Buy Palantir Stock Before May 5th? Weighing Wall Street's Advice

Table of Contents

Palantir's Recent Performance and Future Outlook

Palantir Technologies (PLTR) has shown a mixed bag in recent financial performance. While revenue growth has been relatively strong, driven by increased demand for its data analytics platforms, profitability remains a concern for some investors. Analyzing Palantir's financial performance requires a nuanced approach, looking beyond simple quarterly reports to understand the underlying drivers of growth.

-

Key Factors Driving Palantir's Growth: Palantir's success is largely attributed to its strong presence in government contracts, particularly within the US defense and intelligence sectors. However, the company is increasingly focusing on expanding its commercial partnerships, targeting large enterprises across various industries. This diversification strategy aims to reduce reliance on government contracts and unlock broader growth opportunities.

-

Recent News and Announcements: Recent news concerning new contract wins or strategic partnerships significantly impact Palantir stock price. Monitoring news sources and official company announcements is crucial for understanding the short-term and long-term implications for Palantir's future performance.

-

Potential Catalysts for Future Growth: Several factors could significantly boost Palantir's growth trajectory. These include the successful launch of new products and features, expansion into new geographical markets, and the ongoing adoption of its platform by commercial clients. Further penetration into the rapidly growing data analytics market could also be a significant catalyst. Careful monitoring of Palantir revenue growth will be vital in determining future performance.

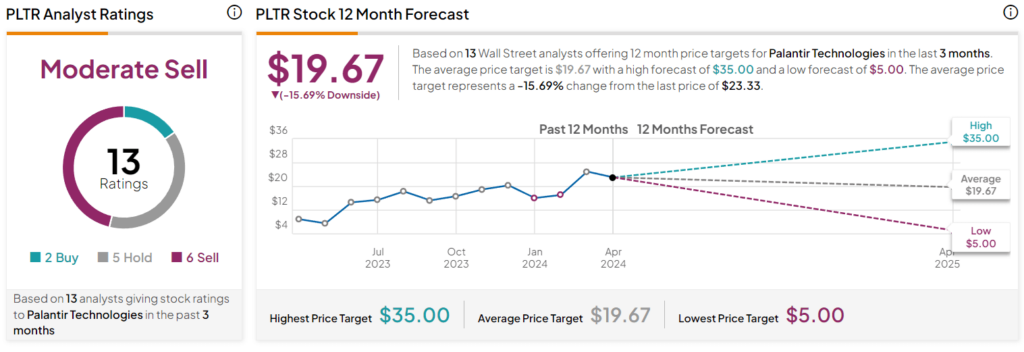

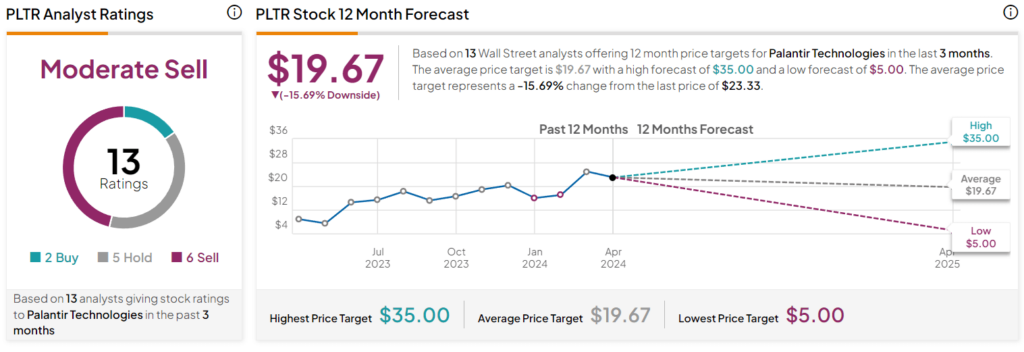

Wall Street Analyst Ratings and Price Targets

Wall Street analysts hold varying views on Palantir stock. While some maintain a "buy" rating, citing Palantir's strong technology and long-term growth potential, others hold a more cautious "hold" or even "sell" rating, pointing to concerns about valuation and profitability.

