$194 Billion And Counting: Tech Billionaires' Losses Since Trump Inauguration

Table of Contents

The Impact of Regulatory Scrutiny

The tech industry has faced unprecedented regulatory scrutiny since 2017. This intensified scrutiny has directly impacted stock prices and, consequently, the net worth of tech billionaires.

Increased Antitrust Investigations

The rise of antitrust lawsuits and investigations against major tech companies has significantly contributed to the decline in their valuations. These legal battles create uncertainty, impacting investor confidence and leading to stock price drops.

- Example 1: The ongoing antitrust lawsuit against Google, alleging monopolistic practices in the search engine market, has resulted in billions of dollars in potential fines and legal fees, directly impacting Google's stock price and the net worth of its CEO, Sundar Pichai.

- Example 2: Facebook (now Meta) has faced numerous antitrust investigations globally, concerning its acquisition of Instagram and WhatsApp, leading to significant stock price fluctuations and impacting Mark Zuckerberg's net worth.

- Example 3: Apple has also faced scrutiny regarding its App Store policies, leading to legal challenges and impacting its overall valuation.

These lawsuits, fueled by concerns over tech monopolies and their market dominance, represent a significant hurdle for these companies and their founders' wealth. The keywords "Antitrust," "Lawsuits," "Stock Prices," "Regulatory Scrutiny," and "Tech Monopolies" highlight the crucial nature of these legal battles in impacting billionaire net worth.

Data Privacy Regulations

The implementation of stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and similar legislation worldwide, has added substantial compliance costs for tech giants. These costs, coupled with the risk of non-compliance penalties, have negatively impacted their valuations and the fortunes of their founders.

- Example 1: GDPR compliance required significant investments in data security and privacy infrastructure, impacting the profitability of many tech companies.

- Example 2: Companies failing to comply with GDPR have faced hefty fines, further impacting their bottom line and the net worth of their CEOs.

- Example 3: The evolving landscape of data privacy regulations globally continues to present a major challenge for tech companies, adding to the uncertainty in the market.

The keywords "Data Privacy," "GDPR," "Regulations," "Compliance Costs," and "Valuation" underscore the significant financial burden of adapting to a stricter regulatory environment.

Market Volatility and Economic Downturns

The tech sector, known for its volatility, experienced significant downturns since the Trump inauguration. These market fluctuations have directly correlated with the fluctuating net worth of tech billionaires.

The Tech Stock Slump

Since 2017, the tech stock market has seen periods of sharp decline, impacting the overall wealth of tech billionaires. These downturns are often linked to broader economic factors and investor sentiment. (Include a chart or graph showing the correlation between tech stock performance and the net worth of prominent billionaires, if possible.)

- Example 1: The dot-com bubble burst of 2000 and the 2008 financial crisis serve as reminders of the vulnerability of tech valuations to economic downturns.

- Example 2: Specific periods of market correction since 2017 can be identified and linked to corresponding drops in billionaire net worth. For instance, the market reaction to specific company announcements or global events can be analyzed.

- Example 3: The impact of rising interest rates on tech valuations can also be explored as a significant factor contributing to losses.

Keywords such as "Tech Stock Market," "Market Volatility," "Economic Downturn," "Stock Prices," and "Market Correction" are critical in understanding this aspect of the issue.

Global Economic Uncertainty

Global economic instability, trade wars, and increased inflation have created uncertainty in the market, impacting investor confidence and leading to lower tech valuations.

- Example 1: The ongoing trade war between the US and China significantly impacted the tech industry, disrupting supply chains and impacting the profitability of many companies.

- Example 2: Global economic uncertainty related to pandemics or geopolitical events also impacts investor sentiment, affecting stock prices.

- Example 3: Rising inflation rates increase the cost of operations for tech companies, impacting their profitability and ultimately influencing billionaire net worth.

Keywords like "Global Economy," "Trade Wars," "Economic Uncertainty," "Inflation," and "Recession" highlight the external factors affecting the tech sector's performance.

The Changing Political Landscape and its Influence

The political climate has played a significant role in shaping the regulatory environment and public perception of the tech industry, impacting the wealth of its leaders.

Shifts in Government Policy

Changes in government policies under different administrations have directly affected the tech industry. These policies include tax reforms, immigration policies, and regulations impacting technological advancements.

- Example 1: Tax reforms can significantly affect the profitability of tech companies and their leaders' wealth.

- Example 2: Immigration policies influence the availability of skilled labor in the tech sector.

- Example 3: Changes in regulations regarding data privacy, antitrust, and other issues significantly impact the industry's profitability.

Keywords like "Government Policy," "Tax Reform," "Immigration Policy," "Political Climate," and "Regulatory Environment" highlight the direct connection between political action and billionaire wealth.

Public Perception and Brand Image

Negative public perception and controversies surrounding tech companies have significantly influenced their stock prices and the wealth of their founders.

- Example 1: Scandals related to data privacy violations have led to decreased consumer trust and impacted company valuations.

- Example 2: Negative press concerning anti-competitive practices has negatively influenced investor confidence and stock prices.

- Example 3: Public perception surrounding social media's role in society has also contributed to the valuation changes of social media giants.

Keywords such as "Public Perception," "Brand Image," "Reputation Management," "Scandals," and "Negative Press" underscore the critical role of public opinion in shaping the financial outcomes of tech companies.

