation. Conversely, shortages can lead to price increases.

The Effects of Low Inflation on the Economy and Individuals

Macroeconomic Impacts of Low Inflation:

Low inflation has both positive and negative macroeconomic impacts:

- Positive Effects:

- Stable Prices: Low inflation creates a more predictable economic environment, facilitating better long-term planning for businesses and consumers.

- Increased Consumer Confidence: When prices are stable, consumers are more likely to spend, which stimulates economic growth.

- Negative Effects:

- Potential for Deflationary Spirals: If inflation falls too low, it can lead to a deflationary spiral, where falling prices lead to decreased spending, further depressing prices and economic activity.

- Slower Economic Growth: While not always the case, prolonged periods of very low inflation might indicate slower economic growth.

- Impact on Interest Rates and Borrowing Costs: Low inflation usually allows for lower interest rates, making borrowing more affordable for businesses and consumers.

Microeconomic Impacts of Low Inflation on Personal Finances:

Low inflation significantly affects personal finances:

- Effect on Savings Accounts and Returns: Low inflation means your savings retain more of their purchasing power over time, although returns might be modest.

- Impact on Investment Strategies: Investors need to consider inflation when selecting investments. Low inflation might reduce the need for high-risk, high-return investments.

- Influence on Debt Repayment: Low inflation can make debt repayment easier, as the real value of debt decreases over time.

- Implications for Retirement Planning and Social Security Benefits: Low inflation can positively influence the long-term purchasing power of retirement savings and Social Security benefits.

Navigating Low Inflation: Strategies for Financial Success

Investing in a Low Inflation Environment:

Several investment strategies are suitable for low-inflation periods:

- Diversification Strategies: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate) helps mitigate risk.

- Real Estate Investment: Real estate can be a good hedge against inflation, as property values often rise with inflation.

- Inflation-Protected Securities (TIPS): TIPS are government bonds that adjust their principal value based on inflation, protecting your investment from inflation's erosive effects.

- Investing in Commodities: Commodities like gold and oil can be good inflation hedges, as their prices tend to rise during inflationary periods.

- Importance of Long-Term Investment Horizons: Long-term investing is generally a more effective strategy in low-inflation environments, allowing your investments to grow over time.

Budgeting and Financial Planning in a Low Inflation Economy:

Even in a low-inflation environment, sound financial planning is essential:

- Developing a Realistic Budget: Creating a budget that tracks your income and expenses is crucial for managing your finances effectively.

- Strategies for Debt Reduction: Prioritizing debt reduction, particularly high-interest debt, is important to improve your financial health.

- Importance of Emergency Funds: Maintaining an emergency fund (3-6 months of living expenses) provides a financial cushion during unexpected events.

- Long-Term Financial Goal Setting: Setting long-term financial goals (retirement planning, homeownership) helps you stay focused and make informed financial decisions.

Conclusion:

This article has provided a foundational overview of low inflation, outlining its causes, effects, and strategies for effective navigation. The accompanying podcast series, "Your Guide to Low Inflation," delves deeper into these critical aspects, offering expert insights and practical advice.

Gain a comprehensive understanding of low inflation and its impact on your financial well-being. Listen to our insightful podcast series, "Your Guide to Low Inflation," and take control of your financial future in a low inflation environment. Learn more and subscribe today! Explore the impact of low inflation on your personal finances and discover strategies for long-term financial success.