-

Consensus Rating and Price Targets: The consensus rating among leading analysts may range from a strong buy to a hold, with price targets varying significantly, reflecting the diverse perspectives and assessment models employed. Investors should critically analyze the methodologies and assumptions used in forming these recommendations.

-

Changes in Analyst Sentiment: It's crucial to monitor any recent shifts in analyst sentiment. A sudden surge in positive ratings or a significant upward revision of price targets could indicate an improving market outlook for Palantir. Conversely, negative shifts warrant careful consideration.

-

Potential Biases and Conflicts of Interest: Investors should be mindful of potential biases or conflicts of interest that could influence analyst ratings. For instance, investment banks providing research coverage may also have trading desks that actively trade Palantir stock.

Evaluating the Risks and Rewards of Investing in Palantir

Investing in Palantir stock involves a certain degree of risk, alongside the potential for substantial rewards. A thorough Palantir risk assessment is crucial before making any investment decision.

-

Potential Risks: Palantir's relatively high valuation compared to its current profitability is a significant concern for some investors. Dependence on government contracts, although currently lucrative, presents a risk, while competition within the data analytics space is intense.

-

Potential Rewards: Palantir's cutting-edge technology, strong government relationships, and growing commercial partnerships offer significant potential for long-term growth and high returns on investment. The expanding market for data analytics presents a substantial opportunity for Palantir to increase its market share.

-

Risk-Reward Profile: Investors must carefully analyze Palantir's risk-reward profile in comparison to other tech stocks or broader market indices. Considering macroeconomic factors like interest rates and inflation is essential, as these elements can significantly influence stock valuations. Diversification is critical to manage risk within a well-balanced investment portfolio.

Alternative Investment Strategies

Considering other investment options is a prudent approach to diversifying your portfolio. Instead of solely focusing on Palantir stock, exploring alternatives allows you to manage risk effectively.

-

Other Tech Stocks with Similar Growth Potential: Investors might consider exploring other technology companies with similar growth prospects, but perhaps with lower risk profiles. Comparing Palantir's valuation and growth potential to similar firms will help you make an informed decision.

-

Alternative Investment Strategies: Considering different asset classes, such as bonds or real estate, can help reduce portfolio volatility and overall investment risk. Your risk tolerance and financial goals will guide you toward the most appropriate investment strategy.

Conclusion

The decision of whether to buy Palantir stock before May 5th is a personal one, contingent on your investment goals and risk tolerance. By carefully considering Palantir's recent performance, Wall Street's predictions, and the inherent risks and rewards, you can make an informed decision. Remember to conduct thorough due diligence before investing in Palantir stock and consult with a financial advisor if needed. Monitor your Palantir investment closely after May 5th to assess its performance and adapt your strategy as necessary. Remember, careful analysis of Palantir financial performance and a well-defined investment strategy are crucial for successful investing.

Featured Posts

-

Former Becker Sentencing Judge Heads Nottingham Attacks Investigation

May 09, 2025

Former Becker Sentencing Judge Heads Nottingham Attacks Investigation

May 09, 2025 -

Indian Insurers Push For Relaxed Bond Forward Regulations

May 09, 2025

Indian Insurers Push For Relaxed Bond Forward Regulations

May 09, 2025 -

Retrospective Trumps 109th Day In Office May 8th 2025

May 09, 2025

Retrospective Trumps 109th Day In Office May 8th 2025

May 09, 2025 -

Germaniya Riski Novogo Naplyva Ukrainskikh Bezhentsev Svyazannogo S Deystviyami S Sh A

May 09, 2025

Germaniya Riski Novogo Naplyva Ukrainskikh Bezhentsev Svyazannogo S Deystviyami S Sh A

May 09, 2025 -

The Great Decoupling A Deeper Dive Into Its Causes And Consequences

May 09, 2025

The Great Decoupling A Deeper Dive Into Its Causes And Consequences

May 09, 2025