Conclusion

The combined impact of increased regulatory scrutiny, market volatility, and a changing political landscape has resulted in significant losses for tech billionaires since Trump's inauguration, totaling $194 billion and counting. This substantial financial impact underscores the interconnectedness of these factors and their influence on some of the world's most prominent individuals. Stay informed about the ongoing changes in the tech sector and the fortunes of its billionaires. Learn more about the factors influencing the wealth of tech billionaires, and understand the complexities impacting this dynamic industry.

Featured Posts

-

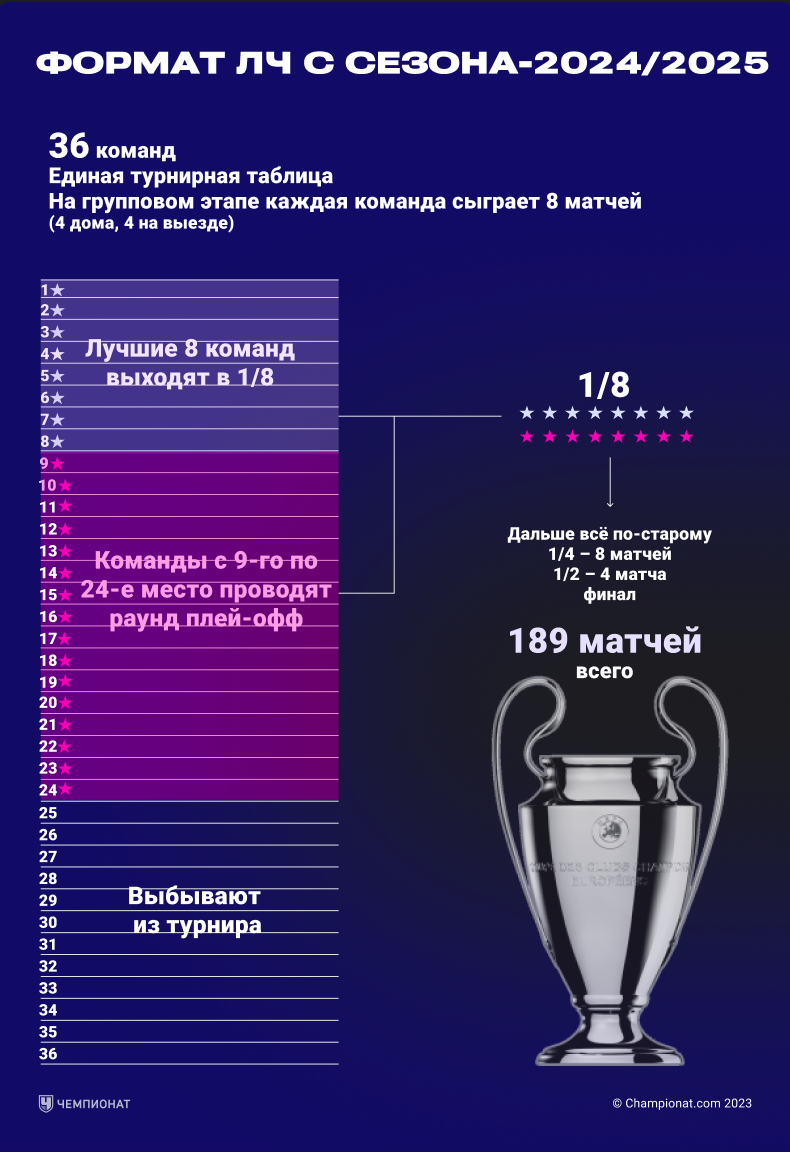

Raspisanie I Prognozy Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025

Raspisanie I Prognozy Polufinaly I Final Ligi Chempionov 2024 2025

May 09, 2025 -

First Listen Mariah The Scientists Burning Blue

May 09, 2025

First Listen Mariah The Scientists Burning Blue

May 09, 2025 -

Snegopad V Permi Aeroport Zakryt Do 4 00 Utra

May 09, 2025

Snegopad V Permi Aeroport Zakryt Do 4 00 Utra

May 09, 2025 -

23 20

May 09, 2025

23 20

May 09, 2025 -

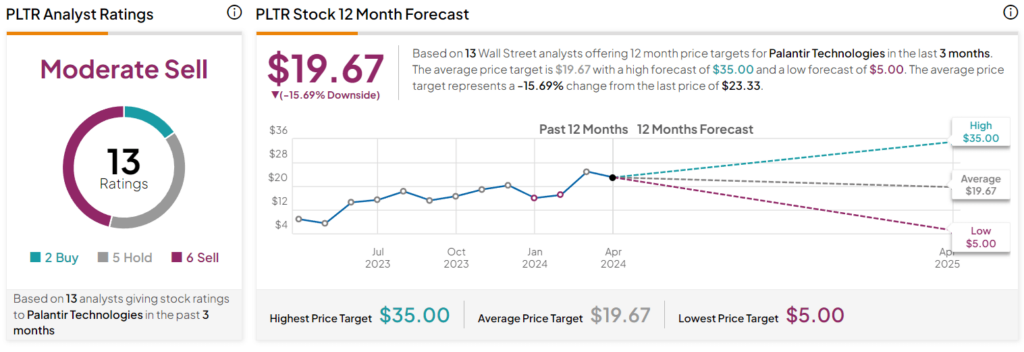

Buy Palantir Stock Before May 5th Weighing Wall Streets Advice

May 09, 2025

Buy Palantir Stock Before May 5th Weighing Wall Streets Advice

May 09, 2025