Featured Posts

-

5 Key Steps To Success In The Private Credit Hiring Boom

May 27, 2025

5 Key Steps To Success In The Private Credit Hiring Boom

May 27, 2025 -

Almanacco Di Lunedi 10 Marzo Cosa E Successo Oggi

May 27, 2025

Almanacco Di Lunedi 10 Marzo Cosa E Successo Oggi

May 27, 2025 -

1923 Season 2 Episode 4 Free Streaming Guide For Tonights Episode

May 27, 2025

1923 Season 2 Episode 4 Free Streaming Guide For Tonights Episode

May 27, 2025 -

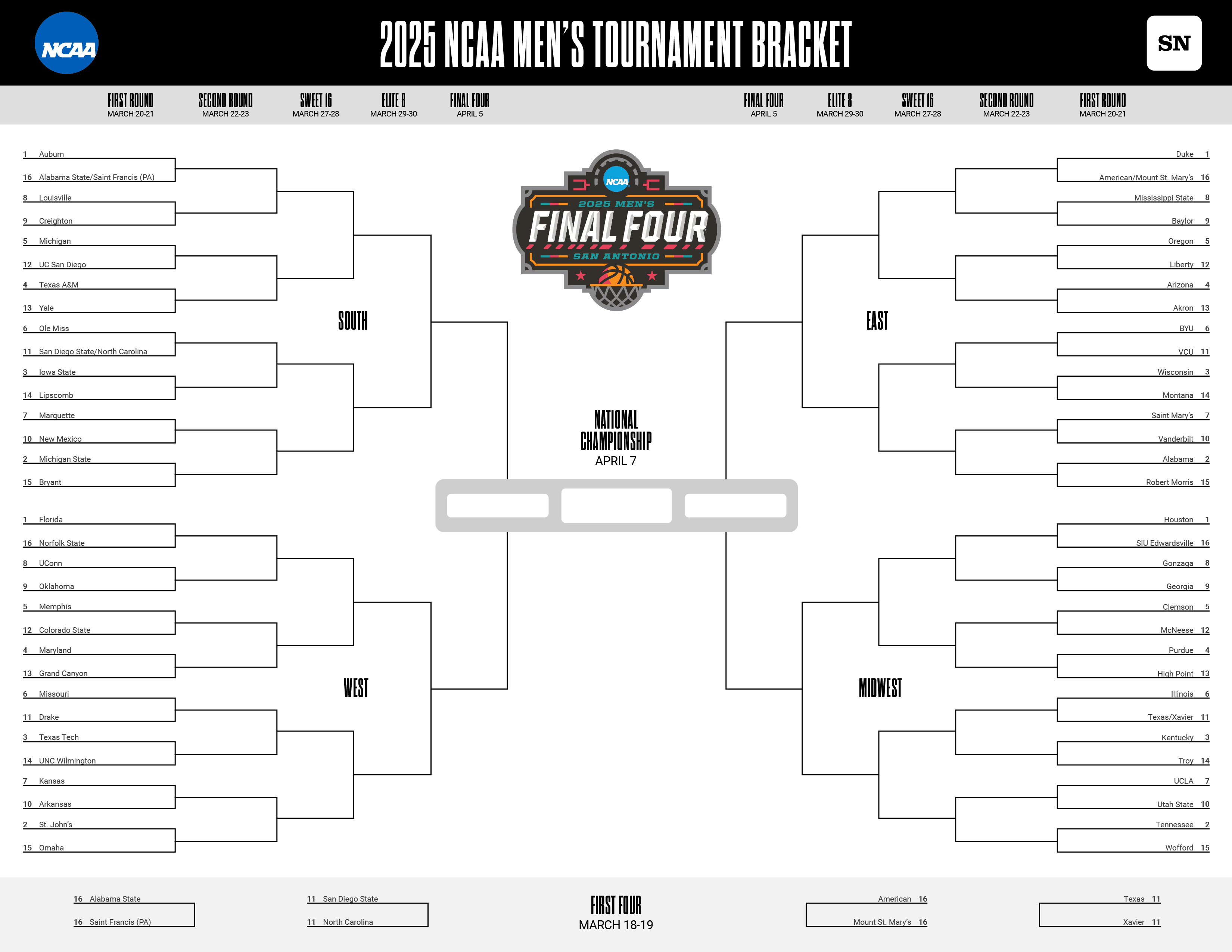

March Madness 2025 Viewing Guide Tv Streaming And Live Options

May 27, 2025

March Madness 2025 Viewing Guide Tv Streaming And Live Options

May 27, 2025 -

Damkar Bandar Lampung 334 Penyelamatan Non Kebakaran Hingga Awal Mei 2025

May 27, 2025

Damkar Bandar Lampung 334 Penyelamatan Non Kebakaran Hingga Awal Mei 2025

May 27, 2025