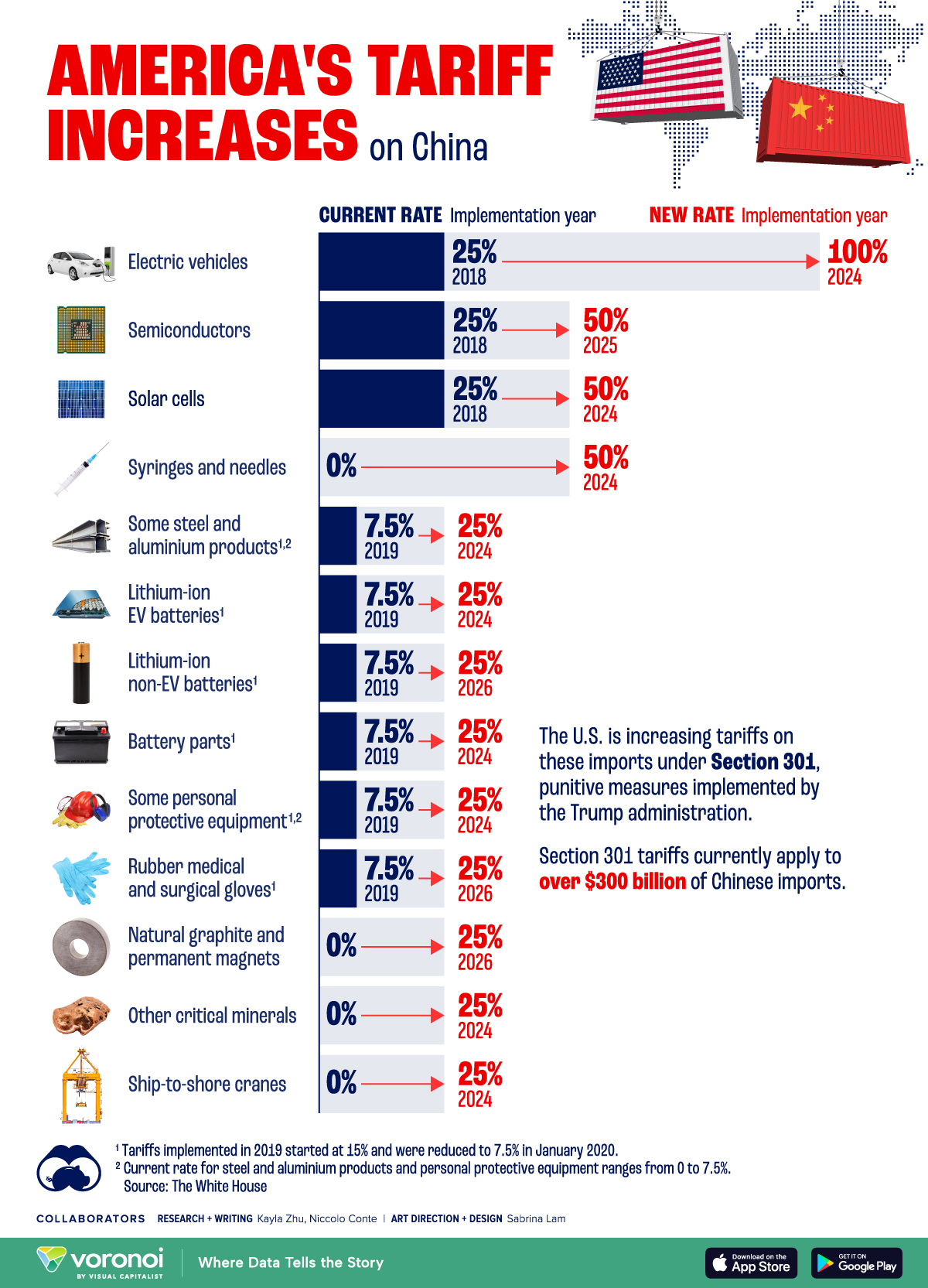

2% Fall On Amsterdam Stock Exchange: Impact Of Trump's Tariff Increase

Table of Contents

Immediate Impact on Key Sectors of the Amsterdam Stock Exchange

The Trump tariff increase immediately impacted several key sectors within the Amsterdam Stock Exchange, causing ripples throughout the Dutch economy.

Technology Sector

Dutch technology companies, heavily reliant on US markets, proved particularly vulnerable. The increased tariffs led to decreased exports, threatening jobs and profitability.

- ASML Holding: Experienced a stock price drop of X% following the tariff announcement, highlighting its significant exposure to the US market.

- Philips: Saw a Y% decrease in its share price, reflecting concerns about reduced US sales and potential retaliatory measures.

- Other tech companies: Numerous smaller Dutch tech firms also experienced setbacks, facing increased costs and reduced competitiveness in the US market.

Keywords: Dutch tech companies, US-Dutch trade, export decline, technology stocks.

Financial Services

The uncertainty created by the tariff increase significantly impacted Dutch banks and financial institutions. Global market volatility led to cautious lending practices and affected investor confidence.

- ING: Faced challenges due to decreased investor confidence and potential losses in international markets.

- ABN AMRO: Experienced pressure on its profitability due to changes in interest rates and reduced lending activities.

- Other financial institutions: Smaller financial institutions also faced difficulties navigating the increased market uncertainty.

Keywords: Dutch banks, financial markets, interest rates, investor confidence, global uncertainty.

Agricultural Sector

Dutch agricultural exports to the US, a significant portion of the sector's output, faced significant challenges due to the increased tariffs. This triggered concerns about potential retaliatory measures from the EU.

- Dairy products: Dutch dairy farmers experienced a decrease in demand for their products in the US market.

- Horticultural products: Increased tariffs impacted the export of flowers, vegetables, and fruits to the US.

- Potential for EU retaliation: The EU could implement retaliatory tariffs, further impacting Dutch agricultural exports to other markets.

Keywords: Dutch agriculture, EU-US trade, agricultural exports, food trade.

Investor Reactions and Market Volatility

The announcement of increased tariffs caused immediate and significant shifts in investor behavior, resulting in increased market volatility.

Decreased Investor Confidence

Investor confidence plummeted following the tariff announcement, leading to a decrease in trading volume and a flight to safety.

- Trading volume: Data showed a significant drop in AEX trading volume in the days following the announcement.

- Analyst quotes: Several financial analysts commented on the negative investor sentiment, forecasting potential further market fluctuations.

- Market uncertainty: The increased uncertainty made investors hesitant to engage in riskier investments.

Keywords: investor sentiment, market volatility, trading volume, stock market reaction.

Flight to Safety

Investors moved their funds towards safer assets, reflecting a risk-averse approach in response to the uncertainty caused by the tariffs.

- Government bonds: Investment in government bonds saw a noticeable increase, as investors sought safety and stability.

- Other safe haven assets: Similar trends were observed in other safe haven assets, like gold and certain currencies.

- Long-term implications: This flight to safety could have long-term effects on investment strategies and economic growth.

Keywords: safe haven assets, government bonds, risk aversion, investment strategy.

Long-Term Implications and Potential Recovery

The long-term effects of Trump's tariff increase on the Netherlands' economy are still unfolding, requiring careful observation and strategic adaptation.

Economic Growth Projections

The tariffs are projected to negatively impact the Netherlands' GDP and overall economic growth.

- Economic forecasts: Several economic forecasts predict a slowdown in Dutch economic growth due to the reduced trade and investment.

- Government response: The Dutch government may implement measures to mitigate the negative impacts, such as financial aid for affected sectors.

- Long-term effects: The long-term effects on different sectors will depend on factors like global market dynamics and government policies.

Keywords: GDP growth, economic forecast, Netherlands economy, government policy.

Opportunities for Diversification

The crisis presents an opportunity for Dutch businesses to diversify their markets and reduce reliance on the US.

- Diversification strategies: Companies can explore new export markets in Asia, Africa, and South America.

- Business adaptation: Adapting business strategies to navigate global trade complexities is crucial.

- Benefits of diversification: Diversification minimizes risk and improves long-term resilience.

Keywords: market diversification, global trade, international trade, business strategy.

Conclusion: Understanding the Amsterdam Stock Exchange's Reaction to Trump's Tariff Increase

Trump's tariff increase had a profound impact on the Amsterdam Stock Exchange, causing a significant 2% drop and increased market volatility. The effects were felt across various sectors, from technology and finance to agriculture. While the immediate impact was negative, the long-term implications will depend on the Dutch government's response, global market dynamics, and the ability of Dutch businesses to adapt and diversify. Staying informed about the ongoing developments regarding Trump's tariffs and their impact on the Amsterdam Stock Exchange and the global economy is crucial. Further research into the AEX and its future performance is recommended for a deeper understanding of these complex economic shifts. Consider exploring resources from the Amsterdam Stock Exchange website and reputable financial news outlets for up-to-date information.

Featured Posts

-

Relx Succes Ondanks Economische Tegenwind De Rol Van Ai In De Groei

May 24, 2025

Relx Succes Ondanks Economische Tegenwind De Rol Van Ai In De Groei

May 24, 2025 -

Escape To The Country How Nicki Chapman Made 700 000 On A Property Investment

May 24, 2025

Escape To The Country How Nicki Chapman Made 700 000 On A Property Investment

May 24, 2025 -

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Debates Symbolic Act Of Rehabilitation

May 24, 2025 -

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025

M56 Car Crash Overturned Vehicle Casualty Treated On Motorway

May 24, 2025 -

Euro Sterker Dan 1 08 Analyse Van De Stijgende Kapitaalmarktrentes

May 24, 2025

Euro Sterker Dan 1 08 Analyse Van De Stijgende Kapitaalmarktrentes

May 24, 2025

Latest Posts

-

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Controversy

May 24, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025

Actress Mia Farrow Seeks Legal Action Against Trump For Venezuela Deportation Policy

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025

Sinatras Four Marriages An Examination Of His Romantic Life

May 24, 2025 -

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025

Farrow Seeks Trumps Incarceration Focus On Venezuelan Deportations

May 24, 2025